Shareholder Proposal Guide: A Playbook for CHROs and Total Rewards

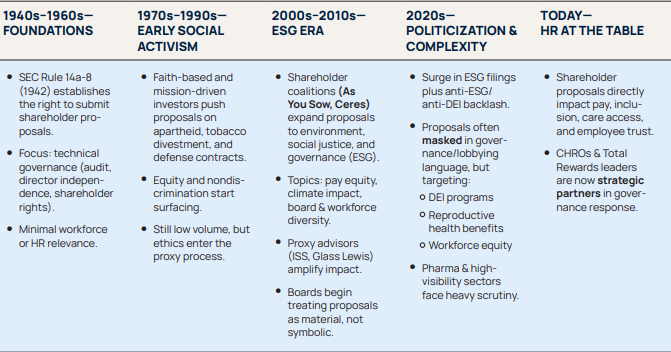

In today’s corporate governance landscape, shareholder proposals are a powerful tool for investors to influence company strategies. Increasingly, they intersect with human capital management, executive compensation, and ESG issues. For CHROs and Total Rewards executives, this means proposals often touch directly on pay equity, DEI (for and against), workforce benefits, labor management and severance, among other HR issues.

This guide provides a step-by-step framework to assess, respond to, and manage shareholder proposals, ensuring alignment with business goals, employee interests, and stakeholder expectations.

Central to success is proactive, cross-functional collaboration across HR, Legal, Investor Relations (IR), and the Board of Directors. A point person should be identified within the company to lead the process (e.g. Legal or Governance leader). By understanding proponent motivations, engaging constructively, and leveraging regulatory tools thoughtfully, HR and Legal leaders can mitigate risks, build trust, and turn challenges into opportunities for enhanced governance and reputation.

Bottom Line

This playbook equips leaders with strategies, examples, and tools to navigate shareholder proposals while minimizing risks and maximizing long-term value.

Shareholder Volume and Themes

- Companies typically receive 4–12 proposals annually, with 70–90% related to ESG.

- Overall volume has declined, but politically motivated “anti-ESG” (e.g., anti-DEI) proposals have risen. These are often generic and filed across industries, unlike the more tailored proposals of five to seven years ago.

- Executive compensation proposals have decreased as pay programs have become more standardized and aligned with investor/ ISS/Glass Lewis expectations.

- A surprising finding: industry-specific issues often surface under broad ESG themes (e.g., healthcare affordability, animal treatment, or climate impacts).

Proponent Intent

- Nowadays, we found, the “ask” is not always clear; proposals can be vague or even misleading. The companies we interviewed stressed the importance of distinguishing genuine concerns (e.g., long-term sustainability, affordability, labor rights) from political crusades or “fishing expeditions.” In the latter case, even extensive engagement may not make much of a difference to the outcome.

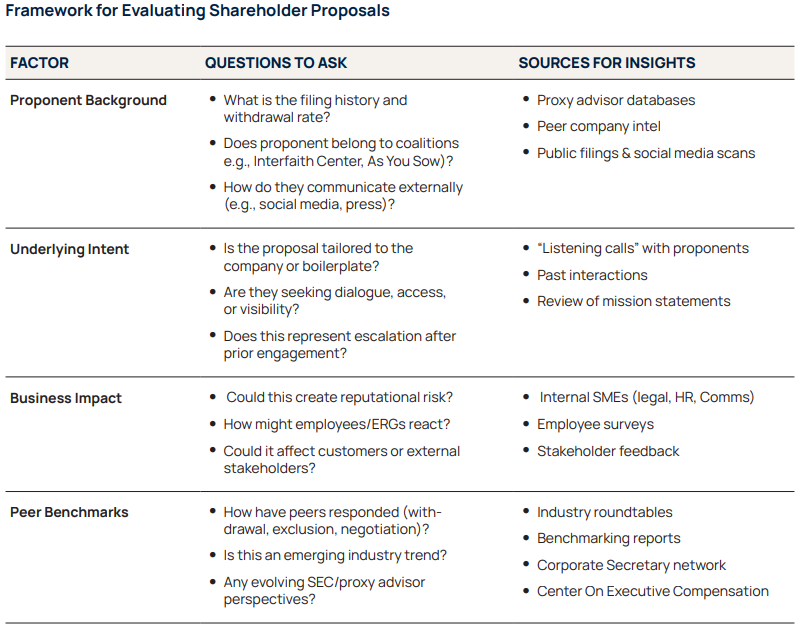

Assessing and Understanding Shareholder Proposals

The first step in responding to a shareholder proposal is a thorough assessment: understanding its content, the proponent’s motivation, and potential impact on the business and workforce.

