$340,000 Raised by Composting and Recycling Worker Cooperative in Massachusetts

Funds raised using innovative community financing tool

Raising capital in the future is not just about valuation, speculation, or a bet in a casino. It’s about community investing in community.

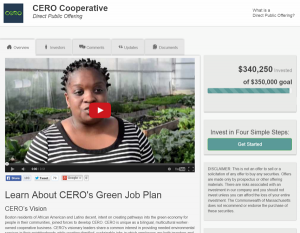

OAKLAND, CALIFORNIA, USA, July 7, 2015 /EINPresswire.com/ -- Cutting Edge Capital (CEC), a leading firm helping social ventures and entrepreneurs raise capital, announced today that its client CERO Cooperative closed its Direct Public Offering (“DPO”) to accredited and unaccredited investors on June 10, 2015, raising $340,000 from 83 investors in Massachusetts, the state in which the offering was registered. Together, clients of the Oakland, California-based firm have now raised over $5 million using the innovative approach sometimes known as investment crowdfunding.— John Katovich, President, Cutting Edge Capital

“With CERO crossing the finish line in its DPO, nine of our clients have each now raised their targeted funding goals from the one-hundred percent, not just the one percent. Raising capital in the future is not just about valuation, speculation, or a bet in a casino,” said John Katovich, President of Cutting Edge Capital. “It’s about community investing in community. This is truly the new capital for a new economy.”

The CERO DPO was filed with Massachusetts securities regulators in February 2014, and was approved four months later. The CERO DPO was also listed on CuttingEdgeX, a platform where mission-driven companies and investors meet, and was promoted through a widespread public outreach campaign undertaken by CERO’s five-person team.

The CERO DPO offered a four percent targeted divided over a term of five years. The offering was open to any Massachusetts resident, and investments ranged from $2,500 to $25,000, with most investors coming in at $2,500, the minimum amount accepted in the offering. Investment in the offering came predominately from the Boston area, with significant interest and support coming from residents of the Dorchester neighborhood, where the organization is located. Dorchester has a strong base among its community-minded residents who support CERO’s long-term mission of “zero waste” and green jobs (CERO stands for Cooperative Energy Recycling and Organics, or “zero” in Spanish). Notable institutional investors in the offering included the Local Enterprise Assistance Fund (LEAF) and Equal Exchange Coffee.

“Here we are a worker cooperative in a low-income community. Traditional lenders wouldn’t even talk to us—we didn’t come in the door with our own capital or a record of successful operations. Although we had thousands of hours of sweat equity and a solid business plan, we didn’t qualify for lending on any kind of traditional terms,” said Lor Holmes, Business Manager of CERO Cooperative. “We wouldn’t have been able to connect with such a phenomenal community of supporters using any other tool. Now that we’ve done it here, hopefully others can do it, too.”

CERO was helped in its DPO by early publicity gained from being awarded the “Community Leadership Award” by Boston Mayor Martin J. Walsh at the Greenovate Boston Summit. During its campaign, the co-op also received media coverage by Yes! Magazine, the Bay State Banner, the Boston Herald, and the Boston Globe.

After raising the first $100,000 in their DPO, CERO qualified for a $100,000 line of credit from the Cooperative Fund of New England. In addition to raising $340,000 in investment capital in its DPO, CERO raised $31,000 in tax-deductible donations from community members and supporters through a separate fund drive. The credit secured by the co-op and the monies raised in its DPO will be used to scale pick-up operations throughout Boston and grow the business internally.

The Direct Public Offering: The Original Securities-Based Crowdfunding Model

Available for decades, Direct Public Offerings have recently become a popular option for companies to self-underwrite and self-administer public securities offerings to both accredited and non-accredited investors in one or more states. A company can market and advertise its offering publicly by any means it chooses—through advertising in newspapers and magazines, at public events and private meetings, and on the internet and through social media channels. DPOs do not need to wait for the passage of the JOBS Act of 2012 or be posted on state crowdfunding platforms—they are legal today and they allow companies to interact directly with the public.

DPOs have helped many companies successfully raise capital from the crowd, including Ben & Jerry’s, Annie’s Homegrown, and Real Goods. DPOs also have an investor benefit: unlike platforms like Kickstarter and Indiegogo that facilitate donations or pre-purchases from individuals who may in return get a T-shirt or the product, DPOs are a true public offering of securities with the opportunity to earn a return on investment.

Other clients of Cutting Edge Capital that have successfully completed DPOs include Massachusetts pickle maker Real Pickles; California organic farm Capay Farms (Farm Fresh to You); Washington general store Quimper Mercantile; and California community grocery store People’s Community Market. In addition, seven new DPOs filed by the firm are currently live and raising funds, with another 25 DPOs being structured by the firm or in the process of being approved by state regulators.

About Cutting Edge Capital

Cutting Edge Capital provides small and mid-sized businesses and nonprofits with the information, tools, and expertise they need to raise capital in a way that fits with their unique business model and long-term goals. As experienced business lawyers, entrepreneurs, and finance experts, the CEC team has identified capital raising strategies that allow businesses to solicit non-traditional sources of funding. These strategies allow businesses to build public support and recognition at the same time they are raising funds. For more information, please visit www.cuttingedgecapital.com.

CERO Cooperative

CERO Cooperative diverts waste destined for landfills and incinerators to productive use as compost in Boston’s flourishing urban agriculture sector. CERO’s worker-owners are local residents intent on creating good jobs and a strong green economy in Boston’s communities of color. They take pride in their role as environmental stewards and keeping their neighborhoods green and prosperous. Visit CERO on the web at http://www.cero.coop/.

Andy Bamber

Cutting Edge Capital

(415) 309-7835

email us here