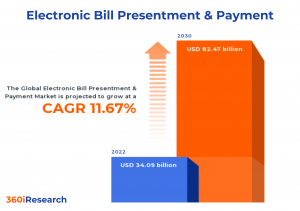

Electronic Bill Presentment & Payment Market worth $82.47 billion by 2030 - Exclusive Report by 360iResearch

The Global Electronic Bill Presentment & Payment Market to grow from USD 34.09 billion in 2022 to USD 82.47 billion by 2030, at a CAGR of 11.67%.

PUNE, MAHARASHTRA, INDIA, November 15, 2023 /EINPresswire.com/ -- The "Electronic Bill Presentment & Payment Market by Product (Electronic Bill Payment, Electronic Bill Posting, Electronic Bill Presentment), Bill or Payment Type (Electric Bill, Gas Bill, Phone Bill), Payment Channel, Vertical - Global Forecast 2023-2030" report has been added to 360iResearch.com's offering.The Global Electronic Bill Presentment & Payment Market to grow from USD 34.09 billion in 2022 to USD 82.47 billion by 2030, at a CAGR of 11.67%.

Request a Free Sample Report @ https://www.360iresearch.com/library/intelligence/electronic-bill-presentment-payment?utm_source=einpresswire&utm_medium=referral&utm_campaign=sample

Electronic bill presentment & payment (EBPP) is a method companies use to collect payments electronically via systems such as direct-dial access and automated teller machines (ATMs) and the internet. It has evolved into a core part of online banking at many financial institutions today. EBPP systems streamline the billing and payment process for businesses and consumers, reducing paper usage and manual administrative tasks. Rapid digitization, rising customer demand for convenient and speedy bill payments, and growth in e-commerce sectors expanded the market growth. However, factors include security concerns regarding electronic transactions, lack of awareness, poor internet connectivity in certain regions, and inconsistencies in regulations across different countries that hamper the market growth. Emerging markets in developing economies are gradually adopting electronic payment methods, technological advancements, shifts in consumer behavior, increasing use of smartphones, and expanding the availability of high-speed Internet, which is expected to create lucrative market opportunities.

Product: High adoption of electronic bill payment to simplify transaction processes

Electronic bill payment is one of the most useful financial tools as it helps customers by providing an automated, hassle-free method for settling the payment of invoices. It simplifies the process of paying bills and managing finances, reducing the need for manual check writing, postage, and in-person transactions. Electronic bill posting is a process in which organizations or businesses electronically publish or present their bills, invoices, and financial documents to their customers or clients. This electronic billing method allows businesses to send bills and invoices through digital channels, such as email, secure online portals, or electronic data interchange (EDI). Electronic bill presentment (EBP) is a technology and process that allows businesses, organizations, and service providers to deliver bills, invoices, and statements to their customers or clients electronically via digital channels. EBP eliminates the need for paper-based billing and enables customers to view, access, and manage their bills online through secure portals or email.

Bill or Payment Type: Potential utilization of electronic bill presentment & payment for phone bill payments

Electric utility companies can deliver electronic bills to customers via email or secure online portals. These bills are presented electronically, and customers receive notifications about their availability. Customers can access their electric bills online and make payments directly through the utility company's website or mobile app. They can choose payment methods such as credit/debit cards, bank transfers, or digital wallets. Gas companies can use EBPP to deliver digital gas bills to customers, eliminating the need for paper bills. Customers can access their gas bills through secure online portals or mobile apps, review the details, and complete payments utilizing various online payment modes. Telecommunication companies send electronic phone bills to customers via email or online billing portals. Phone bills can be paid using multiple online payment methods, including credit/debit cards, bank transfers, or digital wallets. Customers may receive automated email or text reminders about upcoming phone bill payments. Water utility companies use EBPP to send digital water bills to customers. Customers can set up scheduled payments for their water bills, ensuring they are paid regularly; also, customers receive immediate payment confirmations after completing online water bill payments.

