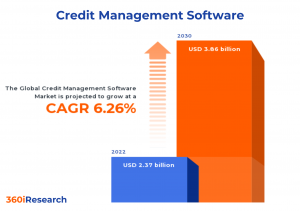

Credit Management Software Market worth $3.86 billion by 2030 - Exclusive Report by 360iResearch

The Global Credit Management Software Market to grow from USD 2.37 billion in 2022 to USD 3.86 billion by 2030, at a CAGR of 6.26%.

PUNE, MAHARASHTRA, INDIA , November 15, 2023 /EINPresswire.com/ -- The "Credit Management Software Market by Offering (Services, Software), Function (Complaints Management, Cost Calculations & Reporting, Dunning), Deployment, Organization Size - Global Forecast 2023-2030" report has been added to 360iResearch.com's offering.The Global Credit Management Software Market to grow from USD 2.37 billion in 2022 to USD 3.86 billion by 2030, at a CAGR of 6.26%.

Request a Free Sample Report @ https://www.360iresearch.com/library/intelligence/credit-management-software?utm_source=einpresswire&utm_medium=referral&utm_campaign=sample

The credit management software is designed to efficiently manage and analyze credit risk, enhance cash flow, reduce bad debts, ensure compliance with various regulations, and optimize customer relationships. This software comprises various solutions that streamline and automate the entire credit management process in financial institutions, corporations, and individual businesses. The increasing need for efficient debt recovery strategies amidst rising delinquency rates drives financial institutions towards adopting advanced tools that improve productivity and minimize human error. Additionally, the growing adoption of cloud-based solutions is another significant factor influencing market growth as it allows seamless integration of various processes across multiple platforms and offers improved accessibility while reducing infrastructure costs. Furthermore, a major concern is data security since this software deals with highly sensitive information about customers' finances, and any breach could lead to reputational damage and legal liabilities for businesses. Integrating emerging technologies, including machine learning, artificial intelligence, and big data analytics, also presents opportunities by enabling organizations to leverage advanced algorithms for predicting customer behavior patterns and implementing proactive measures for mitigating potential risks. Enhancing security features by implementing advanced encryption techniques, multi-factor authentication, and regular audits can help businesses safeguard sensitive financial data within their systems.

Deployment: Increasing deployment of cloud-based solution due to their easy accessibility and cost-effectiveness

The cloud deployment of credit management software has earned significant traction in recent years due to its scalability, flexibility, and cost-effectiveness. Businesses are opting for cloud-based credit management solutions as they provide seamless access to data and analytics from anywhere in the world. On-premises deployment remains a popular choice among businesses that have strict data security requirements and those that require extensive customization of their credit management systems. Companies with established IT infrastructure often favor on-premises solutions as they can better control system maintenance and updates.

Offering: Increasing preference for integrated platforms that provide comprehensive credit risk management capabilities

Software solutions for credit management encompass a wide range of tools that facilitate the assessment, monitoring, and optimization of credit risk within organizations. Depending on the needs and preferences of businesses, these tools can be standalone products and integrated platform solutions. The services include consulting, implementation, training & support for credit management solutions. These services are essential for organizations seeking expert guidance in selecting suitable software products tailored to their business requirements. Furthermore, services help companies optimize software usage by offering proper training and ongoing support. Companies with limited expertise in managing credit risk may find value in partnering with consulting firms to identify suitable software products and implementation partners.

Organization Size: Utilization of credit management solutions by small enterprise to manage complex financial operations

Large enterprises require comprehensive credit management software solutions that can handle high volumes of data, integrate with multiple systems, and provide advanced risk assessment capabilities. They prefer scalable solutions with deep integration capabilities, allowing seamless communication with other enterprise applications such as ERP systems or CRM platforms. Small & medium enterprises often seek cost-effective credit management software that offers essential features without compromising on efficiency and reliability.

Function: Growing utilization of credit management software for dunning for recovering outstanding payments

Complaints management is essential in credit management software as it enables businesses to effectively handle customer grievances related to credit disputes, billing issues, and loan servicing. Cost calculations and reporting allow firms to assess their credit portfolio performance and make informed decisions for optimizing revenue growth while minimizing risks. Organizations with large-scale lending operations or complex financial structures prefer this feature to streamline internal processes and improve decision-making efficiency. Dunning is a vital function of credit management software that automates the process of contacting customers for debt collection. Businesses that handle a large volume of receivables or have multiple overdue accounts prefer this feature as it improves their cash flow management and reduces manual workloads associated with collections efforts.

Regional Insights:

In the American region, credit management software is widely adopted by financial institutions and businesses due to its capability to mitigate credit risks, improve cash flow, and streamline the overall debt recovery process. America has major established players along with new startups contributing to significant investments in research and development, paving the way for innovative solutions in the region. In the European Union, countries such as Germany, France, and Italy are experiencing rapid adoption of credit management software. The EU’s strict data protection regulations have led to an increase in demand for secure and compliant credit management solutions, driving innovation within this space. The APAC witnessed a surge in fintech startups and investments, resulting in increased adoption of credit management software solutions among banks and non-banking financial companies. The APAC region has rapidly growing economies that foster expansion opportunities for global players looking to tap into its vast consumer base.

