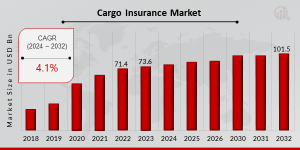

Cargo Insurance Market to Exhibit Moderate Growth at a CAGR of 4.1% from 2024 to 2032

Cargo Insurance Market Research Report By, Type, Coverage, Industry, Commodity, Scale, Regional

WY, UNITED STATES, January 23, 2025 /EINPresswire.com/ -- The global Cargo Insurance market is witnessing steady growth, with significant expansion projected over the next decade. In 2022, the market size was valued at USD 71.4 billion, and it is expected to grow from USD 73.6 billion in 2023 to an estimated USD 101.5 billion by 2032. This growth represents a compound annual growth rate (CAGR) of 4.1% during the forecast period (2024–2032). Factors such as the increasing volume of global trade, the rise in e-commerce logistics, and the need for risk mitigation in cargo transportation are driving market growth.Key Drivers of Market Growth

Rising Global Trade Volumes

The growing interconnectedness of global markets has led to an increase in the volume of goods transported across borders. Cargo insurance ensures financial protection for goods in transit, boosting its adoption among businesses involved in international trade.

Expansion of E-Commerce Logistics

The rapid growth of e-commerce has increased the demand for efficient logistics and transportation services. Cargo insurance plays a vital role in protecting goods from damage, theft, or loss during transit, making it an essential component of the e-commerce supply chain.

Increased Risk Mitigation in Transportation

Cargo transportation faces risks such as natural disasters, accidents, and piracy. Insurance coverage provides businesses with financial security against such uncertainties, driving the demand for comprehensive cargo insurance policies.

Technological Advancements in Insurance Services

The integration of technology, such as blockchain and IoT, is enhancing transparency and efficiency in the cargo insurance process. These innovations streamline claims management and risk assessment, making cargo insurance more accessible and reliable.

Download Sample Pages - https://www.marketresearchfuture.com/sample_request/23895

Key Players in the Cargo Insurance Market

• Allianz

• Zurich Insurance Group

• Generali

• Liberty Mutual

• Munich Re

• Travelers

• AIG

• Swiss Re

• Tokio Marine

• Lloyd's of London

• Chubb

• AXA

• Hannover Re

Browse In-depth Market Research Report: https://www.marketresearchfuture.com/reports/cargo-insurance-market-23895

Market Segmentation

The cargo insurance market is segmented based on coverage type, mode of transportation, end-user, and region to provide a comprehensive understanding.

1. By Coverage Type

Comprehensive Coverage: Includes protection against all risks, including damage, theft, and loss.

Named Perils Coverage: Covers specific risks such as fire, collision, or overturning.

2. By Mode of Transportation

Marine Cargo Insurance: Dominates the market due to the large volume of goods transported via sea routes.

Air Cargo Insurance: Growing demand driven by the rise in express shipping and high-value goods transportation.

Land Cargo Insurance: Includes coverage for goods transported via road and rail.

Multimodal Transportation Insurance: Increasing adoption with the growth of integrated logistics solutions.

3. By End-User

Manufacturers: Significant users of cargo insurance for safeguarding raw materials and finished goods during transit.

Logistics Service Providers: Critical users for ensuring safe and secure transportation of goods.

E-commerce Companies: Increasingly adopting cargo insurance to enhance customer satisfaction and reduce operational risks.

4. By Region

North America: Leading market due to high trade volumes and advanced logistics infrastructure.

Europe: Growth driven by the expansion of cross-border trade within the EU and beyond.

Asia-Pacific: Fastest-growing region, fueled by rapid industrialization, increasing exports, and the rise of e-commerce.

Rest of the World (RoW): Moderate growth anticipated in emerging markets in the Middle East, Latin America, and Africa.

Procure Complete Research Report Now: https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=23895

The cargo insurance market is set to expand steadily as global trade and e-commerce activities continue to grow. With advancements in technology and increasing awareness of risk mitigation, cargo insurance is poised to remain a critical component of global supply chain operations.

Related Report -

Life And Non-Life Insurance Market

https://www.marketresearchfuture.com/reports/life-and-non-life-insurance-market-24573

Parametric Insurance Market

https://www.marketresearchfuture.com/reports/parametric-insurance-market-24564

Specialty Insurance Market

https://www.marketresearchfuture.com/reports/specialty-insurance-market-24601

Reverse Factoring Market

https://www.marketresearchfuture.com/reports/reverse-factoring-market-24693

Trade Finance Market

https://www.marketresearchfuture.com/reports/trade-finance-market-24698

About Market Research Future –

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research Consulting Services. The MRFR team have a supreme objective to provide the optimum quality market research and intelligence services for our clients. Our market research studies by Components, Application, Logistics and market players for global, regional, and country level market segments enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Market Research Future

Market Research Future

+1 855-661-4441

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.