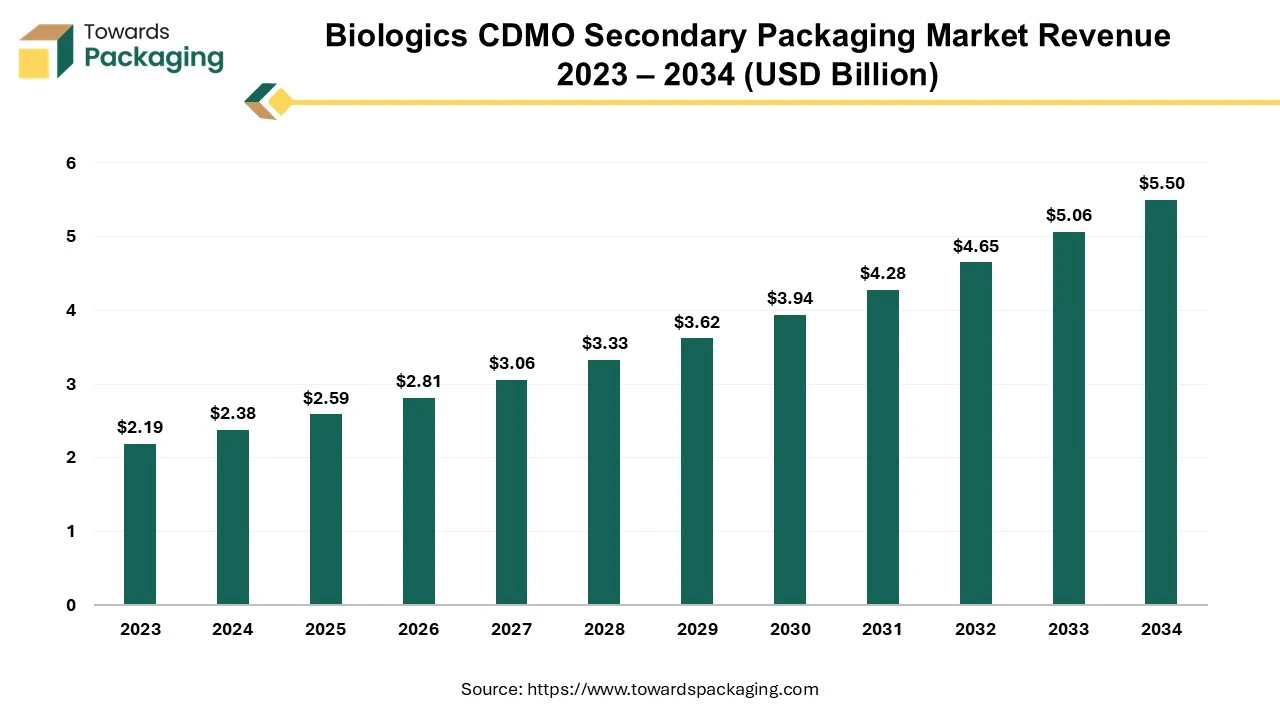

Biologics CDMO Secondary Packaging Market Size to Strike USD 5.50 Bn by 2034

The biologics CDMO secondary packaging market size stood at US$ 2.38 billion in 2024 and is predicted to exceed US$ 5.50 billion by 2034, experiencing a CAGR of 8.75% from 2025 to 2034.

Ottawa, April 08, 2025 (GLOBE NEWSWIRE) -- The biologics CDMO secondary packaging market size to record US$ 2.59 billion in 2025 and is projected to grow beyond US$ 5.50 billion by 2034, a study published by Towards Packaging a sister firm of Precedence Statistics.

Get All the Details in Our Solutions – Download Brochure: https://www.towardspackaging.com/download-brochure/5363

The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and collaboration to develop new technology for biologics CDMO secondary packaging, which has estimated to drive the growth of the biologics CDMO secondary packaging market in the near future.

Market Overview:

The complex drugs derived from living organism, including vaccines, monoclonal antibodies, gene therapies, and recombinant proteins is referred to as biologics. These require specialized handling due to their specialized handling due to their sensitivity to temperature, light, and contamination. Contract Development and Manufacturing Organizations –CDMO offer outsourced services for drug development and manufacturing, including secondary packaging, which ensures biologics are safely stored, transported, and ready for distribution. Secondary packaging is known as the external packaging of already primary-packaged biologics products. Unlike primary packaging, secondary packaging offers identification, protection, and convenience in logistics.

