Oilfield Equipment Market to Reach USD 173.86 Billion by 2031 Driven by Resurgent Demand for Crude Oil

Unlocking Potential: Trends and Innovations in the Oilfield Equipment Market

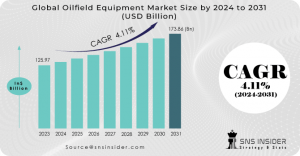

TEXES, AUSTIN, UNITED STATES, June 13, 2024 /EINPresswire.com/ -- The Oilfield Equipment Market Size at USD 125.97 Billion in 2023. The market is expected to reach USD 173.86 Billion by 2031, reflecting a CAGR of 4.11% over the forecast period 2024-2031.Download Sample Copy of Report: https://www.snsinsider.com/sample-request/2372

Top Key Players:

ABB, Baker Hughes, Delta Corporation, EthosEnergy Group Limited, Integrated Equipment, Jereh Oilfield Equipment, MSP/Drilex, Inc., Sunnda Corporation, Uztel S.A, Weir Group

Increasing Demand for Crude Oil Fuels Growth in the Oilfield Equipment Market

The global oilfield equipment market is having a period of significant growth, driven by a rise in demand for crude oil painting. This demand is fueled by rising global energy requirements and a recent increase in oil prices. The added demand for crude oil is leading to a rise in crude-yielding conditioning, which in turn necessitates the use of high-performance, effective, and dependable oilfield equipment. The discovery of vast, uncharted hydrocarbon reserves in both onshore and offshore basins is creating immense eventuality for the oilfield equipment market. Governments in these regions are heavily invested in product conditioning, further driving the demand for oilfield equipment. Companies are continuously investing in exploration and development to produce safer, more secure, and technologically advanced oilfield equipment. This focus on invention not only improves functional effectiveness but also reduces environmental impact. The discovery of new oil reserves, adding demand for cleanser-burning natural gas druthers, and advancements in automation and data analytics present instigative growth openings.

Impact of Geopolitical Issues

The Russia-Ukraine war has cast a long shadow on the global oilfield equipment market. The conflict has disrupted supply chains, leading to price fluctuations for essential raw materials. This, in turn, has impacted the cost and availability of oilfield equipment. However, the war has also triggered a surge in oil prices, potentially leading to increased investments in exploration and production activities in the long run.

A potential economic slowdown could also dampen market growth. Reduced industrial activity due to an economic downturn could translate into lower demand for oil and gas, ultimately impacting the need for oilfield equipment. For instance, a significant decline in manufacturing output could lead to a decrease in demand for crude oil, thereby affecting the oilfield equipment market.

Segmentation Analysis of the Oilfield Equipment Market

Drilling equipment dominates the market, accounting for over 73% of the total share. This dominance can be attributed to the crucial role drilling rigs play in exploration and production activities. Field production machinery, pumps & valves, and other equipment used for processing and transportation also hold significant market share.

Onshore and offshore oil & gas exploration and production activities are the primary drivers of demand for oilfield equipment. The rising focus on horizontal wells and unconventional reserves is expected to influence segment growth.

Regional Analysis: North America leading the market

North America currently holds the leading position in the global oilfield equipment market due to the extensive development of shale gas reserves and high demand from the U.S. and Canada. However, the Asia Pacific region is anticipated to witness the fastest growth rate over the forecast period. Increasing investments in crude oil & natural gas extraction in China. Growing energy demand in developing economies across the region.

Europe presents a stable market with significant use of drilling equipment in horizontal wells across several countries. Additionally, the adoption of mud-cap drilling technology in the UK, Russia, and Norway is expected to create lucrative opportunities for drilling fluid companies.

Buy Complete Report: https://www.snsinsider.com/checkout/2372

Recent Developments

In June 2024: Gazprom Neft implemented 3D printing technology at an Arctic oilfield, enabling on-site creation of spare parts, and streamlining equipment maintenance processes.

In April 2024: Deep Well Services (DWS) and CNX Resources Corp. announced a joint venture to establish AutoSepSM Technologies, offering automated flowback solutions, signifying advancements in oilfield service technologies.

In April 2023: Liberty launched Liberty Power Innovations (LPI), focusing on compressed natural gas (CNG) solutions and well-site fueling, reflecting the industry's shift towards cleaner-burning natural gas.

Key Takeaways

Gain a comprehensive understanding of market growth drivers, opportunities, and challenges.

Identify the most promising market segments and capitalize on emerging trends.

Make informed decisions regarding technology adoption and business strategies.

Forecast market performance and anticipate future developments to gain a competitive edge.

Akash Anand

SNS Insider | Strategy and Stats

+1 415-230-0044

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

Instagram

YouTube

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.