Why are euro area households still gloomy and what are the implications for private consumption?

Prepared by Alina Bobasu, Dario Esposito and Johannes Gareis

Published as part of the ECB Economic Bulletin, Issue 6/2024.

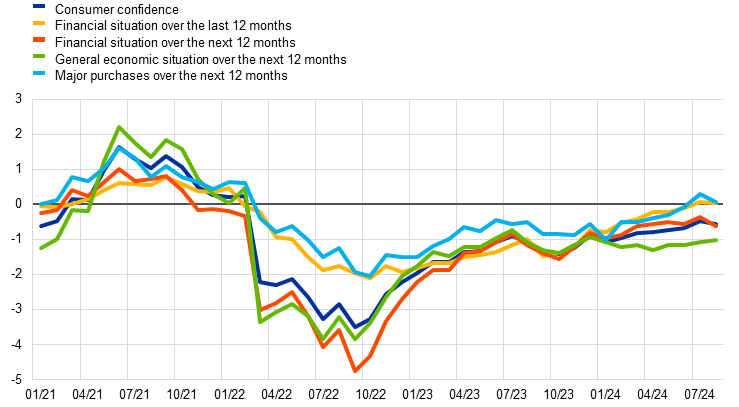

Consumer confidence in the euro area plummeted when Russia launched its full-scale invasion of Ukraine and has remained at a low level since then, despite some recovery. Consumer confidence has gradually improved from its post-invasion low of September 2022. However, it has not yet returned to its pre-pandemic average and was well below its pre-invasion levels as of August 2024 (Chart A). This box analyses the underlying factors that explain this subdued consumer confidence and assesses the implications of persistently low confidence for private consumption in the short run.

Households’ expectations for the general economic situation in particular are weighing on consumer confidence. The European Commission’s consumer confidence index is a composite indicator calculated as the arithmetic mean of the balance series (i.e. the percentage of positive responses minus the percentage of negative responses) for four survey questions. These questions relate to households’ expectations for the next 12 months in respect of their financial situation, the general economic situation and major purchases, as well as their perceptions of their financial situation over the last 12 months.[1] Households’ expectations for the general economic situation have been largely unchanged since mid-2023, hampering any further recovery in consumer confidence following the improvement seen after the post-invasion slump (Chart A). By contrast, all other components of consumer confidence have continued to improve, with households’ assessments of their past financial situation and intention to make major purchases standing marginally above their pre-pandemic averages in mid-2024.

Chart A

Consumer confidence and its components

(standardised percentage balances)

Sources: European Commission and ECB staff calculations.

Notes: The data are standardised for the period from January 1999 to December 2019 and the zero line marks the pre-pandemic average. The latest observations are for August 2024.

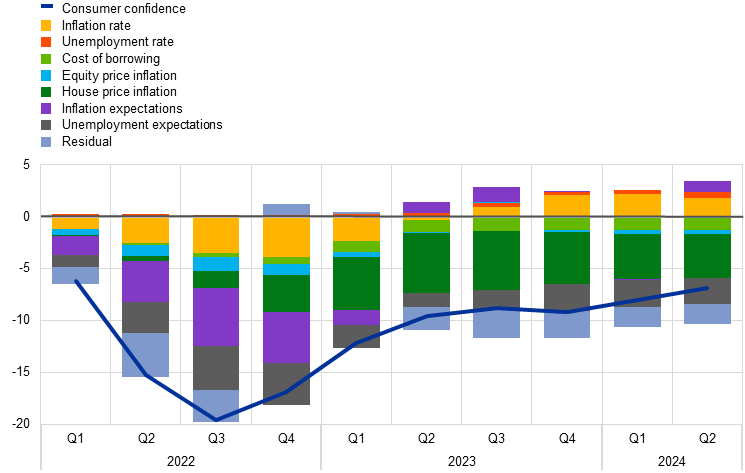

A linear regression model captures the historical relation between consumer confidence and various determinants of private consumption.[2] The model regresses consumer confidence on a constant, two lags of consumer confidence and the contemporaneous values of the inflation rate, the unemployment rate, a measure of borrowing costs, the annual percentage change in stock prices, the annual percentage change in house prices and households’ inflation and unemployment expectations for the next 12 months.[3] The lags allow for the gradual response of consumer confidence to changes in the other variables. Households’ expectations for future inflation and unemployment are included as they often reflect consumer confidence better than actual outcomes, given that they shape perceptions of households’ well-being.[4] They also, by definition, reflect the forward-looking nature of most components of consumer confidence.[5]

