Harris County takes the lead in Property Tax Lawsuits across Texas

O'Connor was able to examine how Harris County leads the way in Texas property tax lawsuits.

HOUSTON, TEXAS , UNITED STATES , December 22, 2023 /EINPresswire.com/ -- Harris County leads the state in the number of binding arbitration cases and judicial appeals in 2021. Harris Central Appraisal District reported 5007 binding arbitration cases, the highest in the state by far. The next 4 highest counties for binding arbitration filings are: 2) Travis County – 558, 3) Dallas County – 508, 4) Galveston County – 374, and 5) Tarrant County – 357 binding arbitration cases.Harris County Binding Arbitration Filings

Harris County also leads the state in number of judicial appeals with 6,652. The next four highest counties are: 2) Dallas County – 2,027, 3) Travis County 1,654, 4) Tarrant County – 1,307 and 5) Bexar County – 1,014.

Harris County Judicial Appeal Filings

Harris County judicial appeals filed in 2021 were at more than double the statewide level. Harris County property owners filed judicial appeals for $110 billion of $687 billion of property valued by Harris Central Appraisal District. This is 16% of Harris County value versus 7.5% of property subject to a judicial appeal statewide. Judicial appeals in Texas include property with a total value $324 billion, out of a total of $4.335 trillion.

Harris County Judicial Appeal Tax Savings

Property tax savings via judicial appeals have soared in Harris County and statewide. Harris County property owners have reduced their property taxes by $59.3 million in 2012. Harris County judicial appeal property tax savings increased to $313.4 million in 2021, a 428% increase. Texas-wide judicial appeal property tax savings have risen from $215.9 million in 2012 to $832.4 million in 2021, a 285% increase.

Binding Arbitration versus Judicial Appeals

Binding arbitration is limited to property valued under $5 million (except homestead residences have no binding arbitration cap). Binding arbitration involves a deposit of $450 or higher which is refunded (except $50) if the filing is settled or the property owner wins the hearing. Binding arbitration is not subject to discovery in most cases, which is a favorable factor at appraisal districts enamored with paper discovery. Judicial appeals involve costs not associated with a binding arbitration including filing/service fees (~$375), legal fees for attorneys, and the cost for expert reports. Binding arbitration cases are typically resolved in 6 to 9 months versus judicial appeals which often linger for 12 to 36 months.

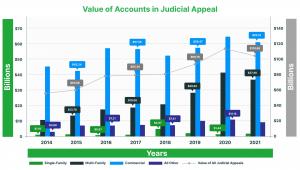

Value of Accounts in Judicial Appeal

The costs of judicial appeals discourage most property tax consultants and property owners from pursuing judicial appeals valued below $20 million. The average value of single-family accounts in lawsuits are about $1.97 million in Harris County and $4.1 million in Texas. However, the average assessed value of multifamily in judicial appeal accounts is $29.3 million in Harris County and $32.6 million in Texas. Commercial property involved in a judicial appeal had an average value of $16.1 million in Harris County and $18.6 million statewide in 2021.

O’Connor Aggressively Coordinates Judicial Appeals – Provides Turnkey Service

O’Connor coordinates teams that file judicial appeals, coordinate with clients, prepare expert witness reports on market value and unequal appraisal, and negotiate settlements. O’Connor pays all the costs including filing fees, legal fees, expert witness fees, etc. Clients pay nothing unless their property taxes are reduced below the appraisal review board level in a judicial appeal. Few if any competitors pay all the costs for judicial appeals. Most competitors consider judicial appeals for accounts valued over $10 to $15 MM. O’Connor is willing to coordinate judicial appeals for commercial accounts valued over $750,000 and residential over $1,500,000. O’Connor can pursue binding arbitration for properties valued well below $1.500,000

O’Connor is not a law firm but instead of just providing the legal component, O’Connor coordinates and pays for attorneys, filing fees, tax consultants, expert witnesses, and staff to coordinate.

Are Property Tax Savings from Judicial Appeals Successful?

