2025 Proxy Season Review: From Escalation to Recalibration

With the 2025 proxy season marked by fewer proposals, heightened scrutiny, and more selective investor support than previous years, this report shares guidance on how companies can approach offseason engagement with investors and prepare for the 2026 proxy season.

Trusted Insights for What’s Ahead®

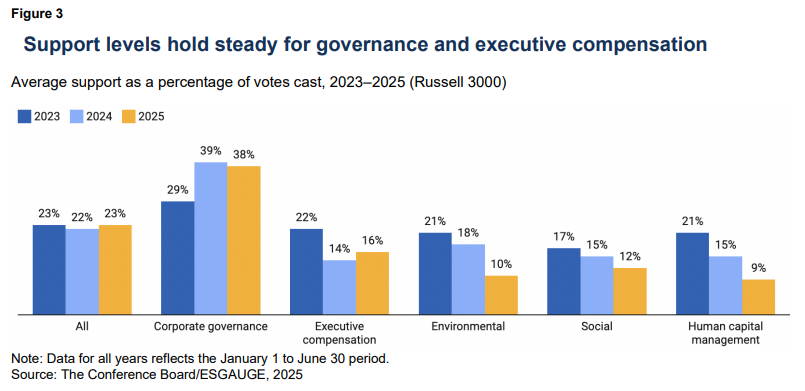

- A drop in shareholder proposal volume was most pronounced across environmental, social, and human capital management topics, reflecting both reduced filing activity and investor fatigue with repetitive or prescriptive proposals.

- Companies filed a record number of Securities and Exchange Commission (SEC) noaction requests, leveraging new SEC guidance (Staff Legal Bulletin 14M, SLB 14M) to challenge proposals—particularly those viewed as micromanaging or lacking relevance.

- Institutional investor engagement was affected by new SEC guidance issued in February 2025, which introduced uncertainty around Schedule 13G eligibility. Some investors temporarily paused or narrowed the scope of engagement, shaping a more cautious, issuer-led dialogue environment heading into the 2026 proxy season.

- Average support for say-on-pay held steady but more companies fell into the “watch list” zone (below 90%), signaling increasing investor scrutiny of pay practices—even when proposals technically passed.

- Companies can consider proactively enhancing proxy disclosures and engagement documentation—especially around proposal negotiations and investor feedback—to maintain investor confidence and limit voting surprises in 2026.

Shareholder Proposals: A More Selective Season

Following record activity in 2024, the 2025 proxy season marked a notable dip in shareholder proposal volume. Companies across the Russell 3000 saw a decline in shareholder proposal submissions, with environmental, social, and human capital proposals each falling by more than 20% year-over-year.

With fewer proposals filed, proponents may have concentrated on narrower, more material issues. The share of failed proposals fell to 52% from 59% in 2024, lifting passage rates to 7% from 5%. Withdrawals declined to 18%, continuing a gradual downward trend since 2022. At the same time, issuers made record use of the no-action process, filing 325 requests in the Russell 3000—a new high—reflecting increased reliance on SLB 14M [1] to challenge proposals. While the overall grant rate remained stable at 55%, the elevated number of requests underscores the extent to which companies lean on procedural tools to manage proposal risk. Looking to 2026, proposal volume may remain subdued but scrutiny on proposal quality, engagement practices, and the limits of exclusion mechanisms will continue.

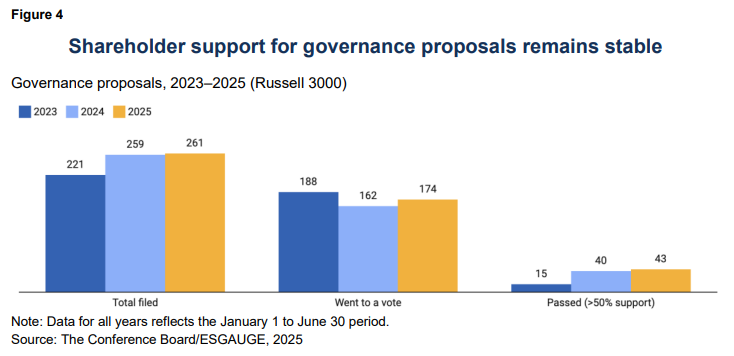

While proposal volume fell across most categories—particularly environmental, social, and human capital management—governance proposals remained a steady area of focus, drawing the highest levels of support and accounting for the majority of successful outcomes. Across the board, proposals that advanced were those seen as materially relevant, well targeted, and aligned with investor priorities. The continued decline in support for prescriptive or duplicative proposals reflects both evolving investor expectations and growing caution in a more complex and politically charged regulatory landscape.

