Rogers Park Township Residential Values Soaring 24%, Commercial Values Climb 37%

CHICAGO, ILLINOIS, UNITED STATES, August 20, 2024 /EINPresswire.com/ -- Residential Assessment Surges

Property owners in Cook County are all too familiar with the rise of their home values. In 2024, residential property in Rogers Park Township has collectively jumped from just over $4.9 billion to $6 billion, an increase of 24%. The climb in assessments is the most pronounced for homes in the highest and lowest value ranges. Residential property owners of homes in the $500K to $750K saw an average increase of 27%. Homes over the $1.5 million price point saw an increase of 17%; however, it is one of the least gains in value assessment.

Commercial Values Gain Even More Pronounced

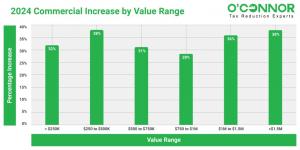

In contrast to homes, commercial property increases are the highest valued accounts in Rogers Park Township. Commercial property worth over $1.5 million in 2024 in Rogers Park Township of Cook County, Illinois was on average assessed at 38%. Property owners of commercial accounts valued between 250k to 500k noticed a significant increase of 38%. Owners of commercial properties valued between $500K and $750K had the smallest percent increase of 31%. On average, commercial values rose 37%.

What Can Property Owners Do?

The numbers illustrate the massive increase in assessments that have occurred across Cook County. Property owners should ensure that they have all the eligible and correct exemptions before appealing the assessment value. O’Connor is available to provide help in the appeals process, which can be challenging to comprehend. Our team of researchers, who maintain a proprietary database, collaborate closely with our licensed tax agents to provide the most compelling evidence to substantiate sales and unequal appraisal reduction arguments. O’Connor collaborates with attorneys who specialize in property tax to take every measure possible to achieve a reduction in property taxes for our clients.

About O’Connor:

O’Connor is among the largest property tax consulting firms in the United States, providing residential property tax reduction services in Texas, Illinois, and Georgia, as well as commercial property tax reduction services across the United States. O’Connor’s team of professionals possess the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs more than 900 professionals worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™. There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Property owners in Cook County are all too familiar with the rise of their home values. In 2024, residential property in Rogers Park Township has collectively jumped from just over $4.9 billion to $6 billion, an increase of 24%. The climb in assessments is the most pronounced for homes in the highest and lowest value ranges. Residential property owners of homes in the $500K to $750K saw an average increase of 27%. Homes over the $1.5 million price point saw an increase of 17%; however, it is one of the least gains in value assessment.

Commercial Values Gain Even More Pronounced

In contrast to homes, commercial property increases are the highest valued accounts in Rogers Park Township. Commercial property worth over $1.5 million in 2024 in Rogers Park Township of Cook County, Illinois was on average assessed at 38%. Property owners of commercial accounts valued between 250k to 500k noticed a significant increase of 38%. Owners of commercial properties valued between $500K and $750K had the smallest percent increase of 31%. On average, commercial values rose 37%.

What Can Property Owners Do?

The numbers illustrate the massive increase in assessments that have occurred across Cook County. Property owners should ensure that they have all the eligible and correct exemptions before appealing the assessment value. O’Connor is available to provide help in the appeals process, which can be challenging to comprehend. Our team of researchers, who maintain a proprietary database, collaborate closely with our licensed tax agents to provide the most compelling evidence to substantiate sales and unequal appraisal reduction arguments. O’Connor collaborates with attorneys who specialize in property tax to take every measure possible to achieve a reduction in property taxes for our clients.

About O’Connor:

O’Connor is among the largest property tax consulting firms in the United States, providing residential property tax reduction services in Texas, Illinois, and Georgia, as well as commercial property tax reduction services across the United States. O’Connor’s team of professionals possess the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs more than 900 professionals worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™. There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Patrick O'Connor, President

O'Connor

+ + +1 713-375-4128

email us here

Visit us on social media:

Facebook

X

LinkedIn

YouTube

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.