Ready for the Deal: Transaction Readiness in Turbulent Times

Benchmarking transaction readiness

After intense speculation in the third quarter of 2024, many industry watchers predicted 2025 would usher in a wave of successful IPOs—finally reviving the public markets after a prolonged quiet period. Yet, as economic headwinds intensified and U.S. fiscal policy shifted unexpectedly, companies began to rethink even their most foundational transaction plans. Analysts, anticipating the typical pattern of M&A activity surging when the IPO market stalls, were met instead with a stalling deal environment—prompting a deeper question: are organizations truly “transaction ready?”

If companies ultimately choose not to proceed with IPOs or acquisitions due to wider economic or policy trends, does that signal robust maturity and readiness, or merely short-term adaptability? What qualifies as genuine preparedness for transformative transactions, and what are the structures, processes, and personnel that must be firmly in place before leaders can say with confidence that their organizations are ready to act?

This report—the result of a targeted survey and research collaboration between Diligent Institute, Wilson Sonsini, NetSuite, the CFO Alliance, and the CFO Leadership Council—seeks to uncover the defining elements that make an organization transaction-ready. As market volatility and uncertainty become the norm rather than the exception, our core objective is to distill what it takes for companies to have sufficiently mature governance and controls; to be equipped for complexity, agility, and accountability in every aspect of the deal-making process.

Methodology

Our 10-question global survey was distributed to senior leaders including board directors, C-suite executives, corporate secretaries, and general counsels (GCs) from both public and private companies across a wide range of industries, geographies, and organizational sizes. A total of 233 executives participated, and the sample includes public (32%), private (64%), and pre-IPO (4%) organizations. A full demographic breakdown can be found in the appendix.

Key Findings

- Despite economic turbulence, nearly half of organizations (49%) are prioritizing M&A or strategic partnerships in their growth strategies.

- Only 5% use AI evaluations or data collection to facilitate transactions, but many believe AI will become crucial to transaction readiness in the future.

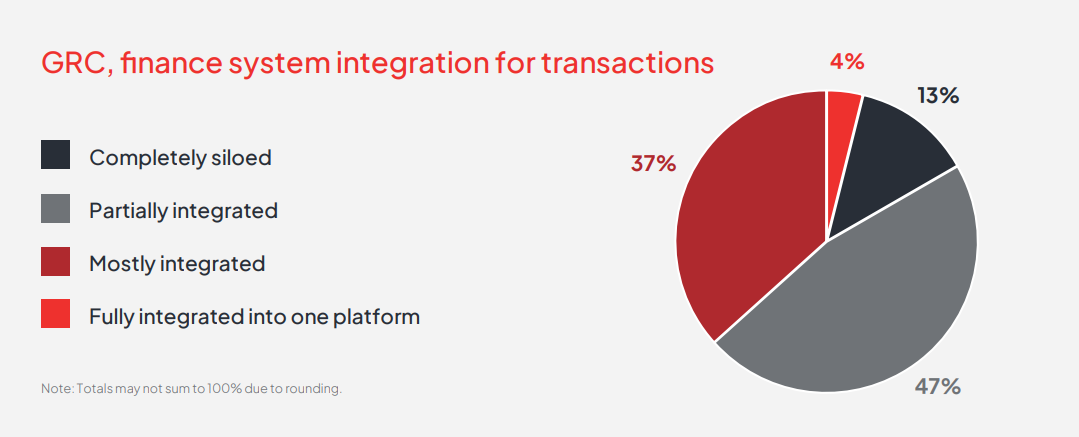

- Only 4% of respondents say their GRC and financial systems are fully integrated for transactions, highlighting potential gaps.

- Economic uncertainty is driving caution including delayed deals (49%), enhanced due diligence (40%), and adjusted financial modeling (46%).