Vertical: BFSI uses electronic bill presentment & payment for large-scale financial transactions

The BFSI sector requires a robust, secure, and efficient EBPP solution. As an industry responsible for large-scale financial transactions, there is a need for real-time payment confirmations to ensure smooth financial operations. Educational institutions demand simple and user-friendly EBPP systems primarily for collecting tuition fees and other miscellaneous charges. Government bodies opt for EBPP systems that can handle large volumes of transactions and provide seamless services to citizens. The EBPP system in healthcare needs to be HIPAA compliant with a focus on patient data privacy. The manufacturing industry opts for EBPP systems that integrate seamlessly with their existing ERP systems. Owing to the rise in subscription-based models, the media industry leans towards EBPP systems that support recurring billings. Retailers prefer EBPP solutions that offer multi-channel billing options to cater to a broader consumer base. The telecommunication sector favors EBPP systems that can handle a high volume of micro-transactions efficiently.

Payment Channel: Proliferation of mobile apps & wallets for payments

Interactive voice response (IVR) systems are employed extensively in telecommunication-based services for instant payment. Customers can interact with the company’s host system via a telephone keypad or speech recognition. Payment kiosks are self-service machines often located in public places, such as retail stores, malls, government offices, or bill payment centers. Customers can use these kiosks to pay their bills in person. Mobile apps and digital wallets on smartphones and tablets provide a convenient way for customers to access and pay their bills. These apps are offered by bill issuers, banks, and third-party payment service providers and enhance ease of payment and ensure quick transactions. Bill issuers typically provide secure websites where customers log in to the accounts and access their bills. Companies facilitate bill payments on their websites for customer convenience, enabling users to pay bills anytime without needing app downloads or extra software.

Regional Insights:

The Americas significantly contribute to the world's EBPP market, driven by increasing internet and smartphone penetration, growing customer preference for paperless transactions, and stringent regulations promoting digital transactions underscore its dominance. Further, government initiatives encourage the adoption of digital payment technologies in the region. Europe's adherence to digital payment services, swift adaptation to fintech innovations, and the strong presence of global players stimulate EBPP growth. EU's significant payment-integration initiative reflects the potential for EBPP in this region. The APAC region reflects rapid advancement in EBPP due to the proliferation of fintech companies, supportive government initiatives for cashless transactions, such as "Digital India," and a massive consumer base that has positioned APAC as a key EBPP market. Moreover, the robust e-commerce growth and an expanding middle-class population with higher internet penetration further accelerate adoption in this region.

FPNV Positioning Matrix:

The FPNV Positioning Matrix is essential for assessing the Electronic Bill Presentment & Payment Market. It provides a comprehensive evaluation of vendors by examining key metrics within Business Strategy and Product Satisfaction, allowing users to make informed decisions based on their specific needs. This advanced analysis then organizes these vendors into four distinct quadrants, which represent varying levels of success: Forefront (F), Pathfinder (P), Niche (N), or Vital(V).

Market Share Analysis:

The Market Share Analysis offers an insightful look at the current state of vendors in the Electronic Bill Presentment & Payment Market. By comparing vendor contributions to overall revenue, customer base, and other key metrics, we can give companies a greater understanding of their performance and what they are up against when competing for market share. The analysis also sheds light on just how competitive any given sector is about accumulation, fragmentation dominance, and amalgamation traits over the base year period studied.

Key Company Profiles:

The report delves into recent significant developments in the Electronic Bill Presentment & Payment Market, highlighting leading vendors and their innovative profiles. These include ACI Worldwide, Inc., Agile Payments, Alacriti Inc., Aliaswire, Inc., Alliance Payment Solutions, BTRS Holdings Inc., CORE Business Technologies, CSG Forte Payments, Inc., Doxim Inc., E-Complish, Inc., Esker, S.A., FIS Global, Fiserv, Inc., J.P. Morgan & Co., Jack Henry & Associates, Inc., Kubra, Mastercard International Incorporated, Microsoft Corporation, Nordis Technologies, Paymentus Corporation by Paymentus Holdings, ProgressSoft Corporation, Ricoh USA Inc., SAP SA, TPS Worldwide, and Western Union Financial Services, Inc..

