Retaining the C-Suite After CEO Turnover

In 2021, FW Cook sought to better understand how companies can effectively retain their C-suite leaders after CEO turnover. Ensuring stability across the leadership team is an important factor in executing proper CEO succession, particularly as it applies to high-value individuals that may have been considered as CEO candidates themselves. Our prior study found that special one-time equity grants made to the leadership team have a strong retention effect in the short term, but that the effect wanes quickly

This year, FW Cook refreshed the study with new data to test for changes in the prevalence or effectiveness of special equity grants as a retention strategy. While the original study focused on CEO turnover events between 2011 and 2015 (and an associated retention period through 2020), this year’s analysis focused on the following five-year window. Further, our updated analysis builds upon the original research by also exploring the retentive value of all outstanding equity awards (i.e., annual and special grants) held by C-suite leaders.

The findings in our updated study are largely aligned with those of the original analysis. Particularly, special equity grants made to non-CEO executives in the wake of CEO turnover continue to show a strong, but limited, retentive effect – typically lasting approximately two to three years. Prevalence and design of such awards remain consistent, although the dollar value of such awards has increased materially.

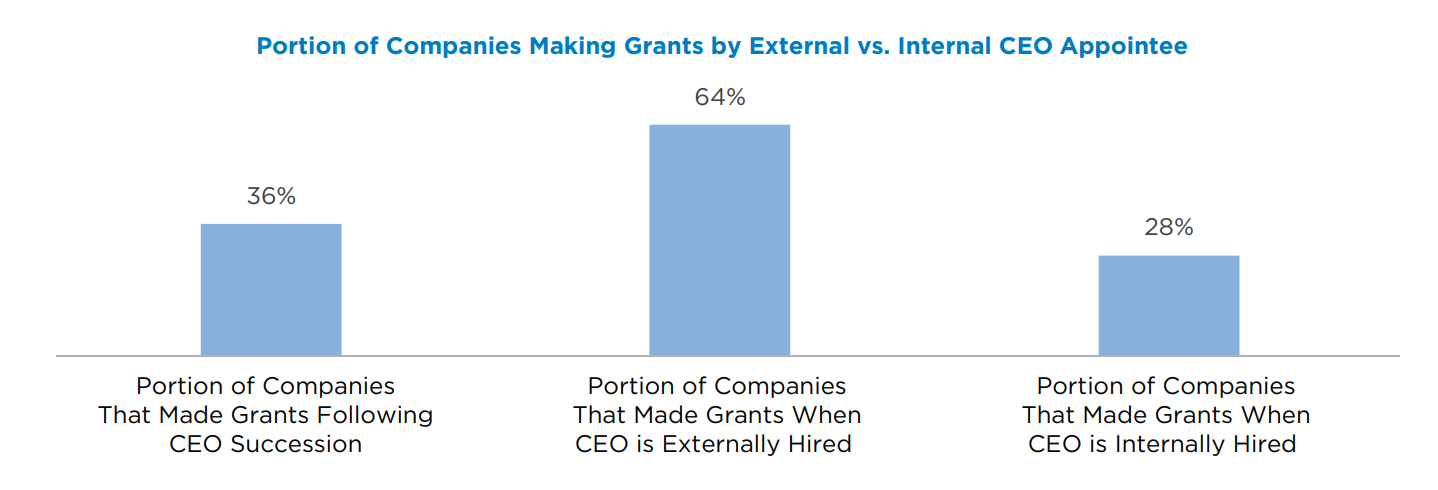

A new finding identified in this year’s study is that non-CEO executive grants are twice as common when the CEO is an external hire. Lastly, a correlation between total outstanding equity and length of retention was identified, regardless of whether special retention grants were made.

To study the effectiveness of retention grants, FW Cook researched 100 large-cap organizations in the United States, identifying a sample with CEO turnover between 2016 and 2020 (47 in total) – and among those, companies making accompanying retention grants to non-CEO named executive officers (NEOs). Of this sample, 36% of companies made succession-related retention grants to non-CEO NEOs, to a total of 39 individuals. Total outstanding equity was measured for 160 NEOs (i.e., all non-CEO NEOs at the 47 companies, excluding special circumstances).