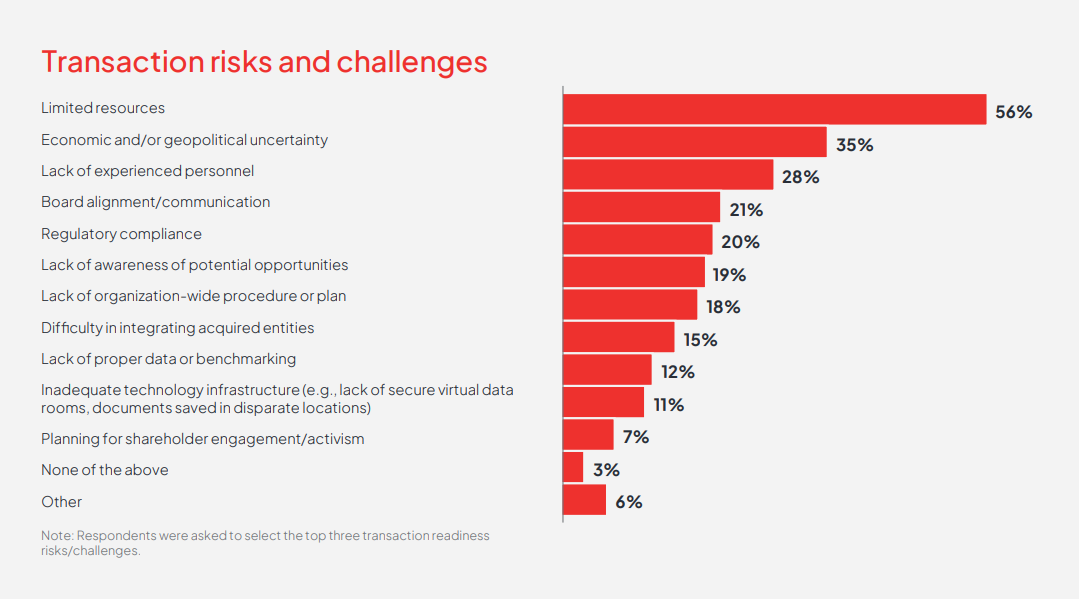

- The top transaction challenges are limited resources (56%), economic/geopolitical uncertainty (35%), and lack of experienced personnel (28%).

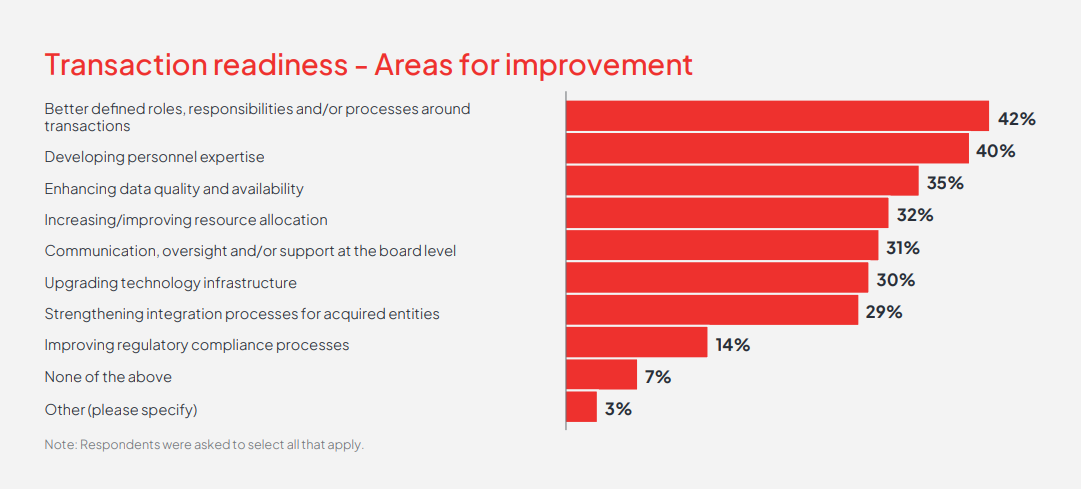

- Corporate leaders want more defined roles/processes (42%), increased personnel expertise (40%), enhanced data quality (35%), and better board communication (31%) around transactions.

