Black Legend Capital Explains the Investment Outlook in the Cannabis Industry

With legalization and commercialization ramping up within the cannabis market, Black Legend Capital explains why now is the time for investment in the industry.

LOS ANGELES, CA, UNITED STATES OF AMERICA, October 3, 2016 /EINPresswire.com/ -- Within the U.S., Colorado still remains a central model of the modern cannabis regulatory climate and economy. In November 2000, Colorado voters legalized medical marijuana with the approval of Amendment 20. This article authorized the possession of limited amounts of medical marijuana for patients and their primary caregivers. In 2010, the Colorado government ruled in favor of industry advocates as legislators passed the Colorado Medical Marijuana Code to regulate the commercialization of marijuana. Now, the recent Colorado Senate Bill addressing the regulation of out-of-state investment in cannabis found that marijuana businesses need to have ready access to capital from investors in states outside of Colorado. However, while the United States cannabis market’s immense growth continues as a result of the legalization effort, trends favoring the acceptance of cannabis are global. Outside the U.S., legalization supporters consider marijuana possession either legal or tolerated in Argentina, Bangladesh, Cambodia, Canada, Chile, Colombia, the Czech Republic, India, Jamaica, Jordan, Mexico, Portugal, Spain, Uruguay, Germany and the Netherlands.Marijuana is a global multi-billion dollar industry with programs for medical use that have been running in places like Germany, Canada, Australia, Israel and the Czech Republic. Uruguay, Peru, Colombia and the Netherlands have been some of the few countries to legalize the consumption and possession of cannabis, while in Spain adults are permitted, in certain jurisdictions, to join “associations” where groups of collective adults consume and grow cannabis. For example, countries like Canada have already installed a fully functional nationwide medical program and will plan to implement a recreational program by the next year.

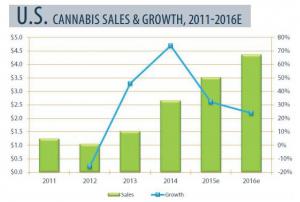

The U.S. marijuana industry has been in recent years either one of the fastest or the fastest growing industry in the country. The industry experienced astronomical growth with revenues rising 54.7% during 2014, following the legalization of recreational marijuana consumption in Colorado and Washington. Medical marijuana has been the main driver of the industry for the past 10 years, due to its legality, ability to help patients cope with various symptoms, and its potential for high profitability. Cannabis based medicines can relieve an incredible number of symptoms, including nausea from chemotherapy, loss of appetite among HIV positive patients, multiple sclerosis spasms, depression, anxiety, sleep disorders, psychosis and Tourette syndrome, and many more.

Investors can gain high returns on investment through vertical integration in the industry. Although a federal prohibition is in place, there are an estimated 20 million people in the U.S who consume cannabis every month. Within ten years, the cannabis industry is expected to reach a combined total market of $ 100 billion annually and more than 50 million consumers in the U.S if federal prohibition is discontinued. About 62% of Americans already live in states where cannabis is legal in either medicinal or recreational use. Also, with a higher demand for medicinal uses of cannabis, big pharma looks to meet this demand by creating CBD and THC pills for ill patients. This will allow investors to be fully invested in the massive pharmaceutical industry.

The cannabis market is no different than other markets in that once it matures, competitiveness and an upsurge in capital will bring more obstacles for entry. This represents an opportunity to enter a market whose potential is largely untapped before legislation opens the floodgates for commercialization. The combination of strong demand and high potential inherent within the industry, coupled with the regulatory changes coming soon, have created the best time for strategic investment in the cannabis industry.

We are in the early stages of a powerful secular growth cycle for the cannabis and cannabis related industries. Ackrell Capital, a provider of objective research solutions, estimates that within 5 to 10 years there will be a substantial amount of mature companies who have the capacity to dominate the U.S based cannabis consumer market. Inevitably, well-resourced, well-managed, and well-positioned companies will have a myriad of opportunities for significant growth, and savvy investors quick to respond to this transitional period will be able to take advantage of it.

About Black Legend Capital, LLC

Black Legend Capital is an investment bank and M&A advisory group based in Los Angeles with satellite offices in Houston, New York and London.

Black Legend Capital was founded in 2011 by former Merrill Lynch and Duff & Phelps senior investment bankers involved in over $13bn transactions in the USA, and focuses on energy, consumer products and technology. Black Legend Capital partners with corporations and management teams to provide strategy and consulting resources to facilitate industry projects to generate leading returns for clients.

Black Legend Capital, LLC

12121 Wilshire Blvd., Ste. 205

Los Angeles, California 90025

blacklegendcapital.com

info@blacklegendcap.com

Claudia Della Mora, Managing Director

George Matin, Managing Director

Mark Zaim, Analyst

William Nguyen, Analyst

http://www.blacklegendcapital.com/busness_m_market_overview_claudiadellmora.php

Claudia Della Mora

Black Legend Capital

email us here

(310) 770-7542

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.