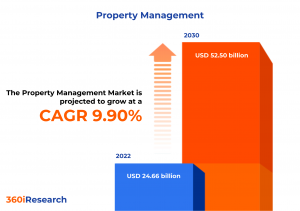

Property Management Market worth $52.50 billion by 2030, growing at a CAGR of 9.90% - Exclusive Report by 360iResearch

The Global Property Management Market to grow from USD 24.66 billion in 2022 to USD 52.50 billion by 2030, at a CAGR of 9.90%.

PUNE, MAHARASHTRA, INDIA , December 5, 2023 /EINPresswire.com/ -- The "Property Management Market by Offering (Services, Solution), Ownership (In-House, Third Party), Deployment, Geographic Location, End-Use - Global Forecast 2023-2030" report has been added to 360iResearch.com's offering.The Global Property Management Market to grow from USD 24.66 billion in 2022 to USD 52.50 billion by 2030, at a CAGR of 9.90%.

Request a Free Sample Report @ https://www.360iresearch.com/library/intelligence/property-management?utm_source=einpresswire&utm_medium=referral&utm_campaign=sample

The property management market refers to the industry providing oversight and management services for real estate properties, including residential and commercial units. Services may encompass daily operations, such as maintenance, administration, and tenant relations, and strategic oversight, such as capital improvements and portfolio management. End-users include property owners, real estate investors, and corporate entities with real estate holdings, which utilize these services to maintain and increase the value of their properties while ensuring compliance with various regulatory standards. The property management landscape is briskly expanding in response to key economic trends and societal shifts. As economic growth fuels a rise in income and fosters broader development, a surge in property demand naturally follows, catalyzing expansion within the property market. Concurrently, urbanization intensifies the need for property management services, given the upswing in rental accommodations and commercial premises within urban territories. This trend is compounded by the rapid integration of advanced property management technologies and software, which streamline asset management processes, making the sector more attractive to new players and investors. The property management industry is navigating a dynamic landscape punctuated by an intensifying competitive environment. This heightened rivalry often precipitates price wars and, in some cases, may lead to compromises in service quality as firms vie for market dominance. Moreover, the sector grapples with ever-evolving regulatory frameworks, which can overturn established operational practices and inflict additional costs linked to compliance. A further critical dependency lies in the capricious nature of real estate markets, with economic shifts that can erode property values and dampen market activity, affecting property management firms' growth trajectory. However, integrating smart home technologies alongside the Internet of Things (IoT) is revolutionizing the sector, offering a predictive approach to maintenance that enhances operational efficacy. Property management firms are positioned to broaden their influence by introducing consultancy and advisory services, providing invaluable insights to investors and thereby driving market expansion.

Offering: Development of next-generation platform to deliver full-suite solutions

The services offered in the property management industry can broadly be categorized into administrative and operational support services, tenant acquisition, maintenance and repair, legal and financial services, and technology-driven services. Each service is designed to fulfill specific needs based on property type, location, and target markets. Managed services in property management refer to ongoing operational functions that are outsourced to a third party. These services often include day-to-day management activities that ensure the efficient running of properties. Professional services in property management involve specialized expertise provided on a consultative basis. This segment includes advisory and support services tailored to meet the strategic objectives of property management. Solution offerings in property management are an essential part of the industry, as they encompass various applications and tools designed to optimize processes and enhance operational efficiency. In property management, CRM solutions are used to manage and analyze tenant interactions and data throughout the tenant lifecycle. The goal is to improve business relationships with tenants, enhance customer service, and drive tenant retention and satisfaction. Sophisticated facility management solutions help property managers oversee maintenance activities, space allocation, and utilization. These tools facilitate the efficient operation of facilities and can help optimize energy usage and reduce operational costs. Integrated security and surveillance management solutions streamline the monitoring and managing of security measures. These platforms assist in risk assessment, deploying security technologies, and operational security strategies.

Ownership: Rising demand for third-party management services to leverage expertise, networks, and purchasing power

In-house property management is the practice where a property owner or a real estate investment company manages their properties without outsourcing the responsibilities to an external service provider. The in-house model is often preferred when the ownership entity has sufficient scale, expertise, and resources to manage the operations internally effectively. In-house management directly oversees property maintenance, tenant relations, and financial operations, potentially leading to better-aligned interests with ownership objectives. However, it can also involve greater fixed costs and may need more flexibility or scale economies that a third-party provider could offer. Third-party property management is a segment where property owners outsource management responsibilities to specialized firms that operate on a fee or contract basis. This arrangement is usually preferred by property owners needing more time, expertise, or scale to manage properties efficiently. Third-party management offers cost efficiencies, lower capital expenditure, and access to an established infrastructure.

