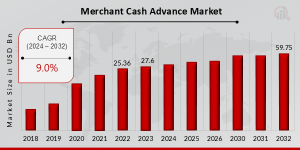

Merchant Cash Advance Market Size Is Likely To Reach a Valuation of Around 59.75 Billion by 2032

Merchant Cash Advance Market Research Report By, Loan Amount, Industries Served, Advance Term, Repayment Frequency, Repayment Mechanism, Regional

NC, UNITED STATES, January 23, 2025 /EINPresswire.com/ -- The global Merchant Cash Advance (MCA) market is poised for robust growth, driven by the increasing demand for flexible financing solutions for small and medium-sized enterprises (SMEs). In 2022, the market size was valued at USD 25.36 billion, and it is projected to grow from USD 27.6 billion in 2023 to an estimated USD 59.75 billion by 2032. This represents a compound annual growth rate (CAGR) of 9.0% during the forecast period (2024–2032). Key factors fueling this growth include the rising adoption of alternative financing methods, technological advancements in financial services, and the increasing number of SMEs globally.Key Drivers of Market Growth

Growing Demand for Alternative Financing

Traditional bank loans often come with stringent eligibility requirements, making them less accessible to small businesses. Merchant cash advances offer a more flexible and accessible alternative, enabling SMEs to secure funds quickly without extensive credit checks or collateral.

Expansion of Small and Medium-Sized Enterprises

The growing number of SMEs globally is a major driver for the MCA market. These businesses often require quick access to working capital to manage operations, inventory, and expansion plans, fueling the demand for merchant cash advances.

Technological Advancements in Financial Services

The integration of fintech solutions, such as AI-driven credit scoring and automated payment systems, is streamlining the MCA process. These advancements are improving application efficiency, reducing risk, and expanding the reach of MCA services.

Rising E-Commerce and Digital Transactions

The shift towards e-commerce and digital payments has increased the adoption of merchant cash advances. Businesses engaged in online sales benefit from MCA services to meet cash flow needs and manage operational expenses efficiently.

Download Sample Pages - https://www.marketresearchfuture.com/sample_request/24003

Key Players in the Merchant Cash Advance Market

• Square

• Shopify Capital

• National Funding

• CAN Capital

• Merchant Advance Capital

• PayPal Working Capital

• Funding Gates

• Funding Circle

• Kabbage

• Capital One Merchant Services

• Lendio

• Biz2Credit

• OnDeck

• Square Capital

• Stripe Capital

Browse In-depth Market Research Report: https://www.marketresearchfuture.com/reports/merchant-cash-advance-market-24003

Market Segmentation

The merchant cash advance market is segmented based on type, provider, end-user, and region to provide a comprehensive analysis.

1. By Type

Split Funding: A portion of daily card sales is automatically directed to repay the advance.

ACH (Automated Clearing House) Withdrawals: Fixed amounts are debited from the borrower’s bank account.

2. By Provider

Direct MCA Providers: Companies that directly offer advances to merchants.

Brokers: Intermediaries connecting merchants with MCA providers.

3. By End-User

Retail Businesses: Significant adopters due to fluctuating cash flow and high operational costs.

Restaurants and Hospitality: Utilize MCA for inventory purchases, payroll, and equipment upgrades.

Healthcare Practices: Increasingly adopting MCA to manage operational expenses and expand services.

E-Commerce Businesses: Rising segment due to the growing reliance on digital payments and rapid scaling needs.

4. By Region

North America: Dominates the market, driven by a well-established SME sector and widespread adoption of fintech solutions.

Europe: Growth supported by increasing awareness of alternative financing options and SME expansion.

Asia-Pacific: Fastest-growing region due to rapid digitization, a booming SME sector, and rising e-commerce adoption.

Rest of the World (RoW): Moderate growth expected, fueled by the expansion of SMEs in emerging markets.

Procure Complete Research Report Now: https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=24003

The Merchant Cash Advance market is set for substantial growth as businesses increasingly seek alternative and flexible financing solutions. With technological innovations and the global expansion of SMEs, the MCA market will continue to thrive, offering tailored financial solutions to meet the diverse needs of small and medium-sized enterprises.

Related Report -

Banking ERP Software Market

https://www.marketresearchfuture.com/reports/banking-erp-software-market-24836

Anti Money Laundering Solutions Market

https://www.marketresearchfuture.com/reports/anti-money-laundering-solutions-market-24771

Crypto Wallet Market

https://www.marketresearchfuture.com/reports/crypto-wallet-market-24727

BFSI BPO Service Market

https://www.marketresearchfuture.com/reports/bfsi-bpo-service-market-29090

Business Income Insurance Market

https://www.marketresearchfuture.com/reports/business-income-insurance-market-28778

About Market Research Future –

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research Consulting Services. The MRFR team have a supreme objective to provide the optimum quality market research and intelligence services for our clients. Our market research studies by Components, Application, Logistics and market players for global, regional, and country level market segments enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Market Research Future

Market Research Future

+1 855-661-4441

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.