Retaining the C-Suite after CEO Turnover: Update to Original Study

Special Grants Continue to Show Retentive Power through the Three-Year Mark

Both the original and updated studies show that the retentive power of special equity grants is strongest in the three-year window following CEO turnover. Among NEOs who eventually depart the company, those who did not receive such a grant typically leave within the first year, while those who do receive a grant typically do so at year three – aligned with the most common vesting period of retention awards.

The chart above shows the timing of NEO departures following CEO turnover. Among NEOs who received retention grants but eventually left the company (dark blue), the most common departure point for these individuals is the third year (32%), compared to 26% who departed within the first year, suggesting their desire to stay through some or all of the grant’s vesting period. Far fewer executives delayed their departure to later years, beyond the point when most grants had typically vested. In contrast, NEOs who did not receive such grants (and eventually departed) are shown in light blue. The most common departure point for these individuals is the first year following CEO turnover (30%). Note that the percentage of receivers and non-receivers who eventually departed the company was identical (79% for each group).

This finding closely follows that of the original study, which showed similar peaks – grant receivers typically departed at the three-year point, while non-receivers typically departed within the first year.

Consistency in the findings suggest that retention grants continue to have a strong effect on their ability to keep leaders in the seat for a period of two to three years, but that efficacy considerably wanes afterwards. Our study suggests that such awards may not be relied upon to ensure long-term retention. However, the findings show that special retention grants can maximize stability in the short-term following CEO turnover, a critical period during which the business strategy may be in flux, particularly when externally-hired CEOs are still settling into their new seats.

We also analyzed the effectiveness of special retention grants by measuring the average retention period of NEOs as a function of dollars. Grants between $3mm and $5mm in value, representing the range between the 50th and 75th percentile of grant values in the study, resulted in the longest retention periods (4.1 years on average). Grants of lesser value only retained executives for 3.5 years on average, while larger outlier grants only retained executives for 2.6 years, suggesting that NEOs considered highly likely to depart were not swayed by “Hail Mary” grants, but rather were more motivated by outside factors.

Retention Grants Have Increased in Size, but Remain Similar in Structure

Special retention grants typically range between $1.6mm at the 25th percentile to $5.0mm at the 75th percentile (median of $3.0mm). This shows an increase from the original study, in which grants typically ranged from $1.1mm to $4.1mm (median of $2.5mm). The annual growth rate of the awards’ values exceeds inflation over the same time period, in line with trends seen in annual executive compensation levels (source: U.S. Bureau of Labor Statistics).

Absolute dollar figures also reflect fact that the sample relied on large-cap companies. To control for size, FW Cook also measured grant values as a multiple of salary, finding that multiples typically ranged from 2.1x to 6.5x at the 25th and 75th percentiles (median of 3.9x).

Vesting schedules vary depending on companies’ specific situations and objectives. A plurality of awards vest after three years (38%). One-third vest over a longer period of time, while just over a quarter vest in under three years. The original study found similar vesting periods, with three- and four-year periods being the most common. The majority of awards (72%) use a cliff-vesting schedule, as opposed to ratable or back-loaded vesting, which can be useful mechanisms for ensuring that NEOs are retained for the entirety of the intended period.

Prevalence of Special Retention Grants Holds Steady

Although a majority of companies with CEO turnover did not make special retention awards, granting such awards to non-CEO NEOs remains a common strategy, used by 36% of relevant companies in the sample. This prevalence is nearly identical to that identified in the 2021 study (37%).

Prevalence can also be measured by analyzing the portion of NEOs in the sample receiving retention grants. This year’s study finds that 21% of NEOs received retention grants, closely tracking that of the original study, which identified that 20% of relevant NEOs received retention grants. On average, companies made grants to 2.3 NEOs – commonly business unit presidents and Chief Financial Officers.

Grants are More Common When CEO is Externally Hired

This year’s report introduces a new analysis which measures the prevalence of retention grants by the type of newly appointed CEO (external candidate versus internal candidate). As shown below, when the new CEO was recruited from the outside, 64% of companies made special retention grants. Conversely, only 28% of companies made grants when promoting an internal candidate to the role. Externally hired CEOs often introduce a new vision for the company, which may cause significant uncertainty among the existing leadership team. Further, continuity in leadership may be viewed as more important when appointing an external candidate as CEO. For these reasons, retention grants are more than twice as common among companies hiring an external CEO compared to companies promoting an internal candidate.