The transaction environment: Growth strategies, confidence, and the impact of economic turbulence

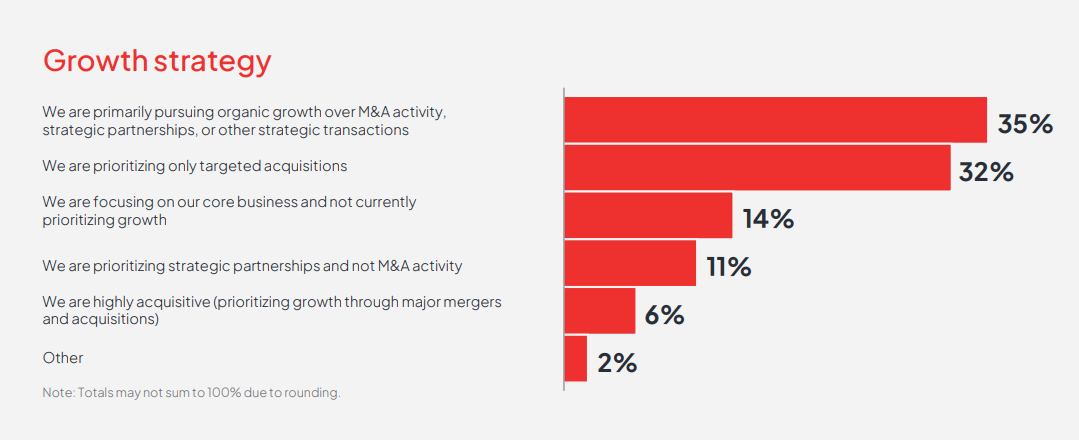

To set the stage, we asked our respondents to tell us more about what their organization’s current growth strategies look like, choosing from a selection of options. The most popular answer (35%) is that organizations are primarily pursuing organic growth over M&A activity, strategic partnerships, or other strategic transactions (like growing revenue or market share within existing markets).

“Steady increases in transaction activities in our market appear to be very productive and encouraging,” says one respondent. “However, our level of success within our existing market has served to discourage our board from pursuing other ventures following the COVID-19 pandemic. Internal expansion will take precedence over external M&A efforts.”

Pursuing organic growth is shortly followed by organizations saying they are prioritizing only targeted acquisitions (32%). Only 6% of respondents characterize their companies as “highly acquisitive.”

“While many organizations are still prioritizing growth through M&A and strategic partnerships, they’re taking much longer to evaluate deals and are being more selective about opportunities,” adds Ranga Bodla, Vice President of Field Engagement and Marketing at NetSuite. “What we’re seeing is that companies need to leverage technology and data analytics to manage this extended evaluation process more effectively—whether that’s through better financial modeling, enhanced due diligence tools, or integrated systems that can provide real-time insights. The organizations that invest in these technological capabilities now will be better positioned to move quickly and confidently when the right opportunities arise.”

According to our results, private companies are less likely to pursue M&A activity in the current environment compared to public companies (with 36% pursuing organic growth over M&A compared to 31% for public companies). Nearly half of public companies (46%) are prioritizing M&A compared to 35% of private companies.

Regionally, companies based in North America are more likely to be prioritizing targeted acquisitions compared to companies headquartered elsewhere in the world (39% to 24%).

39% of companies based in North America are prioritizing targeted acquisitions

24% of companies based outside of North America are prioritizing targeted acquisitions

When asked how confident our respondents are in their organization’s readiness to support a major transaction, they rate confidence at a 5.7 on a ten-point scale, where “1” is not at all confident and “10” is extremely confident.

“We’re seeing a renewed focus on disciplined growth, with CFOs in our community being more selective about M&A than in previous cycles,” says Nick Araco, CEO of CFO Alliance. “Rather than chase volume, finance leaders are concentrating on the right-fit opportunities that align with a clear investment thesis and deliver sustainable value. This heightened intentionality reflects a shift toward quality over quantity in deal-making.”