Inquire Before Buying @ https://www.360iresearch.com/library/intelligence/electronic-bill-presentment-payment?utm_source=einpresswire&utm_medium=referral&utm_campaign=inquire

Market Segmentation & Coverage:

This research report categorizes the Electronic Bill Presentment & Payment Market in order to forecast the revenues and analyze trends in each of following sub-markets:

Based on Product, market is studied across Electronic Bill Payment, Electronic Bill Posting, and Electronic Bill Presentment. The Electronic Bill Presentment is projected to witness significant market share during forecast period.

Based on Bill or Payment Type, market is studied across Electric Bill, Gas Bill, Phone Bill, and Water Bill. The Electric Bill is projected to witness significant market share during forecast period.

Based on Payment Channel, market is studied across Interactive Voice Response, Kiosk, Mobile App & Wallets, and Website. The Mobile App & Wallets is projected to witness significant market share during forecast period.

Based on Vertical, market is studied across BFSI, Education, Government, Health care, Manufacturing, Media, Retail, and Telecommunication. The Retail is projected to witness significant market share during forecast period.

Based on Region, market is studied across Americas, Asia-Pacific, and Europe, Middle East & Africa. The Americas is further studied across Argentina, Brazil, Canada, Mexico, and United States. The United States is further studied across California, Florida, Illinois, New York, Ohio, Pennsylvania, and Texas. The Asia-Pacific is further studied across Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. The Europe, Middle East & Africa is further studied across Denmark, Egypt, Finland, France, Germany, Israel, Italy, Netherlands, Nigeria, Norway, Poland, Qatar, Russia, Saudi Arabia, South Africa, Spain, Sweden, Switzerland, Turkey, United Arab Emirates, and United Kingdom. The Americas commanded largest market share of 36.72% in 2022, followed by Europe, Middle East & Africa.

Key Topics Covered:

1. Preface

2. Research Methodology

3. Executive Summary

4. Market Overview

5. Market Insights

6. Electronic Bill Presentment & Payment Market, by Product

7. Electronic Bill Presentment & Payment Market, by Bill or Payment Type

8. Electronic Bill Presentment & Payment Market, by Payment Channel

9. Electronic Bill Presentment & Payment Market, by Vertical

10. Americas Electronic Bill Presentment & Payment Market

11. Asia-Pacific Electronic Bill Presentment & Payment Market

12. Europe, Middle East & Africa Electronic Bill Presentment & Payment Market

13. Competitive Landscape

14. Competitive Portfolio

15. Appendix

The report provides insights on the following pointers:

1. Market Penetration: Provides comprehensive information on the market offered by the key players

2. Market Development: Provides in-depth information about lucrative emerging markets and analyzes penetration across mature segments of the markets

3. Market Diversification: Provides detailed information about new product launches, untapped geographies, recent developments, and investments

4. Competitive Assessment & Intelligence: Provides an exhaustive assessment of market shares, strategies, products, certification, regulatory approvals, patent landscape, and manufacturing capabilities of the leading players

5. Product Development & Innovation: Provides intelligent insights on future technologies, R&D activities, and breakthrough product developments

The report answers questions such as:

1. What is the market size and forecast of the Electronic Bill Presentment & Payment Market?

2. Which are the products/segments/applications/areas to invest in over the forecast period in the Electronic Bill Presentment & Payment Market?

3. What is the competitive strategic window for opportunities in the Electronic Bill Presentment & Payment Market?

4. What are the technology trends and regulatory frameworks in the Electronic Bill Presentment & Payment Market?

5. What is the market share of the leading vendors in the Electronic Bill Presentment & Payment Market?

6. What modes and strategic moves are considered suitable for entering the Electronic Bill Presentment & Payment Market?

Read More @ https://www.360iresearch.com/library/intelligence/electronic-bill-presentment-payment?utm_source=einpresswire&utm_medium=referral&utm_campaign=analyst

Mr. Ketan Rohom

360iResearch

+ 1 530-264-8485

ketan@360iresearch.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.