UK Automotive Turbocharger Market Set to Double by 2035 as Emission Targets Redefine Powertrain Efficiency

The United Kingdom Automotive Turbocharger Market is segmented by vehicle type, product, fuel, sales channel, actuator, and sub-region from 2025 to 2035.

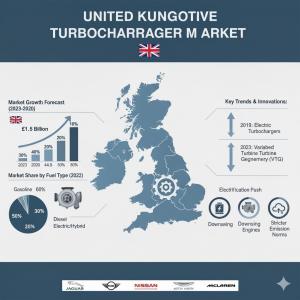

NEWARK, DE, UNITED STATES, November 12, 2025 /EINPresswire.com/ -- The United Kingdom’s automotive turbocharger market is entering a transformative decade driven by stringent decarbonization mandates, rapid hybridization, and ongoing advancements in energy-efficient powertrain design. According to recent projections, the market is set to expand from USD 1,140.0 million in 2025 to USD 2,484.1 million by 2035, achieving a compound annual growth rate (CAGR) of 8.1%.

The UK government’s ambitious roadmap to phase out new petrol and diesel vehicle sales by 2035, coupled with interim goals to meet Euro 7 and ultra-low emission standards, is reshaping powertrain strategies across the nation’s automotive value chain. Turbochargers have emerged as a bridge technology — enabling manufacturers to meet fuel economy and emission benchmarks while maintaining vehicle performance.

Subscribe for Year-Round Insights → Stay ahead with quarterly and annual data updates -

https://www.futuremarketinsights.com/reports/sample/rep-gb-21934

Turbocharging the UK’s Path to Cleaner Mobility

Turbocharging is playing a pivotal role in the UK’s shift toward hybrid internal combustion engines (ICEs). As fully electric vehicles (EVs) advance but face infrastructure and affordability barriers, turbo-integrated engines offer a practical, scalable pathway to emission reduction.

Passenger vehicles dominate turbocharger adoption in the UK, led by Jaguar Land Rover, Mini (BMW), and Nissan, all of which have accelerated integration of downsized turbocharged petrol and diesel engines. Compact and mid-size turbocharged models have become the backbone of the UK market — delivering both regulatory compliance and dynamic drivability demanded by consumers.

Hybrid models pairing small turbocharged engines with electric motors are gaining traction, especially among buyers seeking efficiency without compromising performance. This dual-energy strategy is aligning well with consumer sentiment across London, Manchester, and Birmingham, where Ultra-Low Emission Zones (ULEZs) continue to expand.

Variable Geometry Turbochargers (VGT): The Market Leader

Among turbocharger technologies, Variable Geometry Turbochargers (VGTs) hold the dominant market share. VGTs enable precise control of exhaust gas flow to the turbine, allowing optimized boost pressure across a wide RPM range — a necessity for both urban stop-start driving and high-speed motorway conditions typical of UK usage patterns.

VGTs are particularly prevalent in diesel vehicles, which still comprise a significant portion of commercial and rural fleets. As OEMs continue refining low-emission diesel and hybrid powertrains, the demand for advanced VGT systems is expected to sustain leadership through 2035.

Regional Market Outlook

North East – Anchored by Nissan’s Sunderland plant, the North East remains a strategic hub for turbocharged engine production and exports to Europe. Research clusters in Newcastle are pioneering lightweight turbo materials and enhanced thermal management technologies, further strengthening the region’s role in the global turbo supply chain.

North West – The region’s industrial backbone, including Greater Manchester and Merseyside, supports high turbocharger penetration in heavy-duty vehicles and commercial fleets. The aftermarket and remanufacturing segment is thriving, with growing consumer interest in cost-effective upgrades and eco-friendly refurbishments.

West Midlands – As the UK’s automotive epicenter, the West Midlands hosts Jaguar Land Rover and several Tier-1 suppliers leading turbo innovation. Local R&D initiatives, backed by the Advanced Propulsion Centre UK, are advancing electrified turbo systems and digital boost management solutions, reinforcing the area’s leadership in hybrid performance.

East Midlands – With automotive suppliers concentrated around Leicester, Derby, and Nottingham, the region’s turbocharger market benefits from strong logistics and manufacturing infrastructure. Rising adoption of bi-fuel and turbocharged diesel LCVs is propelling steady aftermarket and OEM demand.

South East – Home to Oxfordshire’s high-performance automotive cluster and R&D facilities, the South East is driving next-generation e-turbo and hybrid-compatible turbo systems. Close collaboration between OEMs, Formula 1 teams, and academic institutions is helping shape the future of intelligent forced induction technologies.

