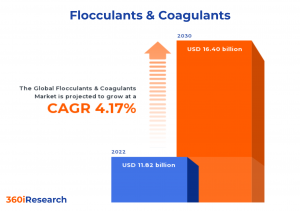

Flocculants & Coagulants Market worth $16.40 billion by 2030 - Exclusive Report by 360iResearch

The Global Flocculants & Coagulants Market to grow from USD 11.82 billion in 2022 to USD 16.40 billion by 2030, at a CAGR of 4.17%.

PUNE, MAHARASHTRA, INDIA, November 10, 2023 /EINPresswire.com/ -- The "Flocculants & Coagulants Market by Product (Coagulants, Flocculants), Type (Inorganic, Organic), Form, End-User - Global Forecast 2023-2030" report has been added to 360iResearch.com's offering.The Global Flocculants & Coagulants Market to grow from USD 11.82 billion in 2022 to USD 16.40 billion by 2030, at a CAGR of 4.17%.

Request a Free Sample Report @ https://www.360iresearch.com/library/intelligence/flocculants-coagulants?utm_source=einpresswire&utm_medium=referral&utm_campaign=sample

The flocculants & coagulants market comprises chemical substances employed in the treatment of drinking water, wastewater, and many industrial processes. These chemicals facilitate the aggregation of suspended particles in fluids, resulting in the formation of flocs and precipitates, which can be easily separated from the liquid medium. Increasing demand for clean water across various industries has driven businesses to adopt enhanced water treatment techniques that utilize these chemicals. Additionally, strict regulations imposed by governments worldwide related to water quality standards have necessitated effective treatment solutions using flocculating and coagulating agents. Despite the progress made in this sector, several limitations and challenges persist across the flocculants & coagulants market. The fluctuating cost of raw materials directly impacts product prices, making it difficult for manufacturers to maintain stable prices in a competitive market. Additionally, concerns about environmental sustainability pose a threat to long-term growth as governments implement stricter regulations and promote eco-friendly alternatives. However, advanced polymerization techniques are being employed to create tailor-made products with precise molecular weight distribution ranges that ensure efficient performance at minimal doses. Additionally, manufacturers can leverage nanotechnology-based solutions to create more effective flocculating and coagulating agents with precise control over particle size. Moreover, using advanced analytics and process modeling in water treatment plants is helping manufacturers optimize their products for specific applications.

Product: Growing demand for coagulants in municipal water treatment plants and industrial wastewater facilities

Coagulants are vital for promoting the aggregation of suspended particles in water, enabling the effective removal of contaminants such as organic matter, bacteria, and colloidal particles. They form larger flocs that can be separated through sedimentation or filtration processes. Coagulants find applications in municipal water treatment plants, industrial wastewater facilities, and desalination plants. The primary categories of coagulants are inorganic such as aluminum sulfate) and organic, including polyDADMACs. Flocculants are utilized in diverse applications, such as wastewater treatment plants and stormwater management systems. They are categorized into anionic (negatively charged), cationic (positively charged), and non-ionic (no charge) types. Both coagulants and flocculants play crucial roles in maintaining water quality; however, selecting the appropriate type is vital for optimal results. Factors influencing product selection include water chemistry, contaminant types, system design, and operational conditions.

Type: Significant utilization of inorganic flocculants and coagulants owing to their low cost and high efficiency

Inorganic and organic flocculants and coagulants play vital roles in water treatment processes due to their distinct advantages. Inorganic variants, primarily composed of metal salts such as aluminum sulfate, ferric chloride, ferrous sulfate, and sodium aluminate are preferred for their low cost and high efficiency in treating issues such as turbidity, color, and heavy metals in water. Aluminum sulfate is one of the most commonly used inorganic coagulants. It reacts with dissolved impurities to form insoluble aluminum hydroxide precipitates, easily removed through sedimentation or filtration. It is used extensively for treating drinking water, wastewater, industrial effluents, and swimming pool water. Ferric chloride is a chemical compound that works similarly to alum although uses ferric ions instead of aluminum. Ferric chloride is highly effective at removing suspended solids, phosphorus compounds, heavy metals, and other contaminants from water streams. Ferrous sulfate serves as an alternative to ferric chloride for treatment processes that require milder pH conditions. Sodium aluminate offers an alternative to alum and other aluminum-based coagulants, effective in applications with high alkalinity or when a higher pH is desired for the treated water. Inorganic coagulants may be unsuitable for all applications due to concerns about residual metals or increased sludge generation. Organic flocculants offer an alternative solution derived from natural or synthetic polymers, including poly(diallyldimethylammonium chloride), polyacrylamide derivatives, and polyamines. They are particularly effective in addressing specific water treatment challenges such as oil and grease removal or bio-toxicity reduction. Poly(diallyldimethylammonium chloride) (PolyDADMAC) is a cationic polyelectrolyte that effectively neutralizes negatively charged particles in water, causing them to aggregate into larger flocs. It is widely utilized in municipal wastewater treatment, industrial processes, and drinking water purification due to its low toxicity and excellent performance at various pH levels. Polyacrylamide Derivatives are synthetic polymers that come in different molecular weights and charge densities, enabling them to be tailored for specific treatment needs. They are highly effective at increasing floc size and promoting rapid sedimentation of suspended solids. Polyamines are organic coagulants that contain nitrogenous functional groups. They can neutralize negatively charged particles, promote floc formation, and improve filtration efficiency in various water treatment settings. Polyamines are commonly used for treating raw waters with low turbidity or during clarification processes in the papermaking industry. The selection between inorganic and organic flocculants depends on the desired application efficacy while balancing cost considerations and environmental impact concerns.

