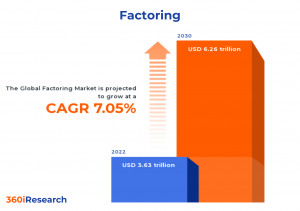

Factoring Market worth $6.26 trillion by 2030, growing at a CAGR of 7.05% - Exclusive Report by 360iResearch

The Global Factoring Market to grow from USD 3.63 trillion in 2022 to USD 6.26 trillion by 2030, at a CAGR of 7.05%.

PUNE, MAHARASHTRA, INDIA, November 16, 2023 /EINPresswire.com/ -- The "Factoring Market by Type (International Factoring, Non-Notification Factoring, Notification Factoring), Industry (Aerospace & Defense, Automotive & Transportation, Banking, Financial Services & Insurance) - Global Forecast 2023-2030" report has been added to 360iResearch.com's offering.The Global Factoring Market to grow from USD 3.63 trillion in 2022 to USD 6.26 trillion by 2030, at a CAGR of 7.05%.

Request a Free Sample Report @ https://www.360iresearch.com/library/intelligence/factoring?utm_source=einpresswire&utm_medium=referral&utm_campaign=sample

Factoring is a debtor finance medium where a business sells its accounts receivables or invoices to a third party, called a factor, at a discount. It is an essential tool for providing working capital to businesses that might have cash flow issues due to slow-paying customers or longer sales cycles. The end-users of factoring services are diverse, including small businesses struggling with cash flow gaps due to delayed payments from customers, seasonal businesses requiring funding during peak periods, and fast-growing companies in need of working capital for business expansion. Improved international trade enhances opportunities for factoring companies to address cross-border transaction challenges faced by exporters/importers. However, limited awareness of factoring services among businesses and strict regulatory frameworks aimed at factoring services have impacted their adoption worldwide. Market players are expected to keep up with the changing regulations while ensuring the provision of quality services to expand the market development. They are also leveraging advanced data analytics tools to improve risk assessment and decision-making processes, allowing factors to gain a competitive edge.

Type: Emerging need of factoring to help businesses for managing better working capital management of the businesses

International factoring facilitates trade across borders by partnering with global factoring companies and service optimizes cash flow for businesses engaged in international transactions while minimizing risk exposure. Non-notification factoring, or confidential factoring, enables businesses to sell accounts receivable without informing customers about the involvement of a factor. Providers focus on offering discreet funding options for companies seeking to maintain customer relationships while accessing immediate financing. Notification factoring involves selling accounts receivable to a factor who assumes responsibility for collecting payments from customers. Furthermore, businesses should evaluate their requirements when choosing an appropriate factoring solution and collaborate with reputable providers offering tailored services that match their unique needs.

Industry: Exponential penetration of factoring for digital banking and government & public industries to ensure smooth financial operations

Factoring is an essential financial tool that enables businesses to maintain cash flow by selling invoices to third parties across major end-use verticals. Aerospace & defense companies rely on factoring to manage cash flow challenges due to long lead times and high capital investments. Automotive & transportation companies can benefit from factoring services by addressing liquidity issues arising from extended payment terms with suppliers or customers. The growth of digital banking services has been a significant development in this sector. These services can leverage factoring solutions to bridge payment gaps amidst fluctuating project timelines. The increasing demand for green building solutions contributes to this sector's factoring needs in building, construction & real estate. Moreover, surge in e-commerce growth boosted the adoption of factoring services owing to seasonality and inventory management challenges. Additionally, increased focus on renewable energy sources is a notable development affecting this industry. Increased public spending during the global economic recovery requires factoring services to maintain liquidity amidst high research and development costs across healthcare, manufacturing, and education. In the education sector factoring services ensure timely payments from students or governments, given their reliance on tuition fees. The continued trend of online learning expansion that started during the COVID-19 pandemic has influenced this sector.

Regional Insights:

In the Americas, factoring is widely utilized by small to medium-sized enterprises (SMEs) seeking immediate cash flows instead of waiting for invoice payments. Many factoring companies are currently focusing on collaborating with fintech companies to improve efficiency through automation solutions. The Asian market has been experiencing rapid growth in recent years because of increasing trade activities within emerging economies such as India and China. Asia-Pacific is home to smaller factoring businesses and less-established credit histories compared to other regions; however, the region shows potential for new entrants and international player expansion. Europe is among the largest factoring markets globally due to the well-established regulatory framework that promotes more comprehensive credit risk management practices. Factoring service providers in Europe focus on providing tailored solutions considering the unique needs of clients, varying from small single-invoice transactions to comprehensive supply chain finance programs for large-scale buyers and suppliers.

FPNV Positioning Matrix:

The FPNV Positioning Matrix is essential for assessing the Factoring Market. It provides a comprehensive evaluation of vendors by examining key metrics within Business Strategy and Product Satisfaction, allowing users to make informed decisions based on their specific needs. This advanced analysis then organizes these vendors into four distinct quadrants, which represent varying levels of success: Forefront (F), Pathfinder (P), Niche (N), or Vital(V).