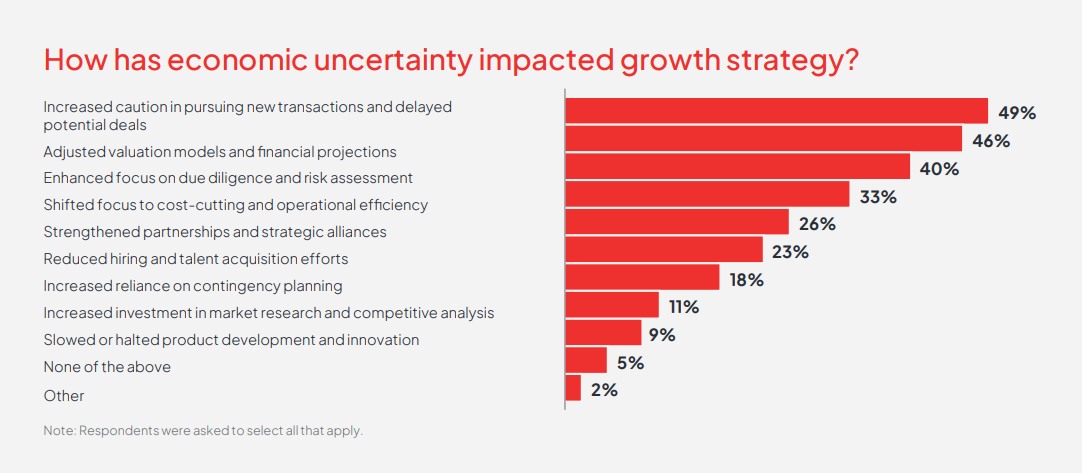

How is economic uncertainty impacting organizations’ growth strategies? Nearly half of respondents (49%) cite increased caution in pursuing new transactions and delayed potential deals, followed by adjusted valuation models and financial projections (46%) and enhanced focus on due diligence and risk assessments (40%).

Says one respondent, “We need to strengthen our governance structures to suit the current VUCA environment.”

Public companies are more likely to enhance focus on due diligence and risk assessments compared to private companies (49% to 37%) and shift focus to cost-cutting and operational efficiency (38% to 31%) because of economic turbulence. Private companies, meanwhile, are more likely to reduce hiring (27% to 17%).

Globally, North American companies cite adjusting financial models because of economic turbulence at higher rates compared to their non-North American counterparts (50% to 39%).

50% of companies based in North America cite adjusting financial models because of economic

39% of companies based outside of North America cite adjusting financial models because of economic turbulence

Transaction readiness approaches, integration and tools

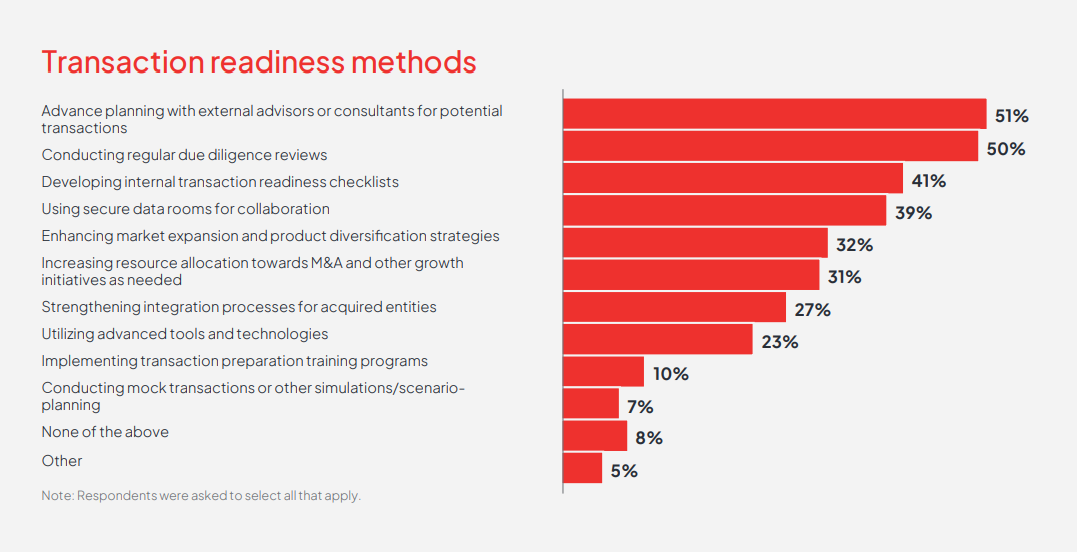

How are companies getting and staying transaction-ready, particularly in this environment? The most common methods our respondents cite are engaging in advanced planning with external advisors or consultants and conducting due diligence reviews (at 51% and 50%, respectively) followed by developing internal transaction checklists and using secure data rooms for collaboration (41% and 39%, respectively).

