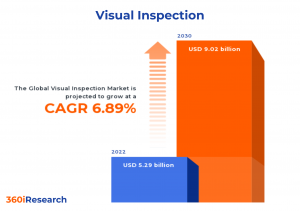

Visual Inspection Market worth $9.02 billion by 2030, growing at a CAGR of 6.89% - Exclusive Report by 360iResearch

The Global Visual Inspection Market to grow from USD 5.29 billion in 2022 to USD 9.02 billion by 2030, at a CAGR of 6.89%.

PUNE, MAHARASHTRA, INDIA, November 10, 2023 /EINPresswire.com/ -- The "Visual Inspection Market by Component (Hardware, Services, Software), Technology Type (3D Vision, AI-based Inspection, Camera-based Inspection), Application, Industry Vertical - Global Forecast 2023-2030" report has been added to 360iResearch.com's offering.The Global Visual Inspection Market to grow from USD 5.29 billion in 2022 to USD 9.02 billion by 2030, at a CAGR of 6.89%.

Request a Free Sample Report @ https://www.360iresearch.com/library/intelligence/visual-inspection?utm_source=einpresswire&utm_medium=referral&utm_campaign=sample

Visual inspection is a critical and widely used method for assessing the quality, conformity, and integrity of products, materials, and infrastructure across various sectors. It involves systematically evaluating an item or structure using the naked eye or optical instruments such as magnifying glasses, microscopes, and cameras to identify surface defects, anomalies, and deviations from established standards or patterns. The visual inspection market is primarily driven by stringent quality control measures in the food & beverage and pharmaceutical industries, along with government initiatives supporting Industry 4.0 and robotic automation. However, limitations related to frequent maintenance and calibration of inspection systems and concerns surrounding false positives and negative occurrences in these systems may restrain growth. Market players are incorporating AI and ML technologies for precise defect detection and traceability. Furthermore, the rising popularity of 3D vision systems for accurate inspection presents additional potential by facilitating faster processing times, improved detection capabilities, and increased flexibility and adaptability to different production environments.

Technology Type: Rising popularity of machine vision to offer high-speed precision inspections

3D vision technology provides depth information for accurate object recognition and measurement. It is essential in the automotive, aerospace, electronics, and pharmaceutical industries for quality control, robot guidance, and defect detection. AI-based inspection systems leverage machine learning algorithms to improve detection accuracy and reduce false positives. This technology is suitable for complex inspections where traditional rule-based systems fall short. Camera-based inspection systems use high-resolution cameras to capture images of products or components for quality checks, and these systems aid in detecting defects such as surface scratches or minute component misalignments on production lines. Computer vision technology processes digital images and recognizes patterns, enabling automated inspection systems for quality control and sorting applications. Machine vision systems use cameras, sensors, and software algorithms to inspect objects at high speeds with great precision. Smart cameras are standalone devices that combine image capture with processing capabilities on chipsets without needing external PCs or controllers. These cameras are ideal for space-constrained environments or applications requiring decentralized inspection solutions.

Industry Vertical: Need for visual inspection processes in compliance with regulatory standards in the pharmaceutical industry

The aerospace and defense industry requires highly stringent visual inspection solutions to ensure the safety, performance, and reliability of their products. These industries typically opt for advanced automated or robotic inspection systems when inspecting aircraft components, spacecraft materials, and defense equipment. Visual inspection is crucial in maintaining quality standards within the automotive industry. In the electronics and semiconductor industries, microscopic-scale defects can significantly impact device performance. Ensuring product quality and safety is paramount within the food & beverage industry; thus, visual inspections are crucial for detecting foreign objects or contaminants throughout the production process. The manufacturing sector requires efficient visual inspection solutions to reduce production downtime and improve operational efficiency. Visual inspections are essential in the packaging industry for quality assurance and product traceability. Specialized automated inspection equipment can identify defects such as particulates or foreign matter within drug products' containers or delivery systems. Visual inspection technologies are increasingly being utilized in the retail and fast-moving consumer goods (FMCG) sectors to maintain product quality, enhance supply chain efficiency, and ensure customer satisfaction.

