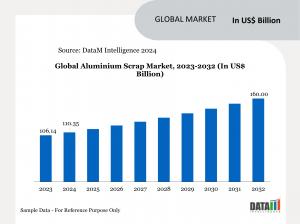

Aluminium Scrap Market to hit US$160.00 billion by 2032: Major Manufacturers & Supply Chain in 2025

Aluminium Scrap Market Growth Drivers – EV Lightweighting, Green Metals & Sustainability Trends

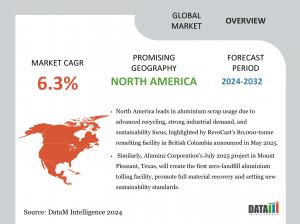

According to DataM Intelligence, the global aluminium scrap market was valued at USD 110.35 billion in 2024 and is projected to grow to USD 160.00 billion by 2032, registering a compound annual growth rate (CAGR) of 4.84% between 2025 and 2032.

Rapid urbanization, growing aluminium recycling rates, circular economy initiatives, and high demand for lightweight materials in automotive, aerospace, electronics, and construction sectors are accelerating aluminium scrap consumption. As recycled aluminium requires 95% less energy than primary aluminium production, manufacturers are increasingly turning to scrap to reduce operating costs and carbon emissions.

The Asia-Pacific region led the market in 2024, accounting for the highest revenue share of 61.21%.

Among end-users, the automotive segment dominated in 2024, contributing the largest share at 40.36%.

Get a Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):– https://www.datamintelligence.com/download-sample/aluminium-scrap-market

Growth Drivers

• More than 70 million tonnes of aluminium scrap were recycled globally in 2024, projected to cross 110 million tonnes by 2032.

• Recycled aluminium reduces up to 12 tonnes of CO₂ emissions per tonne of metal, driving sustainability-focused manufacturing.

• Automotive OEMs target 30%–50% recycled aluminium in vehicle bodies by 2030, boosting scrap demand.

• Expanding beverage can recycling networks recovered >670 billion cans in 2024, supporting circular packaging systems.

• High energy costs in smelting are shifting manufacturers from primary aluminium to recycled scrap, saving USD 1,200–1,600 per tonne in production expenses.

Market Segmentation Analysis

By Grade

• Casting Scrap – 47% share (USD 34.0 billion in 2024), projected to reach USD 59.8 billion by 2032, driven by automotive and industrial component re-casting.

• Extrusion Scrap – 32% (USD 23.1 billion), expected to exceed USD 41.4 billion by 2032, fueled by construction profiles and window frames.

• Sheet Scrap – 21% (USD 15.2 billion), forecast to reach USD 23.4 billion by 2032, supported by packaging and aerospace manufacturing.

By End-Use Industry

• Automotive – 34% (USD 24.6 billion), expected to reach USD 45.0 billion by 2032 due to EV lightweighting and fuel-efficiency mandates.

• Building & Construction – 29% (USD 21.0 billion), projected to exceed USD 35.3 billion with rising urban development and infrastructure renovation.

• Packaging – 20% (USD 14.5 billion) driven by beverage cans and sustainability-led packaging innovations.

• Electrical & Electronics – 11% (USD 8.0 billion), supported by demand for heat sinks and wiring components.

• Others (Aerospace, Marine, Industrial Machinery) – 6% (USD 4.3 billion) and rapidly growing due to precision casting needs.

Request for Customized Sample Report as per Your Business Requirement: https://www.datamintelligence.com/customize/aluminium-scrap-market

Regional Insights

United States

The U.S. aluminium scrap market was USD 17.8 billion in 2024, projected to reach USD 32.4 billion by 2032 at 7.4% CAGR.

• Over 65% recycling rate in the beverage can industry strengthens domestic scrap utilization.

• Automotive OEMs like Tesla, GM, and Ford are increasing recycled aluminium use in EV platforms.

• Investments worth USD 2.1 billion announced in 2024 to expand scrap-based rolling and extrusion capacity.

