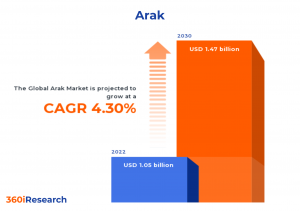

Arak Market worth $1.47 billion by 2030, growing at a CAGR of 4.30% - Exclusive Report by 360iResearch

The Global Arak Market to grow from USD 1.05 billion in 2022 to USD 1.47 billion by 2030, at a CAGR of 4.30%.

PUNE, MAHARASHTRA, INDIA, November 10, 2023 /EINPresswire.com/ -- The "Arak Market by Raw Material (Aniseed, Dates, Dried Flowers, Herbs and Fruits), Alcohol Content (31% to 45%, 46% to 70%, Above 70%), Distribution Channel - Global Forecast 2023-2030" report has been added to 360iResearch.com's offering.The Global Arak Market to grow from USD 1.05 billion in 2022 to USD 1.47 billion by 2030, at a CAGR of 4.30%.

Request a Free Sample Report @ https://www.360iresearch.com/library/intelligence/arak?utm_source=einpresswire&utm_medium=referral&utm_campaign=sample

Arak is an alcoholic beverage traditionally made in the Middle East, particularly in countries such as Lebanon, Syria, Iran, and Iraq. It is a clear, unsweetened, distilled spirit that is usually derived from dates, grapes, or other fruits. Arak is typically distilled twice and then infused with aniseed for flavor and is mostly enjoyed by people throughout the region on special occasions and has several health benefits owing to its natural ingredients. The arak is experiencing a surge in popularity, with a growing interest in traditional and craft beverages. Consumers increasingly seek unique and culturally significant drinks, leading to a rise in the demand for arak. Additionally, the international trade activities surrounding arak have expanded, facilitating its distribution and accessibility in global markets. This increased trade has allowed arak to reach a broader audience and cater to the growing interest in Middle Eastern alcoholic beverages. Furthermore, new production technologies bring advancements to the traditional manufacturing process to enhance the production efficiency and quality of arak, leading to improved products for consumers. Simultaneously, there is a growing emphasis on brand building within the arak as producers diversify their offerings by incorporating new flavors and ingredients into arak and focusing on brand building. Moreover, the Arak market is facing challenges due to the fluctuating cost of raw materials and the easy availability of substitute products. Arak producers need to carefully navigate these factors by managing costs effectively and implementing strategies to differentiate arak from other alcohol spirits and emphasize its unique qualities to maintain consumer preference and its easy availability.

Alcohol Content: Significant popularity of Arak with alcohol content 31%-45% and 46%-70% due to rich flavor profiles and cultural significance

Arak, with 31% to 45% alcohol Content, is preferred for moderate consumption at social gatherings. Arak, with 46% to 70% alcohol content, is ideal for experienced drinkers seeking a robust flavor and aroma. Araks above 70% alcohol content cater to niche consumers seeking an exceptionally potent experience. These spirits are often used for special occasions or by enthusiasts who appreciate their strong flavor and intense effect. However, this category has a limited market due to its high alcohol level and potential health risks associated with excessive consumption. Araks with less than 30% alcohol content serve consumers looking for a milder spirit that retains the unique taste of the traditional beverage while offering a more approachable drinking experience. While maintaining traditional flavors. In conclusion, the diverse alcohol content range of Arak meets varying consumer preferences, catering from casual socializing to traditional consumption methods. Arak's diverse alcohol content range caters to various consumer preferences and occasions, from casual socializing to traditional consumption methods. The moderate (31%-45%) and high (46%-70%) segments remain popular among most drinkers due to their rich flavor profiles and cultural significance, whereas the lower (<30%) and extremely high (>70%) segments cater to niche markets seeking specific experiences or accessibility options.

