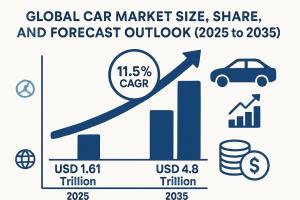

Car Market to Surge from USD 1.61 Trillion in 2025 to USD 4.8 Trillion by 2035, Driven by Innovation & Demand

SUV dominance, EV adoption, and flexible ownership models reshape manufacturing strategies in high-growth automotive markets

NEWARK, DE, UNITED STATES, August 12, 2025 /EINPresswire.com/ -- The global car market, valued at USD 1.61 trillion in 2025, is on course to reach nearly USD 4.8 trillion by 2035, expanding at a CAGR of 11.5%. This growth is underpinned by rising consumer demand for SUVs, steady expansion of electric vehicle (EV) portfolios, and the adoption of advanced mobility technologies that are redefining automotive manufacturing priorities.

For original equipment manufacturers (OEMs), the next decade presents an opportunity to reinforce market positioning through innovative product design, localized production, and digital service integration—all while navigating shifting regulations and supply chain dynamics.

Sustained Growth with Multi-Phase Momentum

From 2025 to 2028, the market’s rolling CAGR is projected at 10.6%, buoyed by hybrid adoption in ASEAN markets and a phased internal combustion engine (ICE) transition in select OECD nations. Between 2028 and 2031, growth accelerates to 11.4% as AI-driven driver assistance systems gain traction. By 2031-2035, CAGR climbs further to 12.2%, led by demand for software-defined vehicle platforms, premium electric sedans, and performance utility models.

This multi-phase trajectory ensures manufacturers can plan capacity expansions without relying on volatile single-trend spikes. Price stability across transition phases allows OEMs to maintain margins while modernizing fleets and upgrading features.

SUVs Lead 2025 Segment Share

SUVs dominate with a 38% share in 2025, driven by consumer preference for spacious cabins, higher road visibility, and multi-terrain adaptability. Toyota RAV4, Hyundai Tucson, and Ford Bronco are among top performers, benefiting from robust resale values—18% higher than hatchbacks on average over three years.

OEMs targeting SUV demand in regions such as North America, the Middle East, and Australia will benefit from established customer loyalty, lifestyle alignment, and the ability to refresh models at consistent intervals.

Gasoline Still Strong, EVs Gaining Ground

Gasoline vehicles hold the largest propulsion share at 49% in 2025, sustained by accessible refueling infrastructure and competitive maintenance costs. Meanwhile, EVs secure a 26% share, supported by regulatory incentives, urban charging network growth, and diversified model offerings from Tesla, BYD, and Volkswagen.

For manufacturers, this dual-track market—where gasoline remains vital while EV adoption accelerates—offers room for portfolio balance. Hybridized and dual-fuel models are already serving as transitional solutions in low-emission zones.

Individual Ownership and Franchised Dealers Maintain Dominance

Individual use accounts for 69% of car sales in 2025, underscoring the importance of personal mobility across both developed and emerging markets. In rural and semi-urban areas, personal cars remain essential transport, while urban buyers prioritize autonomy, status, and convenience.

Franchised dealers continue to lead distribution with a 62% share, leveraging after-sales service, warranty integration, and financing support to retain customer trust. For OEMs, hybridizing physical dealerships with digital platforms is proving essential in sustaining buyer engagement.

Emerging Ownership Models Reshape Market Access

Subscription-based models are gaining traction, with Japan, Germany, and major Indian metros recording rapid uptake. Bundled services, contactless onboarding, and digital key systems are shortening delivery and return cycles while increasing retention among younger buyers and urban fleets.

Manufacturers adapting platforms for subscription and pay-per-mile models can tap new urban mobility revenue streams without cannibalizing traditional sales channels.

Regional Growth Hotspots

• China leads with a CAGR of 14.8%, driven by affordable EV adoption, export-oriented production, and vertically integrated battery supply chains.

• India follows at 13.2%, boosted by compact EV launches under USD 10,000, battery-swapping pilots, and rising urban penetration.

• Germany posts 12.3%, focusing on premium EVs, hydrogen platforms, and AI-enhanced assembly quality.

• United States grows at 9.4%, where SUVs and pickups dominate, while EV adoption remains concentrated in urban zones.

• United Kingdom expands at 8.6%, with renewed capacity utilization and EV-centric line conversions.

These varied growth rates underscore the need for manufacturers to tailor strategies to local infrastructure, regulatory climates, and consumer behavior.

Addressing Manufacturing Challenges

Supply chain volatility remains a core challenge. In 2024, lithium carbonate prices fluctuated by over 45%, while semiconductor lead times averaged 38 weeks. Rising energy costs in Europe and Japan, coupled with shipping rate increases of up to 18% on key trade lanes, added further strain.

Manufacturers are countering these pressures through:

• Localization: Establishing production clusters in Indonesia, Morocco, and Mexico to cut costs and shorten lead times.

• In-house assembly: Prioritizing critical subcomponent manufacturing to stabilize procurement.

• Digital integration: Employing real-time analytics and digital twin frameworks to improve precision and output efficiency.

These strategies not only mitigate cost escalation but also align with government localization mandates in high-growth ASEAN markets.

Key Manufacturer Strategies for the Next Decade

Market leaders are already positioning for the 2035 horizon:

• Toyota Motor (13.7% share) is expanding hybrid lines across ASEAN and Latin America.

• Volkswagen is leveraging regional manufacturing tie-ups to strengthen sedan and crossover offerings.

• Ford Motor is optimizing platform sharing for cost control and production flexibility.

• General Motors is investing in large SUV and pickup platforms for the North American market.

• BMW is boosting EV output while preserving premium sedan leadership.

• Tesla is scaling global capacity through Gigafactory expansion in Germany and China.

• Hyundai Motor is extending its dealership footprint in Asia and the Middle East.

Second-tier players like Tata Motors, Suzuki Motor, and Honda Motor are targeting value-driven segments, leveraging compact EVs and low-emission ICE vehicles to expand reach in emerging markets.

Request Car Market Draft Report:

https://www.futuremarketinsights.com/reports/sample/rep-gb-22992

For more on their methodology and market coverage, visit

https://www.futuremarketinsights.com/about-us

Explore Related Insights

Car Security System Market:

https://www.futuremarketinsights.com/reports/car-security-system-market

Car Battery Chargers Market:

https://www.futuremarketinsights.com/reports/car-battery-chargers-market

Automotive Airbag Market:

https://www.futuremarketinsights.com/reports/automotive-airbag-market

Connected Car Market:

https://www.futuremarketinsights.com/reports/connected-car-market

Car Security System Market:

https://www.futuremarketinsights.com/reports/car-security-system-market

Editor’s Note:

The global car market Manufacturers are responding with localized production, hybrid portfolios, and connected service models. Regional growth hotspots include China, India, and Germany, offering significant expansion opportunities.

Rahul Singh

Future Market Insights Inc.

+1 347-918-3531

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.