The key functions of secondary packaging in biologics are product protection, patient convenience & safety, regulatory compliance and cold chain support. The secondary packaging shields biologics from contamination, physical damage, and environmental exposure. The regulatory compliance ensures labeling, sterilization, and track-and-trace systems meet global regulations. Many biologics require strict temperature control, so secondary packaging may include insulated materials and temperature-monitoring devices.

The components of biologics secondary packaging include: cartons & boxes, labels & inserts, blister packs & trays, tamper-evident & anti-counterfeiting features, and cold chain packaging. The cartons and box packaging is used as outer packaging that holds vials, syringes, or blister packs.

If there's anything you'd like to ask, feel free to get in touch with us @ sales@towardspackaging.com

Major Key Trends in Biologics CDMO Secondary Packaging Market:

Smart & Connected Packaging

Serialization, real-time tracking, and patient engagement are crucial for regulatory compliance and supply chain security. Implementation of global track-and-trace regulations (e.g., DSCSA in the U.S., FMD in Europe). Rising concerns about drug counterfeiting and patient adherence. RFID, NFC, and QR code-based track-and-trace systems. Smart labels with real-time monitoring and digital patient interaction.

Sustainability & Eco-Friendly Packaging Solutions

Growing pressure from regulators, pharmaceutical companies, and consumers to reduce packaging waste and environmental impact. Global push for sustainable pharmaceutical packaging. Companies adopting ESG (Environmental, Social, and Governance) goals are driving the need for the sustainable secondary packaging. Biodegradable and recyclable packaging materials are being used for manufacturing sustainable secondary packaging for CDMO. The use of energy-efficient manufacturing processes for secondary packaging is done for manufacturing eco-friendly secondary packaging.

Expansion of Pre-Filled Syringes & Auto-Injectors

The shift towards patient-centric, self-administration biologics is driving demand for specialized packaging for injectables. Rising adoption of the self-administered biologics., has driven the demand for the pre-filled syringes & auto-injectors. Tamper-evident and child-resistant secondary packaging are being developed due to rise in demand for pre-filled syringes.

Increased Automation & Robotics in Packaging

Advanced automation enhances efficiency, reduces human error, and ensures regulatory compliance. Demand for high-speed, high-precision packaging solutions has driven the demand for the automation and robotics in packaging. Need for quality assurance in handling sensitive biologics has driven the demand robotics in packaging. AI-driven automated packaging lines for greater efficiency. Robotics for precise handling of delicate biologic products.

Outsourcing to CDMOs for End-to-End Packaging Solutions

Pharma and biotech companies are increasingly outsourcing packaging needs to CDMOs due to: High cost of in-house packaging infrastructure for biologics and regulatory complexity requiring specialized expertise. Need for faster time-to-market, especially for COVID-like pandemic responses. CDMOs offering integrated packaging solutions (primary, secondary, labeling, and cold chain management) are in high demand.

Join now to access the latest packaging industry segmentation insights with our Annual Membership: https://www.towardspackaging.com/get-an-annual-membership

Cold Chain Packaging Advancements

- Temperature-sensitive biologics require advanced cold chain packaging solutions, including:

- Phase-Change Materials (PCMs) for maintaining specific temperature ranges.

- IoT-enabled temperature monitoring to ensure real-time tracking.

- Advanced insulation materials that minimizes reliance on dry ice and lower environmental impact.

- The demand for cryogenic packaging (below -80°C) is growing due to cell and gene therapies.

Growth in Biologics and Personalized Medicine

The rising demand for monoclonal antibodies, gene therapies, cell therapies, and mRNA vaccines is driving the demand for specialized packaging solutions. Personalized medicine requires smaller batch sizes, which challenges CDMOs to develop flexible, scalable packaging solutions.

Limitations & Challenges in Biologics CDMO Secondary Packaging Market

Stringent Regulatory Compliance

Different countries have strict guidelines for biologics packaging, including FDA (U.S.), EMA (Europe), and WHO regulations. Compliance with DSCSA (U.S.) and FMD (EU) requires costly investments in serialization, barcoding, and anti-counterfeiting measures. CDMOs must adhere to precise requirements for patient information, multi-language labels, and child-resistant features. Regulatory Compliance increases costs and complexity, making it harder for smaller CDMOs to compete.

Shortage of Experienced CDMOs:

- Not all CDMOs have the expertise to handle biologic-specific secondary packaging, limiting options for pharmaceutical companies.

Capacity Constraints:

- High demand for biologics has stretched CDMO facilities, leading to long production timelines and bottlenecks.

Demand for Skilled Workforce:

- Handling advanced packaging automation, compliance, and cold chain logistics requires specialized labor, which is in short supply.

