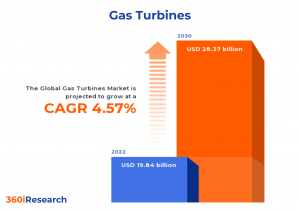

Gas Turbines Market worth $28.37 billion by 2030, growing at a CAGR of 4.57% - Exclusive Report by 360iResearch

The Global Gas Turbines Market to grow from USD 19.84 billion in 2022 to USD 28.37 billion by 2030, at a CAGR of 4.57%.

PUNE, MAHARASHTRA, INDIA, November 16, 2023 /EINPresswire.com/ -- The "Gas Turbines Market by Type (Aero-Derivative Gas Turbines, Heavy-Duty Gas Turbines, Industrial Gas Turbines), Technology (Closed Cycle, Combined Cycle, Open Cycle), Rating Capacity, Application - Global Forecast 2023-2030" report has been added to 360iResearch.com's offering.The Global Gas Turbines Market to grow from USD 19.84 billion in 2022 to USD 28.37 billion by 2030, at a CAGR of 4.57%.

Request a Free Sample Report @ https://www.360iresearch.com/library/intelligence/gas-turbines?utm_source=einpresswire&utm_medium=referral&utm_campaign=sample

A gas turbine is an engine that converts the energy from fuel combustion into mechanical energy. The system is widely used across power generation, manufacturing, and oil & gas industries due to its highly reliable machine-run capacity. Increasing demand for electricity driven by industrial growth and infrastructure development are the major factors accelerating the use of gas turbines. With the shift to renewable energy sources in support of government initiatives, the need for high-performing gas turbines has expanded. However, gas turbines' functional limitations and environmental impact impede product penetration. Market players are working on building more advanced gas turbines while focusing on predictive maintenance facilities to enable flexible and more effective operations of gas turbines. Moreover, several investments have been made in distributed and decentralized power generation activities across emerging economies, creating new opportunities for deploying modern gas turbines. The aging power generation infrastructure in many countries has also required gas turbines for replacement due to their operational flexibility and resilience.

Rating Capacity: Continuous increase in use of 120-300 MW capacity gas turbines with investments in renewable energy

Gas turbines with a rated capacity of less than 40 MW are commonly used in small-scale industrial processes for operating machines and equipment. Gas turbines with a 40-120 MW rated capacity are most often used for combined heat and power (CHP) plants, district heating systems, and medium-scale manufacturing facilities. Gas turbines with a rated capacity of 120-300 MW are often utilized for larger-scale electricity generation and renewable energy production applications. In comparison, those gas turbines with ratings over 300 MW are primarily used for utility-scale electricity production or in large-scale oil & gas industries.

Type: Increasing use of heavy-duty gas turbines for power generation

Industrial gas turbines are large-scale turbine systems used to power industrial facilities such as factories and power plants. They produce high torque output, allowing them to drive large pumps or compressors for various industrial processes. Aeroderivative is lighter and more compact than industrial gas turbines, and due to their ability to shut down and handle load changes quicker than industrial machines, they are widely employed in electrical power generation. Heavy-duty gas turbines are designed for stationary applications at power plants, where they serve as the primary source of electricity generation. Heavy-duty units feature robust construction that enables them to operate under harsh environmental conditions with minimal maintenance requirements. They are primarily large-sized with a rated capacity of more than 75 MW, capable of burning various fuels, ranging from natural gas to heavy liquid residuals.

Technology: Growing use of open-cycle gas turbine for marine applications

An open-cycle gas turbine is a type of gas turbine in which the hot gases produced by the combustion of liquid fuel are utilized to rotate the turbine, and the remaining heat is drained into the atmosphere. This type of technology is useful for applications that require higher output quickly. A closed-cycle gas turbine is a gas turbine in which the air is continuously circulated within the turbine. The closed-cycle gas turbine has more thermal efficiency when compared to open-cycle systems. A combined-cycle power plant generates up to 50% more energy from the same fuel as it combines gas and a steam turbine. The extra heat produced by the gas turbine is shifted to the nearby steam turbine to generate additional power.

Application: Proliferation in use of gas turbines in the aviation sector

Gas turbines are a popular form of energy production for oil & gas applications, as they can generate high amounts of power with relatively small-scale equipment. They are often used in drilling rigs to provide the necessary electricity required to pressurize and control the flow of oil or gas during the extraction process. Gas turbines have long been used in power generation due to their low cost and reliable performance. This system can be used in many manufacturing processes to control torque and speed output during operation precisely. It makes them ideal for textiles or paper manufacturing industries where exacting speeds and torque requirements must be consistently met. Gas turbine engines propel an aircraft and are often available as turbojet, turbofan, turboshaft, and turboprop.

Regional Insights:

The Americas region has observed a growing market for gas turbines, driven by their rising power generation activities, shale gas exploration, and industrial applications. The U.S. and Canada share the presence of established companies working on offering highly-efficient gas turbines to their long-term industrial clients. The Asian market is denoted by rising urbanization, investments in power generation, and renewable energy, backed by the government's current focus on optimizing its energy mix. China, India, Japan, and South Korea observed increased use of gas turbines in power plants and combined heat & power systems, which has witnessed a recent rise in deployment. The market in Europe is driven by the growing focus of market players on renewable energy integration and grid stability supporting the country's energy transition. Germany, the UK, and the Netherlands have a mature gas turbine market, with players focused on expanding their production facilities and introducing energy-efficient systems. The Middle East & Africa has abundant oil & gas reserves, particularly across the UAE, Saudi Arabia, South Africa, Nigeria, and Egypt, to meet their increasing energy needs, driving the adoption of gas turbines in the region.