Regional Growth Rates (CAGR, 2025–2035)

Yorkshire and the Humber – 8.3%

Wales – 8.2%

Scotland – 8.0%

Greater London – 7.9%

Challenges: Navigating Transition and Trade Complexity

The post-Brexit environment presents logistical and regulatory headwinds, with increased costs and supply chain delays impacting raw materials and cross-border trade with the EU. Divergent emissions standards between the UK and Europe could further complicate turbocharger homologation and component certification.

Simultaneously, the 2035 ICE sales ban introduces strategic uncertainty. While hybrid vehicles provide a crucial medium-term opportunity, pure EV adoption may eventually dampen traditional turbocharger demand. The sector’s long-term resilience will depend on its adaptation toward electrified and hydrogen-boosted propulsion systems.

Opportunities: Electrification, Aftermarket Expansion, and Circular Design

Despite transitional challenges, multiple growth vectors are emerging:

Hybrid and Mild-Hybrid Systems: Demand for low-inertia, electric-assist turbochargers in plug-in and mild hybrids is accelerating, particularly in response to hybrid incentives across UK urban centers.

Aftermarket and Remanufacturing: With consumers prioritizing cost efficiency, the remanufactured turbocharger segment is gaining strong traction, notably in the North West and East Midlands. Retrofit kits and ECU remapping services are extending vehicle lifecycles while ensuring emissions compliance.

R&D Leadership in E-Turbos and Hydrogen Boosting: The South East and West Midlands are spearheading e-turbo and hydrogen-compatible technologies, leveraging government-backed programs like Innovate UK and the Faraday Battery Challenge to advance clean propulsion innovation.

Circular Manufacturing: The industry is moving toward recyclable materials, modular turbo designs, and AI-driven production optimization, aligning with the UK’s broader industrial sustainability agenda.

Checkout Now to Access Industry Insights:

https://www.futuremarketinsights.com/checkout/21934

Competitive Landscape

The UK turbocharger market is moderately consolidated, with a mix of global leaders and specialized domestic manufacturers driving innovation and market competitiveness:

• Garrett Motion Inc. – Holds an estimated 20–25% market share, maintaining a strong presence through advanced boosting technologies and OEM partnerships.

• BorgWarner Inc. – Accounts for approximately 15–20% of the market, leveraging extensive product innovation in electric and hybrid turbo systems.

• Continental AG – Captures around 10–15% of the share, emphasizing smart turbocharging systems integrated with emission control technologies.

• Mitsubishi Heavy Industries Ltd. – Represents roughly 8–10% of the market, known for durable, high-performance turbocharger solutions across multiple vehicle classes.

• IHI Corporation – Commands an estimated 5–8% share, focusing on precision engineering and compact turbo designs for improved fuel efficiency.

• Other notable players – Including Melett Ltd., Turbo Dynamics Ltd., AET Engineering, Owen Developments, and Bosch Mahle Turbosystems, collectively contribute 30–35% of the market, strengthening the competitive ecosystem through remanufacturing, customization, and performance-oriented solutions.

Recent developments highlight market dynamism. In May 2024, Melett Ltd. expanded its product lineup to include full turbocharger kits for Ford, Mazda, and Land Rover models, addressing growing OEM and aftermarket demand. In September 2024, BorgWarner introduced advanced twin-turbo systems for General Motors’ Corvette ZR1, reinforcing technological leadership in performance and hybrid applications.

Outlook 2025–2035: A Decade of Intelligent Boost

Between 2020 and 2024, turbochargers became standard across UK passenger vehicles as automakers pursued compliance with Euro 6d-TEMP standards and ULEZ policies. From 2025 onward, the focus shifts toward intelligent, electrified turbo technologies — including AI-driven boost control, 48V e-turbos, and lightweight composite turbine materials.

As the UK navigates the complex transition toward zero-emission mobility, turbochargers will continue to underpin its hybrid strategy — enabling cleaner combustion, energy recovery, and high-efficiency performance across the nation’s evolving automotive ecosystem.

Purchase Full Report for Detailed Insights

Have a specific Requirements and Need Assistant on Report Pricing or Limited Budget please contact us - sales@futuremarketinsights.com

About Future Market Insights (FMI)

Future Market Insights, Inc. (FMI) is an ESOMAR-certified, ISO 9001:2015 market research and consulting organization, trusted by Fortune 500 clients and global enterprises. With operations in the U.S., UK, India, and Dubai, FMI provides data-backed insights and strategic intelligence across 30+ industries and 1200 markets worldwide.

Why Choose FMI: Empowering Decisions that Drive Real-World Outcomes: https://www.futuremarketinsights.com/why-fmi

Sudip Saha

Future Market Insights Inc.

email us here

+1 347-918-3531

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.