One respondent cites, “Clear process, disciplined due diligence and analysis, detailed planning,” when asked about lessons learned from previous transactions.

Notably, less than a quarter (23%) are using advanced tools and technologies (such as AI-powered evaluations), suggesting potential gaps in transaction readiness.

“Adopting enhanced document management systems to help track a company’s contracts and terms can be leveraged as company’s run their business, but then can also be tapped into when it comes time to populate a data room or integrate a target business as part of a deal,”says Mullen.

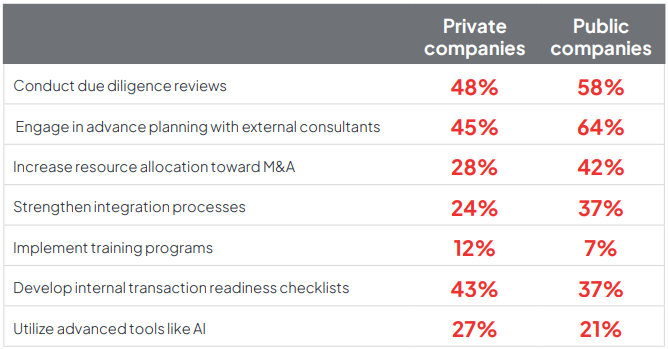

Public companies are more likely to conduct due diligence reviews compared to private companies (58% to 48%), engage in advance planning with external consultants (64% to 45%), increase resource allocation toward M&A (42% to 28%) and strengthen integration processes (37% to 24%).

Private companies, meanwhile, are slightly more likely to implement training programs (12% to 7%), develop internal transaction readiness checklists (43% to 37%), and utilize advanced tools like AI (27% to 21%).

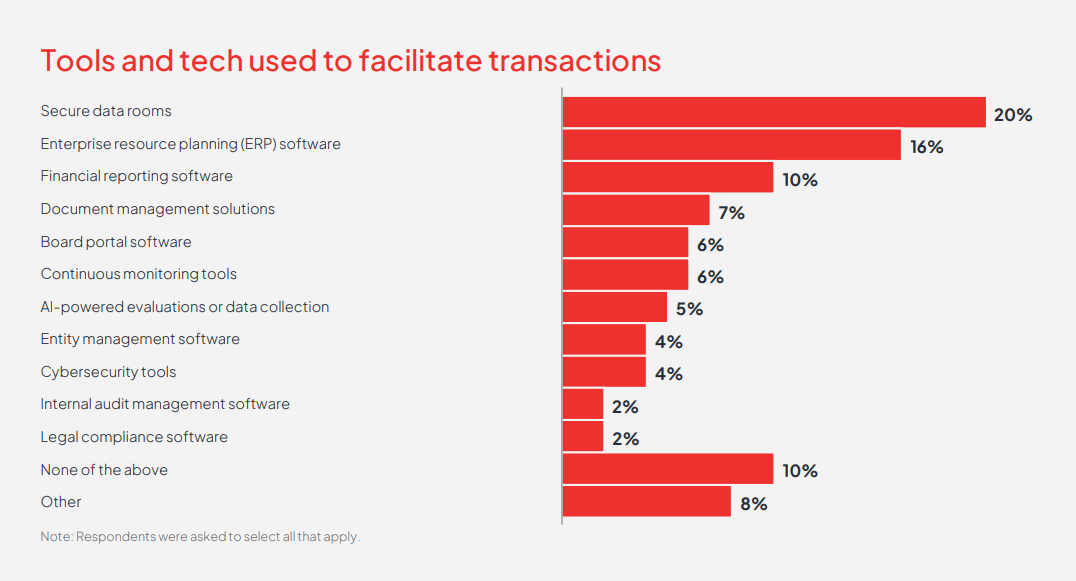

What technologies are companies using to facilitate transaction readiness? Our survey finds level of technology adoption relatively low across the board in this area. One-fifth (20%) say they use secure data rooms, 16% use enterprise resource planning (ERP) software, and 10% use financial reporting software.

