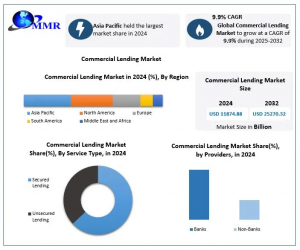

Commercial Lending Market Size Worth USD 25270.32 Billion by 2032 | Driven by Fintech Innovation & ESG Financing Trends

Commercial Lending Market is expanding, driven by rising business investments, digital lending innovations, and growing demand for flexible financing solutions.

Global Commercial Lending Market Overview 2025: Fintech Innovation, AI-Powered Lending & ESG Financing Reshape Corporate Loans Worldwide

Global Commercial Lending Market is witnessing rapid transformation, fueled by fintech innovation, AI-powered digital lending platforms, ESG financing, and sustainability-linked loans (SLLs). Accelerated SME financing, corporate lending, and blockchain-enabled commercial lending solutions are reshaping the global business loan ecosystem. With traditional banks and alternative non-bank lenders competing, the market offers significant opportunities for digital banking transformation, AI-driven underwriting, and green financing, driving operational efficiency, transparency, and growth worldwide.

Gain Valuable Insights – Request Your Complimentary Sample Now @ https://www.maximizemarketresearch.com/request-sample/230608/

Global Commercial Lending Market Drivers 2025–2032: Fintech Innovation, AI-Driven Lending, and ESG Financing Fuel Exponential Growth

Global Commercial Lending Market Size is propelled by robust GDP growth, rising SME financing, and an AI-driven transformation in commercial lending. As global economic recovery accelerates post-pandemic, demand for digital lending platforms, fintech credit solutions, sustainability-linked loans (SLLs), and ESG-based financing surges, creating vast opportunities across the evolving fintech lending market worldwide.

Global Commercial Lending Market Restraints: Rising Interest Rates, Cybersecurity Threats, and Fintech Disruption Slow Growth Momentum

Global Commercial Lending Market Forecast 2025–2032 also highlights key restraints, including rising interest rates, complex regulatory frameworks, and growing cybersecurity risks. Limited access to SME credit, tightened underwriting standards, and the inability of traditional banks to match fintech lending innovations are slowing AI-driven transformation in commercial lending and impacting the overall business loan market growth potential.

Global Commercial Lending Market Opportunities: AI, Blockchain, and ESG Financing Fuel Fintech-Driven Lending Growth Worldwide

Global Commercial Lending Market opportunities arise from expanding digital transformation in banking, AI-based underwriting, and blockchain-enabled commercial lending solutions. Increasing demand for cybersecurity-integrated financing, green financing, and ESG-based lending growth empowers lenders to expand securely, enhance transparency, and capture new revenue streams within SME financing, corporate lending, and the global business loan ecosystem.

Global Commercial Lending Market Segmentation: Fintech Lending, AI Banking, and Large Enterprises Reshaping Business Loan Dynamics

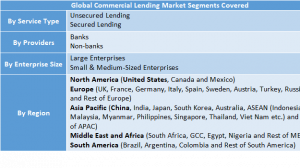

Global Commercial Lending Market is segmented by service type, providers, and enterprise size. Large enterprises dominate the market with over 70% share, supported by strong credit ratings, large-scale corporate loans, and access to syndicated and secured lending solutions. Meanwhile, the rise of fintech lending platforms, AI-driven banking solutions, and SME-focused digital financing models is revolutionizing the global business loan ecosystem, driving commercial lending market growth and reshaping competitive dynamics worldwide.

Feel free to request a complimentary sample copy or view a summary of the report @ https://www.maximizemarketresearch.com/request-sample/230608/

Key Trends Shaping the Global Commercial Lending Market: How AI, Fintech, and ESG Financing Are Transforming Corporate Lending

Global Commercial Lending Market is witnessing a surge in AI-driven digital lending platforms that automate credit assessment, streamline loan origination, and enhance customer engagement. This rapid digital banking transformation enables lenders to boost operational efficiency and offer personalized financing solutions across corporate and SME segments.

The rise of fintech lending platforms and alternative non-bank lenders is reshaping the competitive landscape. By providing faster approvals, flexible loan structures, and data-driven underwriting, these players are expanding credit access to underserved SMEs and driving innovation within the global business loan and commercial financing ecosystem.

Growing global emphasis on ESG and sustainability-linked loans (SLLs) is transforming lending priorities. Financial institutions are increasingly tying loan terms to environmental and social performance metrics, driving transparency, responsible investing, and long-term value creation across corporate lending and institutional financing markets.

Global Commercial Lending Market Developments 2025: AI, ESG Financing, and Blockchain Innovations Reshape Fintech Lending Worldwide

American Express Launches Unified Digital Lending Platform

In January 2025, American Express unveiled an AI-driven digital platform integrating loans, cards, and merchant financing, enhancing speed and efficiency across North America’s fintech lending landscape.

BNP Paribas Expands ESG-Linked Corporate Financing

In March 2025, BNP Paribas introduced a €3B sustainability-linked lending program, aligning loan terms with ESG metrics and boosting green commercial lending across Europe.

ICBC Funds High-Tech Innovation Loans

ICBC launched an ¥80B fund in March 2025 to support AI-driven and high-tech sector financing, strengthening digital lending transformation across the Asia-Pacific region.

