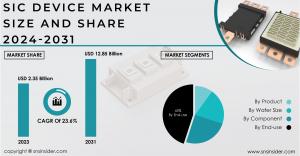

SiC Device Market Size to Cross USD 12.85 Billion at CAGR of 23.6% by 2031, Fueled by Electrification Push

SiC Device Market Size, Share, Growth Drivers and Regional Analysis, Global Forecast 2024 - 2031

AUSTIN, TEXAS, UNITED STATES, May 27, 2024 /EINPresswire.com/ -- SiC Device Market SizeAccording to a comprehensive report by SNS Insider, the SiC Device market, valued at USD 2.35 Billion in 2023, is projected to reach a staggering USD 12.85 Billion by 2031. This remarkable growth trajectory is expected to maintain a robust Compound Annual Growth Rate (CAGR) of 23.6% throughout the forecast period of 2024-2031.

The growing demand for sustainability and electrification has propelled the adoption of SiC semiconductor devices across multiple sectors.

SiC devices are revolutionizing various industries, finding applications in converters, inverters, power supplies, battery chargers, and motor control systems. In the automotive industry, SiC is playing a pivotal role in EV battery chargers, on-board chargers, DC-DC converters, and powertrains. The use of SiC in EVs translates to faster charging times, extended driving range, and enhanced overall efficiency. Beyond the automotive sector, SiC is gaining traction in renewable energy (photovoltaic inverters, wind turbines), medical imaging (MRI and X-ray power supplies), industrial automation (air conditioning, auxiliary power supplies), and integrated vehicle systems.

Market Analysis

-The SiC device market presents significant growth opportunities due to its expanding end-users in emerging industries like electric vehicles and power electronics. The growing adoption of SiC semiconductor devices in EV charging infrastructure, driven by global efforts to reduce carbon emissions and the surge in EV production, is a key catalyst for market expansion.

-For instance, In December 2023, STMicroelectronics N.V. partnered with Li Auto to supply SiC MOSFET devices for high-voltage battery electric vehicles (BEVs).

Download Free Sample Report with Full TOC & Graphs @ https://www.snsinsider.com/sample-request/2971

KEY PLAYERS:

- Coherent Corp.

- Fuji Electric Co. Ltd

- Infineon Technologies AG

- Microchip Technology Inc.

- Mitsubishi Electric Corporation

- ON Semiconductor Corp

- Renesas Electronics Corporation

- ROHM Co. Ltd

- Toshiba Electronic Devices & Storage Corporation

- WOLFSPEED INC

While the SiC device market is poised for substantial growth, it faces challenges in the manufacturing process, including defects such as scratches, micro pipes, crystalline stacking faults, stains, and surface particles. These issues can potentially impact the performance of SiC devices. However, market players are proactively addressing these challenges through substantial investments in research and development, aiming to enhance SiC semiconductor device manufacturing and mitigate design challenges.

-In December 2022, ROHM Co., Ltd. partnered with Shenzhen BASiC Semiconductor Ltd. to develop SiC power devices for automotive applications.

Recent Developments

• In January 2024, Infineon Technologies AG expanded its wafer supply agreement with Wolfspeed, Inc., worth USD 20 billion, for SiC 150 mm wafers.

• In July 2023, WOLFSPEED, INC. signed a USD 2 billion wafer supply agreement with Renesas Electronics Corporation for a 10-year supply of silicon carbide bare and epitaxial wafers.

KEY MARKET SEGMENTS:

By Component

• Schottky Diodes

• FET/MOSFET Transistors

• Integrated Circuits

• Rectifiers/Diodes

• Power Modules

• Others

By Component, the power modules segment dominated the market in 2023 and is expected to maintain its dominance from 2024 to 2031, thanks to the role of silicon carbide power modules in improving power consumption efficiency and reducing operational costs in energy, e-mobility, and industrial applications.