FPNV Positioning Matrix:

The FPNV Positioning Matrix is essential for assessing the Credit Management Software Market. It provides a comprehensive evaluation of vendors by examining key metrics within Business Strategy and Product Satisfaction, allowing users to make informed decisions based on their specific needs. This advanced analysis then organizes these vendors into four distinct quadrants, which represent varying levels of success: Forefront (F), Pathfinder (P), Niche (N), or Vital(V).

Market Share Analysis:

The Market Share Analysis offers an insightful look at the current state of vendors in the Credit Management Software Market. By comparing vendor contributions to overall revenue, customer base, and other key metrics, we can give companies a greater understanding of their performance and what they are up against when competing for market share. The analysis also sheds light on just how competitive any given sector is about accumulation, fragmentation dominance, and amalgamation traits over the base year period studied.

Key Company Profiles:

The report delves into recent significant developments in the Credit Management Software Market, highlighting leading vendors and their innovative profiles. These include Alterity, LLC by CAI Software, LLC, Apruve, Inc., Banqsoft A/S, Bectran Inc., BlackLine Systems, Inc., CE-iT B.V., Chaser Technologies Limite, Coface by Natixis SA, CreditDevice B.V., CreditForce by Innovation Software Limited, CRIF SpA, Emagia Corporation, Equiniti Limited, Esker, Inc., HighRadius Corporation, Innovative ERP Solutions Ltd., Intelloger Technologies Pvt Ltd., MaxCredible B.V., METRO AG, My DSO Manager by P2B Solutions, Onguard by Visma Group, Payt Software, Pegasystems Inc., Prof. Schumann GmbH, Qualco SA, Serrala Group GmbH, Sidetrade SA, Sysmatch, Tally Solutions Private Limited, and Xolv Finance BV.

Inquire Before Buying @ https://www.360iresearch.com/library/intelligence/credit-management-software?utm_source=einpresswire&utm_medium=referral&utm_campaign=inquire

Market Segmentation & Coverage:

This research report categorizes the Credit Management Software Market in order to forecast the revenues and analyze trends in each of following sub-markets:

Based on Offering, market is studied across Services and Software. The Software is further studied across Integrated and Standalone. The Services is projected to witness significant market share during forecast period.

Based on Function, market is studied across Complaints Management, Cost Calculations & Reporting, and Dunning. The Complaints Management is projected to witness significant market share during forecast period.

Based on Deployment, market is studied across Cloud and On-Premises. The On-Premises is projected to witness significant market share during forecast period.

Based on Organization Size, market is studied across Large Enterprises and Small & Medium Enterprises. The Small & Medium Enterprises is projected to witness significant market share during forecast period.

Based on Region, market is studied across Americas, Asia-Pacific, and Europe, Middle East & Africa. The Americas is further studied across Argentina, Brazil, Canada, Mexico, and United States. The United States is further studied across California, Florida, Illinois, New York, Ohio, Pennsylvania, and Texas. The Asia-Pacific is further studied across Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. The Europe, Middle East & Africa is further studied across Denmark, Egypt, Finland, France, Germany, Israel, Italy, Netherlands, Nigeria, Norway, Poland, Qatar, Russia, Saudi Arabia, South Africa, Spain, Sweden, Switzerland, Turkey, United Arab Emirates, and United Kingdom. The Americas commanded largest market share of 41.32% in 2022, followed by Europe, Middle East & Africa.

Key Topics Covered:

1. Preface

2. Research Methodology

3. Executive Summary

4. Market Overview

5. Market Insights

6. Credit Management Software Market, by Offering

7. Credit Management Software Market, by Function

8. Credit Management Software Market, by Deployment

9. Credit Management Software Market, by Organization Size

10. Americas Credit Management Software Market

11. Asia-Pacific Credit Management Software Market

12. Europe, Middle East & Africa Credit Management Software Market

13. Competitive Landscape

14. Competitive Portfolio

15. Appendix

The report provides insights on the following pointers:

1. Market Penetration: Provides comprehensive information on the market offered by the key players

2. Market Development: Provides in-depth information about lucrative emerging markets and analyzes penetration across mature segments of the markets

3. Market Diversification: Provides detailed information about new product launches, untapped geographies, recent developments, and investments

4. Competitive Assessment & Intelligence: Provides an exhaustive assessment of market shares, strategies, products, certification, regulatory approvals, patent landscape, and manufacturing capabilities of the leading players

5. Product Development & Innovation: Provides intelligent insights on future technologies, R&D activities, and breakthrough product developments

The report answers questions such as:

1. What is the market size and forecast of the Credit Management Software Market?

2. Which are the products/segments/applications/areas to invest in over the forecast period in the Credit Management Software Market?

3. What is the competitive strategic window for opportunities in the Credit Management Software Market?

4. What are the technology trends and regulatory frameworks in the Credit Management Software Market?

5. What is the market share of the leading vendors in the Credit Management Software Market?

6. What modes and strategic moves are considered suitable for entering the Credit Management Software Market?

Read More @ https://www.360iresearch.com/library/intelligence/credit-management-software?utm_source=einpresswire&utm_medium=referral&utm_campaign=analyst

Mr. Ketan Rohom

360iResearch

+1 530-264-8485

ketan@360iresearch.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.