Respiratory Care Device Market to Surpass USD 39.79 Billion by 2031

Respiratory Care Device Market Poised for Expansion Owing to Rising Prevalence of Respiratory Disorders

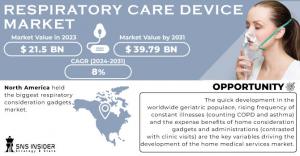

AUSTIN, TEXAS, UNITED STATES, June 6, 2024 /EINPresswire.com/ -- The Respiratory Care Device Market Size, valued at USD 21.5 Billion in 2023, is expected to reach USD 39.79 Billion by 2031, registering a compound annual growth rate (CAGR) of 8% from 2024 to 2031.The respiratory care device market is anticipated to witness significant growth in the coming years, driven by the increasing prevalence of respiratory disorders such as chronic obstructive pulmonary disease (COPD), tuberculosis (TB), asthma, and sleep apnea. Technological advancements and their growing applications in homecare settings are further propelling the market forward.

List of Respiratory Care Device Market Companies Profiled in Report:

- 3M

- AG & Co. KGaA

- BD

- Chart Industries Inc.

- DeVilbiss Healthcare LLC

- Dragerwerk AG

- Fisher & Paykel Healthcare Ltd

- GE Healthcare

- Getinge AB

- Hamilton Medical

- Masimo corporation

- Medtronic plc.

- Philips Healthcare

- ResMd Inc.

- SAES Pure Gas Inc.

- Teleflex Incorporated

Download Free Sample Report of Respiratory Care Device Market @ https://www.snsinsider.com/sample-request/1072

Rising Respiratory Illnesses and Technological Advancements Drive Respiratory Care Device Market Growth

The respiratory care device market is experiencing a surge, fueled by several key factors. One significant driver is the concerning rise in respiratory illnesses like Chronic Obstructive Pulmonary Disease (COPD), Tuberculosis (TB), asthma, and sleep apnea. According to a World Health Organization update from October 2022, a staggering 87% of new TB cases occur in the 30 countries most burdened by the disease. This alarming statistic translates to a growing demand for respirators, a positive trend for the market.

Another factor propelling market growth is the high prevalence of asthma. As per the CDC's December 2022 update, a significant portion of the population is affected, with 8.0% of adults and 6.5% of children under 18 diagnosed with asthma in 2021. This translates to a heightened need for inhalers, further driving market expansion.

The healthcare sector is also witnessing a revolution driven by advancements in Artificial Intelligence (AI). Market players are actively investing in and developing innovative respiratory devices. A prime example is Xplore Health Technologies' collaboration with Airofit, Denmark, in November 2022. Together, they launched Airofit Pro, the first-of-its-kind respiratory muscle training (RMT) device. This data-driven smart system personalizes breathing exercises for users, leading to stronger and more efficient respiratory muscles. Airofit Pro, priced at USD 422.74 (Rs 34,990), exemplifies the technological advancements that are poised to propel the respiratory care device market forward in the coming years.

Recent Developments

- July 2022: Smile Train, Inc. partnered with Lifebox to launch the Lifebox-Smile Train pulse oximeter, aiming to improve access to pulse oximetry for anesthesia and critical care.

- July 2022: Omron Healthcare introduced a portable oxygen concentrator, a medical molecular sieve-based device offering a continuous supply of high-purity oxygen, marking a significant advancement in the oxygen therapy category.

Point-of-Care Testing Fueling Growth

Point-of-care (POC) testing, conducted near or at the patient's bedside, is witnessing a surge in popularity.

The growing trend of self-testing by patients is another significant factor propelling the POC respiratory disease diagnostics market. Technological advancements like device miniaturization and microfabrication processes are expected to further support POC testing and the management of respiratory diseases in the coming years.

Government bodies across developed and developing nations recognize POC technology's potential to expand public healthcare networks and address unmet medical needs. Additionally, the decreasing number of skilled technicians in centralized systems is driving the preference for POC testing.

