Spectrem Group’s Affluent Investor Confidence Indices Rise in February in the Wake of the Recent U.S. Market Correction

Index range: -31 to -51, Bearish; -11 to -30, Mildly Bearish; 10 to -10, Neutral; 11 to 30, Mildly Bullish; 31 to 51, Bullish.

Short-Term Optimism Tempered by Uncertainty About the Long-Term Direction of the Economy

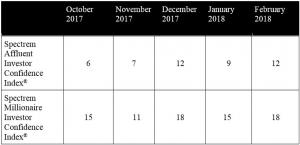

CHICAGO, IL, UNITED STATES, March 1, 2018 /EINPresswire.com/ -- U.S. investor sentiment rebounded significantly in February following the first significant market correction in more than two years, according to Spectrem Group’s High Net Worth Insights newsletter. The Spectrem Millionaire Investor Confidence Index (SMICI®) and the Spectrem Affluent Investor Confidence Index (SAICI®) both increased by three points in the month, now standing at 18 and 12, respectively. Both indices are now in mildly bullish territory.The monthly Spectrem Investor Confidence indices track changes in investment sentiment among the 17 MM households in America with more than $500,000 of investable assets (SAICI), and those with $1 MM or more (SMICI). The February survey was fielded between Feb. 15-21, 2018.

While investors expressed a renewed interest in investing in stock and stock mutual funds, the Spectrem Household Outlook uncovered growing concerns about the long-term future of the economy. The Outlook, which is a monthly measure of the long-term confidence among investors across four financial factors which impact a household’s daily life, dropped to 29.90 after reaching a 13-year high of 39.60 in January.

The pessimistic results were due primarily to a severe decline in sentiment toward long-term prospects for the American economy. The outlook for the economy fell to 21.20 overall, a drop of more than 22 points, as investors expressed concern that the continued bull market may be increasingly disconnected from the overall economy.

“Recent tax cuts have driven a resurgence in investor interest in actively participating in the markets," said Spectrem President George H. Walper, Jr. “However, the reduced Household Outlook is an indicator that investors are uncertain about longer-term prospects for the overall economy, perhaps because of the new tax regime’s impact on the U.S. budget deficit.”

Charts, including a deeper analysis of the Index and its methodology, are available upon request. Additional insights include:

• Investors Bounce Back Into The Stock Market

About Spectrem Group: Spectrem Group (www.spectrem.com) strategically analyzes its ongoing primary research with investors to assist financial providers and advisors in understanding the Voice of the Investor.

# # #

George H. Walper, Jr.

Spectrem Group

(224) 544-5350

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.