Distribution Channel: wider availability of arak from restaurants & bars

The distribution channels for arak can vary depending on the region, including distilleries, duty-free stores, liquor stores, restaurant & bars, and online retailers. In some cases, these distilleries may have their own retail outlets or tasting rooms, allowing consumers to purchase arak directly from the source. Arak is often available in duty-free airport stores, catering to international travelers willing to purchase alcoholic beverages without paying import taxes or duties. Duty-free stores can be a convenient option for travelers to buy arak when visiting or departing from countries where it is commonly produced. Liquor stores offer a wide selection of alcoholic beverages, including arak, allowing consumers to purchase bottles for personal consumption. The rise of eCommerce has opened up opportunities for arak producers to sell their products online. Online retailers specializing in spirits or dedicated arak producers' websites can offer a convenient way for consumers to purchase arak and deliver it to their doorstep. Furthermore, the restaurants and bars establishments often have a selection of arak brands for customers to enjoy with their meals or as standalone drinks. In some regions where arak is traditionally produced, such as Lebanon or Iran, it is more widely available in local retail outlets and restaurants. However, in other parts of the world, the distribution of arak is limited, where specialty stores or online retailers are the primary sources for acquiring it.

Raw Material: Growing use of aniseed for flavor development

Aniseed, dates, dried flowers, herbs, fruits, and grapes are among the key ingredients that contribute to unique flavor profiles and cater to diverse consumer tastes. Aniseed is essential for giving Arak its distinct licorice-such as taste. Dates serve as an alternative sugar source for fermentation in regions where grapes are scarce or expensive. Iran, Saudi Arabia, and the UAE are significant data suppliers. Dried flowers, herbs, and fruits such as rose petals, mint, and apricots allow manufacturers to create diverse Arak flavors. Grapes remain the primary base ingredient for traditional Arak production in Lebanon, Israel, and Jordan.

Regional Insights:

The Arak market in the Americas is a niche, driven by Middle Eastern communities. The U.S., Canada, and Mexico have a presence of Iranian, Lebanese, and Syrian communities showing interest in arak. Arak brands such as Razzouk and Gantous & Abou Raad are preferred, although limited branding and awareness hinder market penetration. Furthermore, in the APAC, there is a growing interest in arak and Middle Eastern alcoholic beverages among certain communities and establishments in the region. Australia has witnessed a rise in the availability and consumption of arak, particularly in cities with diverse culinary scenes and a growing interest in international spirits. However, in cosmopolitan cities with diverse populations and culinary scenes, such as Singapore, Hong Kong, and Dubai, it is possible to find arak in specialty liquor stores or establishments that cater to international spirits. Moreover, the geographic landscape of arak in the EMEA region is diverse, with significant variations in arak production, consumption, and availability across different countries. It is deeply rooted in the Middle Eastern drinking culture and is primarily consumed in countries such as Lebanon, Syria, Iran, and Iraq. Countries such as Germany, France, and the United Kingdom have also witnessed a growing demand for arak, often driven by consumers exploring unique spirits from around the world. The availability and consumption of arak in different countries within the EMEA region can vary, and it is often influenced by factors such as cultural ties, diaspora communities, and international trade.

FPNV Positioning Matrix:

The FPNV Positioning Matrix is essential for assessing the Arak Market. It provides a comprehensive evaluation of vendors by examining key metrics within Business Strategy and Product Satisfaction, allowing users to make informed decisions based on their specific needs. This advanced analysis then organizes these vendors into four distinct quadrants, which represent varying levels of success: Forefront (F), Pathfinder (P), Niche (N), or Vital(V).

Market Share Analysis:

The Market Share Analysis offers an insightful look at the current state of vendors in the Arak Market. By comparing vendor contributions to overall revenue, customer base, and other key metrics, we can give companies a greater understanding of their performance and what they are up against when competing for market share. The analysis also sheds light on just how competitive any given sector is about accumulation, fragmentation dominance, and amalgamation traits over the base year period studied.

