Corrugated Packaging Market North America Hits USD 105.1B at 6.5% CAGR | DS Smith Packaging Ltd, Georgia-Pacific, Saica

Analysis of Corrugated Packaging Market Covering 30+ Countries Including Analysis of US, Canada, UK, Germany, France, Nordics, GCC countries, Japan

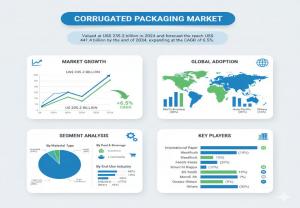

ROCKVILLE, MD, UNITED STATES, October 23, 2025 /EINPresswire.com/ -- The global corrugated packaging market is valued at approximately US$ 235.2 billion in 2024, and is forecast to expand at a compound annual growth rate (CAGR) of around 6.5% to reach about US$ 441.4 billion by 2034. This upward trajectory signals robust demand for corrugated packaging solutions as industries increasingly adopt sustainable, lightweight, and protective packaging formats for shipment, storage, and retail distribution.Market Drivers & Growth Catalysts

Several key factors are fueling this demand. The surge in e-commerce operations has heightened needs for reliable, cost-effective, and protective packaging solutions; corrugated boxes serve as ideal options due to their combination of strength, light weight, and recyclability. Omnichannel retailing and online fulfillment create significant volume requirements for shipping containers, particularly with customized box formats for last-mile delivery. Additionally, environmental awareness and regulatory shifts are pushing brands toward recyclable and compostable materials, with corrugated packaging often favored over plastic or non-recyclable alternatives. Improvements in digital printing, fluting design, and structural optimization further enhance performance while reducing material usage and freight cost.

Segmentation: Board Types, Flutes & End-Uses

Corrugated packaging is offered in different structural formats—single wall, single face, double wall, triple wall boards—each optimized for varied load, stacking, and protective requirements. Single wall boards dominate in many standard retail and e-commerce shipping applications because they strike a balance of cost, strength, and weight. Double and triple wall boards are increasingly used in heavier goods, industrial shipments, or logistics applications where additional protection is required. Flute design and digital printing enable packaging customization for branding, high-resolution graphics, and structural strength improvements, enabling more efficient transport and appealing retail presentation.

End uses span a broad set of industries including food & beverages, electronics, home & personal care, healthcare, logistics, and industrial chemicals. The food & beverage segment is a major contributor due to the need for packaging that can safely store, transport, and protect perishable or processed goods. Meanwhile, electronics and e-commerce fulfilment drive demand for custom corrugated cartons with structural integrity for fragile items.

Regional Insights & Market Outlook:

North America accounts for 23.6% of the global corrugated packaging market, supported by its mature industrial infrastructure that serves diverse sectors including retail, food and beverages, electronics, and e‑commerce.

Asia-Pacific is one of the fastest growing regions, driven by rising manufacturing, large consumer markets, and fast-growing e-commerce sectors. Many countries are scaling up packaging infrastructure and adopting modern production methods, which supports strong demand for corrugated packaging solutions. North America and Europe remain significant markets owing to mature supply chains, high consumer expectations, strict regulations on packaging waste, and strong demand for sustainable and recyclable packaging formats. In these regions, companies also invest in automation and high-tech printing and finishing to meet both brand and regulatory demands. Emerging markets in Latin America, Middle East & Africa also show growing adoption as retail and e-commerce infrastructures expand and packaging standards improve.

Competitive Landscape & Key Players:

Key Companies Profiled: DS Smith Packaging Ltd.; Georgia-Pacific, LLC; Saica Group; International Paper; Westrock Company; Mondi Group; Pratt Industries Inc.; Oji Holdings Corporation; Packaging Corporation of America; International Paper Company; Corrugated Container Corporation; Rengo Co., Ltd.; Smurfit Kappa; Atlantic Corrugated Box; WestRock Company; Wisconsin Packaging Corporation; Menasha Corporation

The corrugated packaging market features a mixture of large global packaging manufacturers, specialized converters, and regional producers. Leading firms compete on product quality, design innovation, sustainability credentials, supply reliability, and ability to deliver custom printed or structural board solutions. Many companies are expanding their capacity, upgrading machinery for digital printing or lighter board designs, and offering value-added services like custom design, just-in-time manufacturing, or integrated packaging solutions for e-commerce fulfilment. Strategic partnerships with brands, logistics providers, or fulfilment firms are common as companies aim to streamline packaging workflows and reduce materials cost.

In March 2024, Mondi PLC revealed its strategic plan to acquire DS Smith, signaling consolidation efforts within the corrugated packaging industry. Around the same period, the Corru Pack Print India Expo 2024 took place from March 7 to March 9 at the India International Convention and Expo Center in New Delhi, showcasing the latest innovations and machinery for the corrugated packaging sector.

Challenges & Market Restraints

Despite strong demand, the market faces some constraints. Raw material cost fluctuations (e.g. pulp, recycled paper) and energy costs can affect margins for packaging producers. Logistics, storage, and handling of corrugated materials also require precise supply-chain coordination to avoid damage or waste. In some markets, the shift to lighter board or lighter fluting means trade-offs in strength or stacking capacity must be managed carefully. Additionally, smaller players or emerging markets may struggle with investment in high-precision cutting, digital printing, or automation for custom packaging solutions, which may limit adoption of premium formats.

Future Outlook & Strategic Imperatives

Looking ahead to 2034, the corrugated packaging market is poised for substantial growth, more than doubling in value over the decade. To capture this opportunity, packaging manufacturers should continue to invest in automation, digital printing, lighter structural designs, and recyclable / compostable materials. Expanding capacity in high-growth geographies, especially in Asia-Pacific and emerging markets, and partnering with e-commerce platforms and fulfilment logistics will help align supply with rising demand. Offering value-added services like design, custom printing, structural optimization, and fulfilment packaging can help firms differentiate and serve brand customers more effectively.

Request for Discount: https://www.factmr.com/connectus/sample?flag=S&rep_id=9981

Buy Now at USD 2900: https://www.factmr.com/checkout/9981

Check out More Related Studies Published by Fact.MR Research:

Round Corrugated Box Market: https://www.factmr.com/report/1020/round-corrugated-box-market

Packaging Automation Solution Market: https://www.factmr.com/report/packaging-automation-solution-market

Packaging Robots Market: https://www.factmr.com/report/packaging-robots-market

CPP Packaging Film Market: https://www.factmr.com/report/cpp-packaging-film-market

Editor’s Note:

Fact.MR is a leading global market research and consulting firm, known for delivering actionable insights across industries. Our study on the Corrugated Packaging Market integrates technology assessment, clinical trends, and regional insights to provide strategic intelligence for healthcare stakeholders. As innovation accelerates in vascular access technologies, Fact.MR continues to guide market participants in capturing opportunities and navigating challenges in this rapidly advancing field.

S. N. Jha

Fact.MR

+1 628-251-1583

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.