Rising Funding & Investment activities to Grow Market Potential

Personalized treatments require specialized packaging solutions (e.g., cryogenic storage for cell therapies). CDMOs that offer tailored secondary packaging solutions, such as customized labeling and traceability features, have a competitive edge. The need for compliance with FDA, EMA, and other regulatory agencies is pushing biologics companies to outsource packaging to experienced CDMOs. Serialization and track-and-trace regulations (such as the U.S. Drug Supply Chain Security Act) drive demand for advanced secondary packaging solutions.

“In March 2025, At its Woodstock, Illinois, location, Woodstock Sterile Solutions, a top blow-fill-seal (BFS) contract development and manufacturing organization (CDMO), is investing $8 million in a new automated, high-speed bottle packaging line to increase its BFS capabilities.”

Many biologics require cold chain packaging to maintain efficacy, leading to increased investment in temperature-controlled packaging solutions. Growth in global distribution networks for biologics is boosting demand for specialized CDMO services. Increasing investment activities by the companies for developing bottle packaging for CDMO has estimated to create lucrative opportunity for the growth of the biologics CDMO secondary packaging market over the forecast period.

Private Company Investments:

- Catalent Inc.: In April 2022, Catalent Inc. invested $350 million to expand drug manufacturing capabilities in Bloomington, Indiana. This expansion aims to enhance their capacity to meet the growing demand for biologic therapies and associated packaging solutions.

- At Pack Expo International 2024, Bradman Lake Group showcased innovative packaging systems designed for diverse market sectors, including pharmaceuticals. These systems aim to improve efficiency and reliability in packaging processes.

Regional Analysis

North America’s Dominance to Sustain: What to Expect till 2034?

North America region held the largest share of the biologics CDMO secondary packaging market in 2024, driven by the factors such as advanced infrastructure for biologic packaging and well-equipped cold chain logistics and storage facilities. The U.S. is home to major biopharma giants like Pfizer, Moderna, Amgen, and Bristol-Myers Squibb, driving demand for biologics CDMO services. Growth in monoclonal antibodies, gene therapies, and mRNA vaccines requires specialized packaging solutions. The increasing number of biosimilars (generic versions of biologics) is fueling demand for customized secondary packaging. North America has a well-established network of CDMOs, including leading companies like Catalent, Lonza (U.S. division), and Thermo Fisher Scientific.

High investment in packaging automation, robotics, and smart packaging technologies enhances production efficiency. Research &Development funding from both private and government sectors in North America region supports cutting-edge packaging solutions. North America has a well-developed cold chain infrastructure, crucial for packaging temperature-sensitive biologics. Companies like UPS Healthcare, DHL Life Sciences, and FedEx Cold Chain provide specialized biologics logistics. Advanced insulated shippers, phase-change materials (PCMs), and real-time IoT tracking ensure product integrity.

Major Factor for the Market’s Expansion in North America:

Expansion of the biologics CDMO companies in North America region has driven the growth of the biologics CDMO secondary packaging market in the region. For instance, in July 2024, Agilent Technologies Inc. declared that it has finalized a deal to pay US$925 million to buy BIOVECTRA, a prominent specialized contract development and manufacturing company. BIOVECTRA, a Canadian company, manufactures highly effective active pharmaceutical ingredients, biologics, and other compounds for targeted therapies. In three crucial areas, the acquisition expands on Agilent's CMO expertise in oligonucleotides and CRISPR therapies: increases the range of services offered.

BIOVECTRA provides lipid nanoparticle (LP) formulation, DNA and ImRNA capabilities, and sterile fill-finish services. include modalities that are expanding quickly. GLP-1, highly potent active pharmaceutical ingredients (HPAPIs), and antibody drug conjugates (ADs) are among the rapidly expanding markets in which BIOVECTRA specializes. The acquisition also provides superior equipment to facilitate gene editing. Customers will have a single supplier for gene-editing technologies thanks to Agilent's gNA expertise and BIOVECTRA's biologicals capabilities.

Elevate your packaging strategy with Towards Packaging. Enhance efficiency and achieve superior results—schedule a call today: https://www.towardspackaging.com/schedule-meeting

Major Investments & Government Initiatives in U.S

- In 2021, GRAM opened a new finishing manufacturing facility and warehouse center in Grand Rapids, Michigan, adding 110,000 square feet to its footprint. The company also invested in advanced finishing equipment, including a new labeling machine with a packaging line and automated inspection systems.

- In April 2022, Asahi Kasei Medical acquired Bionova Scientific, a U.S.-based biologics CDMO specializing in recombinant protein therapeutics. This acquisition aimed to strengthen Asahi Kasei's position in the biopharmaceutical CDMO sector.

