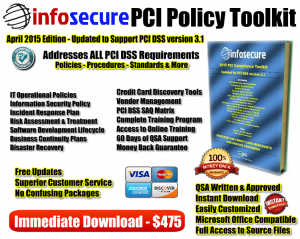

Payment Experts from InfoSecure Provide Updated PCI DSS v3.1 Policy Templates

The most comprehensive set of PCI policy templates are now available for download from InfoSecure.

The leading payment experts from InfoSecure have created the most comprehensive set of PCI policy templates available and released them for download at http://policytoolkit.infosecurepci.com.

The newly released Toolkit addresses the most recent 3.1 version of the Payment Card Industry Data Security Standard.

It’s important for organizations to review their written policies and procedures, especially if they are more than a year old. As standards change, business often fall out of compliance simply because their written policies are not properly maintained. Additionally, the increased rigor of PCI DSS 3.1 provide important security safeguards for protecting credit card data.

InfoSecure, the leading provider of comprehensive PCI policies and procedures, provides a single Toolkit that helps merchants and service providers of all sizes. There aren’t any confusing options from which to choose, and the Toolkit’s low price ensures wide access to professional documentation.

The documents are written by a PCI certified Qualified Security Assessor (QSA) with over 20 years of experience helping organizations protect confidential data, especially credit card information. The Toolkit is complete in every way and includes all the policies, procedures, methodologies, standards, forms, Training, and other material necessary to help organizations achieve rapid compliance with PCI DSS 3.1.

You’ll get immediate access to everything you’ll need, not just the policy document. Our exclusive package includes everything you’ll need to help achieve rapid compliance, including:

A comprehensive policy document: This is your main PCI DSS policy document. The policies and procedures are numbered exactly to the PCI DSS requirements. If you want to know your process for PCI DSS 2.3, simply turn to your policy document (section 2.3). This makes it easy for your auditor and your IT staff to comply with PCI requirements and ensure cardholder security.

User-level information security policy: Why is this important? PCI DSS requirement 12 requires your organization to have an information security policy. You don’t want this to be the same document that has all of your IT procedures; it will confuse your users. InfoSecure has created a separate user-level information security policy that contains everything your general users need to ensure a secure operating environment.

An exclusive PCI documentation matrix: This is an Excel spreadsheet that enumerates all of the over 400 PCI DSS control objectives. Use this matrix to quickly identify which PCI requirements your organization must comply with based on SAQ type.

Computer security incident process: Did you know that PCI DSS requires a specific process for dealing with computer security incidents? The InfoSecure Policy Toolkit meets all of the PCI requirements. What’s more, the process provides specific guidance for dealing with any security incident.

Disaster recovery plan: No one wants to deal with an IT disaster, but it’s important to have a plan. This disaster recovery plan is well worth the $475 price by itself. Use this template and get a huge head start in creating a disaster recovery plan specific to your organization. The included text and headings remove all the guesswork and will save time and money for your organization.

Risk assessment methodology: PCI DSS requires an annual risk assessment. Our compliant methodology includes a specific process that will ensure your compliance with PCI DSS. The methodology includes all of the forms you’ll need to complete an annual risk assessment.

Operating system configuration standards: Our PCI DSS required configuration standards are based off of industry accepted CIS recommendations. You’ll get a huge head start on compliance by using our predefined configuration standards. We have recommendations for all major operating systems and applications. If you have an OS that isn’t covered, we will create a standards document for you at no additional cost.

A complete security awareness Training program: When we say complete, we mean it. A security awareness PowerPoint slide deck, Training log, and a certificate of Training template. This Training program meets all PCI requirements. You'll also get free access to the online learning management system located at http://training.infosecurepci.com.

Change management procedures: Many organizations are missing a documented, standardized change management procedure. This well-defined process includes all the details and forms you’ll need to implement a PCI DSS compliant change management process at your organization.

PCI operating processes: PCI DSS requires security to be a part of your ‘business-as-usual’ philosophy to credit card security. InfoSecure’s operating processes will ensure that your IT staff maintains your compliant environment on to ensure the ongoing security of cardholder data. Examples include: secure data destruction, document retention processes, password reset procedures, and dozens more.

Security operations procedures: In addition to the PCI operating processes, there are daily, weekly, monthly, quarterly, and yearly security procedures that your IT staff will need to perform to maintain compliance. Our innovative approach documents everything your staff will need to do on a periodic basis to ensure ongoing security and compliance of PCI DSS.

60 days of unlimited support: When you purchase either package, you’ll get access to the author and PCI DSS expert. He will answer all your PCI and security related questions to help you achieve rapid compliance. Yes, customer service like this really does exist!

Our Guarantee: Your satisfaction with the PCI security template package is guaranteed, or you get your money back!

Patrick Bass

InfoSecure Redteam, Inc. d/b/a InfoSecure

877-674-6965

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.