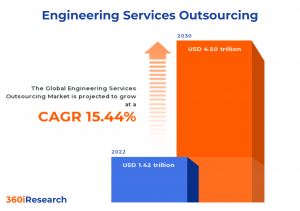

Engineering Services Outsourcing Market worth $4.50 trillion by 2030 - Exclusive Report by 360iResearch

The Global Engineering Services Outsourcing Market to grow from USD 1.42 trillion in 2022 to USD 4.50 trillion by 2030, at a CAGR of 15.44%.

PUNE, MAHARASHTRA, INDIA, November 16, 2023 /EINPresswire.com/ -- The "Engineering Services Outsourcing Market by Service (Designing, Prototyping, System Integration), Location (Off-Shore, On-Shore), Application - Global Forecast 2023-2030" report has been added to 360iResearch.com's offering.The Global Engineering Services Outsourcing Market to grow from USD 1.42 trillion in 2022 to USD 4.50 trillion by 2030, at a CAGR of 15.44%.

Request a Free Sample Report @ https://www.360iresearch.com/library/intelligence/engineering-services-outsourcing?utm_source=einpresswire&utm_medium=referral&utm_campaign=sample

Engineering services outsourcing (ESO) is a business practice where companies subcontract various engineering functions and tasks to external service providers. These service providers, often in different geographic regions or countries, offer engineering services and expertise to support a company's design, development, and engineering processes. ESO is particularly prevalent in industries where engineering is crucial, such as aerospace, automotive, electronics, and manufacturing. The heightened need for cost-effective and efficient operations, increased demand for product innovation and development, rapid technological advancements, and the evolving global regulatory landscape drive market growth. However, communication gaps and the complexities of managing offshore engagements pose challenging factors impacting market growth. The rise of Industry 4.0, emphasizing automation, machine learning, and data exchange, offers possibilities for ESO providers to establish niche areas of expertise and accelerate digital transformation to outsource more of their engineering needs, thus broadening the market scope for ESO.

Application: Poleferating use in telecom applications providing net design and optimization

Outsourcing in the Automotive sector contributes significantly to the rapid design and development of advanced safety systems, navigation tools, vehicle connectivity, and hybrid powertrains. Engineering services outsourcing plays a pivotal role in the consumer electronics sector, assisting in the quick turnaround of products such as wearables, smart appliances, and entertainment systems. In Healthcare, engineering services outsourcing aids in the design and manufacturing of medical devices, biomedical engineering, and data solutions. This fosters technological advancements in telemedicine, diagnostic and monitoring systems, and patient care, improving healthcare quality and accessibility. For the Industrial sector, outsourcing engineering services provides competitive advantages in areas such as automation, process improvement, and supply chain management. In the Semiconductor industry, outsourcing enables rapid design and development of advanced chips and circuits. Services rendered include physical design, verification, and fabrication, facilitating advancements in microprocessor technology, memory devices, and integrated circuits to cater to the exponentially growing demand in this sector. The Telecommunication sector employs engineering services outsourcing for network design, optimization, operations and maintenance, and software development. It’s instrumental in the proliferation of 5G technology, the Internet of Things (IoT), and the rollout of fiber optic networks, enhancing global communication infrastructure.

Service: Penetration of system integration services to synchronize multiple subsystems

Designing services includes the meticulous planning and organizing of resources to understand better how an engineering service can be delivered effectively. This stage ensures that the service is user-centric, competitively positioned, and provides genuine value to customers. It also involves appraising performance indicators, identifying potential areas of innovation, mapping the service processes, differentiation strategies, and compliance requirements. Prototyping is the second crucial step, where theoretical plans are given a physical form or an advanced digital representation. This is achieved through rigorous iterations and constant feasibility assessments on different models, focusing on cost-effectiveness, functionality, and user interaction. Prototypes offer a real-world execution scenario, allowing stakeholders to understand the service features illustratively. System Integration is all about synchronizing multiple subsystems into a holistic service. This step involves converging different engineering facets, combining various modules to function seamlessly as one integrated system. It ensures seamless data exchange, system compatibility, and overall process efficiency. The testing phase is the iterative process encompassing various tests to ensure the quality and correctness of the service. Ensuring a high-quality service performance consistently, testing services help to meet safety regulations, create reliable services, and contribute to customer satisfaction.

Location: High adoption of offshore engineering services outsourcing

Offshore engineering services outsourcing typically refers to engaging engineering services from professionals in different geographical areas foreign to the hiring company's domain. This outsourcing is highly adopted due to its cost-effectiveness and allows companies to access a broader pool of skills and expertise, thereby facilitating increased productivity and efficiency. Onshore engineering services Outsourcing involves outsourcing to companies within the same geographical margin as the hirer. Opted by organizations requiring close collaboration, direct control over the engineering services, and reducing language or cultural barriers, onshore outsourcing usually comes with a higher cost.

Regional Insights:

The Americas has a significant landscape in engineering services outsourcing (ESO) owing to increased demand for precision engineering services underpinned by advancements in the aerospace and defense sectors. The increasing focus on automation, the advent of Industry 4.0 trends, the surge in green energy projects, propelling the need for specialized engineering services in this sector, and high R&D spending and government incentives significantly fueled the market demand. In the European Union (EU) countries, the automotive industry plays a pivotal role, driving the need for engineering services outsourcing as the demand for electric vehicles has mainly sparked innovative designs requiring specialized engineering skills, which further enhanced the market landscape in the region. Asia Pacific nations showcase developing landscapes due to the constant need for high-quality engineering services across various sectors, prominently manufacturing and electronics. Countries sustain a continuous demand for engineering services due to technological advancement and significant investments in research.