Market Share Analysis:

The Market Share Analysis offers an insightful look at the current state of vendors in the Factoring Market. By comparing vendor contributions to overall revenue, customer base, and other key metrics, we can give companies a greater understanding of their performance and what they are up against when competing for market share. The analysis also sheds light on just how competitive any given sector is about accumulation, fragmentation dominance, and amalgamation traits over the base year period studied.

Key Company Profiles:

The report delves into recent significant developments in the Factoring Market, highlighting leading vendors and their innovative profiles. These include ABN AMRO Group, Aerofund Financial, Inc., American Receivable, Apex Capital Corp., Axiom Bank, N.A., Bluevine Inc. By Fundthrough, BNP Paribas S.A., Breakout Capital, LLC, Canbank Factors Ltd., Capital One Financial Corporation, Catalyst Financial Company, CIT Group Inc., Close Brothers Group PLC, Deutsche Leasing Group, Drip Capital Services India LLP, eCapital, Inc., FactorCloud, Fundbox, Inc., Infusion Funding, LLC, King Trade Capital, New Century Financial, Inc., Nucleus Commercial Finance Ltd., OTR Solutions, Riviera Finance of Texas, Inc., Rosenthal & Rosenthal, RTS Financial Service, Inc., Simplex Group, TBS Factoring Service, LLC, Triumph Financial, Inc., and Universal Funding Corporation.

Inquire Before Buying @ https://www.360iresearch.com/library/intelligence/factoring?utm_source=einpresswire&utm_medium=referral&utm_campaign=inquire

Market Segmentation & Coverage:

This research report categorizes the Factoring Market in order to forecast the revenues and analyze trends in each of following sub-markets:

Based on Type, market is studied across International Factoring, Non-Notification Factoring, and Notification Factoring. The International Factoring is projected to witness significant market share during forecast period.

Based on Industry, market is studied across Aerospace & Defense, Automotive & Transportation, Banking, Financial Services & Insurance, Building, Construction & Real Estate, Consumer Goods & Retail, Education, Energy & Utilities, Government & Public Sector, Healthcare & Life Sciences, Information Technology, Manufacturing, Media & Entertainment, Telecommunication, and Travel & Hospitality. The Information Technology is projected to witness significant market share during forecast period.

Based on Region, market is studied across Americas, Asia-Pacific, and Europe, Middle East & Africa. The Americas is further studied across Argentina, Brazil, Canada, Mexico, and United States. The United States is further studied across California, Florida, Illinois, New York, Ohio, Pennsylvania, and Texas. The Asia-Pacific is further studied across Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. The Europe, Middle East & Africa is further studied across Denmark, Egypt, Finland, France, Germany, Israel, Italy, Netherlands, Nigeria, Norway, Poland, Qatar, Russia, Saudi Arabia, South Africa, Spain, Sweden, Switzerland, Turkey, United Arab Emirates, and United Kingdom. The Europe, Middle East & Africa commanded largest market share of 37.29% in 2022, followed by Americas.

Key Topics Covered:

1. Preface

2. Research Methodology

3. Executive Summary

4. Market Overview

5. Market Insights

6. Factoring Market, by Type

7. Factoring Market, by Industry

8. Americas Factoring Market

9. Asia-Pacific Factoring Market

10. Europe, Middle East & Africa Factoring Market

11. Competitive Landscape

12. Competitive Portfolio

13. Appendix

The report provides insights on the following pointers:

1. Market Penetration: Provides comprehensive information on the market offered by the key players

2. Market Development: Provides in-depth information about lucrative emerging markets and analyzes penetration across mature segments of the markets

3. Market Diversification: Provides detailed information about new product launches, untapped geographies, recent developments, and investments

4. Competitive Assessment & Intelligence: Provides an exhaustive assessment of market shares, strategies, products, certification, regulatory approvals, patent landscape, and manufacturing capabilities of the leading players

5. Product Development & Innovation: Provides intelligent insights on future technologies, R&D activities, and breakthrough product developments

The report answers questions such as:

1. What is the market size and forecast of the Factoring Market?

2. Which are the products/segments/applications/areas to invest in over the forecast period in the Factoring Market?

3. What is the competitive strategic window for opportunities in the Factoring Market?

4. What are the technology trends and regulatory frameworks in the Factoring Market?

5. What is the market share of the leading vendors in the Factoring Market?

6. What modes and strategic moves are considered suitable for entering the Factoring Market?

Read More @ https://www.360iresearch.com/library/intelligence/factoring?utm_source=einpresswire&utm_medium=referral&utm_campaign=analyst

Mr. Ketan Rohom

360iResearch

+ 1 530-264-8485

ketan@360iresearch.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.