Medicare open enrollment kicks off in Montana – and plans are more expensive than ever

Carly Graf | The Missoulian

October 17, 2025

More than 260,000 Montanans will be notified this week that it’s time to enroll in a Medicare plan for next year. When they check out their options for re-upping the government-backed health insurance for seniors, many will find that the cost of their coverage has ballooned.

Some plans will carry double-digit percentage increases in premium prices. Others come with higher deductibles and out-of-pocket expenses.

Medicare’s annual open enrollment period began Wednesday and runs through December 7. It marks the start of the yearly health insurance sign-up cycle for many Montanans who rely on either the longtime public benefit or the Affordable Care Act (ACA) marketplace for health care coverage.

But against a backdrop of rising costs and political uncertainty wrought by the current government shutdown, insurance agents and healthcare providers across the state say they are bracing for a looming disaster when people go to pick an insurance plan.

“The unknown is going to create a lot of confusion, and it is going to create a lot of uninsured people,” said Sean Jacobs, a broker at Rocky Mountain Insurance Group in Helena.

As Montana’s population ages, Medicare plays an increasingly important role in keeping people healthy and managing health care system costs.

“We like to say Medicare is like navigating a maze,” said Kelly Jennaway, a co-owner of McLeod Insurance and Financial Services in Bozeman. “There are so many options out there, and what might be the best for one person might not be the best for another person.”

The patchwork of options ranges from barebones plans that cover the basics, like inpatient hospital stays, preventative screenings and outpatient care to bundled packages that are sold by private insurance companies. There are one-offs that allow people to bulk up their plans by adding prescription drug coverage or more money to pay for out-of-pocket costs.

Jacobs, who has about 400 regular clients on annual Medicare enrollment, said certain plans are requiring customers to shoulder increases of up to 25%, the largest jump he’s ever seen. He worries some people might not realize their costs are going to skyrocket if they simply re-enroll in the plan they’ve always had.

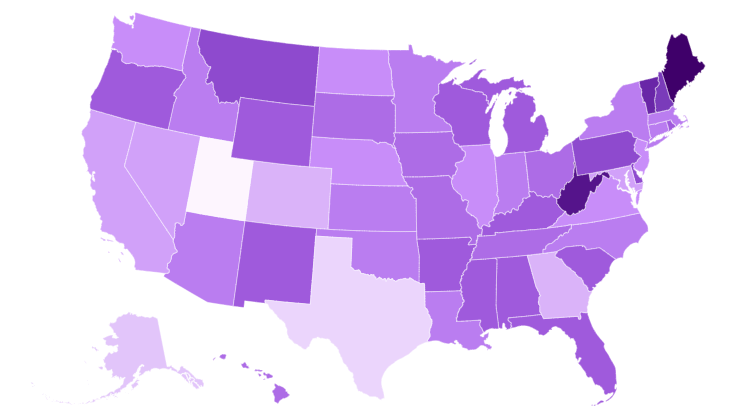

Medicare enrollment, by state

At 23%, Montana has a larger share of its total population enrolled in Medicare than many of its neighbors. This map shows Medicare enrollment as a percentage of population by state.

Jacobs works with many seniors on fixed incomes, so even a marginal increase can be destabilizing.

Unlike Medicaid and private plans, where Montana regulators and lawmakers have some authority, Medicare costs are determined through federal negotiations with insurance companies — mostly behind closed doors.

Numerous insurance agents said they generally attribute this year’s price hikes to rising costs of health care and the effort of insurance companies to recoup revenue they will lose because of a Biden-era cap on out-of-pocket prescription drug prices for Medicare enrollees.

“Only the company knows that,” Jacobs said. “And they’ll never release the ‘why.’”

How many people are enrolled in traditional Medicare?

Traditional Medicare provides coverage of outpatient care, preventative screenings and inpatient hospital stays. In Montana, 71% of Medicare enrollees rely, at least in part, on this program for health care coverage.

Government shutdown

While Medicare enrollees are receiving notice of potential changes to their costs, the 77,000 Montanans who purchase health insurance on the federal marketplace are waiting to learn how big of a bill they’ll be hit with on Nov. 1 when that open enrollment period begins.

Earlier this year, each of the three insurance companies that sell Montana plans on the marketplace proposed staggering premium price hikes. Blue Cross Blue Shield of Montana, the state’s largest insurer, submitted increases of 23% and 33% for the two plans it sells.

In their filings with the state auditor’s office, the companies cited increased medical costs and changes to federal programs as the reason for the hikes.

Most Montanans on the ACA exchange receive monthly subsidies that make premiums more affordable. A pandemic-era federal policy expanded those subsidies, giving many consumers a financial buffer during an economically uncertain time.

Those ACA enhanced premium tax credits will lapse at the end of the year without congressional action, and are currently at the center of the federal government shutdown fight. The impasse is largely due to Democrats’ insistence on renewing the subsidies and the Republicans’ refusal to do so as a condition of reopening.

The average monthly subsidy for a Montana resident is currently $545. Jacobs said he works with some families who currently pay $350 a month with the ACA tax credit but could pay around $2,200 a month without it.

“I expect the uninsured rate to go up to probably one of the highest uninsured rates you’ve ever seen,” he said. “People simply won’t be able to afford it, or they will decide not to afford it.”

Republicans, including Montana’s all-GOP federal delegation, say the subsidies were always meant as a short-term stopgap, not as permanent help.

A spokesperson for U.S. Sen. Steve Daines, the senior senator from Montana who sits on the chamber’s Finance Committee, told Fox Business Thursday morning Democrats were stalling a resolution to the shutdown for political points.

“They are frustrated,” Daines said. “They are angry. But sadly they are expressing their anger and frustration by shutting down the government and hurting the American people.”

The delegation is at odds with Montana’s GOP Commissioner of Securities and Insurance James Brown, who came out last month along with state auditors from around the country in favor of renewing the ACA credits.

“At a time when costs are rising everywhere, I’m proud that our office is doing its part to keep insurance rates in check,” Brown told the Montana State News Bureau on Wednesday. “We’ve stopped more than $21 million in unjustified rate hikes and saved tens of thousands of Montanans from paying more than they should. Protecting Montanans is what my office is here to do.”

Democrats counter that people are feeling financial strain and could choose to go without insurance rather than pay a high price, which will ultimately cost the system more down the line when they seek emergency room care.

“We are talking about families with kids, we’re talking about seniors, retirees who aren’t old enough for Medicare but desperately need healthcare coverage, countless farmers, ranchers, small business owners and freelancers,” said U.S. Senator Patty Murray, a Democrat from Washington, in a press call earlier this week.

Murray, one of the lone Senate Democrats in the otherwise deep red geographic pocket, hosted a press conference on Wednesday with a handful of Montanans. Murray claimed she’s heard from Montana residents with concerns about the potential surge in health costs.

Montana Sen. Cora Neumann, D-Bozeman, also participated in the event. She expressed concern that Montana’s GOP lawmakers in D.C. were “out of touch” with the impact that the price increases could have on the average family.

With less than three weeks until the marketplace opens for business and no clear path forward in sight, many people are left to wonder what this all means for them.

“That is the question that no one can answer,” Jennaway said. “It’s basically a wait-and-see because we can’t give any assurances.”

Click HERE to read the full article

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.