Key factors contributing to the decline in support across most categories include:

- Increased proposal quality scrutiny: Investors continue to be selective, supporting only proposals that are company specific, performance linked, and tied to material risks.

- Growing fatigue with prescriptive or duplicative proposals: Many proposals revisited previously addressed topics or imposed rigid implementation requirements, undermining investor confidence.

- Shifting preference toward engagement over escalation: Institutional investors favor direct engagement and improved disclosures over formal shareholder resolutions, especially when proposals lack new insight or urgency.

- Political and legal headwinds: In 2025, heightened politicization of environmental, social & governance (ESG) topics and regulatory uncertainty have made some investors more reluctant to back proposals that may appear ideologically charged or operationally risky.

- Universal proxy and activism dynamics: The availability of more direct tools—like proxy contests under the universal proxy rule—may be redirecting investor energy away from nonbinding shareholder proposals in favor of more forceful governance interventions.

As companies look ahead to 2026, aligning proposal responses and engagement efforts with evolving and increasingly risk-sensitive investor expectations will be critical to maintaining support and avoiding unnecessary friction during the next proxy season.

Governance: Structural Stability Amid Shifting Priorities

Governance proposals remained a focal point in 2025, with 261 submissions—more than any other category—and continued to receive the strongest average support (38%). Both the number of proposals filed and the overall level of investor backing stayed consistent with 2024 levels, reflecting ongoing shareholder appetite for enhanced accountability and transparency. Proposals seeking to expand shareholder rights—such as allowing shareholders to call special meetings or eliminating supermajority voting thresholds—were particularly well supported. The stability of governance proposal performance, both in volume and outcome, underscores investors’ sustained emphasis on long-term board oversight and structural improvements, even amid broader declines across the ESG landscape.

» The most common corporate governance topic filed in 2025 was granting shareholders the right to call special meetings, with 74 proposals filed, up from 26 in 2024. Other leading topics included proposals to eliminate supermajority voting (41 in 2025, 49 in 2024) and to separate CEO and chair roles (31 in 2025, 45 in 2024). The most successful topic remained board declassification, with 10 of 20 proposals passing in 2025 (50%), following four of nine in 2024 (44%).

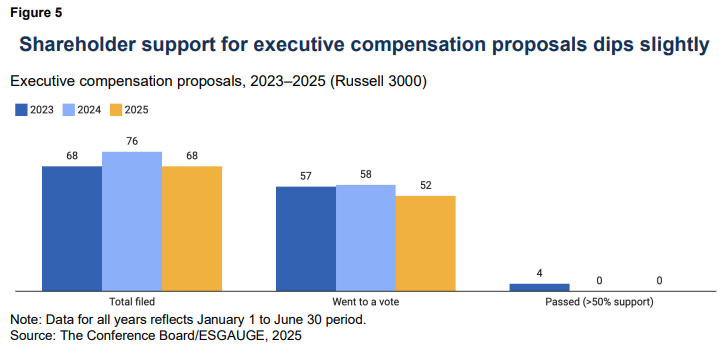

Executive Compensation: Low Volume, Low Traction

Executive compensation proposals remained relatively stable in volume in 2025, with 68 submitted (compared to 76 in 2024) and an average support level of 16% (14% in 2024). Despite ongoing public scrutiny of pay practices, shareholder interest in supporting prescriptive compensation proposals—such as those on severance agreements, clawbacks, or ESG-linked pay metrics—remained tepid, with none passing. The consistently low passage rates suggest that while compensation continues to be a focus area, most investors prefer engaging companies directly or leveraging say-on-pay votes to register concerns, rather than supporting shareholder-submitted resolutions.