This stage involves gathering data, consulting peers, and carefully distinguishing between constructive operational concerns and proposals driven by political or reputational agendas.

KEY STEPS IN ASSESSMENT

1. Review Proposal Volume and Categories

Track how many proposals your company receives annually and classify them by type. Proposal mix often fluctuates. Companies we interviewed reported the following general split among their proposals:

- 30–40% social (e.g., DEI, pay equity, human rights)

- 25–30% governance (e.g., board structure, shareholder rights)

- ~30% environmental

- Occasional compensation-focused proposals

2. Assess Intent and Motivation

Engage directly with proponents to uncover their true objectives. “Listening calls” can reveal whether a filer is reasonable, fact-driven, and/or pursuing a broader agenda, which will then drive your engagement strategy. Key considerations include:

1. Proponent history: Review prior filings, withdrawal rates, and engagement with peers. Patterns may reveal whether a filer typically uses proposals as a pressure tactic or generally collaborates toward a solution.

2. Underlying issues: Some proposals mask narrow, industry-specific concerns (e.g., pharmaceutical access or product affordability) under popular themes like DEI to get broader investor support. Companies told us they had to dig under the surface to find out what the proponent’s goal really was.

3. Filing strategy: Many proponents begin with KPIs or scorecards and escalate to formal proposals only after dialogue fails. Often a proponent will point to companies that are best in class for doing what the proponent wants another company to follow. For instance, scorecards that rank a company’s pay transparency and pay equity efforts can be used to encourage companies that are not as transparent to bolster their practices. Early engagement can sometimes prevent escalation to a costly proxy fight.

4. Template vs. tailored: Some use boilerplate filings replicated across companies, signaling a broader agenda; others file tailored requests, indicating a deeper intent to influence the company’s strategy or industry practice.

Because the filing process itself is resource-intensive for both sides, understanding how and why a proposal was filed can help sharpen the company’s response strategy. Is this a tactical escalation after dialogue stalled, a first attempt by an activist group or part of a broader campaign across companies? Taking the time to assess intent may save effort in the long run. One company noted that proposals often request the company to take actions that are already underway—simply because the proponent is unaware of existing initiatives.

3. Distinguish Genuine vs. Agenda-Driven Proposals

- Genuine proposals seek dialogue and improvement (e.g., using scorecards to highlight leaders and laggards).

- Agenda-driven proposals may be politically motivated (e.g., anti-DEI filings) or designed to generate media soundbites.

Executive Snapshot— Why Shareholder Proposals Matter

Shareholder proposals may be non‑binding, but they drive real outcomes: board debate, institutional investor pressure, media coverage, and employee perception. In today’s environment, even low‑support proposals (20–30%) can trigger policy reviews or reputational risks.

1. More Than Votes

- Proposals force public positions on sensitive issues (DEI, reproductive health, executive pay).

- A 25% “yes” vote can signal dissatisfaction from large investors like BlackRock or Vanguard—even without reaching a majority.

- Dual‑class share structures may mask true levels of dissent.

2. Volume & Complexity Are Rising

Proposal topics are no longer just “governance.” Most connect directly to culture, fairness, or employee experience.

- Social/ESG: DEI, labor practices, benefits

- Compensation: Severance practices, clawbacks, pay equity

- Governance: Voting rights, board structure

- Hybrid: Lobbying or pricing framed as oversight 6

3. Stakeholder Impacts

- Employees: ERGs and staff view proposals as cultural statements; silence breeds mistrust.

- Investors: Use proposals to demand better disclosure, not always adoption.