End-User: Increasing usage of flocculants and coagulants in food processing industries

The food & beverage industry requires high-quality water for production processes and maintaining hygiene standards. Flocculants & coagulants are vital in removing impurities, including suspended solids, organic matter, and bacteria, from the water. In the metals and mining sector, the extraction, processing, and refining of ores generate large volumes of wastewater having high concentrations of suspended solids and heavy metals. Flocculants & coagulants help treat this wastewater by promoting particle aggregation and settling out contaminants before discharge or reuse. Municipal water treatment facilities require flocculants and coagulants to purify drinking water and treat wastewater before releasing it into the environment. The primary goal is removing turbidity-causing particles such as silt, clay, and algae blooms in natural surface waters. The oil & gas industry employs flocculants & coagulants to treat produced water and process applications such as enhanced oil recovery. In the pulp and paper industry, flocculants & coagulants are essential for water recycling and effluent treatment by removing suspended solids or color-causing compounds from wastewater streams. The increasing demand for sustainable solutions and addressing environmental concerns have led manufacturers to develop innovative products tailored to diverse challenges while maintaining profitability in the metals & mining, municipal water treatment, and oil & gas industries.

Form: Robust adoption of liquid flocculants and coagulants due to ease of use

Liquid flocculants and coagulants are popular in water treatment processes due to their ease of application, rapid response times, minimal equipment requirements, accurate dosing control, uniform distribution, and reduced sludge production. Powdered flocculants and coagulants are preferred in industries where cost-effectiveness or limited storage space is essential; they offer an extended shelf life and lower transportation costs. Liquid forms provide better application control; however, they may incur higher transportation expenses. Powder forms offer cost advantages, although they require specialized equipment for accurate dosing. The selection between liquid or powder flocculants & coagulants depends on factors such as industry-specific requirements, storage space availability, cost considerations, and handling preferences.

Regional Insights:

The Americas region has been experiencing a surge in demand for flocculants & coagulants due to the escalating need for potable water treatment facilities and wastewater management systems. Strict environmental regulations on water pollution are bolstering the adoption of these chemicals in industries such as oil & gas, mining, power generation, pulp & paper, textiles, and food & beverages, among others. Moreover, ongoing investments in research & development activities are aimed at developing innovative products with improved efficiency to meet the specific requirements of end-users in this region. The EMEA region is witnessing robust growth in the flocculant & coagulant market owing to strict environmental regulations imposed by European governments that mandate industries to adopt sustainable water management practices. Additionally, increased awareness about water conservation requirements has led to higher adoption rates of these chemicals across various sectors, including municipal wastewater treatment plants. Manufacturers have undertaken numerous research & development initiatives across Europe to develop advanced products with higher efficiency, reduced environmental impact, and lower operational costs. In particular regions such as the Middle East & Africa, where water scarcity is a pressing issue, there's an evident need for efficient water treatment solutions, which further propels the demand for flocculants and coagulants. Moreover, governments across countries such as India, China, and Japan are implementing stringent regulations on industrial wastewater discharge and investing heavily in upgrading existing water infrastructure. These factors collectively contribute to the escalating demand for flocculants and coagulants across various sectors, such as municipal water treatment plants, power generation, and chemical industries.

FPNV Positioning Matrix:

The FPNV Positioning Matrix is essential for assessing the Flocculants & Coagulants Market. It provides a comprehensive evaluation of vendors by examining key metrics within Business Strategy and Product Satisfaction, allowing users to make informed decisions based on their specific needs. This advanced analysis then organizes these vendors into four distinct quadrants, which represent varying levels of success: Forefront (F), Pathfinder (P), Niche (N), or Vital(V).

Market Share Analysis:

The Market Share Analysis offers an insightful look at the current state of vendors in the Flocculants & Coagulants Market. By comparing vendor contributions to overall revenue, customer base, and other key metrics, we can give companies a greater understanding of their performance and what they are up against when competing for market share. The analysis also sheds light on just how competitive any given sector is about accumulation, fragmentation dominance, and amalgamation traits over the base year period studied.