- The U.S. Food and Drug Administration (FDA) provides stringent regulations and guidelines that ensure the safety and efficacy of biologic products. This regulatory framework supports the development and manufacturing processes of CDMOs, fostering a conducive environment for growth and investment.

U.S. Secondary Packaging Market Trends

The U.S. leads in cell and gene therapy (CGT) development, which requires customized secondary packaging for individualized treatments. The U.S. has leading CDMOs such as Catalent, Lonza (U.S. division), Thermo Fisher Scientific, and Samsung Biologics (U.S. operations). The U.S. has an advanced cold chain infrastructure, essential for packaging temperature-sensitive biologics. Major logistics providers like DHL Life Sciences, UPS Healthcare, and FedEx Cold Chain specialize in biologics transportation and packaging solutions.

Asia's Developed R&D Sector to Promote the Growth

Asia Pacific region is seen to grow at the fastest rate in the biologics CDMO secondary packaging market during the forecast period. China, India, South Korea, and Japan are experiencing a surge in biologics production, driven by increasing demand for monoclonal antibodies, vaccines, and biosimilars. The growth of local biotech startups and global pharmaceutical outsourcing to Asia Pacific CDMOs is boosting secondary packaging needs.

A booming biologics sector in Asia Pacific is increasing the demand for CDMO packaging services. Lower labor and operational costs in Asia Pacific region attract global pharmaceutical companies to outsource biologics secondary packaging to the region. Countries like China and India are investing heavily in packaging automation and sterilization, improving efficiency while maintaining cost benefits. Asia Pacific’s cost efficiency makes it a preferred hub for biologics packaging outsourcing.

Leading Asia Pacific CDMOs (e.g., WuXi Biologics (China), Syngene (India) and Samsung Biologics (South Korea)) are expanding their packaging and labeling capabilities. New biologics manufacturing and packaging facilities are being established in India, China and Southeast Asia to meet increasing global demand.

“To promote self-reliance in API and bulk drug manufacturing, the government has allocated INR 69.4 billion (around US$800 million) under the Bulk Drug Parks Scheme. This initiative aims to establish large-scale manufacturing facilities, thereby enhancing production capabilities and reducing dependency on imports.”

China’s NMPA-National Medical Products Administration) and India’s CDSCO (Central Drugs Standard Control Organization) are strengthening biopharmaceutical packaging regulations. Countries like South Korea and Japan have strict GDP-Good Distribution Practice and GMP-Good Manufacturing Practices standards for biologics packaging. The key players like FedEx Cold Chain, DHL Life Sciences, and UPS Healthcare are expanding their biologics packaging and distribution capabilities in Asia Pacific.

South Korea and Japan are leaders in regenerative therapies and precision medicine, increasing the demand for customized secondary packaging. Asia Pacific CDMOs are investing in flexible packaging lines to accommodate these specialized requirements. Asia Pacific hosts major pharmaceutical packaging companies such as Amcor, Gerresheimer and SCHOTT Pharma.

Segment Outlook

Boxes Took the Largest Share in 2024, Cartons Segment to Grow Rapidly

The boxes segment dominated the biologics CDMO secondary packaging market with the largest share in 2024. The boxes segment dominates the biologics CDMO secondary packaging market owing to its versatility, protective capabilities, and regulatory compliance. Boxes are cost-efficient compared to rigid plastic or metal secondary packaging. They are stackable, lightweight, and easy to transport, minimizing logistics costs. Mass production of standardized carton boxes allows CDMOs to scale packaging operations efficiently. Boxes packaging provide an affordable yet effective secondary packaging solution for biologics.

The cartons segment is anticipated to witness lucrative growth during the forecast period. Shields biologic products from physical damage (e.g., impact, compression). The cartons provide a barrier against light, moisture, and contaminants, preserving product integrity. The cartons packaging reduces risk of tampering and enables tamper-evident designs. Cartons are easily printable for brand identity, product details, and regulatory information. Carton packaging is the preferred choice for secondary packaging in biologics CDMOs due to its protective properties, compliance with regulations, cost efficiency, and sustainability while enabling easy branding, serialization, and handling.

Superior Protection & Stability: Ampoules to Gain Significant Share

The ampoules segment accounted for the largest biologics CDMO secondary packaging market share in 2024. The ampoules provide superior protection for biologics, provides high chemical stability, sterility assurance, and is preferred for lyophilized & liquid biologics. Biologics, such as vaccines, monoclonal antibodies, and gene therapies, are highly sensitive to contamination, light exposure, oxidation. Ampoules, typically manufactured of glass offer a hermetic seal that prevents degradation and contamination. Ampoules are compatible with lyophilisation processes, making them a preferred choice over other formats.

