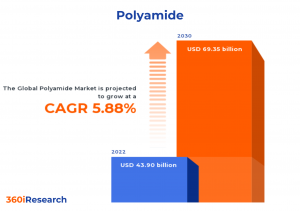

Polyamide Market worth $69.35 billion by 2030, growing at a CAGR of 5.88% - Exclusive Report by 360iResearch

The Global Polyamide Market to grow from USD 43.90 billion in 2022 to USD 69.35 billion by 2030, at a CAGR of 5.88%.

PUNE, MAHARASHTRA, INDIA, November 10, 2023 /EINPresswire.com/ -- The "Polyamide Market by Product (Aliphatic Polyamides, Aromatic Polyamides), Type (Bio-Based, Conventional), End-User Industries - Global Forecast 2023-2030" report has been added to 360iResearch.com's offering.The Global Polyamide Market to grow from USD 43.90 billion in 2022 to USD 69.35 billion by 2030, at a CAGR of 5.88%.

Request a Free Sample Report @ https://www.360iresearch.com/library/intelligence/polyamide?utm_source=einpresswire&utm_medium=referral&utm_campaign=sample

The polyamide market includes the production, sales, and application of diverse synthetic polymers known as nylons, characterized by their durability, versatility, and lightweight properties. These materials are commonly employed in automotive, aerospace & defense, electronics & electrical appliances, packaging, and consumer goods manufacturing. Growing demand for lightweight materials in automotive applications for better fuel efficiency and increased need for high-performance components in aerospace and military sectors are driving the market growth. Moreover, the rising utilization of flexible packaging across various industries, including food products, beverages, and pharmaceuticals, propels market growth. Fluctuations in raw material prices of polyamides and water absorption and shrinkage issues associated with polyamides are restraining the market growth. Additionally, the ongoing research and developments for exploring sustainable alternatives such as bio-based polyamides derived from renewable sources have contributed to market expansion by offering environmentally friendly substitutes. In addition, expanding polyamide’s applications across 5G and wearable devices is expected to create significant growth opportunities in the market.

Product: Growing demand for aliphatic polyamides for superior moisture absorption properties at a lower cost

Aliphatic polyamides are characterized by their long-chain linear structures composed of repeating amide linkages between carbon atoms. Aliphatic polyamides include polyamide 11, polyamide 12, polyamide 6, and polyamide 66. Polyamide 11 is a bio-based, high-performance thermoplastic derived from castor oil, which offers excellent impact resistance, low moisture absorption, good chemical resistance, and dimensional stability even at elevated temperatures. Polyamide 12 is a versatile thermoplastic characterized by its low density, remarkable flexibility, high impact strength, excellent chemical resistance to hydrocarbon-based fuels and solvents, and UV radiation stability. Polyamide 6, also known as Nylon 6 or polycaprolactam, is formed by the polymerization of caprolactam monomers. PA6 exhibits outstanding mechanical properties such as high tensile strength & modulus and is used in engineering applications, including gears & bearings, and within textiles due to its inherent toughness & abrasion resistance. The polycondensation of hexamethylenediamine and adipic acid synthesizes polyamide 66. PA66 exhibits similar properties to PA6 but with improved heat resistance, tensile strength, and stiffness at higher temperatures. The most widely used aliphatic polyamides are polyamide 6 (polycaprolactam) and polyamide 66 (polyhexamethylene adipamide). These materials are valued for their excellent mechanical properties, high chemical resistance, low moisture absorption, and good dimensional stability. Aromatic polyamides comprise phenyl rings within their polymer chains, enhancing thermal stability, fire resistance, and chemical resistance. Aromatic polyamides comprise aramid and polyphthalamide. Aramid is a class of high-performance aromatic polyamides characterized by their exceptional strength-to-weight ratio, high thermal resistance, and excellent flame retardancy. Polyphthalamide (PPA) is a semi-aromatic polyamide distinguished by its robust mechanical properties and excellent chemical resistance to aggressive environments such as strong acids or bases. The selection between aliphatic and aromatic polyamides depends on the specific application requirements, ranging from cost-effectiveness to extreme performance demands.

