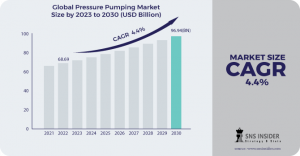

Pressure Pumping Market to Surge to USD 101.2 Billion by 2031 Driven by Expanding Wastewater Treatment Plants

Powering Performance: Key Trends Shaping the Pressure Pumping Market

TEXES, AUSTIN, UNITED STATES, June 13, 2024 /EINPresswire.com/ -- The pressure pumping market size, valued at USD 71.7 billion in 2023, will reach USD 101.2 billion by 2031, and a CAGR of 4.4% over the forecast period 2024-2031.Download Sample Copy of Report: https://www.snsinsider.com/sample-request/2374

Top Key Player:

Baker Hughes, Schlumberger Limited, Halliburton, C&J Energy Services, Inc., Calfrac Energy Services Ltd., Trican, Superior Energy Services, Inc.

Exponential Rise in Wastewater Treatment Plants Fueling Pressure Pumping Market Growth

The pressure pumping market is anticipated to witness significant growth in the coming years, driven by the burgeoning need for wastewater treatment plants globally. Wastewater treatment plays a crucial role in addressing water scarcity by enabling water reuse. Pressure pumps are extensively employed in these facilities to propel used water through the treatment process. As the construction of wastewater treatment plants accelerates worldwide, the demand for pressure-pumping solutions is expected to rise in tandem. This escalating demand aligns with the projected growth in water and wastewater infrastructure development.

Rising demand for oil and gas, in particular from unconventional sources such as shale gas and tight oil, has also significantly increased the pressure pumping market. Extracting these resources necessitates pressure pumping techniques, and their production is poised for a substantial increase in the foreseeable future. Additionally, numerous governments are actively encouraging the oil and gas sector through favorable regulations, tax breaks, and subsidies. This supportive environment for exploration and production activities is likely to translate into an amplified demand for pressure pumping services.

Segment Analysis: Hydraulic Fracturing dominates the market

The hydraulic fracturing segment dominated the pressure pumping market. North America has witnessed the highest adoption of hydraulic fracturing, and this trend is projected to continue until 2025. This, in turn, is expected to generate a significant upswing in demand for pressure pumping services in the years to come.

Cementing, on the other hand, is growing at a faster rate with a healthy CAGR. Consistent demand for drilling activities in the U.S. and stable oil prices are expected to maintain a strong demand for cementing services throughout the forecast period. However, a rising number of drilled but uncompleted wells in the U.S. could potentially hinder growth in this segment.

Impact of Russia-Ukraine War and Economic Slowdown

The Russia-Ukraine war has had a multifaceted impact on the pressure pumping market. On the one hand, the disruption of oil and gas supplies from Russia has intensified the global quest for alternative energy sources, potentially leading to increased pressure pumping activity for unconventional oil and gas extraction in other regions. On the other hand, the war has also triggered a global economic slowdown, which could dampen investments in the oil and gas sector and, consequently, pressure pumping services.

Economic slowdowns, as exemplified by the recent global economic downturn, can pose a challenge to the pressure pumping market. Reduced industrial activity and infrastructure development projects can lead to a decline in demand for pressure pumping services across various industries. For instance, a slowdown in the construction sector could lead to a decrease in demand for pressure pumps used in building projects.

North America leads in the regional analysis

The North American region, primarily driven by the widespread adoption of hydraulic fracturing and exploration activities for unconventional gas reserves, has emerged as the dominant player in the global pressure pumping market. The advantages offered by horizontal wells have also been a significant factor contributing to the increased adoption of these wells and, consequently, pressure pumping services.

Following North America, the Asia Pacific and Europe regions present significant opportunities for market growth due to rising energy demands. The Middle East & Africa and Latin America regions are also witnessing a shift towards horizontal wells and hydraulic fracturing, which is anticipated to propel the pressure pumping market growth in these areas.

Buy Complete Report: https://www.snsinsider.com/checkout/2374

Recent Developments

In May 2023, Kirloskar Brothers Limited (KBL), introduced the DB xe Pump which boasts exclusive design parameters and a comprehensive range of features, aiming to set new standards in the pump industry.

In December 2021, Grundfos, launched its next-generation CR pumps in India. These pumps boast world-class efficiency upgrades, offering improved flow performance and pressure for diverse applications, including water supply, treatment, and industrial solutions handling high-pressure, hot, dangerous, and aggressive liquids.

Key Takeaways

Understanding various significant factors that boost the market growth opportunities.

Learning about different technological advancements, that drive market expansion.

Analyzing the segmentation analysis and regional analysis like Hydraulic fracturing remains the dominant segment, with North America leading the regional landscape.

Impact of the Russia-Ukraine war and global economic slowdown on the pressure pumping market.

Akash Anand

SNS Insider | Strategy and Stats

+1 415-230-0044

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

Instagram

YouTube

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.