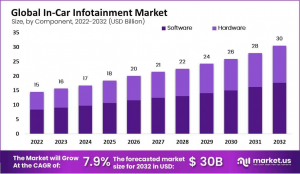

In-Car Infotainment Market Size to Reach USD 30.0 Billion by 2032, Growing at a CAGR of 7.9%

In-Car Infotainment Market is expected to grow from USD 16.0 Billion in 2023 to USD 30.0 Billion by 2032, at a CAGR of 7.9%.

The Global In-Car Infotainment Market is projected to reach approximately USD 30.0 billion by 2032, up from USD 16.0 billion in 2023, expanding at a CAGR of 7.9% from 2023 to 2032.

In-Car Infotainment refers to integrated systems within vehicles that provide entertainment, information, and connectivity features to passengers. These systems typically include audio, video, navigation, internet browsing, and voice-command functionalities, all designed to enhance the driving experience. Over the years, advancements in technology have significantly broadened the scope of in-car infotainment systems, evolving from simple audio players to complex, integrated multimedia hubs offering seamless connectivity with smartphones and other digital devices. This market also encompasses in-vehicle technologies like advanced driver assistance systems (ADAS), which work in conjunction with infotainment to enhance both safety and entertainment for passengers.

The In-Car Infotainment market has witnessed rapid expansion due to increasing consumer demand for connectivity, multimedia features, and personalized experiences. Automakers are now integrating advanced infotainment solutions to differentiate their products and cater to the growing trend of connected living. Factors such as rising consumer preferences for advanced entertainment systems, increasing smartphone penetration, and the push for seamless integration of digital ecosystems within vehicles are propelling this market’s growth. Additionally, consumer expectations for safer, more intuitive interfaces in vehicles are influencing automakers to invest in next-generation infotainment technologies.

Request Your Sample Report Today for In-Depth Insights and Analysis at https://market.us/report/in-car-infotainment-market/request-sample/

The demand for advanced in-car infotainment systems is driven by a variety of factors, including the growing popularity of electric vehicles, autonomous driving, and increasing disposable income, particularly in emerging markets. Furthermore, the rising importance of connected and smart technologies opens significant opportunities for growth. As manufacturers focus on enhancing user interfaces and introducing features like voice recognition, augmented reality navigation, and immersive audio, the market holds promising prospects for both existing players and new entrants.

**Key Takeaways**

~~ The In-Car Infotainment Market is expected to grow significantly from USD 16.0 billion in 2023 to USD 30.0 billion by 2032, with a robust CAGR of 7.9%. This growth is fueled by advancements in connectivity, the rise of electric vehicles, and autonomous driving technologies.

~~ Consumer demand for connected and personalized automotive experiences, as well as regulatory standards focusing on advanced safety and connectivity, are key factors driving market expansion.

~~ The Head-up Display segment leads the market with over 31% share, driven by the demand for safety features and augmented reality (AR) integrations.

~~ The Software segment dominates with more than 58% market share, reflecting the importance of AI integration and connected services in infotainment systems.

~~ The Commercial Vehicle segment captures over 67% of the market, driven by the increasing use of infotainment for fleet management, driver communication, and navigation.

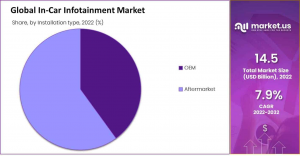

~~ The Aftermarket segment holds more than 60% market share due to rising consumer interest in upgrading vehicles with advanced connectivity and multimedia features.

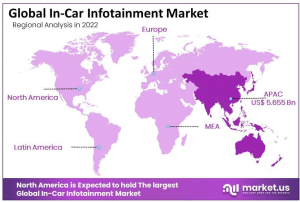

~~ Asia Pacific leads with a 39% market share, propelled by rapid technological adoption and high demand for luxury vehicles equipped with sophisticated infotainment systems.

**Market Segmentation**

In 2022, the Head-up Display (HUD) segment led the global in-car infotainment market with over 31% market share, driven by rising demand for advanced vehicle technology that enhances driver safety and comfort. HUD systems provide real-time data, such as navigation and speed, reducing distractions. The segment is expected to grow due to technological advancements like augmented reality and the rise of electric and autonomous vehicles. Meanwhile, the Audio Unit segment also grew, fueled by consumer demand for premium sound systems, while the Navigation Systems segment experienced moderate growth with GPS and real-time updates. The Connectivity Solutions segment is emerging as a key driver, supported by 5G technology and the need for seamless integration between vehicles and external devices.

