Global Loan Servicing Software Market Size, Share And Growth Analysis For 2024-2033

The Business Research Company’s Loan Servicing Software Global Market Report 2024 – Market Size, Trends, And Market Forecast 2024-2033

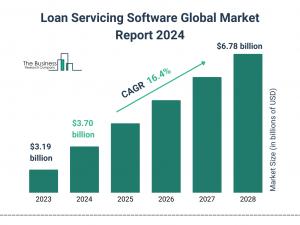

LONDON, GREATER LONDON, UNITED KINGDOM, October 10, 2024 /EINPresswire.com/ -- The loan servicing software market has grown rapidly, rising from $3.19 billion in 2023 to $3.70 billion in 2024 at a CAGR of 16.0%. Growth factors include heightened regulatory compliance requirements, the need for improved efficiency and accuracy, the rise of digital banking and fintech innovations, and expansion in the mortgage and lending industries.

What Is The Estimated Market Size Of The Global Loan Servicing Software Market And Its Annual Growth Rate?

The loan servicing software market is expected to grow rapidly, reaching $6.78 billion by 2028 at a CAGR of 16.4%. Growth will be driven by demand for automation, cloud adoption, regulatory compliance, and enhanced data security. Key trends include cloud-based solutions, AI integration, digitization, and mobile accessibility innovations.

Explore Comprehensive Insights Into The Global Loan Servicing Software Market With A Detailed Sample Report:

https://www.thebusinessresearchcompany.com/sample.aspx?id=18662&type=smp

Growth Driver of The Loan Servicing Software Market

The rise in non-performing loans is projected to enhance the growth of the loan servicing software market. Non-performing loans are those on which borrowers are failing to make interest payments or repay any principal, usually due to financial hardships. The increase in such loans is primarily attributed to economic downturns, rising unemployment, declining property values, and borrower distress. Loan servicing software plays a crucial role in managing these loans by automating monitoring, improving borrower communication, organizing collection efforts, analyzing risk data, ensuring regulatory compliance, and providing detailed reporting to enhance recovery efforts and minimize financial impact.

Explore The Report Store To Make A Direct Purchase Of The Report:

https://www.thebusinessresearchcompany.com/report/loan-servicing-software-global-market-report

Which Market Players Are Driving The Loan Servicing Software Market Growth?

Major companies operating in the loan servicing software market are Wipro Limited, Fidelity National Information Services, Constellation Software Inc., Sopra Banking Software SA, CoreLogic Inc., Temenos AG, ICE Mortgage Technology Inc., Q2 Holdings Inc., nCino Inc., Abrigo, Altisource Portfolio Solutions S.A., nCino Inc., Abrigo, Altisource Portfolio Solutions S.A., Nucleus Software Exports Ltd., Financial Industry Computer Systems Inc., Turnkey Lender Pte. Ltd., Calyx Software, The Mortgage Company, Shaw Systems Associates LLC, Cyrus Technoedge Solutions Pvt. Ltd., LendFoundry, Nortridge Software LLC, AutoPal Software, C Loans Inc

What Are The Emerging Trends Shaping The Loan Servicing Software Market Size?

In the loan servicing software market, major companies are advancing loan management platforms that streamline and automate the entire loan lifecycle, from origination to repayment. These comprehensive platforms are crucial for financial institutions and other lending organizations, enabling them to efficiently manage their loan portfolios and deliver exceptional customer service.

How Is The Global Loan Servicing Software Market Segmented?

1) By Component: Software, Services

2) By Deployment Mode: Cloud-Based, On-Premises

3) By Enterprise Size: Large Enterprises, Small And Medium-Sized Enterprises

4) By End User: Banks, Credit Unions, Mortgage Lenders And Brokers, Other End-Users

Geographical Insights: North America Leading The Loan Servicing Software Market

North America was the largest region in the loan servicing software market in 2023. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the loan servicing software market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Loan Servicing Software Market Definition

Loan servicing software is specifically designed to manage the administrative aspects of loan portfolios post-disbursement. By streamlining daily operations, this software enhances efficiency, accuracy, and compliance for lenders managing active loan portfolios.

Loan Servicing Software Global Market Report 2024 from The Business Research Company covers the following information:

• Market size data for the forecast period: Historical and Future

• Macroeconomic factors affecting the market in the short and long run

• Analysis of the macro and micro economic factors that have affected the market in the past five years

• Market analysis by region: Asia-Pacific, China, Western Europe, Eastern Europe, North America, USA, South America, Middle East and Africa.

• Market analysis by countries: Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA.

An overview of the global loan servicing software market report covering trends, opportunities, strategies, and more

The Loan Servicing Software Global Market Report 2024 by The Business Research Company is the most comprehensive report that provides insights on market size, drivers and trends, market major players, competitors' revenues, market positioning, and market growth across geographies. The market report helps you gain in-depth insights into opportunities and strategies. Companies can leverage the data in the report and tap into segments with the highest growth potential.

Browse Through More Similar Reports By The Business Research Company:

Personal Loans Market 2024

https://www.thebusinessresearchcompany.com/report/personal-loans-global-market-report

Loan Origination Software Global Market Report 2024

https://www.thebusinessresearchcompany.com/report/loan-origination-software-global-market-report

Application Development Software Global Market Report 2024

https://www.thebusinessresearchcompany.com/report/application-development-software-global-market-report

What Does the Business Research Company Do?

The Business Research Company publishes over 15,000 reports across 27 industries and 60+ geographies. Our research is powered by 1,500,000 datasets, extensive secondary research, and exclusive insights from interviews with industry leaders. We provide continuous and custom research services, offering a range of specialized packages tailored to your needs, including a Market Entry Research Package, Competitor Tracking Package, Supplier & Distributor Package, and much more.

Our flagship product, the Global Market Model is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

Oliver Guirdham

The Business Research Company

+44 20 7193 0708

info@tbrc.info

Visit us on social media:

Facebook

X

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.