Key Company Profiles:

The report delves into recent significant developments in the Arak Market, highlighting leading vendors and their innovative profiles. These include Arak Fakra, Bandesh Wine & Spirits, Chateau Ksara, Domaine des Tourelles, Domaine Wardy, Eagle Distilleries, Evaton Inc., Haddad Distilleries, Iberian Coppers Lda, Karam Wines, Kawar, LAC Products, Lebanese Fine Wines Ltd., Massaya, Miami Arak, Muaddi Craft Distillery, Ltd., RIACHI, Victor Kosher Wine, VOS Selections, and Zumot.

Inquire Before Buying @ https://www.360iresearch.com/library/intelligence/arak?utm_source=einpresswire&utm_medium=referral&utm_campaign=inquire

Market Segmentation & Coverage:

This research report categorizes the Arak Market in order to forecast the revenues and analyze trends in each of following sub-markets:

Based on Raw Material, market is studied across Aniseed, Dates, Dried Flowers, Herbs and Fruits, and Grapes. The Aniseed commanded largest market share of 25.31% in 2022, followed by Grapes.

Based on Alcohol Content, market is studied across 31% to 45%, 46% to 70%, Above 70%, and Less than 30%. The 31% to 45% commanded largest market share of 40.33% in 2022, followed by 46% to 70%.

Based on Distribution Channel, market is studied across Distilleries, Duty-free Stores, Liquor Stores, Online Retailers, and Restaurants & Bars. The Restaurants & Bars commanded largest market share of 37.12% in 2022, followed by Liquor Stores.

Based on Region, market is studied across Americas, Asia-Pacific, and Europe, Middle East & Africa. The Americas is further studied across Argentina, Brazil, Canada, Mexico, and United States. The United States is further studied across California, Florida, Illinois, New York, Ohio, Pennsylvania, and Texas. The Asia-Pacific is further studied across Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. The Europe, Middle East & Africa is further studied across Denmark, Egypt, Finland, France, Germany, Israel, Italy, Netherlands, Nigeria, Norway, Poland, Qatar, Russia, Saudi Arabia, South Africa, Spain, Sweden, Switzerland, Turkey, United Arab Emirates, and United Kingdom. The Europe, Middle East & Africa commanded largest market share of 69.21% in 2022, followed by Asia-Pacific.

Key Topics Covered:

1. Preface

2. Research Methodology

3. Executive Summary

4. Market Overview

5. Market Insights

6. Arak Market, by Raw Material

7. Arak Market, by Alcohol Content

8. Arak Market, by Distribution Channel

9. Americas Arak Market

10. Asia-Pacific Arak Market

11. Europe, Middle East & Africa Arak Market

12. Competitive Landscape

13. Competitive Portfolio

14. Appendix

The report provides insights on the following pointers:

1. Market Penetration: Provides comprehensive information on the market offered by the key players

2. Market Development: Provides in-depth information about lucrative emerging markets and analyzes penetration across mature segments of the markets

3. Market Diversification: Provides detailed information about new product launches, untapped geographies, recent developments, and investments

4. Competitive Assessment & Intelligence: Provides an exhaustive assessment of market shares, strategies, products, certification, regulatory approvals, patent landscape, and manufacturing capabilities of the leading players

5. Product Development & Innovation: Provides intelligent insights on future technologies, R&D activities, and breakthrough product developments

The report answers questions such as:

1. What is the market size and forecast of the Arak Market?

2. Which are the products/segments/applications/areas to invest in over the forecast period in the Arak Market?

3. What is the competitive strategic window for opportunities in the Arak Market?

4. What are the technology trends and regulatory frameworks in the Arak Market?

5. What is the market share of the leading vendors in the Arak Market?

6. What modes and strategic moves are considered suitable for entering the Arak Market?

Read More @ https://www.360iresearch.com/library/intelligence/arak?utm_source=einpresswire&utm_medium=referral&utm_campaign=analyst

Mr. Ketan Rohom

360iResearch

+ +1 530-264-8485

ketan@360iresearch.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.