Nigerian Breweries PLC: Emergence of a New Competitor, One Competition too Many?

9M -2014: Revenue and Net income improved by 2.3% and 11.3% respectively.

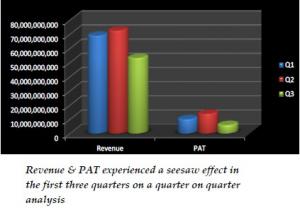

On a quarter on quarter analysis, revenue was up by 5.1% to N72.52billion($439.51M) in Q2 2014 from N68.97billion ($418.04M) in Q1 2014, but declined by 26.6% to N53.24billion ($322.69M) in Q3 2014. Net income on the other hand rose by 37.3% to N13.81billion ($83.71M) in Q2 2014 from N10.06billion ($60.97M) in Q1 2014, but crashed by 57% to N5.95billion ($36.09M) in Q3 2014.

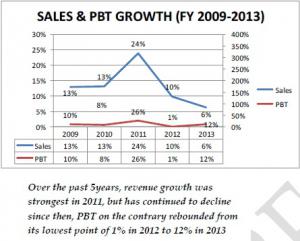

The Company recorded its lowest sales volume in the third quarter which translated to the weak net income performance. However, the 17% reduction in distribution/administrative and other expenses line item in Q3 2014 as well as the stronger revenue growth especially in Q2 2014 ensured that the Company managed a flat revenue growth YoY and an 11% improvement in PAT in the 9M 2014 cumulative performance. We note the steady reduction in the revenue growth from beginning of the year to date (Q1 2014 6.8%, H1 2014 5.7% & 9M 2014 2.3%) and we adduce this trend to the increased competition especially from the emerging low end ‘’Gin/ Spirit’’ market which is increasingly gaining prominence especially among the middle and low income earners.

The Company’s major shareholder, Heineken N.V has proposed its merger with Consolidated Breweries PLC (another subsidiary of Heineken). The merger is expected to be concluded around January 2015. We expect that this merger will boost the Company’s chances of penetrating the lower segment of the brewery market.

The Company traditionally posts its strongest quarterly performance in the fourth quarter because of the associated year end festivities and despite the revenue growth challenge, we expect this trend to continue in 2014.

VALUATION ANALYSIS

Based on our analysis, the stock is currently trading at a 2.59% premium to our estimate fair value of N165.60, with a 12Month investment horizon. In arriving at our fair value for the stock, we focused on the historical financial performance of the stock and our expectation for FY 2014.

Our fair value for Nigerian Breweries shares was calculated using the Dividend Discount Model comprising our expected dividend estimate for the company and GTI Securities customized tweak to adjust for the risk of investing in the Nigerian consumer goods sector. Our Required Rate of Return (RROR) factors in a risk premium of 7% and the yield for the most recently issued 20-Year FGN Bond was applied as the risk free rate of return.

We have placed a NEUTRAL rating on the stock of Nigerian Breweries because the stock is just about fully priced based on our analysis.

FORECASTS

Our FY 2014 revenue forecast for Nigerian Breweries is N266.13 billion ($1.61B) representing a 0.92% decline relative to FY 2013, while our net income estimate for FY 2014 is N41.78 billion ($253.22M) and equates to a 3.01% reduction from FY 2013. This yields an EPS of N5.52 and a forward P/E of 30.76X.

Our revenue forecast for Q4 2014 is N71.40 billion, which represents a 34% improvement from the Q3 2014 revenue figure. We expect that the associated year end festivities as well as the activities surrounding the forth-coming general elections will be the catalysts for the larger volume consumption of the company’s products.

However, our net income forecast for Q4 2014 is N11.95billion and represents a 101% rise from Q3 2014 net income figure which was impaired by poor revenue growth and high finance cost. The expected growth in sales volume in Q4 will be the catalyst for the vastly improved net income expectation for Q4. We do not expect net income margins to strengthen to historical levels of an average of 16.5% as a result of the rising cost of funds triggered by the rising debt profile between H1 2014 and 9Months 2014.

Overall, the Company’s inability to grow sales is a major challenge. Despite our expectation that the Company will record an improvement in sales in the fourth quarter compared with the third quarter, competition is a major challenge in that sector and this will impede overall aggressive growth in the FY 2014.

INVESTMENT CONCLUSION/OUTLOOK FOR NB

The shares of NB is slightly overvalued with focus on our FY 2014 estimates. The stock is currently trading at a 2.59% premium to our fair value estimate of N165.60.

Heineken NV plans to merge its Nigerian subsidiaries NB & Consolidated breweries. With this merger, the installed production capacity of NB will rise to about 19mhl and increase market share to about 70% of the total beer market in Nigeria. This further reestablishes NB’s market dominance in a beer market that is extremely competitive in Nigeria.

However, we think that the threat from the emerging low end gin market is a major cause for concern for both the premium and the mid-level beer brands in Nigeria. The comparatively low cost of these products in addition to the perceived medicinal value gives them the competitive edge over the beer brands and accounts for the huge growth recorded in that market segment in the last two years. We are of the opinion the increasing difficulty in growing revenue currently being experienced especially by the premium beer brands may not only be on account of the shrink in disposable income, but also a gradual change in taste as more people are becoming health conscious and this is reflecting in their consumption pattern.

We have a HOLD recommendation on the shares of Nigeria Breweries because it is trading close to our target price with focus on FY 2014 estimates. The strong dividend antecedence of the company and its relative price stability still makes it a favorite among institutional investors like PFA’s and foreign investors especially during a period of heightened price volatility.

GTI Research

GTI Securities Limited

+2348025869970

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.