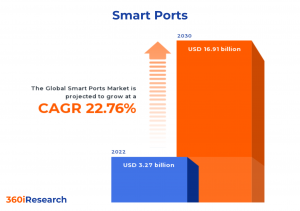

Smart Ports Market worth $16.91 billion by 2030, growing at a CAGR of 22.76% - Exclusive Report by 360iResearch

The Global Smart Ports Market to grow from USD 3.27 billion in 2022 to USD 16.91 billion by 2030, at a CAGR of 22.76%.

PUNE, MAHARASHTRA, INDIA, November 10, 2023 /EINPresswire.com/ -- The "Smart Ports Market by Technology (Artificial Intelligence, Blockchain, Internet of Things), Solution (Gate Automation Solutions, Port Community System (PCS), Smart Cargo-handling System), Throughput Capacity, Port Type - Global Forecast 2023-2030" report has been added to 360iResearch.com's offering.The Global Smart Ports Market to grow from USD 3.27 billion in 2022 to USD 16.91 billion by 2030, at a CAGR of 22.76%.

Request a Free Sample Report @ https://www.360iresearch.com/library/intelligence/smart-ports?utm_source=einpresswire&utm_medium=referral&utm_campaign=sample

Smart ports integrate advanced technologies, such as blockchain, the Internet of Things (IoT), and data analytics, into port operations to enhance efficiency, security, sustainability, and overall management. Rapid urbanization and increasing global trade volumes increase the demand for efficient cargo-handling solutions. Furthermore, stringent government regulations regarding greenhouse gas emissions have driven port authorities to adopt environmentally friendly solutions that employ renewable energy sources and smart waste disposal systems. However, the high initial investments required for incorporating advanced technologies could prevent smaller ports from adopting these solutions. In addition to technological advancements and the adoption of IoT-enabled sensor networks to allow real-time tracking and monitoring of assets within ports is expected to encourage the adoption of smart port solutions globally.

Technology: Deployment of process automation technology in smart ports

Artificial Intelligence (AI) optimizes operations, improving decision-making and enhancing shipping efficiencies in smart ports. AI-powered tools can efficiently analyze data to predict equipment maintenance needs and identify bottlenecks. Blockchain technology ensures secure and transparent data sharing among stakeholders in the maritime sector while reducing paperwork and streamlining processes. It simplifies trade documentation, customs clearance procedures, and financial transactions for all parties involved. The Internet of Things (IoT) is creating transformative smart ports by enabling real-time monitoring of assets and fostering seamless communication between systems throughout the supply chain ecosystem. IoT technologies such as sensors, GPS trackers, and RFID tags help monitor cargo movement within the port premises and track containers during transit, optimizing resource allocation decisions based on accurate data insights from connected devices. Process automation technologies are integral in smart ports as they enhance operational efficiency by automating manual tasks, reducing human error, and increasing productivity. AI enables data-driven decision-making processes and predictive maintenance capabilities; blockchain facilitates secure information sharing among stakeholders; IoT provides real-time asset monitoring for improved resource allocation; and process automation reduces human intervention, leading to increased productivity levels within port operations.

Solution: Extensive use of smart cargo-handling system to enhance operational efficiency

Gate automation solutions enhance smart port security, efficiency, and traffic management. These solutions amalgamate advanced technologies such as optical character recognition (OCR), automatic license plate recognition (ALPR), and radio frequency identification (RFID) to facilitate seamless entry and exit of vehicles and cargo. Port Community Systems (PCS) are essential for improving communication, collaboration, and data exchange among various stakeholders within a port ecosystem. PCS enables streamlining cargo handling, customs clearance, and logistics management processes through a centralized platform. Smart cargo-handling systems optimize cargo loading or unloading operations through remote-controlled equipment such as automated gantry cranes, straddle carriers, and robotic arms. This technology increases safety measures while reducing labor costs and equipment downtime. Traffic monitoring systems are vital for managing congestion, optimizing vessel movements, and ensuring safety at smart ports. These solutions employ advanced sensors, cameras, radar technology, and real-time data analytics to monitor waterway traffic and support decision-making. Gate automation solutions primarily focus on security improvement and smooth vehicular movement. PCS targets enhanced communication between stakeholders within a port ecosystem. Smart cargo-handling systems aim to boost productivity while maintaining safety standards during loading and unloading. Traffic monitoring systems prioritize managing congestion and optimizing vessel movements.

