Cryptocurrency Market Booms with Rising Institutional Adoption, Blockchain Innovation, and Decentralized Finance Growth

Cryptocurrency Market accelerates as institutional investors embrace digital assets, driving credibility and expanding mainstream adoption.

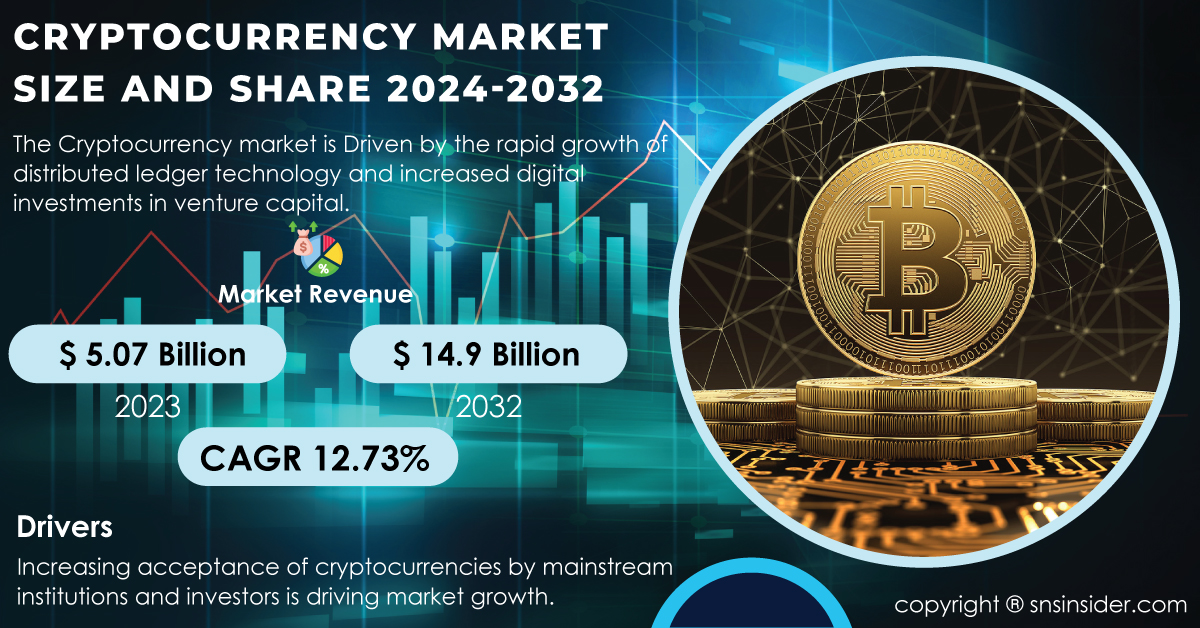

AUSTIN, TX, UNITED STATES, November 6, 2024 /EINPresswire.com/ -- Market Scope and OverviewThe Cryptocurrency Market, valued at USD 5.07 billion in 2023, is expected to soar to USD 14.9 billion by 2032, registering a compound annual growth rate (CAGR) of 12.73% from 2024 to 2032.

Digital currencies like Bitcoin, Ethereum, and newer entrants are gaining traction as both investment assets and mediums for cross-border transactions, particularly as global economic uncertainties drive individuals and institutions toward digital finance solutions. As businesses and consumers seek more efficient and secure financial transactions, the demand for cryptocurrency-related services, such as digital wallets, trading platforms, and blockchain-based financial services, is rapidly growing. This market expansion reflects not only rising interest from private users but also increased involvement from financial institutions and governments exploring regulatory frameworks and pilot programs for digital currencies.

Get a Report Sample of Cryptocurrency Market @ https://www.snsinsider.com/sample-request/1245

Some of the Major Key Players Studied are:

✦ Bitmain

✦ NVIDIA

✦ Xilinx

✦ Intel

✦ Advanced Micro Devices

✦ Ripple Labs

✦ Ethereum Foundation

✦ Bitfury Group

✦ Coinbase

✦ BitGo

✦ Binance Holdings

✦ Canaan Creative

✦ Bitstamp

✦ Others

Expanding Blockchain Use Cases and Financial Inclusion

The primary drivers of the cryptocurrency market include the rapid evolution of blockchain technology and the growing acceptance of cryptocurrencies as mainstream financial assets. As blockchain applications diversify, they have led to the development of decentralized finance (DeFi), smart contracts, and tokenized assets, enabling new financial solutions and increasing interest in cryptocurrencies. Moreover, the need for financial inclusion in regions with limited access to traditional banking has fueled cryptocurrency adoption, as digital assets provide a secure, accessible alternative for those underserved by conventional financial systems.

Institutional investors are increasingly participating in the cryptocurrency market, viewing it as a hedge against inflation and economic uncertainty. Additionally, growing regulatory clarity in several countries is helping to mitigate market risks and build consumer confidence, encouraging more retail investors to explore cryptocurrencies. The emergence of central bank digital currencies (CBDCs) is also influencing the market by increasing the legitimacy of digital currencies and driving additional cryptocurrency adoption.

Segment Analysis

✦ By Component: The hardware sector dominated the cryptocurrency market by component, holding over 76% of the revenue share in 2023. This is primarily due to high demand for cryptocurrency mining equipment, such as ASIC (Application-Specific Integrated Circuit) miners and GPUs (Graphics Processing Units), essential for verifying and processing transactions on blockchain networks. As the mining process requires immense computational power, hardware advancements and innovations are crucial to sustaining cryptocurrency networks.