Rising Burden of Respiratory Disorders

The market's growth is primarily driven by the increasing number of patients suffering from respiratory disorders like COPD and asthma. Other contributing factors include the growing obese and overweight population and the rising number of preterm births. Globally, preterm births have seen an increase over the past two decades. Several factors contribute to preterm births, including maternal health issues like diabetes and high blood pressure, widespread use of infertility treatments, and pregnancies at an inappropriate age (above 40 years or below 20 years). Additionally, specific ethnic groups may be genetically predisposed to preterm births. For instance, the African-American and Hispanic populations in the US have a higher risk of preterm births. Smoking and obesity during pregnancy further elevate the probability of preterm births.

Key Market Segments

By Product:

• Therapeutic Devices

• Monitoring Devices

• Diagnostic Devices

• Consumables and Accessories

By Indication:

• Chronic Obstructive Pulmonary Disease (COPD)

• Asthma

• Sleep Apnea

• Infectious Disease

• Others

By End-User

• Hospitals

• Home Care Settings

• Ambulatory Care Centers

• Others

Have Any Query? Ask Our Experts @ https://www.snsinsider.com/enquiry/1072

Pulse Oximeters Segment Leads Respiratory Care Device Market

The pulse oximeters segment is poised for exceptional growth within the respiratory care device market. This non-invasive technology, which measures blood oxygen saturation, is a critical tool for managing COPD and various other lung conditions. The rising prevalence of respiratory illnesses combined with increased research and development efforts by market players are fueling this segment's expansion.

For example, a beacon of progress is the clinical trial launched in July 2022 by Raydiant Oximetry, Inc. This ongoing study, expected to conclude by December 2023, is evaluating the accuracy of the Raydiant Oximetry Sensing System (Lumerah). This innovative device utilizes safe, non-invasive transabdominal near-infrared spectroscopy to measure fetal arterial oxygen saturation. Positive results from such trials have the potential to pave the way for the development of groundbreaking new products, further propelling the growth of the pulse oximeters segment.

North America Dominates Market Share

North America currently dominates the respiratory care device market, driven by several key factors. Firstly, the region grapples with a significant burden of chronic respiratory illnesses. According to the CDC's 2022 update, a substantial 4.6% of adults over 18 in the United States alone battled COPD, emphysema, or chronic bronchitis in 2021. This large patient population translates to a robust demand for respiratory care devices in the region.

North America boasts a well-established advantage in research and development (R&D). This translates to a constant stream of technologically advanced respiratory devices. The focus on innovation fosters a dynamic market environment, characterized by frequent product launches and strategic partnerships. A prime example is the NIH's May 2022 update, which highlighted a significant investment of USD 150 million in 2022 dedicated to R&D for various respiratory diseases like COPD, asthma, and sleep apnea. This continuous commitment to innovation is expected to propel the development of even more groundbreaking respiratory devices in the region.

Key Takeaways from the Respiratory Care Device Market Study

• Gain insights into market size, growth projections, segmentation, and key drivers and restraints impacting market dynamics.

• Identify key players, their market share, product portfolios, and recent developments to understand the competitive environment.

• Stay informed about the latest technological advancements, regulatory changes, and evolving consumer preferences in the respiratory care device market.

• Discover lucrative market segments and regional opportunities to capitalize on for business expansion.

• Make data-driven decisions regarding product development, marketing strategies, and investment opportunities in the respiratory care device market.

Purchase Respiratory Care Device Market Report @ https://www.snsinsider.com/checkout/1072

Table of Content

Chapter 1 Introduction

Chapter 2 Research Methodology

Chapter 3 Respiratory Care Device Market Dynamics

Chapter 4 Impact Analysis (COVID-19, Ukraine- Russia war, Ongoing Recession on Major Economies)

Chapter 5 Value Chain Analysis

Chapter 6 Porter’s 5 forces model

Chapter 7 PEST Analysis

Chapter 8 Respiratory Care Device Market Segmentation, By Product

Chapter 9 Respiratory Care Device Market Segmentation, By Indication

Chapter 10 Respiratory Care Device Market Segmentation, By End-User

Chapter 11 Regional Analysis

Chapter 12 Company profile

Chapter 13 Competitive Landscape

Chapter 14 Use Case and Best Practices

Chapter 15 Conclusion

Continued…

Other Trending Report

Antipsychotic Drugs Market Outlook

Biosimilars Market Outlook

Akash Anand

SNS Insider Pvt. Ltd

+1 415-230-0044

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.