FPNV Positioning Matrix:

The FPNV Positioning Matrix is essential for assessing the Engineering Services Outsourcing Market. It provides a comprehensive evaluation of vendors by examining key metrics within Business Strategy and Product Satisfaction, allowing users to make informed decisions based on their specific needs. This advanced analysis then organizes these vendors into four distinct quadrants, which represent varying levels of success: Forefront (F), Pathfinder (P), Niche (N), or Vital(V).

Market Share Analysis:

The Market Share Analysis offers an insightful look at the current state of vendors in the Engineering Services Outsourcing Market. By comparing vendor contributions to overall revenue, customer base, and other key metrics, we can give companies a greater understanding of their performance and what they are up against when competing for market share. The analysis also sheds light on just how competitive any given sector is about accumulation, fragmentation dominance, and amalgamation traits over the base year period studied.

Key Company Profiles:

The report delves into recent significant developments in the Engineering Services Outsourcing Market, highlighting leading vendors and their innovative profiles. These include Accenture plc, AFRY AB, Akkodis Group AG, Alten Group, Barton Malow Holdings LLC, Bechtel Corporation, Brasfield & Gorrie, LLC, Capgemini Engineering, Detroit Engineered Products, Entelect Software (Pty) Ltd., EPAM Systems, Inc., Globallogic Inc., HCL Technologies Limited, Infosys Limited, International Business Machines Corporation, Kiewit Corporation, KPIT Technologies Limited, New York Engineers, Quest Global Services Pte. Ltd., RLE International Inc., Strabag SE, Tata Consultancy Services Limited, Tech Mahindra Limited, Wipro Limited, and WPG Consulting LLC.

Inquire Before Buying @ https://www.360iresearch.com/library/intelligence/engineering-services-outsourcing?utm_source=einpresswire&utm_medium=referral&utm_campaign=inquire

Market Segmentation & Coverage:

This research report categorizes the Engineering Services Outsourcing Market in order to forecast the revenues and analyze trends in each of following sub-markets:

Based on Service, market is studied across Designing, Prototyping, System Integration, and Testing. The Testing is projected to witness significant market share during forecast period.

Based on Location, market is studied across Off-Shore and On-Shore. The Off-Shore is projected to witness significant market share during forecast period.

Based on Application, market is studied across Aerospace, Automotive, Consumer Electronics, Healthcare, Industrial, Semiconductors, and Telecom. The Healthcare is projected to witness significant market share during forecast period.

Based on Region, market is studied across Americas, Asia-Pacific, and Europe, Middle East & Africa. The Americas is further studied across Argentina, Brazil, Canada, Mexico, and United States. The United States is further studied across California, Florida, Illinois, New York, Ohio, Pennsylvania, and Texas. The Asia-Pacific is further studied across Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. The Europe, Middle East & Africa is further studied across Denmark, Egypt, Finland, France, Germany, Israel, Italy, Netherlands, Nigeria, Norway, Poland, Qatar, Russia, Saudi Arabia, South Africa, Spain, Sweden, Switzerland, Turkey, United Arab Emirates, and United Kingdom. The Americas commanded largest market share of 38.45% in 2022, followed by Europe, Middle East & Africa.

Key Topics Covered:

1. Preface

2. Research Methodology

3. Executive Summary

4. Market Overview

5. Market Insights

6. Engineering Services Outsourcing Market, by Service

7. Engineering Services Outsourcing Market, by Location

8. Engineering Services Outsourcing Market, by Application

9. Americas Engineering Services Outsourcing Market

10. Asia-Pacific Engineering Services Outsourcing Market

11. Europe, Middle East & Africa Engineering Services Outsourcing Market

12. Competitive Landscape

13. Competitive Portfolio

14. Appendix

The report provides insights on the following pointers:

1. Market Penetration: Provides comprehensive information on the market offered by the key players

2. Market Development: Provides in-depth information about lucrative emerging markets and analyzes penetration across mature segments of the markets

3. Market Diversification: Provides detailed information about new product launches, untapped geographies, recent developments, and investments

4. Competitive Assessment & Intelligence: Provides an exhaustive assessment of market shares, strategies, products, certification, regulatory approvals, patent landscape, and manufacturing capabilities of the leading players

5. Product Development & Innovation: Provides intelligent insights on future technologies, R&D activities, and breakthrough product developments

The report answers questions such as:

1. What is the market size and forecast of the Engineering Services Outsourcing Market?

2. Which are the products/segments/applications/areas to invest in over the forecast period in the Engineering Services Outsourcing Market?

3. What is the competitive strategic window for opportunities in the Engineering Services Outsourcing Market?

4. What are the technology trends and regulatory frameworks in the Engineering Services Outsourcing Market?

5. What is the market share of the leading vendors in the Engineering Services Outsourcing Market?

6. What modes and strategic moves are considered suitable for entering the Engineering Services Outsourcing Market?

Read More @ https://www.360iresearch.com/library/intelligence/engineering-services-outsourcing?utm_source=einpresswire&utm_medium=referral&utm_campaign=analyst

Mr. Ketan Rohom

360iResearch

+ 1 530-264-8485

ketan@360iresearch.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.