In 2022, the software segment led the In-Car Infotainment Market with over 58% market share. This dominance is driven by the rising demand for connected vehicle services and ADAS, which rely on advanced software. Key advancements include AI integration for voice recognition, real-time traffic updates, and personalized experiences. Collaborations between automakers and software developers have also played a significant role in enhancing in-car systems, fueling further growth in the software segment.

In 2022, the commercial vehicle segment dominated the In-Car Infotainment Market, holding over 67% of the share. This growth is driven by the increasing adoption of advanced infotainment systems in commercial fleets for improved driver communication, navigation, and entertainment. Features like real-time tracking, route optimization, and telematics enhance operational efficiency and safety. Additionally, regulatory mandates for vehicle safety and the rise of connected vehicle technologies are boosting demand. Fleet operators are integrating these systems to optimize operations and enhance the in-cabin experience, further fueling market growth.

In 2022, the aftermarket segment dominated the In-Car Infotainment Market, holding over 60% of the market share. This growth is driven by the rising demand for upgraded infotainment systems in older vehicles. Consumers seek advanced connectivity features like Apple CarPlay and Android Auto, as well as enhanced navigation and voice-assisted functionalities. The affordability of aftermarket solutions compared to factory-installed systems also makes them a popular choice among cost-conscious buyers looking to improve their in-car experience.

**Key Market Segments**

Based on Product

~~Audio Unit

~~Display Unit

~~Head-up Display

~~Navigation Unit

~~Communication Unit

Based on component

~~ Hardware

~~ Software

Based Application

~~ Passenger cars

~~ Commercial Vehicle

Based on the Installation type

~~ OEM

~~ Aftermarket

**Emerging Trends**

~~ Advanced Connectivity Integration: Modern vehicles are increasingly integrating advanced connectivity features, such as in-vehicle calling and data connectivity, to enhance the in-car experience. This trend reflects a growing consumer demand for seamless connectivity and enriched in-vehicle entertainment.

~~ Enhanced In-Cabin Experiences: Automakers are focusing on enriching in-cabin experiences by developing innovative technologies that improve connectivity solutions, vehicle safety, and the overall user experience. This includes integrating infotainment systems that serve as central hubs for various automotive functions.

~~ Integration of Artificial Intelligence (AI): The incorporation of AI-powered voice assistants and advanced infotainment systems is becoming more prevalent. These systems aim to provide personalized and interactive experiences for drivers and passengers, enhancing convenience and safety.

"Order the Complete Report Today to Receive Up to 30% Off at https://market.us/purchase-report/?report_id=32774