✦ With the growing value of cryptocurrencies, mining has become a lucrative activity, driving demand for high-performance hardware. This segment is expected to grow further as new cryptocurrencies enter the market, requiring additional mining capabilities. The demand for secure hardware wallets, which protect users' digital assets from online theft, is also rising as more individuals and institutions store digital assets long-term.

✦ By End User: The trading segment led the market, accounting for over 27.0% of revenue share in 2023. Cryptocurrency trading, facilitated by numerous exchanges and trading platforms, has become mainstream due to high liquidity and the potential for short-term gains in this asset class. The trading segment's growth is further fueled by advancements in automated trading algorithms and high-frequency trading platforms, allowing for real-time, seamless trades in a 24/7 market. The proliferation of trading platforms catering to retail investors and institutional participants has significantly contributed to market growth. Additionally, decentralized exchanges (DEXs), which enable peer-to-peer trading of digital assets without intermediaries, are becoming popular due to enhanced privacy, reduced costs, and faster transaction times. The ease of access to cryptocurrency trading platforms via mobile applications has also contributed to market growth, enabling participation from individuals

worldwide.

Market Segmentation and Sub-Segmentation Included are:

By Component

✦ Hardware

✧ FPGA

✧ ASIC

✧ GPU

✧ Others

✦ Software

✧ Mining Software

✧ Exchanges Software

✧ Wallet

✧ Payment

✧ Others

By Process:

✦ Mining

✦ Transaction

By Type:

✦ Bitcoin

✦ Ethereum

✦ Bitcoin Cash

✦ Ripple

✦ Litecoin

✦ Dash

✦ Others

By End User:

✦ Trading

✦ Retail and E-commerce

✦ Banking

✦ Gaming

✦ Government

✦ Healthcare

✦ Others

Regional Analysis

North America dominated the cryptocurrency market in 2023, accounting for a substantial revenue share. This dominance is attributed to the high penetration of digital payment systems, supportive regulatory developments, and the presence of major cryptocurrency companies. The U.S. leads in cryptocurrency trading and adoption due to its robust technological infrastructure and a large population of tech-savvy investors. Additionally, several regulatory bodies in North America are actively developing frameworks to govern digital currencies, providing a stable environment for the market. The region's strong focus on innovation and advanced technology adoption further propels cryptocurrency growth. Major financial institutions, including banks and investment firms, are increasingly involved in the cryptocurrency space, either by investing in digital assets or by offering crypto-related services to clients.

On the other hand, the Asia-Pacific region is projected to be the fastest-growing cryptocurrency market over the forecast period. Countries like China, Japan, South Korea, and India are embracing digital assets for various applications, from trading to cross-border transactions. In China, despite regulatory restrictions, blockchain technology remains a priority, and the government’s plans for the digital yuan are expected to influence the regional market. Japan and South Korea have implemented regulations to ensure secure trading environments, while India has shown interest in regulating digital assets to enable more widespread adoption.

Recent Developments in the Cryptocurrency Market

✦ Launch of Blockchain-Based Payments by Visa (October 2024): Visa announced a pilot program enabling cryptocurrency payments through its extensive payment network. By integrating blockchain technology into its system, Visa aims to provide consumers with a secure and efficient way to conduct cross-border transactions using digital assets.

✦ Partnership Between PayPal and Paxos (August 2024): PayPal expanded its cryptocurrency services by partnering with Paxos, a regulated blockchain infrastructure platform. This partnership allows PayPal users to hold and transact in digital currencies directly from their accounts, further bridging the gap between traditional finance and cryptocurrencies.

Enquire for More Details @ https://www.snsinsider.com/enquiry/1245

Table of Contents- Major Key Points

1. Introduction

2. Research Methodology

3. Market Dynamics

3.1. Drivers

3.2. Restraints

3.3. Opportunities

3.4. Challenges

4. Impact Analysis

4.1. Impact of Ukraine- Russia war

4.2. Impact of Ongoing Recession on Major Economies

5. Value Chain Analysis

6. Porter’s 5 Forces Model

7. PEST Analysis

8. Cryptocurrency Market Segmentation, By Component

8.1. Hardware

8.2. Software

9. Cryptocurrency Market Segmentation, By Process

9.1. Mining

9.2. Transaction

10. Cryptocurrency Market Segmentation, By Type

10.1. Bitcoin

10.2. Ethereum

10.3. Bitcoin Cash

10.4. Ripple

10.5. Litecoin

10.6. Dash

10.7. Others

11. Cryptocurrency Market Segmentation, By End User

11.1. Trading

11.2. Retail and E-commerce

11.3. Banking

11.4. Others

12. Regional Analysis

12.1. Introduction

12.2. North America

12.3. Europe

12.4. Asia-Pacific

12.5. The Middle East & Africa

12.6. Latin America

13. Company Profile

14. Competitive Landscape

14.1. Competitive Benchmarking

14.2. Market Share Analysis

14.3. Recent Developments

15. USE Cases and Best Practices

16. Conclusion

About Us

S&S Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Our staff is dedicated to giving our clients reliable information, and with expertise working in the majority of industrial sectors, we're proud to be recognized as one of the world's top market research firms. We can quickly design and implement pertinent research programs, including surveys and focus groups, and we have the resources and competence to deal with clients in practically any company sector.

Akash Anand

SNS Insider | Strategy and Stats

+1 415-230-0044

email us here

Visit us on social media:

Facebook

X

LinkedIn

Instagram

YouTube

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.