- Media/Public: Even exclusions become headlines (“Company blocks DEI audit vote”).

4. Regulation Isn’t the End

SEC guidance (e.g., SLB 14M, 2025) allows exclusions based on micromanagement or “economic irrelevance.” But exclusion does not erase workforce or reputational impact. HR must still communicate.

5. HR’s Strategic Role

- Owns the data that shapes defenses (pay, equity, benefits).

- Interprets employee sentiment and morale risks.

- Helps boards craft credible narratives for both investors and employees.

- Partners with Legal counterparts.

Engagement and Response Strategy

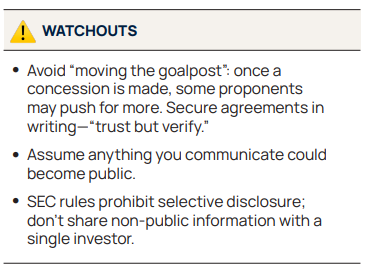

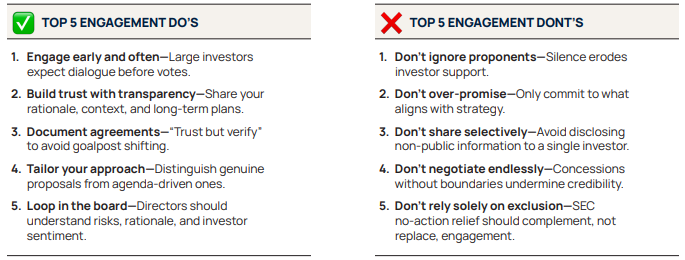

Once the assessment is complete, the next step is to build a response strategy centered on engagement. Large investors increasingly expect companies to engage directly with proponents. Doing so not only increases the chances of withdrawal or compromise but also builds credibility and trust over time.

1. Initial Contact, Negotiation, Withdrawal

Initial Contact Principles

Begin with empathy and openness. Be proactive—don’t wait for the proponent to push—and avoid sounding defensive or dismissive. Meeting with every proponent and listening carefully helps uncover true concerns (e.g., obtaining feedback from local leaders on labor issues).

Build Trust

Transparency is the currency. Share your rationale and data when possible. Proponents may agree to withdraw proposals in exchange for good-faith commitments, such as three- to-five-year plans toward improvement.

Negotiation Tactics

Offer alternatives or phased commitments where feasible. Incremental progress—such as clarifying existing disclosures or issuing statements on relevant topics—can resolve concerns. If proponents’ demands are unrealistic (e.g., providing raw supply chain data on ESG or human capital concerns), explain the operational context and suggest more practical alternatives. Be firm if aligned with your strategy, as over-negotiation can weaken long-term credibility.

Here are some of the success stories we heard:

- One company interviewed received a proposal requesting a report on how their DEI initiatives impact hiring, retention and promotion metrics. The company was denied a “no-action request” but continued to engage with the proponent. Ultimately, the company agreed to enhance their reporting and make a public statement about its commitments and the proponent withdrew the proposal.

- In another example, a health and safety proposal was withdrawn after the company disclosed its progress toward reducing human rights violations in its supply chain by a certain date.

Aim for Withdrawal

Show alignment where possible—“we’re already doing this”—and be transparent about the rationale. If engagement stalls, politely signal intent to seek no-action relief while keeping the door open for dialogue.

2. Consider Exclusion

If engagement fails, companies may seek SEC no-action relief to have the proposal excluded from the proxy. This can be pursued in parallel with dialogue with the proponent— in fact, investor voting outcomes are more favorable when companies demonstrate meaningful dialogue.

Evaluation Factors

Assess the likelihood of success under commonly argued grounds such as:

- Ordinary Business. This argument can be pursued if the proposal is related to the company’s “ordinary business” and seeks to micromanage the company.

- Procedural flaws (e.g., proponent does not own sufficient shares, has issued too many proposals, missed deadlines, other filing errors).

- Substantial Implementation (the company has already “substantially implemented” the proposal).

- Economic irrelevance (proposal relates to operations accounting for less than 5% of assets, sales and earnings).

Process

- File with multiple arguments (“scattershot” approach) using as many grounds as apply to maximize the chance of success.