Notably, North American companies were almost twice as likely as their counterparts in other regions to use secure data rooms (24% to 15%).

24% of companies based in North America use secure data rooms

15% of companies based outside of North America use secure data rooms

Only 5% use AI-powered evaluations or data collection. As a follow-up, we asked respondents to describe what role AI plays in their company transactions. The vast majority of respondents report minimal or no AI usage in this realm, yet. But, many see AI taking on more of a role in transactions in the future: “Limited to date, but will become vital in future,” said one respondent.

Those using AI in their transaction processes are still in the early stages of doing so and are only using the technology for relatively basic tasks. “Not much [AI use] at the moment but working on AI assisting with governance, data management and integration,” said one.

“AI plays a supportive role only in our transactions,” said another. “It does not make binding decisions. We use AI to speed up document review, clause and risk flagging, entity extraction, etc. We use AI search and summarization to triage large data rooms and to prepare diligence notes. We use machine learning tools for sanctions and adverse media screening and for basic anomaly flags.”

Risks, challenges and areas for improvement

Respondents face a variety of risks and challenges when it comes to being transaction ready – citing resources, board alignment, regulatory compliance, technology/data gaps, integration challenges, personnel shortages, and more.

Top of the list of concerns, by a wide margin, is lack of resources (with 56% citing this as a top challenge). Next on the list is economic and geopolitical uncertainty (35%) and lack of experienced personnel (28%).

Private companies are more likely than their public counterparts to cite lack of awareness of opportunities as a concern (24% compared to 11%) and lack of experienced personnel (30% to 22%). Public companies, on the other hand, are more likely to cite regulatory compliance (32% to 13%) and economic/geopolitical uncertainty (41% to 31%), and difficulty integrating acquired entities (20% to 13%).

Companies headquartered outside of North America are more likely to cite geopolitical/economic turbulence as a top concern (39% to 30%) compared to their North American counterparts.

30% of companies based in North America are more likely to cite geopolitical/economic turbulence as a top concern

39% of companies based outside of North America are more likely to cite geopolitical/economic turbulence as a top concern

Respondents also cite an array of areas for improvement when it comes to transaction readiness. Better defined roles, responsibilities and/or processes around transactions took the top spot at 42%, followed by developing personnel (40%), and enhancing data quality and availability (35%).

Public company respondents are more likely to say that they have nothing to improve when it comes to being transaction ready compared to their private company counterparts (11% to 5%). They are also more likely to want to upgrade their technology infrastructure (38% to 27%). Private company respondents, meanwhile, are more likely to want to better define roles, responsibilities and processes around transactions (44% to 36%) and enhance data quality and availability (38% to 27%).

Regionally, respondents outside of North America are more focused on enhancing data quality and availability (40% to 31%) compared to their North American counterparts.

40% respondents outside North America focused on enhancing data quality and availability

31% respondents in North America focused on enhancing data quality and availability

Board involvement & transaction leadership

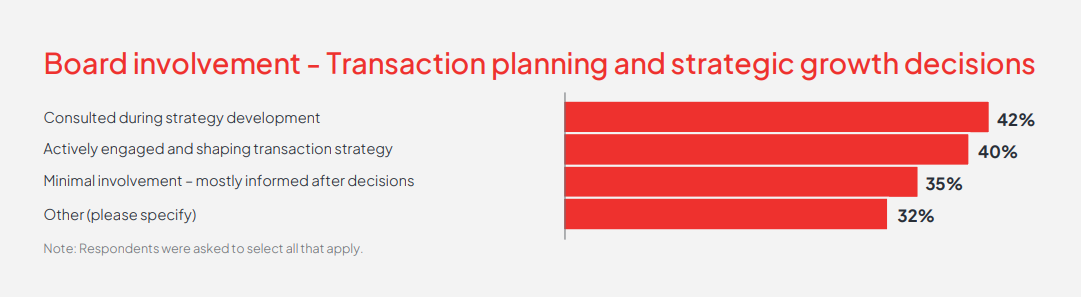

Another crucial component of being transaction ready is getting effective support from the board. Nearly one-third (31%) of respondents want to improve communication, oversight and support at the board level. Rather less than half of respondents (42%) say their board is actively engaged in shaping transaction strategy, highlighting a potential gap.