FPNV Positioning Matrix:

The FPNV Positioning Matrix is essential for assessing the Gas Turbines Market. It provides a comprehensive evaluation of vendors by examining key metrics within Business Strategy and Product Satisfaction, allowing users to make informed decisions based on their specific needs. This advanced analysis then organizes these vendors into four distinct quadrants, which represent varying levels of success: Forefront (F), Pathfinder (P), Niche (N), or Vital(V).

Market Share Analysis:

The Market Share Analysis offers an insightful look at the current state of vendors in the Gas Turbines Market. By comparing vendor contributions to overall revenue, customer base, and other key metrics, we can give companies a greater understanding of their performance and what they are up against when competing for market share. The analysis also sheds light on just how competitive any given sector is about accumulation, fragmentation dominance, and amalgamation traits over the base year period studied.

Key Company Profiles:

The report delves into recent significant developments in the Gas Turbines Market, highlighting leading vendors and their innovative profiles. These include ABB Ltd., Ansaldo Energia S.p.A., Bharat Heavy Electricals Limited, Capstone Green Energy Corporation, Centrax Ltd., Danfoss A/S, Doosan Enerbility Co., Ltd., General Electric Company, GKN PLC, Harbin Electric Corporation, Hindustan Aeronautics Limited, Honeywell International Inc., IHI Corporation, Kawasaki Heavy Industries, Ltd., MAN Energy Solutions, MAPNA Group, Mitsubishi Heavy Industries, Ltd., MTU Aero Engines AG, Nidec Corporation, OPRA Turbines BV, Power Machines, Regal Rexnord Corporation, Rolls-Royce PLC, Siemens AG, Solar Turbines Incorporated, TECO-Westinghouse, Toshiba Corporation, Vericor Power Systems, WEG S.A., and Wärtsilä Corporation.

Inquire Before Buying @ https://www.360iresearch.com/library/intelligence/gas-turbines?utm_source=einpresswire&utm_medium=referral&utm_campaign=inquire

Market Segmentation & Coverage:

This research report categorizes the Gas Turbines Market in order to forecast the revenues and analyze trends in each of following sub-markets:

Based on Type, market is studied across Aero-Derivative Gas Turbines, Heavy-Duty Gas Turbines, and Industrial Gas Turbines. The Aero-Derivative Gas Turbines is projected to witness significant market share during forecast period.

Based on Technology, market is studied across Closed Cycle, Combined Cycle, and Open Cycle. The Combined Cycle is projected to witness significant market share during forecast period.

Based on Rating Capacity, market is studied across 120–300 MW, 40–120 MW, Above 300 MW, and Less than 40 MW. The Above 300 MW is projected to witness significant market share during forecast period.

Based on Application, market is studied across Aviation, Manufacturing, Oil & Gas, and Power Generation. The Oil & Gas is projected to witness significant market share during forecast period.

Based on Region, market is studied across Americas, Asia-Pacific, and Europe, Middle East & Africa. The Americas is further studied across Argentina, Brazil, Canada, Mexico, and United States. The United States is further studied across California, Florida, Illinois, New York, Ohio, Pennsylvania, and Texas. The Asia-Pacific is further studied across Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. The Europe, Middle East & Africa is further studied across Denmark, Egypt, Finland, France, Germany, Israel, Italy, Netherlands, Nigeria, Norway, Poland, Qatar, Russia, Saudi Arabia, South Africa, Spain, Sweden, Switzerland, Turkey, United Arab Emirates, and United Kingdom. The Europe, Middle East & Africa commanded largest market share of 37.41% in 2022, followed by Asia-Pacific.

Key Topics Covered:

1. Preface

2. Research Methodology

3. Executive Summary

4. Market Overview

5. Market Insights

6. Gas Turbines Market, by Type

7. Gas Turbines Market, by Technology

8. Gas Turbines Market, by Rating Capacity

9. Gas Turbines Market, by Application

10. Americas Gas Turbines Market

11. Asia-Pacific Gas Turbines Market

12. Europe, Middle East & Africa Gas Turbines Market

13. Competitive Landscape

14. Competitive Portfolio

15. Appendix

The report provides insights on the following pointers:

1. Market Penetration: Provides comprehensive information on the market offered by the key players

2. Market Development: Provides in-depth information about lucrative emerging markets and analyzes penetration across mature segments of the markets

3. Market Diversification: Provides detailed information about new product launches, untapped geographies, recent developments, and investments

4. Competitive Assessment & Intelligence: Provides an exhaustive assessment of market shares, strategies, products, certification, regulatory approvals, patent landscape, and manufacturing capabilities of the leading players

5. Product Development & Innovation: Provides intelligent insights on future technologies, R&D activities, and breakthrough product developments

The report answers questions such as:

1. What is the market size and forecast of the Gas Turbines Market?

2. Which are the products/segments/applications/areas to invest in over the forecast period in the Gas Turbines Market?

3. What is the competitive strategic window for opportunities in the Gas Turbines Market?

4. What are the technology trends and regulatory frameworks in the Gas Turbines Market?

5. What is the market share of the leading vendors in the Gas Turbines Market?

6. What modes and strategic moves are considered suitable for entering the Gas Turbines Market?

Read More @ https://www.360iresearch.com/library/intelligence/gas-turbines?utm_source=einpresswire&utm_medium=referral&utm_campaign=analyst

Mr. Ketan Rohom

360iResearch

+1 530-264-8485

ketan@360iresearch.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.