Harris County Property Tax Valuations

O'Connor conducted an in-depth analysis of the 2022 Harris County Tax Valuations.

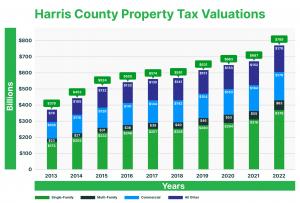

HOUSTON , TEXAS , UNITED STATES , April 2, 2024 /EINPresswire.com/ -- Harris County properties, appraised by the Harris Central Appraisal District, have experienced a substantial increase from $379 billion in 2013 to $788 billion in the most recent 2022 data available, marking a remarkable 108% growth over the past nine years. The statewide growth rate value of 135% surpasses Harris County’s growth rate. Additionally, the total value of all properties assessed by Texas appraisal districts escalated from $2.253 trillion in 2013 to $5.296 trillion by 2022.Harris Central Appraisal District

The Harris Central Appraisal District, a vital government entity, ascertains thorough evaluations of property, and market values in Harris County on a triennial basis. Oversight of this crucial process falls under the purview of a board of directors, tasked with appointing the chief appraiser to uphold standards of accuracy and impartiality.

Harris County Property Value per Acre

In a recent update, it was revealed that Harris County spans an extensive area of 1,777 square miles, encompassing 1,137,280 acres, with an average of 640 acres per square mile. This exceeds the typical county size, averaging around 1,058 square miles. According to the Harris Central Appraisal District’s 2022 data, the total value reaches $788 billion. Remarkably, the value per acre in Harris County stands at $692,881, significantly differing from the statewide average of $25,217 per acre.

Harris County Houses ~48% of Total Value

The Harris Central Appraisal District has determined that single-family homes account for almost half of Harris County’s market value, comprising approximately 48%, which surpasses the Texas average of 46%. Over the past nine years, Harris County has consistently maintained this percentage, ranging between 45% and 48%. In contrast, the statewide average has fluctuated between 41% and 46%.

Apartments, Commercial, Business Personal Property and Industrial / Other ~ 48%

The Harris Central Appraisal District has provided estimates for the property tax breakdown in Harris County for 2022. According to their data, single-family houses accounted for 48%, apartments for 8%, commercial buildings for 23%, and industrial and other assets for 22% of the total tax valuation.

Harris County Property Value $164 BB per 1 Million Population

The value of property per 1 million population has surged to $164 billion, a significant increase from $87 billion per 1 million population in 2013. This marks an impressive 88% growth over nine years, outpacing the growth rates of population and the CPI. It’s worth noting that the market value per 1 million population for the state stands at $176 billion.

Harris County Population Growth and Density

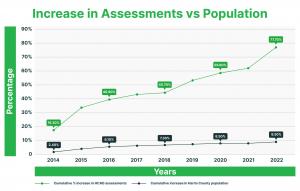

Harris County’s 2022 population growth is 9%, down 2% from the previous update, while Texas’ growth is faster at 13%. Harris County’s population density is 4.2 people per acre, compared to Texas’ 0.17 people per acre. That means there are 5.88 acres of land per resident in Texas. Harris County’s density is 25 times higher than the state average.

Property Value Grows Faster than Population

The contrast between the Harris Central Appraisal District’s substantial increase in the value of taxable property (81%) and the modest population growth rate of 9% is striking. Real estate values nationwide experienced significant growth from 2013 to 2022. However, the market entered a reset phase in early 2022. Rising interest rates have diminished housing affordability and decreased the value of commercial properties.

Transition Period to Slower Property Value Growth

Home prices in Houston and Texas have shown little growth since October 2023, likely maintaining similar values to the year-end of 2022 with variations across markets. Despite a decrease in home sales volume, average prices have remained stable. This decline in sales is due to a reduced pool of sellers, many tied to existing low mortgage rates of around 3.5%. The prospect of new mortgages at 7% dissuades potential sellers from entering the market.

Erratic Reassessment in 2024

There’s a possibility that Texas appraisal districts might significantly raise house values once more. However, the home sale data, including both sales volume and prices, provides little reassurance. In reality, if sales prices remain relatively stable across a metropolitan area, they are varied. Some areas experience higher prices, others lower prices, and some remain unchanged. It appears probable that the 2024 reassessments will yield mixed results, with some assessments increasing and others likely decreasing.