According to the model, rising actual and expected inflation was the initial cause of the decline in consumer confidence compared with the pre-invasion period, followed later by the increasingly negative effects of higher borrowing costs coupled with declining house prices. The model’s results show that the decline in consumer confidence in the euro area following Russia’s invasion of Ukraine compared with the fourth quarter of 2021 was largely explained by rising inflation – both actual and expected (Chart B). The subsequent recovery in consumer confidence was, in turn, mainly supported by falling actual inflation and lower expected inflation. Households’ unemployment expectations also declined in 2023 compared with 2022 but, as of the second quarter of 2024, remained higher than in the fourth quarter of 2021.[6] In addition, monetary policy tightening contributed to higher borrowing costs and a decline in house prices, which began to adversely affect consumer confidence from mid-2022 onwards. Finally, as indicated by the negative contribution of the regression residuals, consumer confidence remained marginally weaker compared with the fourth quarter of 2021 owing to other factors that were not captured in the model, possibly reflecting elevated geopolitical and economic policy uncertainty.[7]

Chart B

Model-based drivers of consumer confidence

(percentage balances and percentage point contributions, deviations from Q4 2021)

Sources: European Commission, Eurostat, ECB and ECB staff calculations.

Notes: The chart shows the contributions of the regressors for a regression of quarterly consumer confidence on a constant, two lags of consumer confidence and the contemporaneous values of the inflation rate, the unemployment rate, a measure of borrowing costs, the annual percentage change in stock prices, the annual percentage change in quarterly house prices and households’ inflation and unemployment expectations for the next 12 months. The cost of borrowing is proxied by the interest rate on consumer loans. The model is estimated using data from the first quarter of 2004 to the second quarter of 2024 and includes a dummy variable for each quarter in 2020. The latest data points are for the second quarter of 2024, except for house price inflation, which is projected for the second quarter of 2024 using a univariate AR(2) model.

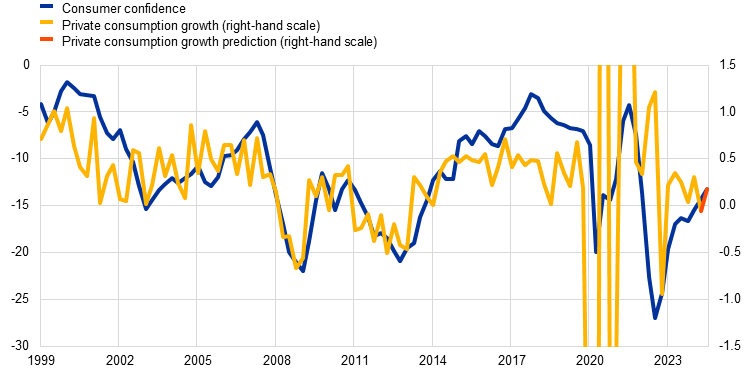

Consumer confidence tends to be strongly correlated with private consumption growth. As shown above, consumer confidence is shaped by variables that are also determinants of private consumption. It thus reflects fundamental information about the current and future state of the economy.[8] In the pre-pandemic period, for instance, consumer confidence was in general highly correlated with quarterly consumption growth, especially during economic downturns.[9]

The fact that consumer confidence remains subdued suggests that private consumption will only improve moderately in the short term. A bridge equation model linking quarterly consumer confidence to quarterly private consumption growth predicts a slight increase in consumer spending in the third quarter of 2024 (Chart C).[10] However, the outlook for private consumption is clouded by uncertainty about developments in the underlying drivers of consumer confidence. Going forward, consumer confidence in the euro area is likely to continue to improve, as inflation declines further, resilient labour markets provide ongoing support and real incomes recover; however, the effects of the recent round of monetary policy tightening are likely to persist for some time, and elevated geopolitical and economic policy uncertainty could temper its recovery.

Chart C

Consumer confidence and private consumption growth

(left-hand scale: percentage balances; right-hand scale: quarter-on-quarter percentage changes)

Sources: European Commission, Eurostat and ECB staff calculations.

Notes: The latest observations are for the second quarter of 2024 for private consumption growth and August 2024 for consumer confidence. The red line reflects the private consumption growth prediction for the third quarter of 2024 based on a bridge equation model that regresses quarterly private consumption growth on a constant, its own lag and contemporaneous quarterly consumer confidence, using data from the first quarter of 1999 to the second quarter of 2024 and including a dummy variable for each quarter in 2020. The prediction for the third quarter of 2024 assumes quarterly consumer confidence at the average level of July and August.

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.