Oil and Gas in 2016: Black Legend Capital Explains Why Now is the Time to Invest in Oil and Gas

The crash of the oil market sets up the best time for acquisitions in oil and gas in the U.S., which can potentially be a net exporter in energy by 2020-2030.

LOS ANGELES, CA, UNITED STATES OF AMERICA, June 25, 2016 /EINPresswire.com/ -- 2009-2014 - The Rise and Fall of the United States Oil IndustryU.S. Becomes the World’s Largest Oil Producer

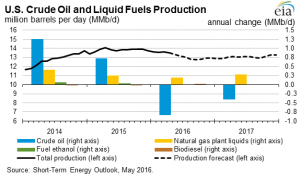

In 2014, the U.S. surpassed Saudi Arabia and Russia to become the world’s largest oil producer; by the end of 2014, the U.S. had nearly doubled production from 2009. Total U.S. crude oil and liquid fuels production hit 13.71 MMb/d in December 2014 and remained roughly the same in 2015, which was 13.74 MMb/d. According to U.S. Energy Information Administration, most of the net increase in U.S. crude oil production resulted from improved production of light crude oil in low-permeability/tight resource formations in areas like the Bakken, Permian Basin, and Eagle Ford.

Oil Prices Plunge in 2014

Despite lowering oil prices resulting from high supply, OPEC and other suppliers were unwilling to cut back on production. Subsidized by government, they instead increased supply in a battle with the U.S. for market share, leading to an even greater drop in oil price. As a result, oil prices dropped from $115 per barrel in June 2014 to almost half of that price by the end of 2014. With the combination of dropping oil prices and high operating expenses, many U.S. producers could not afford to extract oil from shale formations in places like Texas and North Dakota, and new oil and gas discoveries like in the Bakken area were interrupted.

2015-2016 - Creating the Best Time for Acquisitions in Oil & Gas

High Expectations Exacerbate Problems

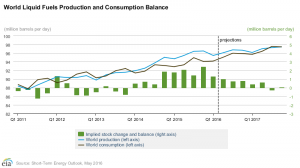

The Energy Information Agency previously claimed that the mismatch between oil supply and demand was shrinking. The general belief was that prices would stabilize in 2015. Forecasts like these caused a sector-wide reluctance to divest; though lowered prices created very good opportunities for strategic acquisition, owners believed that prices would turn around and refused to accept lower valuations.

Opportunities in 2016 and beyond

Investment opportunities have now opened up in 2016. Even lower oil prices have generated a general willingness in the industry to divest properties. These factors have set up the best time to take advantage of investment opportunities in producing and proven assets while prices are low. According to the U.S. Energy Information Administration, the United States has the potential to eliminate net energy imports or even become a net exporter between 2020 and 2030.

Rising Global Demand

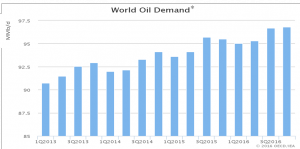

The U.S. Energy Information Administration forecasts that global oil demand will continue to rise, with most of the increase in demand from high-development countries like China, India, and the Middle East. The YOY growth is forecasted to be around 1.2 MMb/d for the whole year, with demand reaching 95.9 MMb/d.

Favorable Legal Framework

In the United States, mineral rights to oil and gas assets are often owned by private parties, and not solely by the government. This allows individuals to directly invest in oil and gas assets. The United States provides a stable legal and political environment, which allows for safer investments in oil & gas compared to other countries, and regulatory commissions to protect operator and investor ownership of oil & gas assets.

Operators typically set up limited partnerships (LP) or joint operating agreements (JOA), which provide attractive tax benefits, provide majority control to investors, and free investors from personal liability.

The lease and investment structure in the United States makes smaller operators attractive to landowners and investors because small operators are more focused on their specific oil & gas projects. There is high transparency between operators & investors (updates, economic reporting, etc.).

Most Attractive Tax Advantages

In oil or gas partnerships, investing general partners qualify for tax write-offs for up to 100% of what are considered “intangible” drilling costs. The actual tax write-off percentage will vary, but the deductible percentage is usually around 85% of the investment.

Once a well starts producing, a general partner's share of expenses related to the well’s production can also be deducted, including severance taxes and most other expenses from the producing well.

Well-head equipment, such as pump jacks, storage tanks, and additional equipment, can be depreciated over a 5-year period.

The estimated reserves for a well are written off using 15% depletion. Depletion is calculated using the dollar amount of oil produced from the well based on Internal Revenue Code section 613.

About Black Legend Capital, LLC

Black Legend Capital is an investment bank and M&A advisory group based in Los Angeles with satellite offices in Houston, New York and London.

Black Legend Capital was founded in 2011 by former Merrill Lynch and Duff & Phelps senior investment bankers involved in over $13bn transactions in the USA, and focuses on energy, consumer products and technology. Black Legend Capital partners with corporations and management teams to provide strategy and consulting resources to facilitate industry projects to generate leading returns for clients.

Black Legend Capital, LLC

12121 Wilshire Blvd., Ste. 205

Los Angeles, California 90025

http://www.blacklegendcapital.com/

info@blacklegendcap.com

Claudia Della Mora, Managing Director

William Nguyen, Analyst

Jim Qiu, Analyst

http://blacklegendcapital.com/busness_m_marketoverview.php

Claudia Della Mora

Black Legend Capital LLC

3107707542

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.