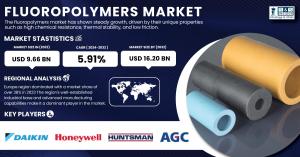

Fluoropolymers Market to Reach USD 16.20 Billion by 2032, Growing at 5.91% CAGR | SNS Insider

The fluoropolymers market is expanding as industries adopt these high-performance materials for durability, chemical resistance, and efficiency.

AUSTIN, TX, UNITED STATES, February 19, 2025 /EINPresswire.com/ -- The Fluoropolymers Market Size was valued at 9.66 Billion in 2023 and is expected to reach USD 16.20 Billion by 2032, growing at a CAGR of 5.91% over the forecast period of 2024-2032.Fluoropolymers are gaining significant traction due to their high resistance to heat, chemicals, and electrical insulation properties, making them vital in industrial applications. The U.S. Environmental Protection Agency (EPA) has reported a steady increase in fluoropolymer production, attributing this to the rising demand from the electronics and automotive industries. In 2023, Daikin Industries announced a $195 million investment to expand its fluoropolymer production in the U.S. Meanwhile, Chemours has been actively developing sustainable fluoropolymers, aligning with environmental regulations set by the European Chemicals Agency (ECHA). The automotive industry is increasingly utilizing fluoropolymers in coatings and fuel hoses due to their non-stick and durability properties. Moreover, Asia-Pacific has witnessed significant investments in fluoropolymer manufacturing, with Chinese firms such as Dongyue Group expanding production capacity to meet surging demand. The growth in fluoropolymer-based coatings, lubricants, and medical applications further fuels the market expansion, indicating a robust growth trajectory through 2032.

Get a Sample Report of Fluoropolymers Market @ https://www.snsinsider.com/sample-request/1442

Key Players:

• AGC Chemicals Americas, Inc. (AF Series Fluoropolymer, Aflas)

• Huntsman Corporation (Hylar Fluoropolymer)

• Dongyue Group Ltd. (FEP, PTFE)

• Poly Fluoro Ltd. (PFA, FEP, PTFE)

• Solvay SA (Solef PVDF, Ryton PPS)

• The Chemours Company (Teflon, Krytox)

• Honeywell International Inc. (Aflas)

• Daikin Industries Limited (Daiflon PTFE, PFA)

• Kureha Corporation (Kureha PTFE, Kureha Fluoropolymer)

• Amco Polymers (Fluoroelastomers, FEP)

• Saint-Gobain Performance Plastics (Fluoroloy, Norprene)

• 3M (Dyneon Fluoropolymers, 3M PTFE)

• Arkema Group (Kynar® PVDF, Rilsan PA11)

• Linde plc (Inovene Fluoropolymers)

• Mitsubishi Chemical Corporation (Lumiflon)

• Daikin America Inc. (Neoflon PTFE, PFA)

• GFL (GFL PTFE)

• Chongqing Changsheng Fluoro Materials Co. (PTFE, FEP)

• Kraton Polymers (Kraton Fluoroelastomers)

• Dynalene, Inc. (Dynalene Fluoropolymer-based solutions)

By Product, Polytetrafluoroethylene (PTFE) dominated the fluoropolymers market in 2023, accounting for 34% of the total revenue.

PTFE is widely used in industrial coatings, medical tubing, and electrical insulation due to its excellent thermal stability and non-reactive nature. Major manufacturers such as Chemours, 3M, and Daikin have been focusing on expanding PTFE production to cater to growing demand from semiconductor and healthcare industries. For instance, PTFE’s application in non-stick cookware has remained a key revenue generator. Additionally, its increasing use in automotive fuel hoses and aerospace components further solidifies its dominance in the market.

By End-User, Industrial equipment emerged as the leading end-use sector in 2023, holding a 32% market share.

The demand for fluoropolymers in sealing solutions, gaskets, and heat exchangers is rising due to their ability to withstand extreme temperatures and corrosive environments. Companies such as Arkema and Solvay have reported increased adoption of high-performance fluoropolymers in chemical processing plants. Furthermore, rapid advancements in semiconductor manufacturing have amplified the need for ultra-pure fluoropolymer coatings, reinforcing this segment’s dominance.

Europe dominated the global fluoropolymers market in 2023, holding a 38% market share.

Germany, France, and the UK lead the region’s demand, driven by stringent environmental regulations and rising applications in the medical and automotive industries. The European Chemicals Agency (ECHA) has implemented strict guidelines on PFAS-based fluoropolymers, encouraging the development of eco-friendly alternatives. Leading companies such as Solvay and Arkema have expanded their production facilities in Europe to meet growing demand. Additionally, the European automotive sector has been increasingly utilizing fluoropolymer coatings for fuel efficiency and emission reduction. The expanding medical sector in Germany, where fluoropolymer-based implants and tubing are widely used, further strengthens the region’s market position.

Buy Full Research Report on Fluoropolymers Market 2024-2032 @ https://www.snsinsider.com/checkout/1442

Asia-Pacific is the fastest-growing region in the fluoropolymers market, projected to expand with a significant CAGR from 2024 to 2032.

Countries such as China, India, and Japan are witnessing significant growth due to increasing industrialization and the booming electronics sector. China remains a major hub for fluoropolymer manufacturing, with firms like Dongyue Group and Zhejiang Juhua ramping up production to meet global demand. In India, the rising adoption of fluoropolymer-based coatings in infrastructure and renewable energy projects is accelerating market expansion. Moreover, Japan's robust semiconductor industry continues to drive demand for high-performance fluoropolymers in critical electronic components, positioning the region for rapid growth.

About Us:

SNS Insider is a global leader in market research and consulting, shaping the future of the industry. Our mission is to empower clients with the insights they need to thrive in dynamic environments. Utilizing advanced methodologies such as surveys, video interviews, and focus groups, we provide up-to-date, accurate market intelligence and consumer insights, ensuring you make confident, informed decisions.

Jagney Dave

SNS Insider Pvt. Ltd

+1 315 636 4242

email us here

Visit us on social media:

Facebook

X

LinkedIn

Instagram

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.