» Severance agreement proposals remained the most frequently filed executive compensation topic, with 30 in 2025 compared to 33 in 2024. Clawback-related proposals also increased, from 12 to 15, while ESG-linked pay metrics held steady at nine proposals.

Human Capital Management: Declining Emphasis and Support

Human capital management proposals experienced the steepest decline among all categories in 2025, with the number filed dropping by 35% and average support falling to just 9%. After peaking in 2024, this category saw a marked reduction in both filings and voting activity—only 39 proposals made it to a vote, less than half of the previous year’s count. While investors continue to view workforce-related risks as material—particularly in areas like pay equity; workplace safety; and diversity, equity & inclusion (DEI)—many proposals were deemed overly prescriptive, duplicative of existing disclosures, or insufficiently tailored to company-specific issues.

» Workplace diversity was the most frequently filed human capital topic in both 2024 and 2025, with 37 and 35 proposals filed, respectively. Pay equity proposals increased slightly in 2024 to 20 before dropping to just three in 2025. Other recurring topics included union- and worker-related assessments, racial equity audits, and EEO-1 disclosures, all of which saw lower filing volumes.

This decline in volume and support is shaped by several converging dynamics:

- Federal scrutiny of corporate DEI programs intensified in 2025, following the Supreme Court’s 2023 affirmative action ruling [2] and broader political challenges to race-based policies. The legal environment has made some investors more cautious about endorsing proposals perceived as risky or noncompliant, as previously documented by The Conference Board® in The Evolving Landscape of DEI Shareholder Proposals.

- Proxy advisors and asset managers have increasingly opposed DEI proposals they view as redundant or overly specific—especially when companies already disclose board and workforce diversity metrics.

- Proposal fatigue is also a factor, as repeat filings on similar DEI topics have struggled to maintain investor attention and differentiate themselves from earlier resolutions.

As legal challenges persist and investor selectivity sharpens, proponents may need to reframe human capital management proposals with a clearer connection to financial materiality and operational relevance. For companies, aligning disclosure practices with evolving expectations—and understanding when and how to engage on sensitive DEI topics—will be critical heading into the 2026 proxy season.

Social: Fewer Proposals, Targeted Wins

Social proposals saw a meaningful decline in 2025, with filings dropping 23% from 265 to 205 year-over-year and the number voted falling 40% to 108. Despite the decrease in activity, the number of social proposals that passed increased to five—compared to just one in 2024 and two in 2023—indicating that while fewer proposals were brought forward, those that were may have been more targeted or better aligned with investor priorities. Nonetheless, overall average support declined to 12% (15% in 2024, 17% in 2023), with many proposals viewed as overly prescriptive or lacking in material relevance. Investors appear to be shifting away from symbolic or duplicative proposals, instead favoring more data-driven engagements and outcome-focused disclosures on social topics such as political activity, AI risks, and human rights.

» Political spending and lobbying disclosure remained the most frequently filed social topic, with 36 proposals filed in 2025 (down from 48 in 2024). In 2025, five proposals on political contributions passed—marking a sharp increase from one the prior year. Other recurring topics in 2025 included human rights due diligence (33), charitable giving transparency (16), racial equity and civil rights audit (12), and AI policies (nine)—none of which passed.

Environmental: Declining Support, Rising Selectivity

The 2025 proxy season saw a drop in both the number and support of environmental proposals, driven by diverging investor approaches, shifting regulatory dynamics, and improving corporate disclosure practices. Just 110 environmental proposals were filed, down 26% from 149 in 2024, while average support fell to just 10%, with none passing. Although climate-related proposals accounted for 50% of all environmental submissions (down from 65% in 2024), newer topics such as biodiversity and clean energy financing gained limited traction.

» Climate-related proposals dominated environmental filings in the last three years, with 101 submitted in 2023, 102 in 2024, and 56 in 2025. These mainly included proposals on emissions disclosures and climate risk, with the two climate-related proposals that passed in 2024 focusing on greenhouse gas emissions disclosure. Plastic pollution was the second-most-common topic, with 20 filings in 2024 and 16 in 2025.