Type: Significant adoption of bio-based polyamides due to their environmental benefits

Bio-based polyamides, derived from renewable resources such as castor oil and other plant-based sources, cater to the increasing demand for environmentally friendly alternatives. They offer similar properties to conventional polyamides while maintaining a lower carbon footprint. Conventional polyamides are synthetic polymers derived from petroleum feedstock. They remain popular due to their cost-effectiveness, availability, and established performance track records. Bio-based and conventional polyamides possess remarkable mechanical properties catering to different market needs. While bio-based polyamides address environmental concerns and regulatory requirements, conventional polyamides remain popular due to their affordability and proven performance.

End-User Industries: Increasing utilization in the automotive and consumer goods & appliances industries due to their extensive application scope

Polyamides are primarily used in the automotive industry for manufacturing various plastic components such as engine covers, air intake manifolds, radiator tanks, and fuel tanks. Polyamides provide a lightweight alternative to metal parts and offer excellent heat resistance, mechanical strength, and durability. Polyamide finds application in consumer goods & appliances industries due to its versatile properties, such as high strength-to-weight ratio, good thermal stability, and excellent electrical insulation capabilities. In the electrical & electronics industry, polyamides are used for producing connectors, cable ties, and circuit breaker housings due to their excellent electrical insulating properties along with resistance to flame retardancy. Polyamides are utilized in the packaging of food products, beverages, and pharmaceuticals due to their excellent barrier properties against oxygen, carbon dioxide, and aromas. They offer resistance to puncture and tear propagation. The textile & carpet industry utilizes polyamides for manufacturing fibers due to their good elasticity, resilience, and abrasion resistance. Polyamide fibers find usage in sportswear, outdoor clothing, upholstery fabrics, and carpets. Polyamides are widely used across various industries, with a major demand for automotive and consumer goods. The electrical & electronics sector leverages insulating properties for product safety, while packaging applications focus on shelf life improvement and sustainability. The textile industry benefits from durability, expanding polyamides' application range. Therefore, there is a growing trend toward bio-based and recycled polyamide materials to meet sustainability goals across all end-user industries.

Regional Insights:

The United States and Canada are significant consumers of polyamides in the Americas owing to the high demand from industries such as automotive, aerospace, electronics, packaging solutions, and textiles. The need for lightweight components in the automotive and aerospace sectors has led to a surge in polyamide usage to reduce weight and improve fuel efficiency. Additionally, increased investments in research and development aim to create sustainable alternatives for traditional materials. Europe represents a significant position in the global polyamide market due to its strict environmental regulations that promote green initiatives and sustainability within various industries. The recent adoption of circular economy action plans has accelerated investments in advanced materials that can be more efficiently recycled or repurposed after use. Innovations in food packaging technologies have led the EU countries to adopt biodegradable polyamides, contributing significantly to waste reduction efforts. Furthermore, in the Middle East & Africa (MEA) region, polyamide demand is primarily driven by oil & gas operations requiring high-performance materials that can withstand harsh conditions. China is one of the major and largest producers and consumers of polyamide materials in the Asia-Pacific region due to rapid economic growth and expanding automotive and textile industries. India and Japan are emerging as significant players in the market owing to increasing infrastructure investments and the adoption of advanced materials across various sectors.

FPNV Positioning Matrix:

The FPNV Positioning Matrix is essential for assessing the Polyamide Market. It provides a comprehensive evaluation of vendors by examining key metrics within Business Strategy and Product Satisfaction, allowing users to make informed decisions based on their specific needs. This advanced analysis then organizes these vendors into four distinct quadrants, which represent varying levels of success: Forefront (F), Pathfinder (P), Niche (N), or Vital(V).

Market Share Analysis:

The Market Share Analysis offers an insightful look at the current state of vendors in the Polyamide Market. By comparing vendor contributions to overall revenue, customer base, and other key metrics, we can give companies a greater understanding of their performance and what they are up against when competing for market share. The analysis also sheds light on just how competitive any given sector is about accumulation, fragmentation dominance, and amalgamation traits over the base year period studied.