Key Company Profiles:

The report delves into recent significant developments in the Flocculants & Coagulants Market, highlighting leading vendors and their innovative profiles. These include Aditya Birla Chemicals by Aditya Birla Group, Akzo Nobel N.V., Aries Chemical, Inc., BASF SE, BAUMINAS Group, Biomicrogel, Buckman, CarboNet, ChemREADY by Zinkan Enterprises, Inc., Chemtrade Logistics Income Fund, Condat, CTX Professional by Fluidra S.A., Di-Corp, Inc., Dia-Chemical Sdn. Bhd., Ecolab Inc., Ecologix Environmental Systems, LLC, Environex International Pty Ltd., Feralco AB, Henan GO Biotech Co.,Ltd, Hunan Yide Chemical Co., Ltd., INWACO process solutions AB, Ixom Operations Pty Ltd., Jayem Engineers, Kemira Oyj, Kendensha Co. Ltd., KSP Water Treatment Chemicals, Mitsui Chemicals, Inc., NIPPON SHOKUBAI CO., LTD., REDA Group, SERVYECO, SNF S.A., Solenis LLC, Solvay SA, Thermax Limited, Tidal Vision, Toagosei Co., Ltd., Veolia Environnement S.A., Vertex Chem Pvt. Ltd., and Yixing Cleanwater Chemicals Co., Ltd..

Inquire Before Buying @ https://www.360iresearch.com/library/intelligence/flocculants-coagulants?utm_source=einpresswire&utm_medium=referral&utm_campaign=inquire

Market Segmentation & Coverage:

This research report categorizes the Flocculants & Coagulants Market in order to forecast the revenues and analyze trends in each of following sub-markets:

Based on Product, market is studied across Coagulants and Flocculants. The Coagulants commanded largest market share of 57.88% in 2022, followed by Flocculants.

Based on Type, market is studied across Inorganic and Organic. The Inorganic is further studied across Aluminum Sulfate, Ferric Chloride, Ferrous Sulfate, and Sodium Aluminate. The Organic is further studied across Poly(diallyldimethylammonium chloride), Polyacrylamide Derivatives, and Polyamines. The Inorganic commanded largest market share of 82.77% in 2022, followed by Organic.

Based on Form, market is studied across Liquid and Powder. The Liquid commanded largest market share of 50.77% in 2022, followed by Powder.

Based on End-User, market is studied across Food & Beverage, Metals & Mining, Municipal Water Treatment, Oil & Gas, and Pulp & Paper. The Municipal Water Treatment commanded largest market share of 42.12% in 2022, followed by Metals & Mining.

Based on Region, market is studied across Americas, Asia-Pacific, and Europe, Middle East & Africa. The Americas is further studied across Argentina, Brazil, Canada, Mexico, and United States. The United States is further studied across California, Florida, Illinois, New York, Ohio, Pennsylvania, and Texas. The Asia-Pacific is further studied across Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. The Europe, Middle East & Africa is further studied across Denmark, Egypt, Finland, France, Germany, Israel, Italy, Netherlands, Nigeria, Norway, Poland, Qatar, Russia, Saudi Arabia, South Africa, Spain, Sweden, Switzerland, Turkey, United Arab Emirates, and United Kingdom. The Europe, Middle East & Africa commanded largest market share of 39.37% in 2022, followed by Asia-Pacific.

Key Topics Covered:

1. Preface

2. Research Methodology

3. Executive Summary

4. Market Overview

5. Market Insights

6. Flocculants & Coagulants Market, by Product

7. Flocculants & Coagulants Market, by Type

8. Flocculants & Coagulants Market, by Form

9. Flocculants & Coagulants Market, by End-User

10. Americas Flocculants & Coagulants Market

11. Asia-Pacific Flocculants & Coagulants Market

12. Europe, Middle East & Africa Flocculants & Coagulants Market

13. Competitive Landscape

14. Competitive Portfolio

15. Appendix

The report provides insights on the following pointers:

1. Market Penetration: Provides comprehensive information on the market offered by the key players

2. Market Development: Provides in-depth information about lucrative emerging markets and analyzes penetration across mature segments of the markets

3. Market Diversification: Provides detailed information about new product launches, untapped geographies, recent developments, and investments

4. Competitive Assessment & Intelligence: Provides an exhaustive assessment of market shares, strategies, products, certification, regulatory approvals, patent landscape, and manufacturing capabilities of the leading players

5. Product Development & Innovation: Provides intelligent insights on future technologies, R&D activities, and breakthrough product developments

The report answers questions such as:

1. What is the market size and forecast of the Flocculants & Coagulants Market?

2. Which are the products/segments/applications/areas to invest in over the forecast period in the Flocculants & Coagulants Market?

3. What is the competitive strategic window for opportunities in the Flocculants & Coagulants Market?

4. What are the technology trends and regulatory frameworks in the Flocculants & Coagulants Market?

5. What is the market share of the leading vendors in the Flocculants & Coagulants Market?

6. What modes and strategic moves are considered suitable for entering the Flocculants & Coagulants Market?

Read More @ https://www.360iresearch.com/library/intelligence/flocculants-coagulants?utm_source=einpresswire&utm_medium=referral&utm_campaign=analyst

Mr. Ketan Rohom

360iResearch

+1 530-264-8485

ketan@360iresearch.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.