Companies Looking for Trouble: Turnaround Letter Contrarian Investing Opportunity

George Putnam's Turnaround Letter notes growing evidence that U.S. bankruptcies are on the rise, which isn’t necessarily a bad thing for these stocks.

Although those figures and trends are interesting, you're probably wondering how, exactly, that will impact your stock portfolio and investing strategy. As contrary as it may seem, an increase in bankruptcies isn't necessarily a bad thing: A periodic culling of weaker companies is healthy for the economy. The threat of distress also helps to focus management's attention. As former Eastern Airlines CEO (and astronaut) Frank Borman once said, "Capitalism without bankruptcy is like Christianity without Hell."

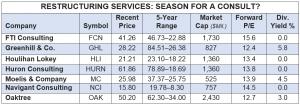

As contrarian investors, we have another take on this bankruptcy/restructuring uptick. For a few companies in particular, that increase would definitely be a good thing: These are companies that consult or advise on corporate restructurings and those that invest in bankruptcies and other distressed situations. Many of these companies are privately held, but these seven contrarian opportunities (recently detailed in our distressed investing newsletter) have actively-traded public stocks and are poised to profit from the anticipated bankruptcy uptick.

Oaktree (OAK), which we recommended last year, is one of the premier private equity and investment management firms that invests in distressed companies. It has a long and distinguished record of investing in corporate restructurings. The firm has recently raised a large new private equity fund, and so it is well positioned to take advantage of an uptick in distress.

FTI (FCN), Huron (HURN) and Navigant (NCI) are management consulting firms that do a significant amount of work advising companies about restructuring. FTI, which we recommended in February, is well-known in the restructuring field. Restructuring work is a smaller, but still significant portion of revenues and profits for Huron and Navigant.

Greenhill (GHL), Houlihan Lokey (HLI) and Moelis (MC) are all boutique investment banks that provide financial consulting and investment banking services to large companies. While all three firms provide advice in a number of other areas, such as mergers and acquisitions, restructurings are an important part of their business.

Linzee Brown

The Turnaround Letter / New Generation Research

6175739550

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.