Houston Home Sales Volume

The volume of home sales in the Houston metro area, reported by the Houston MLS, peaked at 106,229 in 2021, following a surge from 82,229 in 2018. However, it dropped by 10.5% in 2022 to 95,113 houses sold, with another 10% decrease estimated for 2023. Projected 2023 sales are around 85,000, slightly surpassing the 2018 figure of 82,229.

Harris County Home Price Sale Trends

Home prices have remained relatively stable compared to last year. In September, average home sale prices in the Houston area increased by 0.8%, while the median home price rose by 2.2% to $333,000.

Commercial Property Values Down Due to Higher Interest Rates

Commercial property values are closely linked to interest rates, particularly the 10-year Treasury rate. As interest rates rise, so do capitalization rates, resulting in lower market values. The 10-Year Treasury rate increased from 0.96% in January 2021 to 4.81% in October 2023, impacting commercial property markets. This surge in rates has caused a freeze in capital markets, with buyers and sellers unable to agree on acceptable sales prices. Buyers require significantly higher cap rates for attractive returns, driving down sales prices. Consequently, owners are hesitant to accept lower prices and are waiting for interest rates and capital markets to stabilize, unless compelled to sell.

Harris County Property Value in Comparison

In 2022, the Harris Central Appraisal District assessed Harris County’s property at an impressive $788 billion, highlighting its unmatched value compared to other counties. Dallas follows at $392 billion, with Travis at $315 billion, Tarrant at $283 billion, and Bexar at $223 billion, trailing behind.

Are Harris Central Appraisal District (HCAD) Property Values Reliable?

HCAD, like every other appraisal district in Texas, faces a significant challenge. In 2022, HCAD had 307 appraisers responsible for valuing a staggering 1,900,000 property tax parcels. Typically, HCAD conducts evaluations for all properties each year. Of these appraisers, the majority are involved in fieldwork, particularly in recording data for newly constructed properties. It’s estimated that there are around 50 appraisal modelers at HCAD. This means that each of these 50 modelers, who are primarily focused on valuing properties, is tasked with evaluating approximately 38,000 tax parcels.

Managing land values, building data, and assessing conditions and impairments is a daunting task for 307 appraisers. Harris County property owners consistently dispute the initial values set by the Harris Central Appraisal District, with over 400,000 disagreements annually in recent years.

Harris County Owners Actively Protest Property Taxes

According to the latest data from 2022, property owners in Harris County are more inclined to protest compared to property owners statewide. In 2022, property tax protests in Harris County resulted in a reduction of property taxes by $719 million. Additionally, these protests led to a decrease in property values by $43.08 billion in Harris County, encompassing both informal, ARB, and judicial appeals. Texas contributed significantly to property tax savings from protests and judicial appeals, with the statewide total reduction amounting to $243 billion in 2022. Harris County accounted for almost 18% of the statewide reductions.

Homeowner Tips

Homeowners are encouraged to ensure they have a homestead exemption for their primary residence. Those who contest their property taxes in Harris County often find success in reducing them through informal appeals. In our upcoming blog installment on Harris County property taxes, we’ll delve into protest statistics, outcomes, and comparisons to Texas. Contact us at 713-290-9700 for complimentary assistance with homestead exemptions; there are no fees for this service. Additionally, you can enroll in our Property Tax Protection Program™ with no flat fees or upfront costs. Enroll online in just 3 minutes or call us at 713-290-9700, and O’Connor will vigorously protest your property taxes annually, with payment only required if your property taxes are successfully reduced for that year.

Source: Appraisal district assessment and protest data from Texas Comptroller. Tax savings are estimated based on a 2.7% tax rate and no exemptions or homestead caps.

About O'Connor:

O’Connor is among the largest property tax consulting firms in the United States, providing residential property tax reduction services in Texas, Illinois, and Georgia, as well as commercial property tax reduction services across the United States. O’Connor’s team of professionals possess the resources and market expertise in the areas of property tax, cost segregation, and commercial and residential real estate appraisals. The firm was founded in 1974 and employs more than 600 professionals worldwide. O’Connor’s core focus is enriching the lives of property owners through cost-effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™. There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Patrick O'Connor, President

O'Connor

+ +1 713-375-4128

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

YouTube

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.