The bottles segment is anticipated to show the fastest growth during the forecast period. Bottles are ideal for bulk storage of biologics before final dosing into vials, syringes, or ampoules. They allow for large-volume storage of products like cell and gene therapies, monoclonal antibodies, and vaccines. Many biologics require storage in liquid form or freeze-dried (lyophilized) powder.

Recent Breakthroughs in Global Biologics CDMO Secondary Packaging Market

- In January 2025, From January 22 to 23, 2025, Healthcare presented its circular innovations at Pharmapack 2025 in Paris. Attendees will have the chance to learn about Berry's most recent medical products, such as the freshly released ClariPPil bottles and jars for OSD. Additionally, visitors can speak with Berry's experts to find out more about its CDMO (Contract Development and Manufacturing Organization) services, which hasten the entry of healthcare devices and packaging into the market.

- In March 2024, In North Carolina, SMC Ltd. unveils a state-of-the-art facility and expands its sterile fill finish capabilities. Lab to market development, analytical services, device manufacturing, fill finish, final assembly, and secondary packaging are just a few of the services that SMC can now provide to its pharmaceutical clients thanks to the facility. The new facility, which offers high-speed, sterile fill finish lines with on-site formulation, compounding, and packaging capabilities, reinforces SMC's global manufacturing footprint and demonstrates the company's dedication to the pharmaceutical services sector.

More Insights in Towards Packaging:

- Sterile Medical Paper Packaging Market Strategic Growth, Innovation & Investment Trends: https://www.towardspackaging.com/insights/sterile-medical-paper-packaging-market-sizing

- Antimicrobial Packaging Market Research Insight: Industry Insights, Trends and Forecast: https://www.towardspackaging.com/insights/antimicrobial-packaging-market

- Pharmaceutical Bottles Market Outlook Scenario Planning & Strategic Insights for 2034: https://www.towardspackaging.com/insights/pharmaceutical-bottles-market-sizing

- Biopharmaceuticals Packaging Market Outlook Scenario Planning & Strategic Insights for 2034: https://www.towardspackaging.com/insights/biopharmaceuticals-packaging-market-sizing

- Pharma Blister Packaging Machines Market Intelligence, Benchmarking, Consumer Insights & Growth Strategies: https://www.towardspackaging.com/insights/pharma-blister-packaging-machines-market-sizing

- Biotechnology Labels and Packaging Market Research, Consumer Behavior, Demand and Forecast: https://www.towardspackaging.com/insights/biotechnology-labels-and-packaging-market-sizing

- Medical Packaging Market Outlook Scenario Planning & Strategic Insights for 2034: https://www.towardspackaging.com/insights/medical-packaging-market-sizing

- Pharmacy Repackaging System Market Intelligence, Benchmarking, Consumer Insights & Growth Strategies: https://www.towardspackaging.com/insights/pharmacy-repackaging-system-market-sizing

- Multi-med Adherence Packaging Market Trends and Investment Opportunities: https://www.towardspackaging.com/insights/multi-med-adherence-packaging-market-sizing

- Sterile Medical Packaging Market Strategic Growth, Innovation & Investment Trends: https://www.towardspackaging.com/insights/sterile-medical-packaging-market-sizing

Biologics CDMO Secondary Packaging Market Segments

By Product Type:

- Boxes

- Cartons

By Primary Package Type:

- Ampoules

- Blister Packs

- Bottles

- Cartridges

- Syringes and Vials

- Prefilled Syringes

By Region:

-

North America

- U.S.

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

-

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

-

Latin America

- Brazil

- Mexico

- Argentina

-

Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Review the Full TOC for the Biologics CDMO Secondary Packaging Report: https://www.towardspackaging.com/table-of-content/biologics-cdmo-secondary-packaging-market-sizing

Invest in Premium Global Insights @ https://www.towardspackaging.com/price/5363

If you have any questions, please feel free to contact us at sales@towardspackaging.com

About Us

Towards Packaging is a leading global consulting firm specializing in providing comprehensive and strategic research solutions. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations. We stay abreast of the latest industry trends and emerging markets to provide our clients with an unrivalled understanding of their respective sectors. We adhere to rigorous research methodologies, combining primary and secondary research to ensure accuracy and reliability. Our data-driven approach and advanced analytics enable us to unearth actionable insights and make informed recommendations. We are committed to delivering excellence in all our endeavours. Our dedication to quality and continuous improvement has earned us the trust and loyalty of clients worldwide.

Browse our Brand-New Journal:

Precedence Research | Statifacts |Towards Automotive | Towards Healthcare | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire

For Latest Update Follow Us: https://www.linkedin.com/company/towards-packaging/

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.