Japan

Japan’s aluminium scrap market reached USD 6.2 billion in 2024, expected to hit USD 10.1 billion by 2032 at 6.2% CAGR.

• Closed-loop automotive recycling systems by Honda, Toyota, and Mitsubishi drive demand.

• Construction renovation boom increases dismantling scrap availability.

• Government circular economy policies target 70% aluminium recovery rate by 2030.

Key Players:

According to DataM Intelligence, the Aluminium Scrap Market is moderately fragmented, with global smelters, recycling giants, and alloy producers integrating scrap processing into their supply chains.

Novelis Inc | Norsk Hydro | Nucor | EMR | Sims Limited | ArcelorMittal | Hindalco | Rio Tinto | Alumax | Kuusakoski | Constellium SE, Hydro Aluminium, UACJ Corporation, Alcoa Corporation, Gränges AB, Kaiser Aluminum, AMAG Austria Metall AG, Zhongwang Group, China Hongqiao Group

Key Highlights:

1. Novelis increased scrap-based production share to 63% in 2024, investing USD 714 million in recycling mills.

2. Norsk Hydro recycled 380,000 tonnes of post-consumer scrap, a 22% jump YoY.

3. Sims Limited launched a digital scrap traceability system to support ESG reporting.

4. Hindalco invested USD 425 million in India to develop high-purity automotive scrap recycling hubs.

Recent Developments

• Novelis opened a 600,000-tpa scrap sorting facility in Kentucky (Feb 2025).

• Nucor partnered with Ford to supply scrap-based aluminium for next-generation EV platforms (Jan 2025).

• Rio Tinto announced a joint venture with SMR Germany to establish an AI-driven dismantling centre (Dec 2024).

• Kuusakoski deployed robotic scrap separation lines in Finland (Oct 2024) to maximize recovery of high-grade alloys.

Market Outlook and Opportunities

•1. Automotive and EV manufacturing will drive >38% of added aluminum scrap demand by 2032.

2. AI-driven scrap sorting and sensor-based separation expected to reduce impurities by 55%.

3. Closed-loop manufacturing between OEMs and recyclers will emerge as the dominant business model.

4. Asia-Pacific is forecast to record the fastest CAGR (7.9%), supported by construction and packaging growth.

5. High-purity remelt scrap for aerospace alloys represents a USD 6.3 billion opportunity by 2032.

Buy This Report with Year-End Offer (Buy 1 report: Get 30% OFF | Buy 2 reports: Get 50% OFF each! Limited time offer): https://www.datamintelligence.com/buy-now-page?report=aluminium-scrap-market

Conclusion

The Aluminium Scrap Market is at the centre of the global shift toward sustainable and circular manufacturing, aluminium scrap is becoming essential for cost-efficient and low-carbon metal production. Renewable energy transition, stricter decarbonization targets, and surging automotive and packaging demand will continue to accelerate scrap adoption.

According to DataM Intelligence, leading players such as Novelis, Norsk Hydro, Nucor, and Hindalco are reshaping the industry through high-capacity recycling, AI-enabled scrap sorting, and closed-loop partnerships with OEMs. By 2032, recycled aluminium is projected to account for more than 55% of global aluminium supply, solidifying its role as a strategic industrial resource.

Related Reports

Recycled Metals Market – US$ 2.5 million in 2023 to US$ 4.7 million by 2031: https://www.datamintelligence.com/research-report/recycled-metal-market

Secondary Aluminium Market – US$168.75 billion by 2032 at 6.81% CAGR: https://www.datamintelligence.com/research-report/secondary-aluminum-market

Automotive Lightweight Materials Market – Structural Shift Toward Recycled Metals: https://www.datamintelligence.com/research-report/automotive-lightweight-materials-market

Sai Kiran

DataM Intelligence 4market Research LLP

+1 877-441-4866

sai.k@datamintelligence.com

Visit us on social media:

LinkedIn

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.