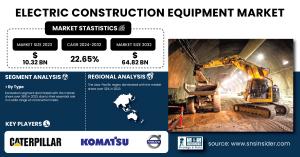

Electric Construction Equipment Market Experiencing Rapid Growth, Expected to Reach USD 64.82 Billion by 2032

Stringent emissions regulations, battery advancements, and cost savings are driving the rapid growth of the Electric Construction Equipment Market.

AUSTIN, TX, UNITED STATES, February 21, 2025 /EINPresswire.com/ -- According to the SNS Insider report, the Electric Construction Equipment Market was valued at USD 10.32 billion in 2023. Projections indicate a substantial growth to USD 64.82 billion by 2032, with a Compound Annual Growth Rate (CAGR) of 22.65% from 2024 to 2032. The Electric Construction Equipment Market is experiencing rapid growth due to the escalating demand for eco-friendly and efficient machinery in the construction industry. This surge is driven by stringent environmental regulations, technological advancements in battery systems, and a global shift toward sustainable infrastructure development.Get a Sample Report of Electric Construction Equipment Market @ https://www.snsinsider.com/sample-request/5553

Key Players:

• Caterpillar Inc. (U.S.): (Cat 301.5 Electric Mini Excavator)

• Komatsu (Japan): (PC30-7E0 Electric Mini Excavator)

• AB Volvo (Sweden): (EC500 Electric Crawler Excavator)

• Hitachi Construction Machinery Co., Ltd. (Japan): (ZX55U-6EB Electric Mini Excavator)

• Deere & Company (U.S.): (John Deere 944K Hybrid Wheel Loader)

• Sany Heavy Industry Co., Ltd. (China):(SY35U Electric Mini Excavator)

• JCB (U.K.): (JCB 19C-1E Electric Mini Excavator)

• HD Hyundai Infracore Co., Ltd. (South Korea): (HX85A Electric Crawler Excavator)

• Kobelco Construction Machinery Co., Ltd. (Japan): (SK17SR-3E Electric Mini Excavator)

• Liebherr (Switzerland): (Liebherr T 264 Electric Mining Truck)

• Xuzhou Construction Machinery Group Co., Ltd. (China): (XCMG XE35U Electric Mini Excavator)

• Yuchai Heavy Industry (China): (Yuchai Electric Wheel Loader)

• Doosan Infracore (South Korea): (DX165W Electric Wheel Excavator)

• CASE Construction Equipment (U.S.): (CASE 570N EP Tractor Loader)

• Kubota Corporation (Japan): (Kubota U55-4 Electric Mini Excavator)

• Terex Corporation (U.S.): (Terex TA300 Electric Articulated Dump Truck)

• Manitou Group (France): (Manitou MT 625e Electric Telehandler)

• Bobcat Company (U.S.): (Bobcat E165 Large Electric Excavator)

• Sennebogen Maschinenfabrik GmbH (Germany): (Sennebogen 8170 E Electric Crawler Crane)

• Wacker Neuson SE (Germany): (Wacker Neuson EZ17e Electric Mini Excavator)

Key Market Segments Driving the Growth of Electric Construction Equipment

By Type: In 2023, the excavators segment led the Electric Construction Equipment Market, capturing over 38% market share. They are well suited for a variety of applications (including digging, trenching, material handling, and demolition), which explains their dominance in the marketplace. The growing adoption of electric excavators has sent a clear signal, as these machines take on less operating costs, enhanced efficiency, less environmental damage, and a leak-proof milestone. This trend was accelerated by the development of battery technology and charging infrastructure. As infrastructure investments and greening construction projects expand, by segment the excavator is likely to hold onto its position as the market leader, powering the industry's shift towards electrification and sustainability.

By Battery Type: The Lithium-Ion battery segment held a market share exceeding 42% in 2023, owing to superior performance characteristics. These batteries provide higher energy density, allowing for longer use on a single charge an essential feature for extended construction work. This prolongs their service life and enables them to be cost-effective, as they incur lower maintenance costs and subsequent downtime. With faster charging capabilities, productivity is improved as the equipment is idle for shorter time intervals. Lithium-ion batteries are lighter, and better for the atmosphere than lead-acid batteries, helping the industry in its pursuit of sustainability. The widespread acceptance of lithium-ion batteries will continue with the improved cost of battery technologies.

By Application: The construction application segment dominated the Electric Construction Equipment Market in 2023, holding over 32% share. This is largely attributed to the wider uptake of electric machines in operations as building construction, infrastructure work, and earthmoving. Increasing concern for sustainable construction practices and stricter environmental regulations have driven the transition from diesel powered equipment to electric alternatives. Such investments in environmentally friendly solutions will minimize both carbon emissions and noise pollution at worksites. Improvements in battery technology and charging infrastructure have made electric construction equipment more viable, further fueling market growth. As a result, electric machineries are increasingly popular in the construction industry.

Asia-Pacific Leads, North America Emerges as Fastest-Growing Region in the Electric Construction Equipment Market

The Asia-Pacific region led the Electric Construction Equipment Market in 2023, accounting for over 32% of the market share. This leadership is fueled by rapid urbanization, massive infrastructure investment, and strong government backing for environmental initiatives. Countries like China, Japan, and South Korea have led the way in deploying electric construction machinery in their projects. The region also maintains its edge with innovations in electric vehicle technologies and strong environmental policies. These initiatives promote emissions reduction, energy efficiency, and environmental targets, making Asia-Pacific a market leader in electric construction equipment.

North America is experiencing swift growth in the Electric Construction Equipment Market, driven by the increasing adoption of electric vehicles (EVs) and construction machinery. Stringent environmental regulations, growing sustainability awareness among consumers, and increased demand for energy-efficient equipment are driving this trend. This transition is a major focus in North America, which is investing heavily in electric construction equipment, with the U.S. and Canada leading the way. Government policies, regulatory pressure and increased environmental awareness from consumers and businesses are driving the adoption of electric equipment faster than before. These factors make North America the fastest-emerging region in the electric construction equipment market.

Buy Full Research Report on Electric Construction Equipment Market 2024-2032 @ https://www.snsinsider.com/checkout/5553

Recent Developments:

• In 2023: Komatsu expanded its electric excavator lineup with the PC05E-1 Electric Micro Excavator and introduced its first large electric models, the PC200LCE-11 and PC210LCE-11, offering zero emissions. At CONEXPO 2023, it unveiled the HB365LC-3 Hybrid Excavator, enhancing fuel efficiency with a diesel-electric system.

About Us:

SNS Insider is a global leader in market research and consulting, shaping the future of the industry. Our mission is to empower clients with the insights they need to thrive in dynamic environments. Utilizing advanced methodologies such as surveys, video interviews, and focus groups, we provide up-to-date, accurate market intelligence and consumer insights, ensuring you make confident, informed decisions.

Jagney Dave

SNS Insider Pvt. Ltd

+1 315 636 4242

email us here

Visit us on social media:

Facebook

X

LinkedIn

Instagram

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.