Total annual property tax savings at Harris County Judicial Appeals ranged from about $250 million to $300 million. Regrettably, most Harris County property owners who could benefit from a judicial appeal simply quit after the appraisal review board (ARB).

Tax Tips – if a person in Harris County has commercial property valued at $750,000 or higher, they would likely benefit from a judicial appeal or binding arbitration.

O’Connor Handles Binding Arbitration

O’Connor handles all aspects of binding arbitration cases including paying the arbitration deposit and taking the risk of losing the deposit ($450 to $1,500). Most property tax consultants require the property owner to pay the binding arbitration deposit. O’Connor handles binding arbitration filing, negotiating a settlement, and/or attending binding arbitration hearings. O’Connor prepares expert reports on market value and unequal appraisal. The client incurs no cost related to pursuing binding arbitration unless we reduce their property taxes and then the fee is a portion of property tax savings.

Additional Reduction to Support Binding Arbitration

A dispute of just $20,000 to 30,000 is sufficient to get O’Connor to work perform a binding arbitration on someone's behalf. O’Connor pays the costs, and then the client only pays if O’Connor can reduce the property taxes further below the appraisal review board level. No flat fees. No upfront costs.

What is SOAH?

The State Office of Administrative Hearings (SOAH) is a quasi-judicial remedy in lieu of binding arbitration or a judicial appeal. SOAH judges hear disputes regarding licensees in Texas such as brokers, appraisers, and barbers. Unlike binding arbitration, there is no maximum value. However, there is a $1 million appraisal review board value minimum and a $1,500 deposit. The $1,500 deposit is returned if the case is settled and can be used to pay a SOAH judge if the case goes to trial.

SOAH filings have been under 100 statewide but appear to be increasing. There are some situations where SOAH makes sense. Discovery is generally minimal for SOAH, leaving the focus on market value and unequal appraisal arguments. In some judicial appeals, appraisal district attorneys focus on voluminous discovery with limited relevance to resolving the value dispute.

Should Someone File a Judicial Appeal or Use Binding Arbitration?

Appeals after the appraisal review board (ARB) are minimal related to initial protests. Binding arbitration cases total about 10,000 annually versus 17,000 judicial appeals annually, or about 27,000 total including binding arbitration and judicial appeal. This total number is small compared to the 2,190,000 total initial protests in 2021; only 1.2% continue past the ARB. Many property owners who stop at the ARB are leaving money on the table. In practice, a high percentage of binding arbitration and judicial appeals reduce property taxes below the level at the appraisal review board (ARB). Appraisal districts are flexible in reviewing binding arbitration cases filed in good faith.

Practice tip – if the amount of value in dispute exceeds $20,000 to $30,000, and the case is rock solid, binding arbitration would make sense at most appraisal districts. Most appraisal districts are inclined to settle cases with well-documented evidence.

Harris County Appeals after ARB Exceeds Statewide Average

Including binding arbitration and judicial appeals (11,659 in 2021) versus total initial tax protests (453,840), Harris County protests extended past the ARB for 2.5% of accounts versus 1.2% statewide.

Have questions about binding arbitration?

Call 713 290 9700 to determine if it will benefit from continuing the appeal after the ARB. O’Connor is involved in coordinating thousands of judicial appeals and binding arbitration cases, as well as a limited number of State Office of Administrative Hearings (SOAH) cases.

Source: Appraisal district assessment and protest data from Texas Comptroller. Tax savings are estimated based on a 2.7% tax rate and no exemptions or homestead caps. O’Connor is a private company specializing in tax reduction and is not affiliated with the Texas Comptroller or any government entity or appraisal district.

About O'Connor:

O’Connor is among the largest property tax consulting firms in the United States, providing residential property tax reduction services in Texas, Illinois, and Georgia, as well as commercial property tax reduction services across the United States. O’Connor’s team of professionals possess the resources and market expertise in the areas of property tax, cost segregation, and commercial and residential real estate appraisals. The firm was founded in 1974 and employs more than 600 professionals worldwide. O’Connor’s core focus is enriching the lives of property owners through cost-effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™. There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Patrick O'Connor, President

O'Connor

+1 713-375-4128

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

YouTube

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.