Insurance Telematics Market Share to Surpass USD 17.7 billion by 2030 owing to Technological Drive | SNS INSIDER

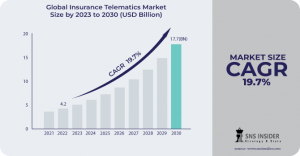

Insurance Telematics Market size was USD 4.2 billion in 2022 and is expected to Reach USD 17.7 billion by 2030 and grow at a CAGR of 19.7%

The SNS Insider report indicates that the Insurance Telematics Market was valued at USD 4.2 billion in 2022, and it is projected to achieve a market size of USD 17.7 billion by 2030, with a compound annual growth rate (CAGR) of 19.7 % expected over the forecast period from 2023 to 2030.

The market scope for Insurance Telematics encompasses the transformative role of telematics, a convergence of informatics and telecommunication, in the auto insurance sector. Telematics facilitates the tracking, storage, and transfer of driving-related data, enabling a comprehensive understanding of driving behavior and the establishment of reasonable auto insurance prices. Real-time services like crash assistance contribute to the growth of bold claims services and support insurers in embracing digital advancements. The integration of Internet of Things (IoT) in both passenger and commercial vehicles further propels the usage of cloud services in insurance telematics, shaping the future of the industry with technological innovations.

𝐆𝐞𝐭 𝐚 𝐒𝐚𝐦𝐩𝐥𝐞 𝐂𝐨𝐩𝐲 𝐨𝐟 𝐭𝐡𝐞 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭: @ https://www.snsinsider.com/sample-request/3346

𝐓𝐡𝐞 𝐩𝐫𝐨𝐦𝐢𝐧𝐞𝐧𝐭 𝐩𝐥𝐚𝐲𝐞𝐫𝐬 𝐨𝐟 𝐭𝐡𝐞 𝐦𝐚𝐫𝐤𝐞𝐭:

• Agero Inc.

• Aplicom

• Intelligent Mechatronic System

• Masternaut Ltd.

• Meta System S.p.A

• MiX Telematics Ltd.

• Octo Telematics S.p.A

• Sierra Wireless Inc.

• TomTom Telematics BV

• and TRIMBLE INC.

𝐌𝐚𝐫𝐤𝐞𝐭 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬:

The Insurance Telematics Market is experiencing robust growth driven by the increasing demand for telematics devices in the insurance and automotive sectors. Key factors include the improvement of premium pricing, enhanced customer perception, and strengthened long-term relationships through closer communication. The surge in regulatory compliance needs in the automotive industry and the widespread adoption of Internet of Things (IoT) technology among insurance telematics providers contribute significantly to the market's expansion. This dynamic landscape reflects a global shift towards advanced technologies, with telematics playing a pivotal role in reshaping the insurance industry and fostering innovation in driving behavior analysis and pricing strategies.

𝐒𝐞𝐠𝐦𝐞𝐧𝐭 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬:

- In terms of type, Pay-as-you-drive (PAYD) dominates the market globally, leveraging custom features such as insurance premium payment based on driving behavior.

- The on-premises deployment segment is anticipated to witness substantial growth, providing real-time information and insights in the auto insurance sector.

- Large enterprises currently dominate the market due to the rising adoption of mobile telematics systems, while small and medium organizations are poised for significant growth.

𝐊𝐄𝐘 𝐌𝐀𝐑𝐊𝐄𝐓 𝐒𝐄𝐆𝐌𝐄𝐍𝐓𝐀𝐓𝐈𝐎𝐍 :

𝐁𝐲 𝐓𝐲𝐩𝐞

• Pay-As-You-Drive

• Pay-How-You-Drive

• Manage-How-You- Drive

𝐁𝐲 𝐓𝐞𝐜𝐡𝐧𝐨𝐥𝐨𝐠𝐲

• OBD-I

• Smartphone

• Hybrid

• Black-box

𝐁𝐲 𝐎𝐟𝐟𝐞𝐫𝐢𝐧𝐠

• Hardware

• Software

• Services

𝐁𝐲 𝐄𝐧𝐝-𝐔𝐬𝐞

• Passenger Vehicle

• Commercial Vehicle

𝐁𝐲 𝐄𝐧𝐭𝐞𝐫𝐩𝐫𝐢𝐬𝐞

• Large Enterprises

• Small and Medium Enterprises

𝐁𝐲 𝐃𝐞𝐩𝐥𝐨𝐲𝐦𝐞𝐧𝐭

• On-premise

• Cloud

𝐁𝐲 𝐃𝐞𝐩𝐥𝐨𝐲𝐦𝐞𝐧𝐭 :

North America remains the most dominant player, driven by key companies, technological advancements, and a growing desire for interconnected services. Cloud adoption by insurance companies in North America provides a competitive advantage, with Accenture's cloud-based solutions leading the way. Asia Pacific is set to emerge with the highest growth rate, fueled by the deployment of telematics and IoT technologies in Japan and China.

𝐊𝐞𝐲 𝐓𝐚𝐤𝐞𝐚𝐰𝐚𝐲𝐬:

• The integration of IoT and cloud services is a driving force behind the growth of the Insurance Telematics Market.

• North America leads the market, while Asia Pacific shows the highest growth potential.

• PAYD dominates globally, on-premises deployment sees substantial growth, and large enterprises lead the market.

𝐁𝐮𝐲 𝐓𝐡𝐢𝐬 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐑𝐞𝐩𝐨𝐫𝐭: @ https://www.snsinsider.com/checkout/3346

𝐑𝐞𝐜𝐞𝐧𝐭 𝐃𝐞𝐯𝐞𝐥𝐨𝐩𝐦𝐞𝐧𝐭𝐬:

• In November 2022, OPES partnered with IMS to offer app-based telematics insurance solutions, O-Car, in Vietnam.

• In October 2022, Driven Telematics partnered with Cambridge Mobile Telematics to enhance driving safety for teen drivers through a new app, providing insights into driving behaviors and enabling families to shop for insurers efficiently.

𝐓𝐀𝐁𝐋𝐄 𝐎𝐅 𝐂𝐎𝐍𝐓𝐄𝐍𝐓𝐒:

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Research Methodology

3. Market Dynamics

3.1 Drivers

3.2 Restraints

3.3 Opportunities

3.4 Challenges

4. Impact Analysis

4.1 Impact of Ukraine- Russia War

4.2 Impact of Recession

4.2.2.1 US

4.2.2.2 Canada

4.2.2.3 Germany

4.2.2.4 France

4.2.2.5 United Kingdom

4.2.2.6 China

4.2.2.7 Japan

4.2.2.8 South Korea

4.2.2.9 Rest of the World

5. Value Chain Analysis

6. Porter’s 5 forces model

7. PEST Analysis

𝘾𝙤𝙣𝙩𝙞𝙣𝙪𝙚…..

𝐂𝐎𝐕𝐈𝐃-𝟏𝟗 𝐈𝐦𝐩𝐚𝐜𝐭 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬 :

The COVID-19 pandemic has brought notable changes to the Insurance Telematics Market. Reduced driving during lockdowns altered risk assessment, challenging usage-based insurance models. Logistical issues hampered device installations, and economic uncertainties affected premium payments. However, the crisis accelerated digital transformation, emphasizing contactless solutions and spurring interest in health telematics. Insurers must adapt pricing models, navigate regulatory considerations, and innovate for long-term resilience in a post-pandemic landscape.

𝐀𝐛𝐨𝐮𝐭 𝐔𝐬:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company 's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety.

Akash Anand

SNS Insider | Strategy and Stats

+1 415-230-0044

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

Instagram

YouTube

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.