Chemicals Global Market Analytics Report 2016 Including: Petrochemicals,Plastics Materials And Resins,Chemicals Products

Chemicals Global Market Analytics provides strategists, marketers and senior management with the critical information to assess the global chemicals sector.

1. Market Characteristics

The chemicals industry is one of the largest manufacturing industries in the world. It manufactures a variety of chemicals products by processing raw materials such as air, water, natural gas, oil, metals and minerals. While many of the products from the industry, such as detergents, soaps and perfumes, are purchased directly by the consumer, 70% of chemicals manufactured are used by other industries, including other branches of the chemicals industry itself, to make products.

2. Market Size

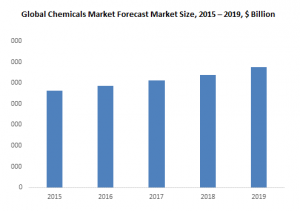

The total value of the chemicals industry globally in 2015 was around $5000 billion. Related to a world population of more than 7 billion in 2015 this equates to about $700 per person per annum. Given that world domestic product was approximately $78 trillion in 2015, the market makes up about 6.5% of the global economy(http://goo.gl/CZT8ZA). The chemicals industry is one of the largest manufacturing industries and is about 45% of the global manufacturing industry market.

3. Historic (2010-2015) Drivers on the Market

i. Emerging Markets Growth – Growth in emerging markets such as China and India fuelled sales of chemicals during 2010 to 2015. Chemicals sales in China constituted a large share of global chemicals sales and grew at a CAGR of 30% from 2003 to 2013.

ii. Low Interest Rate Environment – During the period 2010 to 2015 interest rates in most developed countries were very low. This created a flow of cheap money for investment, both in developed and developing economies. It also encouraged borrowing and discouraged saving in advanced markets, helping to drive spending. Markets such as that for chemicals benefited from the flow of cheap money(http://goo.gl/CZT8ZA) during this period. Chemicals companies borrowed money for process improvements. Companies were able to install more cogeneration capacity with the borrowed funds, which in turn reduced their electricity usage, so cutting their operating costs.

3.1 Restraints on the Market

i. Global Recession – The global economic slowdown following the financial crisis of 2008 was a restraint on the chemicals market during the period 2010-2015. The global economy went into recession in 2008 and 2009 with a decline of about 2% in GDP. While global GDP rebounded to grow at a rate of between 2% and 4% between 2010 and 2015, the effects of the recession were felt in the chemicals industry. Chemicals-producing companies experienced a fall in demand and a lack of access to credit(http://goo.gl/CZT8ZA). Major customers of chemicals industries like automobiles and construction industries faced a downturn during the recession. This, in turn, reduced demand for the chemicals companies and decreased their sales during this period.

ii. Safety – Safety regulation and consequent costs were a major concern for the chemicals industry. Many of its products are potentially hazardous at some stage during their manufacture and transport. These chemicals may be flammable, explosive, corrosive and/or toxic solids, liquids or gases. Manufacturing processes frequently involve high temperatures, high pressures, and reactions which can be dangerous unless carefully controlled. Chemicals companies(http://goo.gl/CZT8ZA) have limits on the breathing rate, toxicity, exposure time and concentration of the chemicals their employees can be exposed to. They also have restraints on the conditions under which particular chemicals can be transported. These regulations have led to higher costs and production limitations in the chemicals industry.

4. Forecast (2015-2020) Drivers on the Market

i. Low Price of Oil – In the beginning of 2015, the oil price dropped below $50 per barrel(http://goo.gl/CZT8ZA). A comparatively low oil price is good news for the chemicals industry which uses oil heavily. A lower oil cost allows companies to reduce prices and increase margins.

ii. Economic Growth – The global economy is expected to go through a continuous period of steady growth during 2015-19. The US economy was already showing strong growth in 2015, and this is likely to continue during the forecast period. The European market is expected to see growth(http://goo.gl/CZT8ZA) return later in the period – between 2016 and 2018. Emerging markets are expected to continue to see generally higher levels of growth than the developed markets during this period. The economic growth of Asian countries is attracting the chemicals industry. Most chemicals companies are entering markets in Asia to gain from this economic growth.

4.1 Restraints on the Market

i. Interest Rate Increases – Interest rates are expected to increase in developed nations, particularly the USA and Europe, between 2015 and 2019. This will decrease the flow of cheap money which has been available for investment in the period 2010-15, making it harder and more expensive for companies in capital-intensive industries(http://goo.gl/CZT8ZA) such as chemicals to raise funds.

ii. Fluctuating Raw Material Costs – The raw materials market is a highly volatile one. When increasing raw material costs coincide with decreasing sales prices, chemicals companies have to compromise on their profit margins. Specialty chemicals manufacturers are extremely sensitive to fluctuating raw material costs, especially as they relate to the price expectations of their own customers.

5. Chemicals Market Comparison With Other Markets

The chemicals industry was the fourth largest of the industries like transportation, manufacture, paper, plastics, rubber and wood and the construction in 2015, accounting for $5000 billion(http://goo.gl/CZT8ZA). Chemicals is one of the main providers to other manufacturing industries including paper, plastics and rubber, machinery and transportation manufacturing; it also plays an important role in construction materials. The industry uses materials from the oil and gas, mining, and to a smaller extent agricultural markets as raw materials for the development of chemicals.

6. Chemicals Market Geography Split

The largest geographic markets by consumption in the chemicals sector are Asia, the Americas and Europe. Asia was the largest geographic market in the chemicals sector in 2015, worth 60% of the global market. China and India are the fast-growing chemicals markets in this region. China accounts for more than half of Asia's chemicals sales. Other than China and India, Japan and Singapore are the important markets in Asia.