Several shifts explain this drop in activity and backing:

- Investor selectivity is rising, with a clear pivot toward proposals that are material, tailored, and clearly linked to enterprise strategy and risk.

- Corporate disclosure improved, with many companies voluntarily reporting more robust climate-related metrics, targets, and governance practices, reducing the perceived need for shareholder intervention (see Corporate Climate Disclosures and Practices).

- The broader environment for climate and environmental action in 2025 is more polarized and uncertain, with federal climate rules paused, ongoing environmental deregulation, and shifts in federal support for renewables. Many sustainability leaders now expect continued headwinds in the US for decarbonization efforts (for more, see Sustainability Under Scrutiny).

- Companies are adopting more cautious sustainability messaging and framing, prioritizing legal defensibility and risk mitigation. This trend is contributing to investor reluctance to support proposals that could expose firms to litigation or reputational risk.

Together, these dynamics point to a reframing of environmental proposals—from broad advocacy to focused accountability. Looking ahead, proposals that are sector specific, outcome driven, and backed by compelling risk or performance rationale are most likely to gain traction with investors.

Proposals Filed by “Anti-ESG” Groups: Persistent but Marginal

Anti-ESG activism maintained its presence in the 2025 proxy season, with proponents filing 105 proposals, roughly consistent with the 109 filed in 2024. These shareholder proposals are generally characterized by their intent to question, restrict, or oppose corporate initiatives related to environmental sustainability, social impact, and DEI initiatives. Common targets include racial equity audits, DEI-related disclosures, climate strategies, charitable giving programs, and other social or human capital commitments.

Despite garnering significant media attention, these proposals again garnered minimal traction: none passed and average support remained low, at 2.4%. This reaffirms that while anti-ESG proposals have become a recurring feature in the proxy landscape, they continue to fall outside the mainstream of investor support. Notably, these proposals proved more difficult to negotiate or withdraw, often being omitted or remaining on the ballot despite limited shareholder backing—adding complexity to the proxy process for companies facing them.

|

Enhancing proxy disclosure: A tactical tool for companies

To better contextualize shareholder proposals—especially those from repeat or politically motivated proponents—companies should continue refining their proxy disclosures. Providing the name and ownership size of the proponent, describing whether engagement took place, and clearly outlining the proposal’s potential operational or legal consequences can help investors make more informed decisions, particularly when ongoing or direct engagement is not feasible. These practices not only promote transparency but can meaningfully influence vote outcomes when a proposal’s intent or relevance is unclear. |

Say-on-Pay: Enduring Support, Evolving Expectations

While overall support for say-on-pay remained relatively high, the distribution of vote outcomes points to a subtle shift in investor sentiment. In the Russell 3000, the proportion of say-on-pay proposals receiving over 90% support fell from 73% in 2020 to 71% in 2025, while those receiving 70–90% support rose from 19% to 23% over the same period. This trend suggests that shareholders are applying greater scrutiny to pay practices—even when ultimately voting in favor—and that boards should not interpret a “pass” as an unqualified endorsement. Companies that received below-average support were more likely to face questions around one-off equity awards, poor pay-for-performance alignment, or insufficient disclosure clarity.

Director Elections: Broad Support, Specific Scrutiny

Directors continued to receive strong average support in 2025, particularly in large-cap companies. However, pockets of investor dissent remain, particularly around perceived overboarding, lack of diversity, or misalignment with ESG expectations.