Component: Advancements in visual inspection hardware to enhance detection qualities

Hardware is the foundation for any visual inspection system, which typically includes cameras, lighting systems, lenses, sensors, robotic arms, or manipulators for positioning objects under investigation, and other ancillary equipment such as cables and connectors. Cameras are essential for capturing high-resolution images of the inspected items; they can be either two-dimensional (2D) or three-dimensional (3D), depending on the application's requirements. The services component encompasses consultation, integration support services such as installation assistance/training/documentation, maintenance agreements, remote monitoring/analysis/report generation, and after-sales support such as spares management & technical helpdesk/resources availability on-demand basis. The software comprises image processing algorithms, machine learning models, and user interfaces that enable the automatic detection of defects in captured images or video streams. Machine learning models utilize artificial intelligence techniques, including deep learning and neural networks, to learn from historical data and accurately predict defect classifications in real-time.

Application: Extensive use of visual inspection for quality control to ensure product safety and customer satisfaction

Assembly verification is crucial in ensuring products are assembled correctly and function as intended. Manufacturers often use visual inspection systems to identify missing, misplaced, or misaligned components. Defect detection is pivotal in identifying product anomalies impacting performance or safety. Measurement & metrology entails precise evaluation of dimensions and geometries to ensure product quality and conformity with design specifications. Packaging inspection is necessary to ensure proper sealing, labeling, and overall integrity of packaged goods before they reach consumers. Quality control and assurance encompass various techniques to ensure manufactured products meet established specifications and standards. Sorting and grading involve classifying items based on attributes such as size, shape, or color. High-speed visual inspection systems can streamline these processes for manufacturers across sectors such as food, pharmaceuticals, and electronics. Surface inspection identifies defects or irregularities on material surfaces that may impact product performance or aesthetics.

Regional Insights:

Visual inspection has been widely adopted in industries, such as automotive manufacturing, aerospace engineering, pharmaceuticals, food processing, and electronics in the Americas. The region has witnessed an increased demand for technologically advanced inspection systems as companies strive to improve product quality while maintaining cost efficiency. In recent years, many American companies have focused on developing smart vision systems incorporating artificial intelligence (AI) and machine learning (ML) technologies to enhance their capabilities. Asia is anticipated to become a major market for visual inspection technology in the coming years due to rising investments in infrastructure development projects across China, India, Japan, South Korea, and Taiwan, among other countries. The production of visual inspection equipment is expected to rise in tandem with demand from major industries such as semiconductor manufacturing and electronics assembly. Moreover, foreign multinational corporations are expanding their presence in Asia-Pacific markets to cater to the rising end-user requirements. In Europe, visual inspection technology is well-integrated into numerous industries, given its strong legacy in advanced manufacturing methods and stringent quality control regulations. The region is home to several leading companies producing visual inspection systems as they are developing innovative solutions such as collaborative robots, intelligent cameras, and hyperspectral imaging for visual inspection.

FPNV Positioning Matrix:

The FPNV Positioning Matrix is essential for assessing the Visual Inspection Market. It provides a comprehensive evaluation of vendors by examining key metrics within Business Strategy and Product Satisfaction, allowing users to make informed decisions based on their specific needs. This advanced analysis then organizes these vendors into four distinct quadrants, which represent varying levels of success: Forefront (F), Pathfinder (P), Niche (N), or Vital(V).

Market Share Analysis:

The Market Share Analysis offers an insightful look at the current state of vendors in the Visual Inspection Market. By comparing vendor contributions to overall revenue, customer base, and other key metrics, we can give companies a greater understanding of their performance and what they are up against when competing for market share. The analysis also sheds light on just how competitive any given sector is about accumulation, fragmentation dominance, and amalgamation traits over the base year period studied.

Key Company Profiles:

The report delves into recent significant developments in the Visual Inspection Market, highlighting leading vendors and their innovative profiles. These include Aantares Vision Group, Advantech Co., Ltd., Baker Hughes Company, Basler AG, Brevetti CEA SpA, Carl Zeiss AG, Cognex Corporation, Emerson Electric Co., FARO Technologies, Inc., General Electric Company, Google LLC by Alphabet Inc., Hexagon AB, International Business Machines Corporation, Jekson Vision Pvt. Ltd., Keyence Corporation, KPM Analytics, Körber AG, Mettler Toledo International Inc., MISTRAS Group, Inc., Mitsubishi Electric Corporation, Mitutoyo Corporation, Nommas AI, Olympus Corporation, Omron Corporation, Ravin AI Ltd., Robert Bosch GmbH, Rolls Royce PLC, SGS S.A., Sick AG, Siemens AG, Stevanato Group S.p.A., Teledyne Technologies Incorporated, TKH Group NV, ViTrox Corporation, Wenglor Sensoric Group, and Wipotec GmbH.