Retaining the C-Suite after CEO Turnover: Update to Original Study

An Analysis of Total Outstanding Equity Also Shows a Strong Retentive Effect – But With Limitations

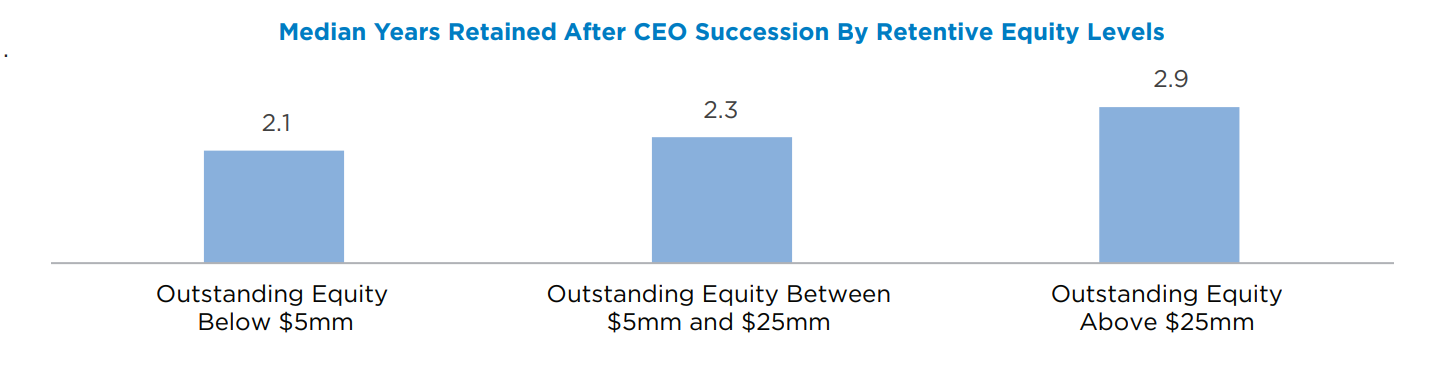

Although one-time, special equity grants can be effective medium-term retention tools, there are many other factors that influence NEO retention among companies with CEO succession, including the magnitude of prior equity awards that have yet to vest. Companies grant the majority of NEO compensation in long-term equity awards vesting over multiple years to provide sufficient levels of retentive equity and ensure continuity within the leadership team. To that end, this year’s report introduces an analysis of the total outstanding equity (“retentive equity”) held by NEOs at companies experiencing CEO turnover. Retentive equity includes both unvested full-value shares and unexercised options.

As shown in the table below, a moderate correlation exists between total retentive equity levels and retention periods of non-CEO NEOs following CEO turnover. NEOs with less than $5mm in total retentive equity stayed for a median of 2.1 years, those with retentive equity between $5mm and $25mm stayed for 2.3 years, and those with retentive equity greater than $25mm stayed for 2.9 years. While higher retentive equity levels are indeed correlated with higher retentive power, we note that the difference of 0.8 years between the lowest-value group and the highest-value group is relatively short.

Further Considerations

Executive compensation is ever-evolving, impacted by changes in talent market preferences, the macroeconomy, the regulatory environment, and more. Much has changed in the five years since FW Cook’s original study on CEO turnover and retention grants was published. However, the consistency between the findings of that study and those identified here show that special equity grants can be used in a targeted manner to bolster short-term stability in the C-suite. Although “doing what is most common” is not a guaranteed winning strategy, it does shed light onto how the broader compensation market plans around and reacts to major changes in leadership.

Insights newly identified in this year’s study may be considered by compensation committees and management to enhance their retentive strategies following the appointment of a new company leader. Notably, the size of special retention grants have not only grown materially, but outpaced inflation over the same time period. If budgets are constrained, grants can either be made on a more targeted basis, to only the highest-potential leaders, or awards can be designed to vest (and be amortized) over a longer time period, thereby reducing equity-based compensation expense. Secondly, companies may wish to consider the fact that retention grants are more prevalent when a CEO is hired externally. Lastly, data on the effectiveness of total retentive equity levels in retaining executives should be used for longer-term planning. Special equity grants are effective tools but should build upon a long-term succession strategy that uses overlapping, annually-made grants to establish strong incentives for senior leaders to remain at companies over time.

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.