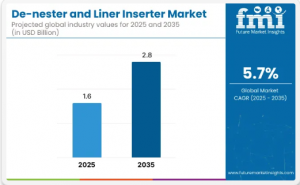

De-Nester and Liner Inserters Market Set to Reach USD 2.8 Billion by 2035 as Automation Drives Packaging Innovation

The de-nester and liner inserters market will expand 75% by 2035, driven by automation in food, pharma, and industrial packaging lines.

NEWARK, DE, UNITED STATES, August 11, 2025 /EINPresswire.com/ -- The global de-nester and liner inserters market is on a transformative growth path, forecast to rise from USD 1.6 billion in 2025 to USD 2.8 billion by 2035, marking a 75% total expansion at a steady 5.7% CAGR. This momentum reflects the increasing demand for automation, hygiene compliance, and operational efficiency across food, pharmaceutical, and industrial packaging sectors.

From 2025 to 2030, the market will add USD 0.5 billion—41.7% of the decade’s total growth—driven by accelerated automation in ready-to-eat meals, dairy, and bakery lines. Between 2030 and 2035, the pace quickens, with an additional USD 0.7 billion generated, fueled by adoption in robotic filling systems, modular servo-driven designs, and liner integration for stringent food-contact regulations.

Automation at the Core of Market Expansion

De-nester and liner inserter systems are vital for separating stacked containers and applying liners with precision, ensuring product freshness, hygiene, and portion accuracy. The cup/bowl de-nester segment, holding 48.3% share in 2025, remains dominant due to widespread use in yogurt, desserts, sauces, and instant meals—applications where quick changeovers and high throughput are essential.

In end-use industries, food packaging leads with a 53.7% share, underscoring the sector’s shift to contamination-free, automated operations. Fully automatic systems, comprising 72.2% of the market, are favored for their ability to integrate seamlessly into high-volume production lines while reducing manual intervention.

Sustainability and Efficiency Converge

The wax paper liner segment is projected to hold 36.1% share in 2025, thanks to its grease resistance, biodegradability, and compatibility with high-speed machinery. This aligns with growing eco-conscious mandates, particularly in North America and Europe.

Ready meals—the leading application at 38.2% share—highlight the need for standardized, high-volume tray handling and hygienic liner placement to meet evolving consumer lifestyles and urban demand.

Regional Growth Hotspots

Asia-Pacific leads global growth, with India achieving the fastest CAGR at 7.4%, supported by affordable, scalable designs from local OEMs. China follows at 7.1%, driven by large-scale meal production and export-oriented automation.

In developed markets, the USA (4.1% CAGR) focuses on industrial-scale automation upgrades, while the UK (3.3% CAGR) emphasizes waste reduction through modular systems. Germany refines precision and compliance features, Japan invests in cleanroom-compatible designs, and South Korea advances smart factory adoption for compact operations.

Shifting Competitive Landscape

The market is evolving from hardware-centric solutions to digitally enabled systems, with software integration and service-based models expected to account for over 40% of revenue by 2035. Global leaders such as SEALPAC, Kaupert Marburg, and OKI continue to dominate through high-speed accuracy and hygienic standards, while mid-sized innovators like Chunlai Packing Machinery Co., Farmo Res SRL, and Millitec Food Systems offer modular, compliance-ready solutions.

Regional specialists—Captel Industries LLP, Zhangjiagang U Tech Machine Co., Ltd., Aoqite Automatic Equipment, and Calmus Machinery—gain traction with cost-effective, application-specific automation tailored for local industries.

Innovation Driving Adoption

Emerging trends include vision-guided robotics, servo-driven modular designs, and IoT-based performance monitoring. Manufacturers are embedding remote diagnostics, smart calibration, and real-time placement verification to meet Industry 4.0 standards.

Recent developments include:

- March 2025 – SEALPAC unveiled high-efficiency traysealers and thermoformers at IFFA 2025, enhancing denesting and liner-inserting workflows.

- June 2025 – Farmo Res showcased pharma-grade automation at Pharmintech Ipack-Ima 2025, reinforcing its position in compliance-critical markets.

Request De-nester and Liner Inserter Market Draft Report: https://www.futuremarketinsights.com/reports/sample/rep-gb-22854

For more on their methodology and market coverage, visit! https://www.futuremarketinsights.com/about-us

Addressing Manufacturer Challenges

While adoption is strong, footprint constraints and format inflexibility remain barriers for smaller operations. The latest modular designs address these by enabling tool-less changeovers, compact layouts, and adaptability to multiple container formats—critical for short production runs and diverse SKUs.

Manufacturers investing in hygienic, high-speed automation stand to benefit from reduced labor dependency, improved contamination control, and scalable production capabilities. The competitive edge now lies not in mechanical speed alone, but in digital adaptability, platform intelligence, and lifecycle service integration.

Related Reports:

Die Cut Display Container Market: https://www.futuremarketinsights.com/reports/die-cut-display-container-market

Bundling Film Market: https://www.futuremarketinsights.com/reports/bundling-film-market

Heat Sealing Tape Market: https://www.futuremarketinsights.com/reports/heat-sealing-tape-market

Editor’s Note:

This release is based exclusively on verified and factual market content derived from industry analysis by Future Market Insights. No AI-generated statistics or speculative data have been introduced. This press release highlights significant shifts in the De-nester and Liner Inserter Market, which is experiencing a pivotal change driven by consumer demand for healthier, more transparent products.

Rahul Singh

Future Market Insights Inc.

+1 8455795705

email us here

Visit us on social media:

Other

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.