Key Company Profiles:

The report delves into recent significant developments in the Polyamide Market, highlighting leading vendors and their innovative profiles. These include AdvanSix Inc., Aramid Hpm, LLC, Arkema Group, Asahi Kasei Corporation, Ascend Performance Materials Operations LLC, Avient Corporation, BASF SE, Beaulieu International Group N.V., Celanese Corporation, China National Bluestar (Group) Co, Ltd., DOMO Chemicals GmbH, DuPont de Nemours, Inc., EMS Group, Envalior GmbH, Evonik Industries AG, FUJIFILM Corporation, Gujarat State Fertilizers & Chemicals Limited, Huntsman Corporation, Huvis Corp., Hyosung Group, Koch Industries, Inc., Kolon Industries, Inc., Kuraray Co., Ltd., Lydall, Inc., Merck KGaA, Mitsubishi Gas Chemical Company Inc., Mitsui Chemicals, Inc., Radici Partecipazioni S.p.A., Roboze S.p.A., Royal DSM, Shanghai J&S New Materials Co.,ltd, Sinopec Corp., Sumitomo Chemical Co., Ltd., Taekwang Industrial Co., Ltd., Teijin Limited, Toray Industries, Inc., TOYOBO MC Corporation, UBE Corporation, X-FIPER New Material Co., Ltd., and Yantai Tayho Advanced Materials Co.,Ltd..

Inquire Before Buying @ https://www.360iresearch.com/library/intelligence/polyamide?utm_source=einpresswire&utm_medium=referral&utm_campaign=inquire

Market Segmentation & Coverage:

This research report categorizes the Polyamide Market in order to forecast the revenues and analyze trends in each of following sub-markets:

Based on Product, market is studied across Aliphatic Polyamides and Aromatic Polyamides. The Aliphatic Polyamides is further studied across Polyamide 11, Polyamide 12, Polyamide 6, and Polyamide 66. The Aromatic Polyamides is further studied across Aramid and Polyphthalamide. The Aliphatic Polyamides commanded largest market share of 85.88% in 2022, followed by Aromatic Polyamides.

Based on Type, market is studied across Bio-Based and Conventional. The Conventional commanded largest market share of 89.68% in 2022, followed by Bio-Based.

Based on End-User Industries, market is studied across Automotive, Consumer Goods & Appliances, Electrical & Electronics, Packaging, and Textile & Carpets. The Automotive commanded largest market share of 51.86% in 2022, followed by Consumer Goods & Appliances.

Based on Region, market is studied across Americas, Asia-Pacific, and Europe, Middle East & Africa. The Americas is further studied across Argentina, Brazil, Canada, Mexico, and United States. The United States is further studied across California, Florida, Illinois, New York, Ohio, Pennsylvania, and Texas. The Asia-Pacific is further studied across Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. The Europe, Middle East & Africa is further studied across Denmark, Egypt, Finland, France, Germany, Israel, Italy, Netherlands, Nigeria, Norway, Poland, Qatar, Russia, Saudi Arabia, South Africa, Spain, Sweden, Switzerland, Turkey, United Arab Emirates, and United Kingdom. The Asia-Pacific commanded largest market share of 36.14% in 2022, followed by Europe, Middle East & Africa.

Key Topics Covered:

1. Preface

2. Research Methodology

3. Executive Summary

4. Market Overview

5. Market Insights

6. Polyamide Market, by Product

7. Polyamide Market, by Type

8. Polyamide Market, by End-User Industries

9. Americas Polyamide Market

10. Asia-Pacific Polyamide Market

11. Europe, Middle East & Africa Polyamide Market

12. Competitive Landscape

13. Competitive Portfolio

14. Appendix

The report provides insights on the following pointers:

1. Market Penetration: Provides comprehensive information on the market offered by the key players

2. Market Development: Provides in-depth information about lucrative emerging markets and analyzes penetration across mature segments of the markets

3. Market Diversification: Provides detailed information about new product launches, untapped geographies, recent developments, and investments

4. Competitive Assessment & Intelligence: Provides an exhaustive assessment of market shares, strategies, products, certification, regulatory approvals, patent landscape, and manufacturing capabilities of the leading players

5. Product Development & Innovation: Provides intelligent insights on future technologies, R&D activities, and breakthrough product developments

The report answers questions such as:

1. What is the market size and forecast of the Polyamide Market?

2. Which are the products/segments/applications/areas to invest in over the forecast period in the Polyamide Market?

3. What is the competitive strategic window for opportunities in the Polyamide Market?

4. What are the technology trends and regulatory frameworks in the Polyamide Market?

5. What is the market share of the leading vendors in the Polyamide Market?

6. What modes and strategic moves are considered suitable for entering the Polyamide Market?

Read More @ https://www.360iresearch.com/library/intelligence/polyamide?utm_source=einpresswire&utm_medium=referral&utm_campaign=analyst

Mr. Ketan Rohom

360iResearch

+ +1 530-264-8485

ketan@360iresearch.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.