Throughput Capacity: Proliferating demand for automation across extensively busy ports

Extensively busy ports handle a significant portion of global trade, facilitating the daily movement of massive cargo volumes. The throughput capacity range for extensively busy ports ranges between 10 million and 30 million twenty-foot equivalent units (TEUs) per annum. Investments in infrastructure, automation, and digitization have become crucial for ensuring efficient operations at these ports. Moderately busy ports handle a considerable cargo volume; however, they do not experience the same congestion levels as their extensively busy counterparts. Their throughput capacity ranges between 1 million to 10 million TEUs per annum. Such ports generally employ smart solutions such as real-time traffic management systems, Intelligent Transport Systems (ITS), and digital data exchange platforms to improve efficiency further while maintaining economic competitiveness among other major regional players. Scarcely busy ports are often located in remote areas or serve specialized niche markets. For these ports, the focus is on maintaining cost-effective operations with minimal investments in smart technologies. Scarcely busy ports handle less than 1 million TEUs per annum. These ports have lower volumes of cargo movement than extensively bust and moderately busy ports; however, they remain essential components within niche trade routes or as secondary options within broader shipping networks. Extensively busy ports prioritize comprehensive automation and digitization initiatives, while moderately busy ports seek targeted solutions from vendors to enhance resource utilization without heavy investments. Scarcely busy ports prefer affordable local solutions or regional partnerships that cater to their specific requirements while keeping costs low.

Port Type: Adoption of innovative port management technologies by inland ports

Inland ports are essential components of the supply chain and trade as they facilitate the movement of goods between land and water transportation networks. They primarily serve as intermodal hubs where various transport modes such as rail, road, and sometimes river converge to enable seamless cargo transfer. Inland ports play a crucial role in reducing congestion at seaports by providing an alternative location for cargo handling and storage. Additionally, they enhance connectivity with hinterlands and facilitate smoother trade flows between regions. Furthermore, implementing smart technologies in inland ports improves operational efficiency through automation, real-time data analytics, and advanced security systems. Seaports are gateways for international trade that connect maritime routes with land-based transportation networks. They support large-scale cargo handling operations involving container ships, bulk carriers, tankers, and other specialized vessels. Seaports can accommodate larger vessels, facilitating higher cargo volume movement. They also serve as critical nodes for regional and global trade flows, enabling economies to access international markets and resources. With smart technologies in seaports, operations have become more efficient while reducing environmental impacts through energy conservation, waste reduction, and carbon emissions reduction.

Regional Insights:

The smart ports market is evolving in the Americas due to digitization initiatives to enhance efficiency and optimize supply chain management. The ports in the region are leveraging technology investments to drive environmental sustainability by adopting shore power systems for vessels. Many member countries in the EU have committed to investing in smart port infrastructure as part of their national digital agendas. In the Middle East & Africa region (MEA), governments increasingly recognize the potential of smart port systems to boost economic growth while ensuring sustainable resource management. In addition, South African ports are undergoing a digital upgrade to enhance their competitiveness within the global market. The APAC region is investing heavily in smart port technology to maintain its position as a major trading economy. Economic growth aspirations, sustainable resource management goals, and technological advancements result in elevated growth of the smart ports market in the APAC region. In addition, a rise in research and innovation initiatives and the upgradation of existing port infrastructures are expected to boost the adoption of smart port solutions globally.

FPNV Positioning Matrix:

The FPNV Positioning Matrix is essential for assessing the Smart Ports Market. It provides a comprehensive evaluation of vendors by examining key metrics within Business Strategy and Product Satisfaction, allowing users to make informed decisions based on their specific needs. This advanced analysis then organizes these vendors into four distinct quadrants, which represent varying levels of success: Forefront (F), Pathfinder (P), Niche (N), or Vital(V).

Market Share Analysis:

The Market Share Analysis offers an insightful look at the current state of vendors in the Smart Ports Market. By comparing vendor contributions to overall revenue, customer base, and other key metrics, we can give companies a greater understanding of their performance and what they are up against when competing for market share. The analysis also sheds light on just how competitive any given sector is about accumulation, fragmentation dominance, and amalgamation traits over the base year period studied.