End-Use: Deployment across industrial buildings to meet rising functionality and logistics

Commercial buildings, such as offices, retail spaces, and malls, prioritize location, amenities, and building aesthetics to attract tenants and shoppers. Property management in this segment focuses on enhancing the customer experience, maintaining high occupancy rates, and ensuring efficient operational services. Industrial buildings, including warehouses, factories, and distribution centers, require functional design and optimal logistics locations. Property management in this sector focuses on the effective management of space, ensuring safety standards, and adapting to technological advancements in operations and supply chain management. Institutional buildings such as schools, government buildings, and hospitals are fundamental in public service and community support. Property management in this segment aims to ensure compliance with stringent regulatory requirements, maintain high levels of accessibility, and promote sustainability. Residential buildings, including multi-family homes, apartments, and condominiums, call for a unique balance between providing personal comfort, fostering community engagement, and managing resources efficiently. High demand is placed on property management companies to deliver amenities, ensure security, and sustain the community's value.

Deployment: Rising adoption of cloud-based property management systems due to minimal initial capital expenditure and scalability

The deployment segment refers to the methods by which property management systems are implemented and accessed by users. On-cloud deployment, also known as cloud-based or Software as a Service (SaaS), entails delivering property management software over the internet. Users can access the software from anywhere with an internet connection, ensuring flexibility and scalability. It typically involves a subscription-based model with vendors managing the IT infrastructure, software upgrades, and security. Compared to on-premise solutions, on-cloud property management systems often offer more straightforward updates, ease of access, and generally lower initial expenses. However, they may pose concerns over data sovereignty and require a constant internet connection for access. On-premise deployment refers to the traditional model where property management systems are installed and run on the client's in-house servers and computers. It allows companies to have complete control over their IT environment, data security, and system modifications. Typically, on-premise solutions require a one-time licensing fee and potential additional costs for maintenance and upgrades. On-premise solutions are predominantly used by large organizations and those with strict data control and security requirements. Companies that prefer a single investment over ongoing subscription expenses may also opt for on-premise deployment.

Regional Insights:

The property management sector in the Americas, particularly in the United States and Canada showcases a mature market environment with steady demand driven by a diverse real estate portfolio encompassing residential, commercial, and industrial properties. Adopting advanced technologies such as the Internet of Things (IoT), artificial intelligence (AI), and cloud computing for operations efficiency is a major growth contributor. Focused regulations and a well-established legal framework also support professional property management services. The Europe, Middle East, and Africa (EMEA) region presents a heterogeneous demand for property management services. In Europe, sophisticated tenant expectations and a strong emphasis on sustainable building practices influence property management strategies. There is a high adoption rate of energy management systems and a growing interest in ‘green’ property management services. The Middle Eastern property market is known for its luxury segments, whereas Africa offers significant growth potential, guided by its developing economic landscape and urbanization trends. Socioeconomic factors, regulatory conditions, and varying degrees of political stability across the EMEA region result in a complex and multifaceted demand for property management services. The Asia-Pacific (APAC) region, represented by key markets like China, India, Japan, and Australia, is characterized by rapid urbanization and economic growth, resulting in a surge in demand for property management services. The increase in high and middle-income populations and a boom in the construction of residential and commercial properties represent significant opportunities. The APAC market is relatively fragmented, with local players dominating certain areas. Technology adoption trends include localized innovation and increased mobile technology utilization for property management tasks. Regulatory environments vary considerably within the APAC region, affecting the stability and predictability of demand.

FPNV Positioning Matrix:

The FPNV Positioning Matrix is essential for assessing the Property Management Market. It provides a comprehensive evaluation of vendors by examining key metrics within Business Strategy and Product Satisfaction, allowing users to make informed decisions based on their specific needs. This advanced analysis then organizes these vendors into four distinct quadrants, which represent varying levels of success: Forefront (F), Pathfinder (P), Niche (N), or Vital(V).

Market Share Analysis:

The Market Share Analysis offers an insightful look at the current state of vendors in the Property Management Market. By comparing vendor contributions to overall revenue, customer base, and other key metrics, we can give companies a greater understanding of their performance and what they are up against when competing for market share. The analysis also sheds light on just how competitive any given sector is about accumulation, fragmentation dominance, and amalgamation traits over the base year period studied.

Key Company Profiles:

The report delves into recent significant developments in the Property Management Market, highlighting leading vendors and their innovative profiles. These include Accruent, LLC, AppFolio, Inc., Aspire Systems, Avail, Avenue, Boom Properties, Bozzuto & Associates, Inc., Breezeway Homes, Inc., CBRE, Inc., CDG Property Management, Colliers International Property Consultants, Inc., CoreLogic, Inc., Cortland, CoStar Group, Inc., Crédit Agricole S.A., Cushman & Wakefield PLC, DoorLoop Inc., Entrata, Inc., Eptura, Inc., Greystar Global Enterprise, LLC, HappyCo, Inc., Hemlane, Inc., Hines Group, Hitachi, Ltd., Hive Properties, Hughes Group Limited, Inhabit, Innago, LLC, International Business Machines Corporation, IQware Inc., Jones Lang LaSalle Incorporated, LeaseHawk, LLC, Lincoln Property Company, Livly, Inc, London Computer Systems, ManageCasa Inc., Matterport, Inc., MRI Software LLC, Mynd Management, Inc., MyndLeaseX, Nexus Property Management, Ohmyhome Limited, Oracle Corporation, Planon Group, Property Boulevard, Inc., Property Matrix, PURE Property Management Company, RealPage, Inc., Realpha Asset Management, Inc., Reapit Limited, Rentec Direct LLC, RentRedi, Inc., ResMan, LLC, Roers Companies, Royal York Property Management Franchising, inc., SAP SE, Savills PLC, Smart Property Systems Inc., Spacewell International NV, Square Yards Group, Strangford Management Ltd, TenantCloud, LLC, Tribe Property Technologies Inc., Trimble Inc., TurboTenant, Inc., Yardi Systems, Inc., and Zumper, Inc..

