By appealing their property taxes, Williamson County property owners were able to save almost $100 million in 2023

Now that the Williamson County hearings have concluded, O'Connor has reevaluated the benefits and disadvantages of contesting the county taxes.

HOUSTON, TEXAS, UNITED STATES, December 15, 2023 /EINPresswire.com/ -- The resolution of property tax appeals for 2023 resulted in impressive savings for Williamson County property owners, exceeding $100 million. Each year, the determination of real estate and personal property market values in Williamson County falls under the jurisdiction of the Williamson Central Appraisal District. Whether property values increase or decrease, property owners always have the option to contest the appraisals provided by the district. Furthermore, O’Connor utilized the initial and final tax rolls provided by the Williamson Central Appraisal District to compile the statistics presented below.Per O’Connor’s insightful forecast, the 2023 property tax savings stemming from Williamson County property tax appeals are expected to surpass a staggering $137 million. This estimation factors in historical data on property tax savings, readily available on Williamson County Property Tax Trends, providing a comprehensive perspective on the substantial financial gains.

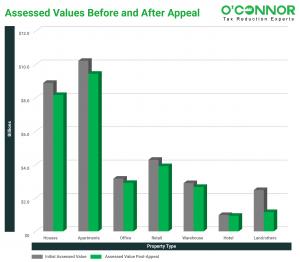

As the year 2023 unfolds, a wave of proactive property tax challenges by Williamson County’s residential property owners promises substantial savings, tallying an impressive $19.5 million. Recent insights from the Williamson Central Appraisal District confirm that a notable 19,262 households have succeeded in reducing their tax assessments. When considering a 2.7% tax rate, while overlooking homestead exemptions, the average assessment decrease equates to $37,515, translating into substantial property tax savings averaging $1,013 for each homeowner.

Apartment complex owners experienced a remarkable turnaround in their property valuations for the 2023 tax appeals. Their initial $10.2 billion value was reduced to $9.4 billion, resulting in a substantial $774 million cut in tax assessments. With a 2.7% tax rate, these owners will save $20.8 million in property taxes in 2023. In Williamson County, commercial apartment owners averaged a 7.6% reduction. The 216 commercial apartment buildings that underwent tax appeal hearings in 2023 saw the average apartment property yielding an impressive property tax saving of $96,750.

The assessed value of commercial property and other property in Williamson County has significantly decreased as a direct outcome of tax disputes. In 2023, a total of 3,724 appeals have been resolved, with a decline of 53.4% the highest of all the percentage reductions. There was a significant fall of $1.3 billion from the initial valuation of $2.4 billion to $1.1 billion. As a final result, based on a 2.7% tax rate, property owners collectively saved $35 million in taxes which is the highest out of all the commercial property types. This amounts to about $9,573 per tax parcel on average.

Hotel owners reaped substantial benefits from tax savings, amounting to $1.2 million, thanks to a tax assessment reduction of $45 million at a 2.7% tax rate. The initial estimated value of hotels challenging their assessments in 2023 dropped from $976 million to $931 million. On average, each hotel saved $19,464 in property taxes for the year, following successful appeals. A total of 63 hotel hearings were held, with an average successful appeal leading to a 4.6% reduction in hotel property assessments.

In this tax season, a financial boon graced the proprietors of Williamson County’s commercial office buildings, showering them with a remarkable $6.9 million in savings. Their office properties, once valued at a robust $3.1 billion, saw a significant trim of $255 million, bringing the total down to a more modest $2.9 billion. The reduction percentage for these commercial office spaces reached an impressive 8.1% for properties that successfully secured reductions, culminating in an enticing average property tax savings of $5,853, when computed at a 2.7% tax rate.

Williamson County property owners exhibited a remarkable ability to trim their initial property valuation, skillfully reducing it from a hefty $32.9 billion to a more manageable $29.1 billion. This impressive transformation was achieved through the culmination of 2023 property tax protests, successfully leading to reductions in 25,969 properties and an extraordinary final average reduction rate of 11.33%. As September 2023 came to a close, both residential and commercial property owners who had lodged protests were celebrating their collective average tax savings, an impressive $154,141 per property, leaving property owners with a well-deserved financial victory.

Apartments with the largest 2023 property tax assessment reduction include the following:

Nestled at 4600 Mays St N. in Round Rock, Texas, the owner of the Lantana Round Rock apartment complex achieved a notable triumph, successfully slashing their property taxes by 41.5%. This amounted to a significant $974,866 in property tax savings. The initial property tax assessment for 2023 stood at $87 million in value. However, after persistent efforts, the property tax evaluation for the 336-unit apartments constructed in 2022 witnessed an amazing decrease of $36 million, ultimately settling at $50.8 million.

Located at 520 Wolf Ranch Pkwy in Georgetown, Texas, The Villas of Georgetown apartment complex saw a notable shift in its property taxes this year. The property’s owner observed a substantial reduction, with the initial value of $39.8 million plummeting to $10 million, marking a phenomenal decrease of $29.8 million. This decrease resulted in significant savings of $805,866 for the apartment owner in 2023, all thanks to the property tax adjustments.

The apartment complex, Allora Georgetown, was built in 2023 and encompasses 432 units. Located at 3001 NE Inner Loop in Georgetown, Texas, this property was initially assessed at $77.8 million. However, a reduction of $25.8 million was implemented, culminating in a final assessment value of $52 million. This decrease equates to a substantial 32% reduction. As a result, property owners stand to gain a tax reduction of $698,278, based on a 2.7% tax rate.

The Williamson Central Appraisal District relies on a team of roughly 73 specialists who assess properties throughout Williamson County. The instances mentioned in the blog above underscore the notable property tax reductions achieved through the property tax appeals process for the 2023 tax year.

The Williamson Central Tax Appraisal District conducts a head-to-head comparison between the starting values and the closing 2023 tax assessments to unveil the thrilling 2023 property tax assessment reduction. What makes this statistic even more eye-catching is that the average decrease soars, as it excludes properties with no reductions, delivering a financial punch worth noticing.

It’s a powerful tip: Dare to challenge your annual property tax assessments and watch your annual tax burden shrink. It’s your money – claim it!

About O'Connor:

O’Connor is among the largest property tax consulting firms in the United States, providing residential property tax reduction services in Texas, Illinois, and Georgia, as well as commercial property tax reduction services across the United States. O’Connor’s team of professionals possess the resources and market expertise in the areas of property tax, cost segregation, and commercial and residential real estate appraisals. The firm was founded in 1974 and employs more than 600 professionals worldwide. O’Connor’s core focus is enriching the lives of property owners through cost-effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™. There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Patrick O'Connor, President

O'Connor

+1 713-375-4128

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

YouTube

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.