The Americas are the second largest geographic market in 2015 with 25% of the market(http://goo.gl/CZT8ZA). North America is the most important region in the Americas. The chemicals industry is one of the USA’s largest manufacturing industries. It is also one of the top exporting sectors of US manufacturing industry.

Europe was the third largest geographic market in 2015 with 15% of the market. The European Union’s (EU) chemicals industry provides a significant contribution to EU net exports. It is one of the region’s most international, competitive and successful industries, connected to a wide range of processing and manufacturing industries. Other significant countries/regions include Africa and Oceania.

"Rapid change in the global economic landscape during the past decade has increased competition between the established multinational companies and the growing companies in the emerging markets(http://goo.gl/CZT8ZA). These budding companies are also likely to introduce products that are specifically customized to meet the needs of the local customers. The rapid increase in the global production of chemicals also has adverse effects on the environment. These effects include air and water pollution, adverse effects on food resources and human health"

7.Chemicals Market Segmentation

The largest market segments in the chemicals sector as of 2015 were petrochemicals, plastics materials and resin and general chemicals products. Petrochemicals was the largest segment in the chemicals sector with a 30% share of the global market(http://goo.gl/CZT8ZA). Plastics materials and resin was the second largest segment with 25% of the chemicals market. The wide spread of plastics and plastic-based products led to expansion of the plastic and resin manufacturing industry over the past five years. Although due to the decrease in demand in industries such as manufacturing and construction during the recession the plastics material and resin markets saw a small drop, at present this market is recovering.

Other significant segments include soap and cleaning compounds, paint & coating and other basic inorganic chemicals.

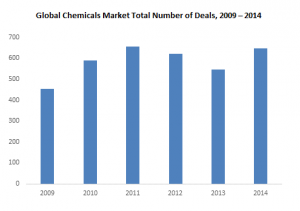

8. Chemicals Competitive Landscape

The chemicals market is fragmented. The top 10 competitors in the market made up 20% of the total market in 2015. BASF was the largest competitor with 5% of the market, followed by Sinopec with 4% and Dow Chemicals with 3%.

The rise of emerging players, especially in Asia and in the Middle East, has increased fragmentation in the chemicals industry. By 2030, it is expected that between five and eight of the global top 10 chemicals companies will come from these two regions, mostly from China. Only a few multinational players(http://goo.gl/CZT8ZA) from established markets are expected to remain in the top 10, while mostly state-controlled giants such as Sinopec, ChemChina, and PetroChina are expected to rise to the top.

"The focus of production is now being shifted to developing countries like China, India and the Middle East, as these countries are increasingly investing in local chemicals production. Rapid growth is expected in local chemicals production in China, India, the Middle East and Africa. During the 2016- 2021 period China’s chemicals production is expected to grow at 15% per year. Similarly, chemicals production in India is expected to have a compound annual growth rate (CAGR) of 12% from 2015 – 2021(http://goo.gl/CZT8ZA). Local production in the Middle East is also expected to grow at over 8% per year from 2014 to 2021. Lower labor costs, low trade barriers, advances in technology and ease of transportation are the key drivers that contribute towards the shift in a significant portion of production in the chemicals industry from developed countries to the developing countries"

9. Chemicals Industry Comparison With Macro Economic Factors

i. During the forecast period the global chemicals share of global GDP is expected to increase by 1% indicating that the global chemicals market is expected to have a slightly higher growth rate than global GDP.

ii. Chemicals Market Size, Percentage Of GDP, By Country

The chemicals industry’s share of GDP was the highest in China(http://goo.gl/CZT8ZA) accounting for 18% in 2015. This reflects the important role of industry in general and chemicals in particular within the Chinese economy. However the share of chemicals in China’s GDP is expected to decline going forward as services make up a larger share in the Chinese economy going forward.

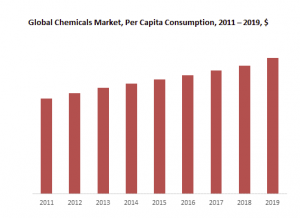

iii. Per Capita Consumption Of Chemicals, Global

Global per capita chemicals consumption grew from $600 in 2011 to $650 in 2015 at a CAGR of 6% and is expected to grow to $800 in 2019 at a CAGR of 5.5%(http://goo.gl/CZT8ZA). Increasing per capita spend on chemicals reflects higher per person consumption generally, especially in the emerging economies.

Buy Now

• Chemicals Global Market Analytics Report is a detailed report giving a unique insight into this market. The report is priced at $1250 for an individual user. To use across your office the price is $1750 and $2500 if you wish to use across a multinational company.

• Clients are able to input on the design of the report and highlight points of special interest.

About The Business Research Company

Visit TheBusinessResearchCompany.com or call +447443439350 or +918897263534 for more information on this and many other titles.

The Business Research Company is a market research and intelligence company which excels in company, market and consumer research. It has research professionals at its offices in the UK, India and the US as well a network of trained researchers globally. It has specialist consultants in a wide range of industries including manufacturing, healthcare, financial services and technology.

The Business Research Company's management have more than 20 years of varied business research experience. They have delivered hundreds of research projects to the senior management of some of the world's largest organizations.

The Business Research Company's Consultants have master’s qualifications from top institutes and include MBAs, MSCs, CFAs and CAs. The Business Research Company's Consultants gain training and qualifications from the Market Research Society and are trained in advanced research practices, techniques, and ethics.

Dinesh Kumar

The Business Research Company

+918897263534

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.