“Miscommunication and misalignment in the growth approach within the executive team negatively affects growth strategy,” says one respondent.

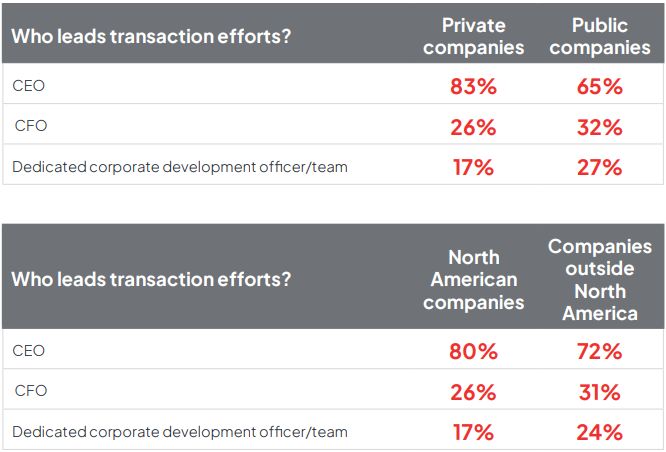

“Companies can better leverage boards by bringing them into strategy discussions early,” says Das. “Ongoing education about competitive and M&A landscapes keeps boards informed and engaged. Consider establishing transaction committees and standardized documentation to formalize board involvement.” Most respondents say their CEO leads transactions (77%) followed by the CFO (28%) and a dedicated corporate development officer or team (20%).

Private company representative overwhelmingly choose the CEO to lead transaction efforts compared to public company counterparts (83% to 65%). Public companies report a wider array of leaders, like the CFO (32% to 26%) and dedicated corporate development officer/team (27% to 17%). In North American companies, representatives say the CEO leads transaction efforts more often than in companies outside North America (80% to 72%). Outside North America, respondents were more likely to choose the CFO (31% to 26%) and corporate development officer/team (24% to 17%).

Best practices and lessons learned

Respondents highlight a diverse and practical range of best practices gleaned from prior transaction experiences. “Good judgment comes from experience; experience comes from bad judgment,” notes one respondent. “We strive to learn from our mistakes in prior situations.” Major themes include:

- Due diligence: Enhanced pre-transaction planning, development of standardized diligence request lists and red-flag trackers, and post-acquisition reviews are commonly cited as central to future readiness.

- Integration planning: Many organizations emphasize early planning for integration, use of dedicated integration teams, and continuous improvement of workflows. Integration playbooks and structuring consistent data rooms are noted as enabling smoother transitions.

- Cross-functional collaboration: Establishing cross-functional or multi-disciplinary teams for transaction execution is mentioned as key, along with learning from previous transaction teams or external advisors.

- Documentation and knowledge management: Maintenance of comprehensive records, checklists, playbooks, and a “lessons learned” log are recurrent suggestions. Knowledge sharing and harvesting outcomes from past deals are prioritized.

- Governance and board engagement: Several responses note increased board involvement, clarified roles and responsibilities, consultation with external board members, and leveraging governance frameworks as best practices.

- Process improvements and controls: Process management tools control enhancement, rigorous procedural discipline, and technology upgrades (including secure data rooms and adoption of AI) are referenced.

- Strategic planning: Respondents highlight early engagement of stakeholders (legal, audit), adaptability, contingency planning, benchmarking performance and ROI, and ongoing training as critical steps.

- Communication: Frequent communication, sequencing communication from board and acquired entities, and open channels between staff and board support successful transaction readiness.

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.