Inquire Before Buying @ https://www.360iresearch.com/library/intelligence/visual-inspection?utm_source=einpresswire&utm_medium=referral&utm_campaign=inquire

Market Segmentation & Coverage:

This research report categorizes the Visual Inspection Market in order to forecast the revenues and analyze trends in each of following sub-markets:

Based on Component, market is studied across Hardware, Services, and Software. The Hardware commanded largest market share of 37.23% in 2022, followed by Software.

Based on Technology Type, market is studied across 3D Vision, AI-based Inspection, Camera-based Inspection, Computer Vision, Machine Vision, and Smart Cameras. The Camera-based Inspection commanded largest market share of 24.45% in 2022, followed by AI-based Inspection.

Based on Application, market is studied across Assembly Verification, Defect Detection, Measurement & Metrology, Packaging Inspection, Quality Control & Assurance, Sorting & Grading, and Surface Inspection. The Quality Control & Assurance commanded largest market share of 20.87% in 2022, followed by Defect Detection.

Based on Industry Vertical, market is studied across Aerospace & Defense, Automotive, Electronics & Semiconductors, Food & Beverage, Manufacturing, Packaging, Pharmaceuticals, and Retail & FMCG. The Automotive commanded largest market share of 20.99% in 2022, followed by Pharmaceuticals.

Based on Region, market is studied across Americas, Asia-Pacific, and Europe, Middle East & Africa. The Americas is further studied across Argentina, Brazil, Canada, Mexico, and United States. The United States is further studied across California, Florida, Illinois, New York, Ohio, Pennsylvania, and Texas. The Asia-Pacific is further studied across Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. The Europe, Middle East & Africa is further studied across Denmark, Egypt, Finland, France, Germany, Israel, Italy, Netherlands, Nigeria, Norway, Poland, Qatar, Russia, Saudi Arabia, South Africa, Spain, Sweden, Switzerland, Turkey, United Arab Emirates, and United Kingdom. The Americas commanded largest market share of 40.04% in 2022, followed by Europe, Middle East & Africa.

Key Topics Covered:

1. Preface

2. Research Methodology

3. Executive Summary

4. Market Overview

5. Market Insights

6. Visual Inspection Market, by Component

7. Visual Inspection Market, by Technology Type

8. Visual Inspection Market, by Application

9. Visual Inspection Market, by Industry Vertical

10. Americas Visual Inspection Market

11. Asia-Pacific Visual Inspection Market

12. Europe, Middle East & Africa Visual Inspection Market

13. Competitive Landscape

14. Competitive Portfolio

15. Appendix

The report provides insights on the following pointers:

1. Market Penetration: Provides comprehensive information on the market offered by the key players

2. Market Development: Provides in-depth information about lucrative emerging markets and analyzes penetration across mature segments of the markets

3. Market Diversification: Provides detailed information about new product launches, untapped geographies, recent developments, and investments

4. Competitive Assessment & Intelligence: Provides an exhaustive assessment of market shares, strategies, products, certification, regulatory approvals, patent landscape, and manufacturing capabilities of the leading players

5. Product Development & Innovation: Provides intelligent insights on future technologies, R&D activities, and breakthrough product developments

The report answers questions such as:

1. What is the market size and forecast of the Visual Inspection Market?

2. Which are the products/segments/applications/areas to invest in over the forecast period in the Visual Inspection Market?

3. What is the competitive strategic window for opportunities in the Visual Inspection Market?

4. What are the technology trends and regulatory frameworks in the Visual Inspection Market?

5. What is the market share of the leading vendors in the Visual Inspection Market?

6. What modes and strategic moves are considered suitable for entering the Visual Inspection Market?

Read More @ https://www.360iresearch.com/library/intelligence/visual-inspection?utm_source=einpresswire&utm_medium=referral&utm_campaign=analyst

Mr. Ketan Rohom

360iResearch

+ +1 530-264-8485

ketan@360iresearch.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.