» At a major company’s 2025 shareholder meeting, a director received over 78% of votes against, following disclosures that he attended just half of board and committee meetings the prior year. While prior attendance had been strong, the lack of explanation in the proxy drew investor scrutiny. The case underscores the importance of clear disclosure: companies should proactively address governance concerns—such as attendance, tenure, or overboarding—to help investors contextualize performance and avoid unexpected dissent.

|

Directors at smaller companies continue to receive lower support

While support for directors remained high across the Russell 3000 in 2025, directors at smaller companies continued to receive lower levels of investor support. Nearly 60% (137 of 189) of directors who failed to receive at least 70% of votes cast were at companies with annual revenue under $1 billion. In contrast, directors at companies with $10 billion or more in revenue were rarely flagged by shareholders. These figures suggest not necessarily higher scrutiny but greater dissatisfaction with board practices at smaller companies—possibly due to less robust governance policies, fewer resources devoted to board refreshment, or weaker proxy disclosures. As investors continue to prioritize board composition, independence, and oversight capabilities, small- and mid-cap companies may need to enhance how they communicate board qualifications and governance strategy to maintain shareholder support. |

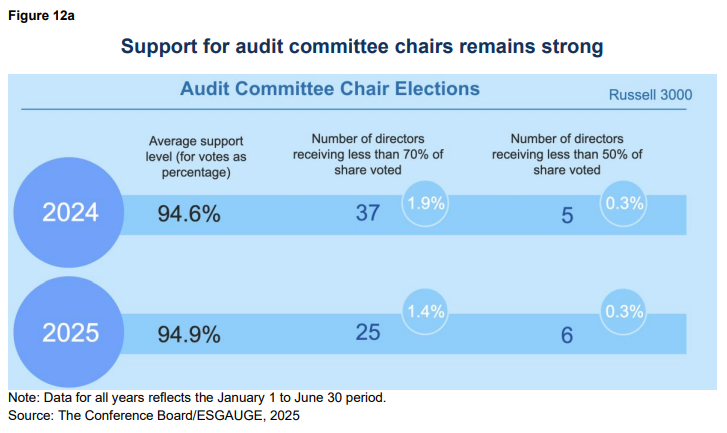

When Governance Falls Short, Committee Chairs Feel It First

Support for board committee chairs remained high in 2025, though differences emerged across roles:

- Audit committee chairs continued to receive the strongest support, averaging just below 95%, consistent with prior years.

- Compensation committee chairs followed closely but some faced pressure from shareholders when say-on-pay votes underperformed.

- Meanwhile, nominating/governance committee chairs drew the lowest average support, indicating that investors are closely watching how boards manage composition, oversight, and accountability.

These voting patterns suggest that while shareholders remain broadly supportive of director leadership, they increasingly use committee-level votes to express concerns over governance and oversight practices. As scrutiny intensifies, particularly in areas such as director tenure and refreshment, companies may need to bolster board evaluations and refreshment disclosures to maintain investor confidence heading into 2026.

Fewer Activism Campaigns, More Contests

While overall shareholder activism campaigns declined sharply across the Russell 3000 and S&P 500 in the first half of 2025, the number of proxy contests reached a new high, indicating a strategic shift in how activists deploy their influence. In total, 29 proxy contests were launched in the Russell 3000, up from 26 in 2024 and more than double 13 contests in 2022.

In a more uncertain economic and regulatory environment, activists are increasingly selective, focusing their efforts where they see the strongest potential for governance or performance gains. The universal proxy rule further lowered barriers to entry, enabling more shareholders to nominate dissident directors without the cost or complexity of traditional proxy contests.

Most of these contests remained narrowly focused—typically involving the nomination of one or two directors rather than efforts to overhaul entire boards. Governance continued to be the leading theme, with proposals aimed at driving board accountability, improving oversight, or catalyzing change. Despite the rise in contest activity, most did not result in board turnover, reinforcing that while contests are now easier to launch, success still depends on presenting a credible thesis and securing investor support. This evolving landscape suggests that proxy contests are becoming a more deliberate and high-impact tool for activism, even as overall campaign volume declines.

Looking Ahead: Offseason Engagement Takes Center Stage

With the volume of shareholder proposals easing and investors taking a more restrained approach to ESG, the offseason presents a valuable window for boards and management teams to recalibrate. Engagement remains a key opportunity for companies to explain governance structures, provide clarity on executive compensation decisions, and proactively address emerging investor concerns—particularly as disclosure expectations continue to evolve. In an environment shaped by regulatory uncertainty and political polarization, companies that foster transparency, responsiveness, and alignment between business strategy and stakeholder interests will be best positioned to maintain investor trust.