By Product

• Optoelectronic Devices

• Power Semiconductors

• Frequency Devices

By Product, the power semiconductors segment led the market in 2023 due to the wide band gap of SiC, making it highly suitable for power semiconductors and enabling smaller, more reliable equipment at higher voltages and switching frequencies.

By Wafer Size

• 1 inch to 4 inches

• 6 inches

• 8 inches

• 10 inches & above

By Wafer Size, the 1-inch to 4-inch segment dominated the market in 2023, driven by the availability of both N-type and P-type variants and their application in power devices like Insulated Gate Bipolar Transistors (IGBTs).

By End-use, the automotive segment led the market in 2023 due to the increasing adoption of SiC semiconductors in electric and IC automobiles, offering advantages such as durability and low energy losses.

By End-use

• Automotive

• Consumer Electronics

• Aerospace & Defense

• Medical Devices

• Data & Communication Devices

• Energy & Power

• Others

Make an Enquiry Before Buying @ https://www.snsinsider.com/enquiry/2971

Impact of Global Disruption

-The Russia-Ukraine war has indirectly impacted the SiC device market. The conflict has disrupted supply chains, particularly for raw materials like neon gas, crucial for semiconductor manufacturing. This disruption has led to price increases and shortages of SiC devices. Additionally, the war has caused economic uncertainty, leading to reduced investments in the automotive industry, a significant consumer of SiC devices.

-An economic slowdown can also adversely affect the SiC device market. During an economic downturn, businesses and consumers tend to reduce spending, leading to decreased demand for electronic devices and automobiles, both of which utilize SiC devices. This reduced demand can force manufacturers to cut production and lower prices, impacting their profitability.

Asia Pacific dominated the SiC semiconductor devices market in 2023, accounting for over 44.23% of revenue share.

-The presence of leading market players and increased investments in development and manufacturing are driving the market's growth in this region. The rising demand for higher efficiency, smaller size, and lower weight SiC semiconductors among various end-use manufacturers in the Asia Pacific region further fuels market growth.

-North America is poised for significant growth due to the presence of prominent players like Gene Sic Semiconductor and ON SEMICONDUCTOR CORPORATION (onsemi) and their extensive customer base.

Key Takeaways

• The SiC device market is experiencing rapid growth, driven by increasing adoption in power electronics and EV charging infrastructure.

• SiC semiconductors offer superior characteristics compared to traditional silicon counterparts, making them ideal for high-voltage and high-current applications.

• The market presents significant growth opportunities due to expanding end-users in emerging industries.

• Challenges in the manufacturing process are being addressed through investments in research and development.

Table of Content – Analysis of Key Points

Chapter 1. Executive Summary

Chapter 2. Global Market Definition and Scope

Chapter 3. Global Market Dynamics

Chapter 4. SiC Device Market Impact Analysis

Chapter 4.1 COVID-19 Impact Analysis

Chapter 4.2 Impact of Ukraine- Russia war

Chapter 4.3 Impact of ongoing Recession

Chapter 5. Value Chain Analysis

Chapter 6. Porter’s 5 forces model

Chapter 7. PEST Analysis

Chapter 8. SiC Device Global Market, by Product

Chapter 9. SiC Device Global Market, by Component

Chapter 10. SiC Device Global Market, by Wafer Size

Chapter 11. SiC Device Global Market, by End-Use

Chapter 12. Regional Outlook

Chapter 13. Competitive Intelligence

Chapter 14. Key Companies Analysis

Chapter 15. Research Process

Continued…

Buy Single User License @ https://www.snsinsider.com/checkout/2971

Contact us:

Akash Anand

Head of Business Development & Strategy

info@snsinsider.com

Phone: +1-415-230-0044 (US) | +91-7798602273 (IND)

Read Related Reports:

Speech And Voice Recognition Market

Digital Signal Processors Market

Milking Robots Market

Akash Anand

SNS Insider Pvt. Ltd

+1 415-230-0044

info@snsinsider.com

Visit us on social media:

Facebook

X

LinkedIn

Instagram

YouTube

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.