Exchange Traded Fund Market to Reach $108234.7 Billion by 2031 | Benefits, Strategies, and Market Trends

Exchange Traded Fund Market to Reach $108234.7 Billion by 2031 | Benefits, Strategies, and Market Trends

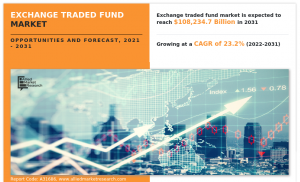

NEW CASTLE, WILMINGTON, UNITED STATES, April 4, 2024 /EINPresswire.com/ -- According to the report published by Allied Market Research, the global exchange traded funded market generated $13828.85 billion in 2021, and is projected to reach $108234.7 billion by 2031, growing at a CAGR of 23.2% from 2022 to 2031. The report offers a detailed analysis of the top winning strategies, evolving market trends, market size and estimations, value chain, key investment pockets, drivers & opportunities, competitive landscape, and regional landscape. The report is a useful source of information for new entrants, shareholders, frontrunners, and shareholders in introducing necessary strategies for the future and taking essential steps to significantly strengthen and heighten their position in the market.

➡️𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 & 𝐓𝐎𝐂 : https://www.alliedmarketresearch.com/request-sample/A31686

COVID-19 Scenario:

The outbreak of the COVID-19 pandemic had negatively impacted the growth of the global exchange traded funded market as it forced governments across the globe to implement stringent lockdowns.

During the COVID-19 pandemic, exchange traded fund firms set up new development strategies for handling challenges and surge the sale of exchange trade funds including tracking expenses against revenue status, checking business model feasibility, and identifying key impacts on business, thereby improving the mobility processes. These factors substantially reduced the impacts of the pandemic on the global market growth.

The report offers a detailed segmentation of the global exchange traded funded market based on type, distribution channel, investor type, and region. The report provides a comprehensive analysis of every segment and their respective sub-segment with the help of graphical and tabular representation. This analysis can essentially help market players, investors, and new entrants in determining and devising strategies based on the fastest-growing segments and highest revenue generation that is mentioned in the report.

Based on distribution channel, the retail segment held the major market share in 2021, holding two-thirds of the global exchange traded funded market share, and is expected to maintain its leadership status during the forecast period. However, the institutional segment, is expected to cite the fastest CAGR of 24.4% during the forecast period.

On the basis of investor type, the institutional investor segment held the largest market share in 2021, accounting for more than two-thirds of the global exchange traded funded market share, and is expected to maintain its leadership status during the forecast period. Moreover, the same segment, is expected to cite the highest CAGR of 23.9% during the forecast period. The report also includes segments such as retail segment.

In terms of type, the equity ETFs segment held the largest market share in 2021, accounting for nearly half of the global exchange traded funded market share. Furthermore, the same segment is expected to maintain its leadership status during the forecast period. Nevertheless, the specialty ETFs segment, is expected to cite the highest CAGR of 26.3% during the forecast period.

➡️𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐂𝐮𝐬𝐭𝐨𝐦𝐢𝐳𝐚𝐭𝐢𝐨𝐧 𝐖𝐞 𝐨𝐟𝐟𝐞𝐫 𝐜𝐮𝐬𝐭𝐨𝐦𝐢𝐳𝐞𝐝 𝐫𝐞𝐩𝐨𝐫𝐭 𝐚𝐬 𝐩𝐞𝐫 𝐲𝐨𝐮𝐫 𝐫𝐞𝐪𝐮𝐢𝐫𝐞𝐦𝐞𝐧𝐭 : https://www.alliedmarketresearch.com/request-for-customization/A31686

Region-wise, the North American region held the major market share in 2021, grabbing nearly half of the global exchange traded funded market share. Moreover, the the market in the same region is slated to dominate the global market share during the forecast period. However, the Asia-Pacific region is expected to cite the fastest CAGR of 25.2% during the forecast period. The report also analyses other regions such as Europe and LAMEA.

The key players analyzed in the global exchange traded funded market report includes BlackRock, Inc., Charles Schwab & Co., Inc., First Trust Portfolios L.P., Goldman Sachs, Invesco Mutual Fund, JPMorgan Chase & Co., Mitsubishi UFJ Financial Group, Inc., State Street Corporation, The Vanguard Group, Inc., and WisdomTree Investments, Inc.

The report analyzes these key players in the global exchange traded funded market. These market players have made effective use of strategies such as joint ventures, collaborations, expansion, new product launches, partnerships, and others to maximize their foothold and prowess in the industry. The report is helpful in analyzing recent developments, product portfolio, business performance, and operating segments by prominent players in the market.

Key benefits for stakeholders

The study provides an in-depth analysis of the global exchange traded fund market forecast along with current & future trends to explain the imminent investment pockets.

Information about key drivers, restraints, & opportunities and their impact analysis on exchange traded fund market trends is provided in the report.

Porter‐™s five forces analysis illustrates the potency of the buyers and suppliers operating in the industry.

The quantitative analysis of the market from 2022 to 2031 is provided to determine the exchange traded fund market outlook.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global exchange traded fund market share, key players, market segments, application areas, and market growth strategies.

➡️𝐈𝐧𝐪𝐮𝐢𝐫𝐞 𝐁𝐞𝐟𝐨𝐫𝐞 𝐁𝐮𝐲𝐢𝐧𝐠: https://www.alliedmarketresearch.com/purchase-enquiry/A31686

Key Market Segments

Distribution Channel

Retail

Institutional

Investor Type

Individual Investor

Institutional Investor

Type

Fixed Income/Bonds ETFs

Equity ETFs

Commodity ETFs

Currency ETFs

Specialty ETFs

Others

➡️𝐁𝐮𝐲 𝐂𝐨𝐦𝐩𝐥𝐞𝐭𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐚𝐭 𝐃𝐢𝐬𝐜𝐨𝐮𝐧𝐭𝐞𝐝 𝐏𝐫𝐢𝐜𝐞 @ https://www.alliedmarketresearch.com/checkout-final/898fca5ea6f0fb1b0cb7c59ca0c40339?utm_source=AMR&utm_medium=research&utm_campaign=P19623

By Region

North America (U.S., Canada)

Europe (UK, Germany, France, Italy, Spain, Rest of Europe)

Asia-Pacific (China, India, Japan, South Korea, Australia, Rest of Asia-Pacific)

LAMEA (Latin America, Middle East, Africa)

➡️𝐋𝐞𝐚𝐝𝐢𝐧𝐠 𝐑𝐞𝐩𝐨𝐫𝐭𝐬 :

Debt Security Market

https://www.alliedmarketresearch.com/debt-security-market-A323202

Hedge Fund Market

https://www.alliedmarketresearch.com/hedge-fund-market-A11630

3D Secure Pay Authentication Market

https://www.alliedmarketresearch.com/3d-secure-pay-authentication-market-A283613

Equity Management Software Market

https://www.alliedmarketresearch.com/equity-management-software-market-A16643

Self-Driving Car Insurance Market

https://www.alliedmarketresearch.com/self-driving-car-insurance-market-A320163

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports Insights" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies, and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

David Correa

Allied Market Research

email us here

+1 5038946022

Visit us on social media:

Facebook

Twitter

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.