To navigate the 2026 proxy season effectively, companies should consider the following priorities during the offseason:

- Lead with transparency: Ensure that proxy statements, investor-facing governance materials, and sustainability reports are comprehensive and accessible, and clearly link ESG and compensation decisions to business performance.

- Strengthen internal coordination: Align legal, governance, and investor relations functions in preparation for engagements. Be ready to respond to investor inquiries with consistent and coherent messaging.

- Tailor engagement: Review institutional investors’ proxy voting policies in advance and use this information to structure targeted, well-informed discussions that respect each investor’s regulatory posture and risk tolerance.

- Elevate board involvement: Consider including directors—especially committee chairs—in select engagements to demonstrate oversight and accountability, while preparing them to speak confidently on strategy, governance, and compensation.

- Document engagement carefully: Maintain clear records of engagement topics and investor feedback to support future disclosures, inform board discussions, and manage compliance risk under evolving SEC guidance.

Companies that treat the offseason as an opportunity for meaningful dialogue rather than a regulatory pause will be better equipped to navigate investor expectations—and withstand scrutiny—when the next proxy season begins.

|

Navigating engagement with institutional investors Investor

engagement became more complex during the 2025 proxy season following SEC guidance issued in February signalling that certain forms of engagement— particularly those suggesting a shared purpose among investors—might disqualify institutional holders from relying on Schedule 13G [3] and instead trigger the more burdensome Schedule 13D filing typically reserved for activists. In response, several of the largest asset managers and investors suspended routine engagement meetings in Q1 while assessing legal risks with counsel. When meetings resumed, many were shorter and more restrained, with fewer forward-looking or thematic discussions, and feedback generally confined to direct responses to company-prepared questions. This trend likely reduced corporate visibility into investor sentiment. To navigate this environment, investors should ensure their proxy voting guidelines are publicly available, clearly written, and easy to interpret. Companies, in turn, should regularly review these materials to better understand investor expectations, anticipate voting behavior, and tailor their engagement approach accordingly. Additionally, companies should ensure that their own publicly disclosed information—such as proxy statements, governance policies, and sustainability reports—is clear, comprehensive, and transparent to ensure that investors have the context they need to make informed voting decisions even in the absence of direct dialogue. |

1The SEC issued Staff Legal Bulletin 14M in February 2025, modifying prior guidance on shareholder proposal exclusions and partially rolling back the broader approach established under SLB 14L (2021). It strengthens companies’ ability to exclude proposals under the ordinary business exception by reinstating a company-specific significance test, allowing exclusion if a proposal lacks a clear nexus to core operations. SLB 14M also tightens the micromanagement standard, clarifying that proposals mandating specific implementation steps can be excluded if they unduly constrain board and management discretion. These changes reverse key elements of SLB 14L, making it easier for companies to challenge ESG and DEI-related proposals and potentially reducing the number that reach shareholder ballots.(go back)

2In June 2023, the Supreme Court, in Students for Fair Admissions v. Harvard and Students for Fair Admissions v. North Carolina, ruled that race-based affirmative action in college admissions violates the Equal Protection Clause of the 14th Amendment, effectively overturning the precedents set by Grutter v. Bollinger (2003) and Bakke v. Regents of the University of California (1978). The court concluded that using race as a factor in admissions lacks sufficient constitutional grounding and fails to meet the standard of strict scrutiny, signaling a significant shift in the legal framework for how institutions can approach diversity and admissions.(go back)

3The SEC’s recent changes to 13G eligibility rules accelerate filing deadlines and expand disclosure requirements for institutional investors holding passive stakes in public companies. Under the new rules, qualified institutional investors (such as asset managers and pension funds) must now file initial Schedule 13G reports within five business days of crossing the 5% ownership threshold, significantly shortening the previous 45-day deadline. Additionally, amendment deadlines were tightened, requiring more frequent updates on ownership changes. These changes are intended to increase market transparency and reduce information asymmetry but may also limit institutional investors’ ability to engage privately with companies on shareholder proposals before making their positions public.(go back)

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.