**Top Use Cases**

~~ Navigation and Traffic Updates: In-car infotainment systems provide real-time navigation assistance and traffic updates, helping drivers plan efficient routes and avoid congestion. This functionality enhances convenience and reduces travel time.

~~~ Entertainment Services: These systems offer access to various entertainment options, including music streaming, video playback, and gaming. For instance, BMW's AirConsole platform allows passengers to play games like Uno and "Who Wants to Be a Millionaire?" using their smartphones as controllers.

~~ Vehicle Diagnostics and Maintenance Alerts: Infotainment systems can monitor vehicle performance and provide alerts for maintenance needs, ensuring the vehicle operates efficiently and safely. This proactive approach helps in timely maintenance and reduces the risk of unexpected breakdowns.

**Major Challenges**

~~ Safety and Security Concerns: The integration of advanced infotainment systems raises concerns about driver distraction and potential security vulnerabilities. Studies have shown that driver distraction is a significant cause of accidents, with nearly eight people killed and over 1,100 injured daily in the U.S. due to inattentive driving.

~~ Consumer Acceptance and Awareness: There is a challenge in achieving widespread consumer acceptance and awareness of infotainment systems. Factors such as lack of awareness and the cost of these systems can impact their adoption and deployment.

~~ Integration with Existing Vehicle Systems: Integrating new infotainment technologies with existing vehicle systems can be complex. Ensuring compatibility and seamless operation across various platforms and manufacturers remains a significant challenge.

**Top Opportunities**

~~ Development of Personalized In-Car Experiences: There is an opportunity to create personalized in-car experiences by leveraging AI and machine learning. This can include personalized entertainment, climate control, and driving assistance, enhancing user satisfaction.

~~ Expansion of In-Car Commerce: Integrating e-commerce capabilities into infotainment systems presents opportunities for in-car purchases, such as ordering food, reserving parking, or paying for tolls, providing convenience to users.

~~ Advancements in Autonomous Vehicle Integration: As autonomous vehicles become more prevalent, infotainment systems can be enhanced to offer a broader range of entertainment and productivity options, transforming the in-car experience.

**Regional Analysis**

Asia Pacific In-Car Infotainment Market with Largest Market Share of 39% in 2023

The Asia Pacific region dominates the in-car infotainment market, holding a 39% share, valued at USD 5.655 billion in 2023. This growth is driven by high automotive production and the rising demand for connected car technologies in countries like China, Japan, and South Korea.

North America and Europe also play significant roles, with North America benefiting from strong automotive manufacturing and in-vehicle connectivity, while Europe’s luxury vehicle segment drives demand for advanced infotainment solutions.

Middle East & Africa and Latin America present growth opportunities, though with smaller market shares compared to the leading regions. In summary, Asia Pacific remains the dominant region in the in-car infotainment market, driving overall global growth.

!! Request Your Sample PDF to Explore the Report Format !!

**Key Players Analysis**

In 2024, the Global In-Car Infotainment Market continues to be shaped by key players that dominate the landscape through technological innovation, strategic partnerships, and strong consumer bases. Volkswagen AG and Audi AG, both part of the VW Group, are driving the shift toward integrated and seamless in-car infotainment systems, leveraging advanced connectivity features and a focus on electric vehicle (EV) integration. Harman International is a leader in premium audio systems and has been capitalizing on its expertise in connected car solutions, positioning itself as a key player in the infotainment ecosystem.

Ford Motor Company and BMW AG are focusing on enhancing user experience with intuitive interfaces, AI-driven personalization, and collaborations with tech giants. Continental AG, Panasonic Corporation, and Pioneer Corporation provide comprehensive solutions across both hardware and software platforms, with Samsung Electronics leading innovation in display and sensor technologies. ALPS ALPINE CO. and Vistron Corporation contribute with their expertise in automotive electronics, ensuring system reliability and performance. These companies, along with other emerging players, will continue to influence the rapid evolution of the market.

Top Key Players in the Market

~~ Volkswagen AG

~~ Harman International

~~ Ford Motor Company

~~ ALPS ALPINE CO., LTD

~~ AUDI AG

~~ BMW AG

~~ Continental AG

~~ PANASONIC CORPORATION

~~ PIONEER CORPORATION

~~ SAMSUNG ELECTRONICS CO

~~ VISTRON CORPORATION

~~ Other companies

**Recent Developments**

~~ 2023: Volkswagen acquired a 4.99% stake in XPENG to develop two mid-size EVs for China, aiming to launch by 2026, accelerating production timelines by 30%.

~~ 2024: Stellantis announced a €5.6 billion investment in South America to enhance vehicle development, focusing on infotainment systems in new models.

~~ 2023: LG Electronics partnered with Renault to strengthen its in-car infotainment position, featuring Google Android Automotive for the Mégane E-TECH Electric, with over-the-air updates and remote status checks.

**Conclusion**

The Global In-Car Infotainment Market is poised for significant growth, projected to reach USD 30.0 billion by 2032, driven by technological advancements in connectivity, the rise of electric and autonomous vehicles, and the increasing demand for personalized and seamless in-car experiences. With key players like Volkswagen, Harman, and BMW leading the way, the market is set to evolve through innovations in AI, advanced safety features, and integrated connectivity solutions. Despite challenges such as safety concerns and integration complexities, emerging opportunities in personalized experiences, in-car commerce, and autonomous vehicle integration offer promising avenues for future growth. The Asia Pacific region remains the market leader, while North America and Europe continue to contribute significantly to the overall expansion.

Lawrence John

Prudour

+91 91308 55334

email us here

Visit us on social media:

Facebook

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.