Inquire Before Buying @ https://www.360iresearch.com/library/intelligence/property-management?utm_source=einpresswire&utm_medium=referral&utm_campaign=inquire

Market Segmentation & Coverage:

This research report categorizes the Property Management Market in order to forecast the revenues and analyze trends in each of following sub-markets:

Based on Offering, market is studied across Services and Solution. The Services is further studied across Managed Services and Professional Services. The Professional Services is further studied across Consulting & Training, Integration & Deployment, and Support & Maintenance. The Solution is further studied across Customer Relationship Management, Facility Management, Project Management, and Security & Surveillance Management. The Facility Management is further studied across Asset Maintenance & Management, Lease Accounting & Real Estate Management, Reservation Management, and Workspace & Relocation Management. The Solution commanded largest market share of 65.32% in 2022, followed by Services.

Based on Ownership, market is studied across In-House and Third Party. The Third Party commanded largest market share of 61.87% in 2022, followed by In-House.

Based on Deployment, market is studied across On-Cloud and On-Premise. The On-Premise commanded largest market share of 56.25% in 2022, followed by On-Cloud.

Based on Geographic Location, market is studied across Rural, Suburban, and Urban. The Urban commanded largest market share of 49.42% in 2022, followed by Suburban.

Based on End-Use, market is studied across Commercial Buildings, Industrial Buildings, Institutional Buildings, and Residential Buildings. The Commercial Buildings is further studied across Office Buildings, Retail Stores, and Shopping Malls. The Industrial Buildings is further studied across Distribution Facilities, Manufacturing Facilities, and Warehouses. The Institutional Buildings is further studied across Government Buildings, Hospitals, and Schools. The Residential Buildings commanded largest market share of 25.26% in 2022, followed by Commercial Buildings.

Based on Region, market is studied across Americas, Asia-Pacific, and Europe, Middle East & Africa. The Americas is further studied across Argentina, Brazil, Canada, Mexico, and United States. The United States is further studied across California, Florida, Illinois, New York, Ohio, Pennsylvania, and Texas. The Asia-Pacific is further studied across Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. The Europe, Middle East & Africa is further studied across Denmark, Egypt, Finland, France, Germany, Israel, Italy, Netherlands, Nigeria, Norway, Poland, Qatar, Russia, Saudi Arabia, South Africa, Spain, Sweden, Switzerland, Turkey, United Arab Emirates, and United Kingdom. The Americas commanded largest market share of 42.52% in 2022, followed by Europe, Middle East & Africa.

Key Topics Covered:

1. Preface

2. Research Methodology

3. Executive Summary

4. Market Overview

5. Market Insights

6. Property Management Market, by Offering

7. Property Management Market, by Ownership

8. Property Management Market, by Deployment

9. Property Management Market, by Geographic Location

10. Property Management Market, by End-Use

11. Americas Property Management Market

12. Asia-Pacific Property Management Market

13. Europe, Middle East & Africa Property Management Market

14. Competitive Landscape

15. Competitive Portfolio

16. Appendix

The report provides insights on the following pointers:

1. Market Penetration: Provides comprehensive information on the market offered by the key players

2. Market Development: Provides in-depth information about lucrative emerging markets and analyzes penetration across mature segments of the markets

3. Market Diversification: Provides detailed information about new product launches, untapped geographies, recent developments, and investments

4. Competitive Assessment & Intelligence: Provides an exhaustive assessment of market shares, strategies, products, certification, regulatory approvals, patent landscape, and manufacturing capabilities of the leading players

5. Product Development & Innovation: Provides intelligent insights on future technologies, R&D activities, and breakthrough product developments

The report answers questions such as:

1. What is the market size and forecast of the Property Management Market?

2. Which are the products/segments/applications/areas to invest in over the forecast period in the Property Management Market?

3. What is the competitive strategic window for opportunities in the Property Management Market?

4. What are the technology trends and regulatory frameworks in the Property Management Market?

5. What is the market share of the leading vendors in the Property Management Market?

6. What modes and strategic moves are considered suitable for entering the Property Management Market?

Read More @ https://www.360iresearch.com/library/intelligence/property-management?utm_source=einpresswire&utm_medium=referral&utm_campaign=analyst

Mr. Ketan Rohom

360iResearch

+1 530-264-8485

ketan@360iresearch.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.