Banco Santander Strengthens SME Financing in Brazil

Banco Santander rolled out a $500M SME credit line under Prospera, expanding fintech-based lending access for rural and urban microbusinesses in South America.

First Abu Dhabi Bank Pioneers Blockchain Lending

FAB deployed blockchain-based smart contracts in April 2025 to modernize cross-border commercial lending, enhancing transparency and operational efficiency across the Middle East and Africa.

Global Commercial Lending Market Competitive Landscape:

Global Commercial Lending Market is dominated by key players like JPMorgan Chase, Bank of America, Citigroup, Wells Fargo, and HSBC, leveraging extensive branch networks, diverse commercial loan portfolios, and AI-driven underwriting solutions. Investments in digital banking transformation, blockchain initiatives, and fintech lending innovation are enabling these institutions to enhance operational efficiency, expand corporate lending, and solidify leadership across the global business loan ecosystem.

Global Commercial Lending Market Regional Insights 2025–2032: APAC’s SME Boom and North America’s AI-Driven Lending Transformation

Asia-Pacific commercial lending market is booming, fueled by rapid SME financing, fintech lending platforms, AI-driven digital lending, and digital banking transformation. China, India, Japan, and Southeast Asia lead growth through infrastructure loans, ESG financing, green loans, and innovative credit solutions. Strong government support and sustainable lending initiatives are reshaping the global business loan and commercial financing ecosystem.

North America’s commercial lending market thrives on mature banking infrastructure, AI-based underwriting, fintech lending innovation, and digital banking transformation. Strong SME and corporate financing demand, combined with robust economic indicators, positions the U.S. and Canada as the second-largest regional hub in global commercial lending and business loan market growth.

Global Commercial Lending Market, Key Players:

North America:

JPMorgan Chase (USA)

Wells Fargo (USA)

Citibank N.A. (USA)

American Express (USA)

Huntington Bank (USA)

TD Bank (Canada)

Bank of Montreal (Canada)

Europe:

Barclays Bank PLC (UK)

BNP Paribas S.A. (France)

Crédit Agricole S.A. (France)

Societe Generale (France)

ING Bank N.V. (Netherlands)

UBS Group AG (Switzerland)

Asia-Pacific:

Bank of China Limited (China)

Industrial Bank Co. Ltd (China)

China Development Bank (China)

Japan Post Bank Co., Ltd (Japan)

Mizuho Bank, Ltd (Japan)

South America:

Banco Santander S.A. (Brazil)

Itaú Unibanco (Brazil)

Banco do Brasil (Brazil)

Bradesco (Brazil)

Banco de Bogotá (Colombia)

Middle East & Africa:

First Abu Dhabi Bank (UAE)

National Commercial Bank (Saudi Arabia)

Standard Bank (South Africa)

Nedbank Group (South Africa)

Qatar National Bank (Qatar)

FAQs:

1.What is the projected size of the Global Commercial Lending Market by 2032?

Ans: Global Commercial Lending Market is projected to reach USD 25,270.32 billion by 2032, growing at a robust CAGR of 9.9% from 2025 to 2032.

2.What are the key drivers of growth in the commercial lending market?

Ans: Growth is driven by fintech innovation, AI-driven digital lending platforms, SME financing, and ESG-based sustainability-linked loans (SLLs).

3.Which segment dominates the commercial lending market?

Ans: Large enterprises dominate the market with over 70% share, leveraging strong credit ratings, corporate loans, and access to syndicated and secured lending solutions.

4.What are the major challenges restraining the commercial lending market?

Ans: Key restraints include rising interest rates, cybersecurity risks, limited SME credit access, and traditional banks struggling to match fintech lending innovations.

5.Who are the leading players in the global commercial lending market?

Ans: Major players include JPMorgan Chase, Bank of America, Citigroup, Wells Fargo, HSBC, American Express, BNP Paribas, ICBC, and First Abu Dhabi Bank, leveraging AI-driven lending, fintech platforms, and ESG financing.

Analyst Perspective:

Industry observers note that the global commercial lending sector is experiencing significant transformation, fueled by fintech innovation, AI-powered lending, and ESG-focused financing trends. Enhanced digital platforms and SME-centric solutions are increasing operational efficiency and expanding credit access. Analysts highlight intensifying competition among traditional banks and emerging non-bank lenders, while investments in blockchain, digital banking, and sustainable loan solutions are seen as key drivers for long-term value creation and market expansion.

Related Reports:

Peer-to-Peer Lending Market: https://www.maximizemarketresearch.com/market-report/global-peer-to-peer-lending-market/54358/

Asset-Based Lending Market: https://www.maximizemarketresearch.com/market-report/asset-based-lending-market/189641/

Maximize Market Research launches a subscription platform for continuous access to global market insights and analysis @ https://www.mmrstatistics.com/

About Us

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

MAXIMIZE MARKET RESEARCH PVT. LTD.

2nd Floor, Navale IT park Phase 3,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

+91 9607365656

sales@maximizemarketresearch.com

Lumawant Godage

MAXIMIZE MARKET RESEARCH PVT. LTD.

+ +91 96073 65656

email us here

Visit us on social media:

LinkedIn

Instagram

Facebook

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.