The IMF and Public Investment Management

The efficiency of public investment depends crucially on how it is managed. Countries with stronger public investment management institutions have more predictable, credible, efficient, and productive investments. Strengthening these institutions arrangements could close up to two-thirds of efficiency gap highlighted above.

To help countries evaluate the strength of the public investment management practices, the IMF has developed a new Public Investment Management Assessment (PIMA).

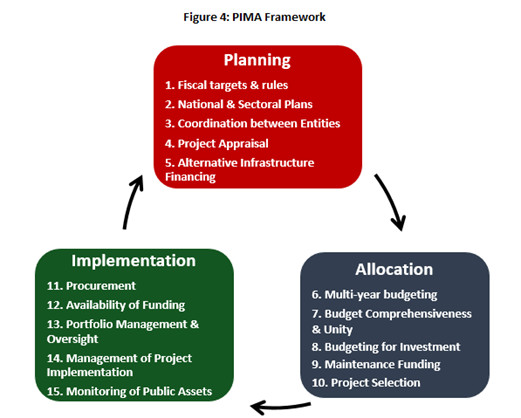

The PIMA evaluates 15 institutions that shape public investment decision-making at the three key stages (Figure 2):

- Planning sustainable investment across the public sector;

- Allocating investment to the right sectors and projects; and

- Implementing projects on time and on budget.

The PIMA provides the most comprehensive assessment of a country’s public investment management systems. In particular, the PIMA:

- covers the full public investment cycle including national and sectoral planning, investment budgeting, project appraisal and selection, and managing and monitoring of project implementation

- is relevant to countries at all levels of development by reflecting advanced practices in the areas of fiscal rules, oversight of PPPs, and monitoring of public assets

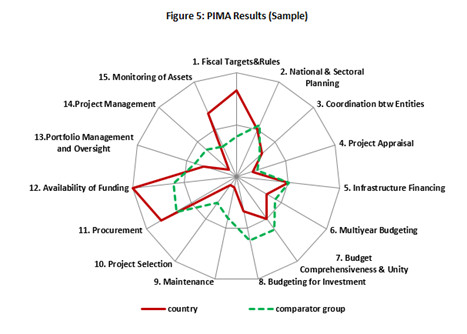

- offers an accessible summary of strengths and weaknesses in the form of summary charts showing how a country’s PIMA scores compare with their peers (Figure 3).

The PIMA findings of the assessment are set out in a concise report. The report estimates the efficiency of the country’s public investment, outlines the relative institutional strengths and weaknesses, and provides practical recommendations to enhance the efficiency and impact of public investment.

The IMF will be piloting the new PIMA assessment over the course of 2015 and 2016.

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.