- Consider retaining outside experts to craft compelling letters.

- Be selective; not every proposal warrants no-action relief. A denied request may carry reputational risks and set a negative precedent.

- HR can play a pivotal role by supplying historical context, economic impact data, and workforce implications.

RISE AND FALL

The SEC’s posture on no-action relief shifts with the political environment. Under Chair Gensler, the agency made it harder for companies to have proposals excluded (SLB 14L), while under Chair Atkins, there has been updated guidance (SLB 14M) to make it easier again.

Submitting a shareholder proposal is a formal SEC-governed process. To qualify, proponents must meet ownership requirements, file within a set time frame and ensure the proposal is properly worded to survive exclusion challenges (proposals are limited to 500 words).

Drafting Statement of Opposition

If the proposal cannot be negotiated, withdrawn, or excluded, get ready—it proceeds to a shareholder vote. In this case, the company must draft a clear, fact-based opposition statement for the proxy.

Key Elements

- Highlight existing practices and explain why the proposal is unnecessary.

- Provide business rationale and emphasize risks of adoption.

- Use peer benchmarks and workforce feedback to strengthen the argument.

- Simplify complex issues, since investors have limited time and attention.

- Involve Legal, IR, HR, and other SMEs; form working groups to refine.

Board Engagement

According to the companies and experts we interviewed, boards differ on the level of engagement they desire with shareholder proposals. However, once a proposal is going in the proxy, the board must be involved.

The draft opposition statement should be reviewed by the board, typically via the Nominating/ Governance Committee. Management should present predictions on proxy advisor recommendations, workforce sentiment, and potential risks. Directors may need education on nuances, so take the time to explain all dimensions clearly.

Engagement Do’s and Dont’s

Managing Outcomes and Long-Term Strategy

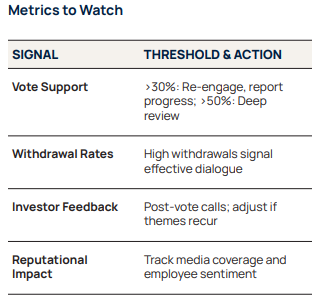

Even after a proposal has gone to a vote, the work isn’t over. Managing outcomes strategically—and engaging afterward—helps shape future responses and strengthen governance.

1. Engage with Shareholders Before and After the Vote

- Pre-Vote Engagement: Meet with top investors early to frame the issue and highlight conversations you’ve had with proponents. This builds credibility, educates investors on the company’s stance, and demonstrates responsiveness. Solicit feedback and note where perspectives differ to determine if more conversations are warranted.

- Post-Vote Analysis: As a general rule, if a proposal garners more than 30% support, it requires attention. Consider actions that align with long-term strategy and disclose them clearly in the next proxy statement. Even low levels of support can spur momentum for change.

- Post-Vote Engagement: Reach outs to institutional investors post-vote demonstrates that the company values every shareholder’s perspective. Investors may have opposed the proposal for reasons unrelated to its core content so (e.g. policy positions) so a conversation helps uncover nuances and find common ground for collaboration which can re-engagement helps translate proposals into value-add changes rather than escalations.

Case in Point: One company described a racial equity audit proposal that went to a vote and failed to gain much support. While the company was not concerned about the support level the proposal would receive, they conducted the audit anyway. Post-vote, large investors noted: “We didn’t support the proposal, but we do support you taking action.”

2. Long-Term Engagement Strategy

Avoid viewing proposals as one-off battles. Instead, track trends, adapt, and build a reputation for constructive engagement. Over-negotiation can undermine credibility, but responsiveness to reasonable themes is different—it builds long-term trust.

- Build peer networks to “compare notes.” We heard over and over again how important it is to engage with peer companies and other recipients of proposals similar to yours.

- Maintain active dialogue with proponents in and out of proxy season.

- Listen closely and adapt based on investor feedback

Bottom Line:

Shareholder proposals are no longer technical proxy events—they are cultural flashpoints. For HR and Total Rewards leaders, each one is a test of alignment between governance strategy with shareholder and workforce trust.

Timeline

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.