Key Company Profiles:

The report delves into recent significant developments in the Smart Ports Market, highlighting leading vendors and their innovative profiles. These include ABB Ltd., Abu Dhabi Ports PSJC, Accenture PLC, Advantech Co., Ltd., Amazon Web Services, Inc., Awake.AI Ltd., Cargotec Oyj, Cisco Systems, Inc., Continental AG, CyberLogitec Co., Ltd. by Eusu Holdings Co., Ltd., Deutsche Telekom AG, Envision Enterprise Solutions Pvt. Ltd., Evergreen Marine Corp.(Taiwan) Limited, Fujitsu Limited, General Electric Company, Hitachi Energy Ltd., Honeywell International Inc., Huawei Technologies Co., Ltd., Hutchison Port Holdings Limited, Identec Solutions AG, Intel Corporation, International Business Machines Corporation, Konecranes PLC, Microsoft Corporation, Mitsui O.S.K. Lines, Ltd., Nokia Corporation, Nortal AS, Royal HaskoningDHV, Schneider Electric SE, Shenzhen Kunyun Information Technology Co., Ltd., Siemens AG, SINAY SAS, Tata Consultancy Services Limited, Tech Mahindra Limited, Telefonaktiebolaget LM Ericsson, Trelleborg AB, Webb Fontaine Group, Windward Ltd., Wipro Limited, and ZPMC Shanghai Zhenhua Heavy industries Co.Ltd..

Inquire Before Buying @ https://www.360iresearch.com/library/intelligence/smart-ports?utm_source=einpresswire&utm_medium=referral&utm_campaign=inquire

Market Segmentation & Coverage:

This research report categorizes the Smart Ports Market in order to forecast the revenues and analyze trends in each of following sub-markets:

Based on Technology, market is studied across Artificial Intelligence, Blockchain, Internet of Things, and Process Automation. The Process Automation commanded largest market share of 34.32% in 2022, followed by Internet of Things.

Based on Solution, market is studied across Gate Automation Solutions, Port Community System (PCS), Smart Cargo-handling System, and Traffic-Monitoring System. The Gate Automation Solutions commanded largest market share of 25.30% in 2022, followed by Smart Cargo-handling System.

Based on Throughput Capacity, market is studied across Extensively Busy, Moderately Busy, and Scarcely Busy. The Extensively Busy commanded largest market share of 42.65% in 2022, followed by Moderately Busy.

Based on Port Type, market is studied across Inland Port and Seaport. The Inland Port commanded largest market share of 85.88% in 2022, followed by Seaport.

Based on Region, market is studied across Americas, Asia-Pacific, and Europe, Middle East & Africa. The Americas is further studied across Argentina, Brazil, Canada, Mexico, and United States. The United States is further studied across California, Florida, Georgia, Illinois, New York, Ohio, Pennsylvania, Texas, Virginia, and Washington. The Asia-Pacific is further studied across Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. The Europe, Middle East & Africa is further studied across Denmark, Egypt, Finland, France, Germany, Israel, Italy, Netherlands, Nigeria, Norway, Poland, Qatar, Russia, Saudi Arabia, South Africa, Spain, Sweden, Switzerland, Turkey, United Arab Emirates, and United Kingdom. The Europe, Middle East & Africa commanded largest market share of 39.09% in 2022, followed by Americas.

Key Topics Covered:

1. Preface

2. Research Methodology

3. Executive Summary

4. Market Overview

5. Market Insights

6. Smart Ports Market, by Technology

7. Smart Ports Market, by Solution

8. Smart Ports Market, by Throughput Capacity

9. Smart Ports Market, by Port Type

10. Americas Smart Ports Market

11. Asia-Pacific Smart Ports Market

12. Europe, Middle East & Africa Smart Ports Market

13. Competitive Landscape

14. Competitive Portfolio

15. Appendix

The report provides insights on the following pointers:

1. Market Penetration: Provides comprehensive information on the market offered by the key players

2. Market Development: Provides in-depth information about lucrative emerging markets and analyzes penetration across mature segments of the markets

3. Market Diversification: Provides detailed information about new product launches, untapped geographies, recent developments, and investments

4. Competitive Assessment & Intelligence: Provides an exhaustive assessment of market shares, strategies, products, certification, regulatory approvals, patent landscape, and manufacturing capabilities of the leading players

5. Product Development & Innovation: Provides intelligent insights on future technologies, R&D activities, and breakthrough product developments

The report answers questions such as:

1. What is the market size and forecast of the Smart Ports Market?

2. Which are the products/segments/applications/areas to invest in over the forecast period in the Smart Ports Market?

3. What is the competitive strategic window for opportunities in the Smart Ports Market?

4. What are the technology trends and regulatory frameworks in the Smart Ports Market?

5. What is the market share of the leading vendors in the Smart Ports Market?

6. What modes and strategic moves are considered suitable for entering the Smart Ports Market?

Read More @ https://www.360iresearch.com/library/intelligence/smart-ports?utm_source=einpresswire&utm_medium=referral&utm_campaign=analyst

Mr. Ketan Rohom

360iResearch

+ +1 530-264-8485

ketan@360iresearch.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.